Meta Platforms (NYSE: META) has announced that it would let go of 11,000 employees, which is around 13% of its workforce. The company’s CEO Mark Zuckerberg has apologized to the impacted employees.

Zuckerberg termed the changes as “some of the most difficult changes we’ve made in Meta’s history.” Apart from the layoffs, Meta Platforms announced that it would cut down on discretionary spending and extend the hiring freeze until the first quarter of 2023.

Zuckerberg offered a clear explanation of how the company reached its current state. He highlighted the rapid digitization that took place during the early days of the pandemic. He also mentioned that, like many others, he thought the rapid growth would carry on even after the pandemic, leading him to boost investments significantly.

Zuckerberg admitted, “Unfortunately, this did not play out the way I expected. Not only has online commerce returned to prior trends, but the macroeconomic downturn, increased competition, and ads signal loss have caused our revenue to be much lower than I’d expected.”

Meta Platforms to Lay Off Thousands of Employees

In what he referred to as the “new environment,” Zuckerberg mentioned that Meta Platforms would direct resources toward advertising, business platforms, an AI discovery engine, and the metaverse. The company is also exploring various other methods to reduce expenses. For example, it is “moving to desk sharing for employees who spend most of their time away from the office.”

Zuckerberg said that the company is making these changes as the revenue outlook is lower than what it envisioned at the beginning of the year. He added, “we want to make sure we’re operating efficiently across both Family of Apps and Reality Labs.” Incidentally, the job losses would both be at the Family of Apps and Reality Labs business.

Many have been critical of Zuckerberg for investing heavily in the Reality Labs business which is building the metaverse.

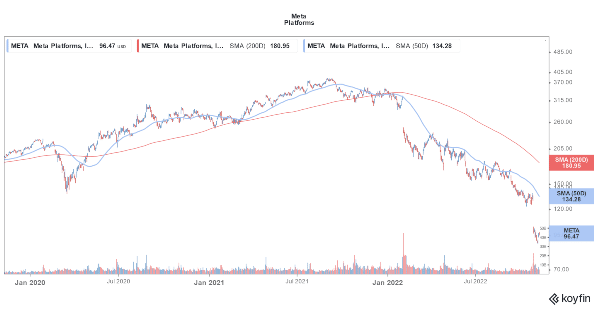

Meta Platforms’ shareholders have been calling upon the management to cut costs. The stock is not only the worst-performing FAANG stock of 2022 but is also the worst-performing S&P 500 stock. In absolute terms, the social media giant has lost almost $750 billion in market cap from its last year’s peaks.

Shareholders Have been calling Upon Zuckerberg to Cut Costs

Altimeter Capital Chair Brad Gerstner, whose firm is a Meta Platforms shareholder, last month an open letter to the company where he made three suggestions.

Firstly, he said that the company should lower its headcount by 20%. Secondly, he said that Meta Platforms should lower its annual capex from $30 billion to $25 billion. Finally, he said that the company should not spend more than $5 billion annually on building the metaverse. Reportedly, the initial performance of Meta’s metaverse business hasn’t been satisfactory.

The Realty Labs segment lost $3.67 billion in Q3 2022. In the third quarter of 2021, it lost $2.63 billion. The Reality Labs segment has almost lost $10 billion this year with one quarter to spare. During the Q3 2022 earnings call, Meta Platforms said that Reality Labs’ losses would be “significantly” higher next year, partially due to higher employee costs.

Metaverse is a long-term opportunity though. Companies like Nvidia also see the metaverse as a key growth driver. We have a list of companies that are a play on metaverse.

Meta Platforms Expects Revenues to Fall in Q4

Meta Platforms’ revenues fell on a YoY basis in both the second and third quarters of 2022. The company’s guidance suggests a YoY fall in Q4 revenues as well. The pressure was building on Meta Platforms to act as several shareholders were getting impatient with the sagging stock.

Meta Platforms stock plummeted after the Q3 earnings release. Microsoft stock too fell after the earnings release that week. However, most analysts see Microsoft as a good buy for the long term.

Zuckerberg sounded somewhat dismissive of the concerns over spiraling costs and rising capex during the Q3 earnings call. Meanwhile, Meta Platforms stock is trading higher in premarkets today as Zuckerberg finally seems to be listening to markets.

Related stock news and analysis

- How to Buy Meta Stock in 2022

- 14 Best Metaverse Crypto Coins to Buy in 2022

- Disney Q4 2022 Earnings: Streaming ‘Win’ Comes at a Big Cost

Dash 2 Trade - New Gate.io Listing

- Also Listed on Bitmart, Changelly, LBank, Uniswap

- Collaborative Trading Platform Token

- Featured in Bitcoinist, Cointelegraph

- Solid Proof Audited, CoinSniper KYC Verified

- Trading Community of 70,000+ Members