Wharton professor Jeremy Siegel has said that the Fed would soon pause its rate hikes. He also said that bond yields have peaked and stocks would not retest their 2022 lows.

Speaking with CNBC, Siegel who earlier this month predicted a 30% rise in US stocks over the next two years, said, “They’re probably going to go 50 basis points [in December], but that should be the absolute pause. If I were there, I’d say you could pause right now, but I think the day of recognition is sooner.”

Notably, the Fed raised rates by 75 basis points earlier this month, which was the fourth consecutive hike of that quantum. After accounting for the hikes in March and May, the Fed has raised rates by a total of 3.75% this year.

After the November meeting, Fed chair Jerome Powell said that the Fed might slow down the pace of hikes. He said, “So that time is coming, and it may come as soon as the next meeting or the one after that. No decision has been made.”

He however cautioned against a premature pivot and said, “The question of when to moderate the pace of increases is now much less important than the question of how high to raise rates and how long to keep monetary policy restrictive.”

Would the Fed Pause Its Rate Hikes Now?

After the strong October jobs report, traders raised their odds of higher rate hikes at the December meeting. However, the inflation data has come softer than expected which has raised hopes that the Fed might take a somewhat dovish stance.

The CPI inflation increased at an annualized pace of 7.7% in October, which was below the 7.9% that economists were expecting. It was the first time since February that annualized inflation fell below 8%.

Also, the wholesale inflation as measured by the PPI (producer price index) rose 8% annualized in October, which was below what economists were expecting.

Higher inflation has taken a toll on US stocks, especially the growth names. However, there is a list of investments that can do well in inflation.

Fed Waited Too Long Before Raising Rates

Siegel is also critical of the Fed as the US central bank waited on the sidelines for too long before embarking on rate hikes this year.

He said, “There’s too much emphasis on the labor market. Workers are trying to catch up… the real wage is down 3% or 4%. Workers are falling behind; they’re just trying to catch up. It’s hard for me to think that that is cause to push inflation when wages have gone up less than inflation.”

There are signs that the US labor market is cooling and several companies are laying off workers amid slowing growth. As the job market weakens, the upwards pressure on wages should also subside.

Jeremy Siegel Says US Stock Markets Have Bottomed

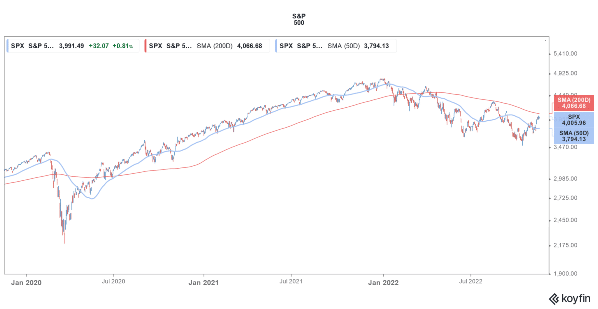

Siegel believes that US stock markets have bottomed. Notably, US stocks have rebounded over the last couple of weeks. The rally gained further wings yesterday after both Walmart and Home Depot released a strong set of earnings.

Siegel also said that US bond yields have peaked. Notably, US bond yields have come off their multi-year highs amid hopes that the Fed might soon pause rate hikes. Bond prices and yields are inversely related and prices rise when bond yields fall. Bond guru Jeffrey Gundlach believes that bonds are an attractive investment option.

Concerns over a US recession are also leading to a fall in bond yields. Several business leaders including Amazon’s Jeff Bezos have warned of a US recession.

Recession Fears Rise amid Rate Hikes

According to Bezos, “Things are slowing down, you’re seeing layoffs in many, many sectors of the economy.” He added, “The probabilities say if we’re not in a recession right now, we’re likely to be in one very soon.”

He advised to “Take as much risk off the table as you can” calling upon people to be prepared for the worst. Notably, Bezos has warned of a recession previously also. Tesla’s CEO Elon Musk has also said that a recession looks likely.

Fed has also said that its rate hikes might lead to a recession. It has however denied that it is trying to push the US economy into a recession deliberately.

Related stock news and analysis

- 8 Potentially Recession-Proof Stocks to Watch in 2022

- How to Buy Bitcoin with PayPal in 5 Minutes

- Retail Earnings, Economic Data & More: What Are Investors Watching This Week

Dash 2 Trade - New Gate.io Listing

- Also Listed on Bitmart, Changelly, LBank, Uniswap

- Collaborative Trading Platform Token

- Featured in Bitcoinist, Cointelegraph

- Solid Proof Audited, CoinSniper KYC Verified

- Trading Community of 70,000+ Members