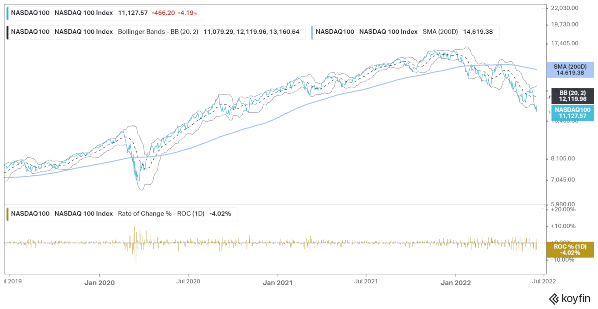

US stocks have seen heightened volatility this year. Last week was the worst week for US markets since 2020. The S&P 500 lost 5.8% in the week while the tech-heavy Nasdaq lost 4.8%. The 30-share Dow Jones Index also fell 4.8% and tumbled below the psychologically crucial 30,000 level.

However, US stocks are bouncing back today and the Nasdaq is up almost 2% in premarket price action. European markets are also trading higher while most major Asian markets, with the exception of China, also closed higher. Would US stocks continue to recover this week and emerge out of the bear market?

While there are several factors that are weighing down US stocks, rising inflation which is leading to aggressive rate hikes by the Federal Reserve has been particularly dampening market sentiments.

Rising Oil and Gas Prices Are Adding to Inflation

Crude oil prices are trading near the $110 per barrel price level. Oil stocks have risen this year and the energy sector is outperforming the markets this year. However, rising oil prices are fuelling inflation across the world. Since spending on oil is a nondiscretionary expense, consumers have lesser money to spend on other goods.

Many economists including former US Treasury Secretary Larry Summers believe that high inflation and rate hikes would lead the US economy into a recession. However, President Biden and other members of his cabinet including Treasury Secretary Janet Yellen don’t believe that a recession is inevitable.

Meanwhile, US stocks are shrugging inflation and recession fears today and all major indices are up sharply today. US stocks have closed with losses in 11 out of the last 12 weeks and we have had among the worst starts to the year in 2022.

Not all analysts are convinced that US stocks can sustain their momentum. Adam Crisafulli of Vital Knowledge believes that the rally could be the typical dead cat bounce. We have had several such dead cat bounces this year but markets have moved on to make fresh lows. Last week, US stocks fell to their lowest levels for the year.

US Stocks are Rebounding Today

The broader market decline does not reflect the pain that recently listed companies have been facing. Many of these high-growth names have lost over 90% of their market cap. The former market favorites and pandemic winner stocks have also sagged and many including Jim Cramer don’t see an early respite for these names.

Cathie Wood of ARK Invest believes that US stocks are near their bottom. While her funds were among the best performing ETFs in 2020, they have crashed badly this year. Wood has continued to buy the dip in her favorite growth names but they have continued to tumble.

Data from FactSet shows that S&P 500 now trades at around 15.6x its forward PE multiple which is below the average multiples for the last five and ten years. While market veteran Ed Yardeni does not believe that US stocks have bottomed, he believes that long-term investors might find good opportunities in these markets.

Investors would be watching several key data points this week. Today, we’ll get the existing homes sales data for May and analysts are expecting a SAAR (seasonally adjusted annual rate) of 5.41 million, below April’s reading of 5.61 million. The new home sales data is also scheduled for later this week. There have been signs of a slowdown in the US housing market with housing starts falling for two straight months.

The flash PMI data would also be released on Thursday. We also have several Fed speakers this week including chair Jerome Powell who would tomorrow testify on monetary policy at the Senate Banking Committee. Powell’s comments would be especially watched by investors as Fed hawkishness has been dampening US stock market sentiments.

Related posts

- Most Undervalued Stocks to Buy – How to Buy Undervalued Stocks

- How to Buy Shares in the UK – Best Stock Brokers Reviewed

- Best Tech Stocks to Buy in 2022 – How to Buy Tech Stocks

Lucky Block - Undervalued Crypto

- Listed on Gate.io, LBank, MEXC, PancakeSwap

- NFT Competitions, Jackpot Draws

- Powers Casino & Sportsbook Platform - luckyblock.com

- 10,000 NFTs Minted

- $2M+ in Prizes Awarded