Chinese stocks like NIO rose late last year amid optimism over the reopening in China. However, they have come off their highs with EV (electric vehicle) stocks especially looking weak.

The economic activity in China hasn’t picked up as much as bulls expected despite the lifting of lockdowns. The country has meanwhile declared a “decisive victory” over the coronavirus.

However, the recent economic indicators suggest that China’s economy is headed for a structural slowdown and the continued tensions with the US—its largest trading partner—aren’t helping matters either.

NIO’s valuation has taken a hit over the last year. It is now the third most valuable Chinese EV company and lost the second position to Li Auto. BYD meanwhile is the largest EV company in China.

Xpeng Motors also fell to the fifth rank. Surprisingly, Zeekr, a privately-held startup Chinese EV company is now valued more than Xpeng Motors.

2022 was a terrible year for EV stocks and Tesla too fell 65% in the year. However, while Tesla has since recovered and has almost doubled from its recent lows, other EV stocks are still sagging.

NIO also lost over two-thirds of its market cap in 2022. Li Auto meanwhile outperformed other EV stocks last year and fell around 36%. These companies’ deliveries somewhat explain the divergence in their price action.

NIO Delivered Fewer Cars Than Li Auto in 2022

Li Auto delivered 133,246 cars in 2022 which was 47.2% higher than the previous year. NIO could only deliver 122,486 cars while Xpeng Motors delivered 120,457 EVs.

Li Auto’s cumulative deliveries reached 272,475 at the end of January. The company surpassed Xpeng Motors on the metric and is now playing catch-up with NIO.

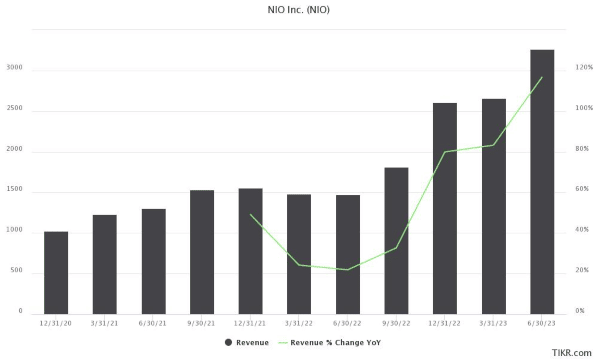

NIO reported mixed earnings for the third quarter of 2022. NIO’s losses widened in the quarter and it reported an adjusted per-share loss of 30 cents which was wider than the 6 cents per share loss that it posted in the corresponding quarter last year.

However, NIO boasts of a strong balance sheet and had $7.2 billion as cash on its balance sheet at the end of September. While the cash pile came down from $8.1 billion at the end of the second quarter, it is nonetheless good enough looking at NIO’s cash needs.

Last year, Baillie Gifford also increased his stake in NIO. Many analysts see NIO as a worthy competitor to Tesla. There is a guide on how to buy NIO stock.

NIO to Report Q4 2022 Earnings Next Month: What to Expect?

NIO would release its Q4 2022 earnings on March 1. Analysts expect the company to post revenues of $2.60 billion—a YoY rise of almost 80%. However, analysts expect the company to report an adjusted net loss of $395 million in the quarter.

During NIO’s Q4 2022 earnings call, markets would look out for commentary on 2023 production guidance. Also, it would be pertinent to track the progression in its gross profit guidance.

The company might also provide some color on its breakeven plans. Previously, NIO said that its core business might become profitable in the fourth quarter of 2023. However, as it launches new models and enters new markets, its costs might rise in the short term.

NIO might also comment on the competitive landscape in the Chinese EV markets where there has been a flurry of price cuts.

Tesla Lowers Model Y Prices in China

Meanwhile, Tesla has raised prices on some Model Y variants. The company had previously lowered prices in January, for the second time in three months. The company also lowered prices in the US in order to spur sales.

All said, amid the divergence in price actions of Tesla and NIO, many find the latter undervalued. However, while NIO might look undervalued as compared to Tesla based on metrics like price-to-sales, it’s worth noting that Tesla is sustainably profitable and generates positive free cash flows consistently.

On the contrary, startup EV companies like NIO are saddled with perennial losses and cash burn. Tesla too was profitable in only a few quarters before Q3 2019 when it turned sustainably profitable.

NIO bulls expect the company to repeat Tesla’s magic especially given its strong brand positioning.

Related stock news and analysis

- Best China Cryptocurrency Projects to Invest in 2023

- How to Invest in Carbon Credits in 2023

- Charlie Munger Calls BYD his Best Investment & Takes a Swipe at Tesla

Fight Out - Next Big Train-to-Earn Crypto

- Backed by LBank Labs, Transak

- Earn Rewards for Working Out

- Level Up and Compete in the Metaverse

- Presale Live Now - $5M Raised

- Real-World Community, Gym Chain