In an internal email, Tesla (NYSE: TSLA) CEO Elon Musk has pushed employees for year-end deliveries. He also apparently told them to not get perturbed by the price action of Tesla stock.

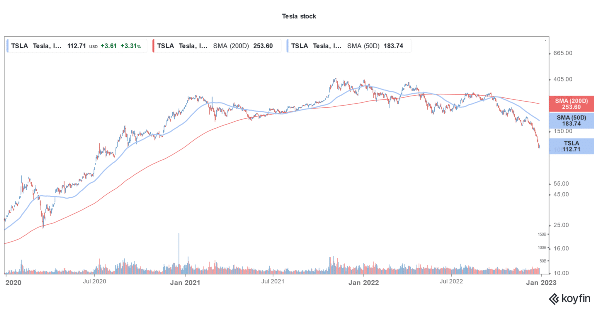

With a YTD loss of almost 70%, Tesla is the worst-performing major tech stock of the year. Barring a miracle over the next two trading sessions, it is on track for the worst month, quarter as well as year in history.

From a market cap of over $1.2 trillion, Tesla’s valuation has slumped to just around $350 billion. Meanwhile, Musk, who gets all his compensation from Tesla in the form of stock options, told employees in an email to not get “bothered by stock market craziness.”

It’s an apparent reference to Tesla’s price action and a bid to reassure employees who also get some part of their compensation in the form of stock options.

Musk also said in the email, “As we demonstrate continued excellent performance, the market will recognize that. Long-term, I believe very much that Tesla will be the most valuable company on Earth!”

Musk Says Tesla Could become the Biggest Company

Notably, Musk, who lost the position as the world’s richest person to Bernard Arnault, has previously also said that Tesla could be the world’s largest company.

During the third quarter earnings call, Musk said that Tesla’s market cap would surpass the combined market cap of Apple and Saudi Aramco, the world’s largest and second-largest company respectively. He also said that Tesla might consider a buyback in 2023.

While Musk told employees not to worry about stock market volatility, he also asked them to help deliver the maximum number of vehicles before December 31. Incidentally, Tesla missed delivery estimates in both the second and third quarters of 2022.

Musk Tells Employees Not to Worry About Stock Market Volatility

Such emails before the end of the quarter have now become a norm than an exception at Tesla even as Musk himself has said that they create inefficiencies. But then, such U-turns are not new for Musk and have made aplenty over the last two years.

Incidentally, while Musk maintains that Tesla has the potential to become the world’s biggest company with a market cap surpassing $4 trillion, he has sold billions of dollars of shares over the last year.

Tesla stock has crashed this year and even some long-time bulls are apprehensive in the short term. Cathie Wood of ARK Invest meanwhile continues to have high conviction in Tesla and bought more shares. She also added more Coinbase stock which is the worst-performing Wood stock and is down 87.1% YTD. With a 4.3% stake, ARK Investment Management is the third largest Coinbase stockholder.

Cathie Wood Bought Tesla Stock amid the Slump

The continued crypto winter has taken a toll on Coinbase stock also. However, many believe that the crypto industry would eventually bounce back—just as it has done multiple times previously. There is a guide on how to buy cryptocurrency safely with low fees.

ARK ETFs are down sharply this year amid the sell-off in growth names and are headed for their worst year ever. Buying the dip in her favorite names did not work for Wood in 2022. She however continues to back Musk and sees Tesla stock rising higher from these levels.

As for Musk, his Twitter antics have taken a toll on his popularity and by extension Tesla brand. With markets getting apprehensive over demand for electric cars, it’s an almost perfect storm for Tesla stock.

Related stock news and analysis

- What is Carbon Credit Trading? A Beginner’s Guide

- Best Twitter Crypto – Cryptocurrency Trending on Twitter

- Tesla is the Worst Performing Major Stock of 2022 amid the Continued Slump

Wall Street Memes (WSM) - Newest Meme Coin

- Community of 1 Million Followers

- Experienced NFT Project Founders

- Listed On OKX

- Staking Rewards