Rivian (NYSE: RIVN) stock is trading lower in US premarket price action today after the company announced a $1.3 billion convertible note offering – and joined the ranks of fellow EV names that have raised cash.

The company intends to raise $1.3 billion through green convertible senior notes due in 2029. The initial investors in the notes would have the option to invest another $200 million into the offering.

The notes would be senior but unsecured and would mature on March 15, 2029, unless redeemed, converted, or repurchased earlier.

The company said: “Rivian will settle conversions by paying or delivering, as applicable, cash, shares of its Class A common stock (the “common stock”) or a combination of cash and shares of its common stock, at Rivian’s election.”

Over the last year, many EV companies – including Nikola, Arrival, Li Auto, Xpeng Motors and Lucid Motors – have raised cash. The cash burn and losses for startup EV companies are not expected to come down anytime soon.

Rivian is currently posting gross losses and also expects to post a negative gross margin in 2023, although it is forecastinh positive gross margins for 2024.

Things are no different for most other EV companies as they continue to burn cash.

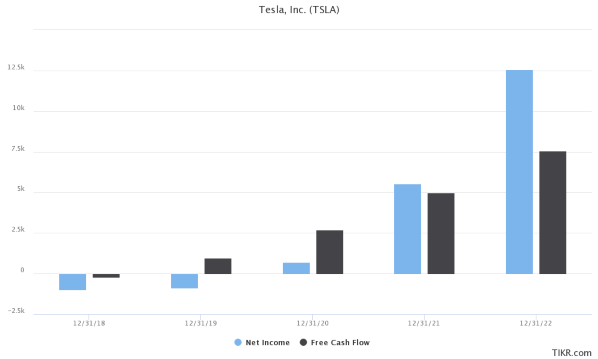

Tesla is an exception as the Elon Musk-run company has turned sustainably profitable and is generating positive free cash flows despite ongoing capex.

Rivian Announces Capital Raise amid Continued Cash Burn

Rivian reported a cash burn of $2.2 billion in Q4 2022, with the company having $11.6 billion of cash and cash equivalents at the end of 2022.

After its blockbuster IPO where it raised nearly $12 billion, Rivian had over $18.4 billion as cash on the balance sheet at the end of 2021.

However, given the operating losses and capex, it is burning billions of dollars of cash every quarter – during the Q4 2022 earnings call, Rivian said that it expects its capex to be around $2 billion annually in 2023 and 2024.

As expected, the question of capital raise cropped up during Rivian’s Q4 2022 earnings call.

The company provided a stock answer and said: “We continue to evaluate a variety of capital markets available to Rivian ranging across the capital structure.

“We plan to employ a portfolio-based approach as we look to maintain a strong balance sheet position.”

Meanwhile, after Rivian announced the convertible note offering market sent the shares south on fears of dilution.

EV Companies Suffer from Slowing Demand & Rising Competition

EV companies are suffering from slowing demand across the board – Lucid Motors, for example, expects to produce between 10,000-14,000 cars in 2023 but has the capacity to produce more cars.

The company’s CEO Peter Rawlinson attributed lower production, which is half of its reservations, to poor brand awareness.

He said that the company has a quality product and just needs to create awareness, terming it as an “entirely solvable problem.”

However, markets did not buy his argument and the stock slumped after its earnings release. LCID stock is nonetheless in the green in 2023 amid rumors that Saudi Arabia is considering acquiring the company.

- Read our guide on buying Lucid Motors stock.

Rivian Provided Tepid 2023 Production Guidance

Rivian’s 2023 production guidance of 50,000 was also below what analysts were expecting. However, the company emphasized that its production is constrained by supply chain issues.

Nonetheless, like Lucid, Rivian also stopped providing reservation numbers. The move further raised fears of slowing demand.

Tesla said that it expects to produce 1.8 million cars in 2023. While it would imply a YoY growth of only about 31%, Musk said that the company could produce as many as two million cars in 2023.

EV Companies Lower Prices to Spur Demand

The frequent price cuts by EV companies also corroborate weakening demand and rising competition. Tesla has lowered the prices of its premium Model S/X by between 4%-9%.

Notably, Tesla Model S and Model X don’t qualify for the federal EV tax credit because of their high price point.

Lucid Motors’ Air sedan also does not qualify for the tax credit, although the company recently offered a $7,500 credit to buyers.

Among other automakers, Ford and Xpeng Motors have also cut prices in 2023.

Coming back to Rivian, the company is looking at various ways to lower its cash burn – in December, it announced that it is putting on “pause” its deal with Mercedes-Benz to jointly produce electric vans in Europe.

During the Q3 2022 earnings call, Rivian said that it would delay the affordable R2 series of vehicles by one year to 2026.

It also announced two rounds of layoffs over the last year and eliminated 12% of positions.

At its peak, Rivian’s market cap was $153 billion, in excess of Volkswagen’s then valuation, while Lucid Motors’ market cap rose as high as $91 billion at the peak.

However, Rivian’s market cap is now just under $16 billion – an 89% decrease.

Related

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops