Fed policy has been a key driver of US stock markets this year as the US central bank has embarked on the most aggressive monetary policy tightening in decades. What to expect from the Fed’s December meeting after a blowout November jobs report?

The November nonfarm payrolls increased by 263,000 which was well ahead of the 200,000 that economists were expecting. The Labor Bureau also upwardly revised the October nonfarm payrolls to 284,000.

Usually, a strong jobs report is a positive for stocks. However, at a time when aggressive Fed rate hikes are the biggest risk for markets, investors see a strong jobs report as a negative as it might prompt the Fed to continue raising rates at a fast pace.

Also, the wage growth was 0.6% in November on a monthly basis which was twice what economists were expecting. Speaking at the Brookings Institution earlier this week, Fed chair Jerome Powell raised concerns over strong wage growth.

He said that the job market “shows only tentative signs of rebalancing, and wage growth remains well above levels that would be consistent with 2% inflation.” He added, “For wage growth to be sustainable, it needs to be consistent with 2% inflation.”

Strong November Jobs Reports Could Lead to a Hawkish Fed

Notably, the Fed is worried that amid high wages and rents, inflation could get entrenched. About a year back, the US central bank said that inflation is transitory. However, it soon retired the term. US inflation peaked at a four-decade high of 9.1% in June and has since come down gradually.

In October, the CPI inflation came in at 7.7% which was lower than what analysts were expecting. The November CPI data would be released later this month which would be the last key economic data before the Fed’s December meeting.

Meanwhile, data released earlier this week showed that core personal consumption expenditure, which is a key data point that the Fed looks at, increased by 0.2% in October which was slightly below estimates.

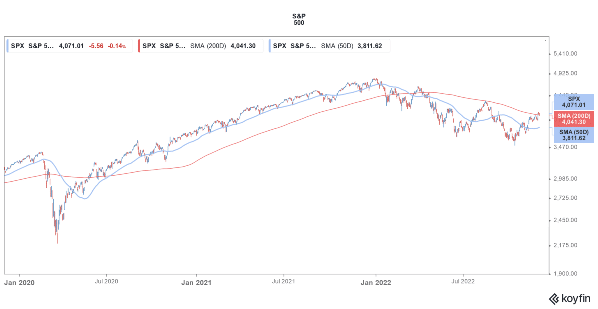

Inflation Has Come Off Its 2022 Highs

While many economists believe that inflation would drop considerably next year, Bill Ackman of Pershing Square Holdings has a contrarian view and believes that it won’t fall below the Fed’s targeted range of 2% anytime soon.

Higher inflation has taken a toll on US stocks, especially the growth names. However, there is a list of investments that can do well in inflation.

After the 75-basis point rate hike in November, which took the total hikes in 2022 to 3.75%, the Fed is looking to slow down the pace of hikes. The November Fed minutes stated, “A substantial majority of participants judged that a slowing in the pace of increase would likely soon be appropriate.”

They added, “A slower pace in these circumstances would better allow the Committee to assess progress toward its goals of maximum employment and price stability.”

Fed Said It Might Slowdown the Pace of Hikes

At the Brookings Institution speech also, Powell talked about the possibility of slowing the pace of hikes and said “The time for moderating the pace of rate increases may come as soon as the December meeting.”

Powell added, “My colleagues and I do not want to overtighten because…cutting rates is not something we want to do soon.” He also talked about the lag impact of monetary policy actions, something which Cathie Wood of ARK Invest has been highlighting.

Meanwhile, US stocks whipsawed yesterday after the strong November jobs report. While stocks were sharply lower in early trade, they eventually recovered and the Dow Jones closed with marginal gains.

All eyes would now be on the November inflation reading and the subsequent Fed meeting which would make or mar the chances of a Santa Claus rally.

Wharton professor Jeremy Siegel predicts that the Fed would pause its rate hikes after a 50-basis point rate hike in December. He also said that markets would not retest their 2022 lows and can deliver 30% returns over the next two years. There is a guide on how to buy stocks with a regulated broker.

Related stock news and analysis

- Best Way to Invest $10k – Top Methods Compared

- How to Day Trade Stocks in 2022 – A Beginner’s Guide

- Musk Suspends Kayne West’s Twitter Account after Antisemitic Tweet

Dash 2 Trade - New Gate.io Listing

- Also Listed on Bitmart, Changelly, LBank, Uniswap

- Collaborative Trading Platform Token

- Featured in Bitcoinist, Cointelegraph

- Solid Proof Audited, CoinSniper KYC Verified

- Trading Community of 70,000+ Members