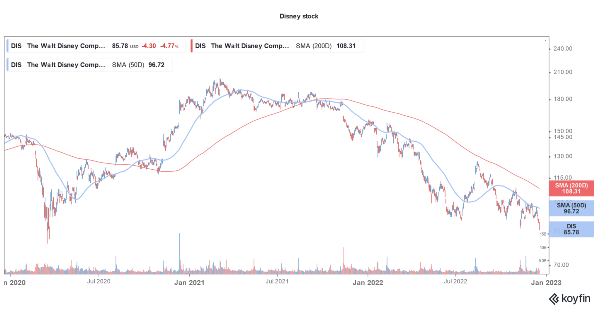

Things have been tough for Disney (NYSE: DIS) in 2022 and the stock is now down almost 45% for the year. Investors wishing for the stock to close 2022 on a high note were left disappointed after “Avatar’s” collections fell short of estimates.

The film raked in $134 million at the opening weekend in domestic sales. However, the number fell short of analysts’ estimates of $175 million. Disney itself had predicted the collections to be between $134-$150 million.

The movie’s international collections were $300.5 million despite a tepid response in China where fear of contracting COVID-19 is scaring many from theatres.

Meanwhile, stakes were high for “Avatar” as the movie was made at a massive budget, which some reports claim is as high as $400 million without the marketing spend.

Disney stock fell to the lowest level since 2020 after lower-than-expected collections of the movie. The pessimism was also visible in cinema stocks and Cinemark and AMC Entertainment also plunged.

AMC stock was once a meme stock darling. It has however plunged over the last year. While analysts are not too optimistic about the prospects, many retail investors see AMC as a multibagger. We have a guide on how to buy AMC stock.

Disney Appointed Bob Iger as the CEO

Last month, Bob Iger returned as Disney CEO and took over the baton from Bob Chapek. Iger is also looking to change Disney’s organizational structure which became too centralized under Chapek.

Iger is driving several changes at the company and wants it to focus on streaming profits rather than subscriber growth.

Disney’s DTC (direct-to-consumer) business lost $1.47 billion in the September quarter as the streaming business continued to post losses.

Disney has said multiple times that its streaming business will become profitable in the fiscal year 2024. It reiterated the views in the fiscal fourth-quarter earnings call. Chapek said during the fiscal fourth quarter 2022 earnings call that the operating losses at the DTC business have “peaked” and would decline going forward.

Disney now offers an ad-supported platform in the US at $7.99 per month. It has simultaneously increased the price of the ad-free tier by $3 to $10.99 as the company strives to make its DTC business profitable.

Netflix Ad-Supported Tier Reportedly Missed Viewership Targets

Netflix too started offering its ad-supported tier at $6.99 per month. Reportedly, the company missed on viewership targets and offered refunds to some advertisers.

Evercore ISI meanwhile is bullish on Netflix stock and has added it to its top ideas for 2023. There is a guide on how beginners can buy Netflix stock.

Coming back to Disney, the company has now lowered its emphasis on subscriber growth and is focusing on profitability.

DIS added a total of 14.6 million streaming subscribers in the fiscal fourth quarter of 2022, of which 12.1 million were Disney+ subscribers. At the end of the quarter, Disney+ had 164.2 million subscribers which was ahead of the 160.45 million that analysts expected. Of these 102.9 million were core Disney+ subscribers and the remaining 61.3 million are Disney+ Hotstar subscribers.

In 2020, Disney said forecast a streaming subscriber count of between 230-260 million by the fiscal year 2024. Earlier this year, it lowered the projection to 215-245 million. It remains to be seen whether Iger continues with the same forecast.

Disney Stock Continues to Plummet

Disney stock soared after Iger returned as the company’s CEO. MoffettNathanson analyst Michael Nathanson upgraded DIS stock from market perform to outperform after Iger took over as the CEO.

Among other brokerages, Wells Fargo and Needham also believe Iger’s return would help the company. We have a guide on how to buy Disney stock.

Disney stock has sagged as markets have been concerned over spiraling losses in the streaming business. Jon Christian, EVP of the digital media supply chain at Qvest believes that the media industry is at an “inflection point.”

He said, “The game has changed. It used to be just subscribers at all cost…but now [investors] need these services to be profitable.” Christian added, “Only time will tell, but I think everything’s on the table to try to improve profitability and make the platforms more creative to their overall business.”

Incidentally, under Iger’s watch, Disney had completed several acquisitions and also started its theme park in Shanghai. With Disney stock now sagging at almost the lowest level since 2014, markets expect Iger to yet again steer the company on the path of profitable growth.

Related stock news and analysis

- Best Small-Cap Stocks to Invest in by Performance

- Troubles Mount for Meta Platforms after EU’s Antitrust Complaint

Wall Street Memes (WSM) - Newest Meme Coin

- Community of 1 Million Followers

- Experienced NFT Project Founders

- Listed On OKX

- Staking Rewards