US stocks closed with gains last week despite the Friday slump. Here are the key earnings and economic indicators that investors would watch next week.

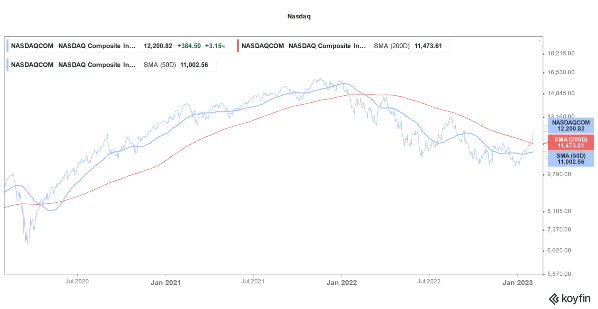

Looking back at the last week, the Nasdaq Composite gained 3.3% and the tech-heavy index is now up 15% for the year. It has now closed with gains for five consecutive weeks. It is the longest winning streak for US tech stocks since November 2021.

The rise is a welcome break for investors as the index shed almost a third of its value in 2022 and underperformed other major indices.

Looking back at the last week, corporate earnings started on a positive note as both General Motors and SoFi impressed with their fourth-quarter earnings. The Fed also took a less hawkish approach and raised rates by 25 basis points.

Powell said at the press conference, “We can now say I think for the first time that the disinflationary process has started.” While he emphasized that it’s “very premature to declare victory” his tone was a lot less hawkish than it has been in the past.

Meta Platforms also impressed markets with its Q4 2022 earnings. The company’s CEO Mark Zuckerburg touted efficiency and productivity multiple times during the earnings call as the social media giant looks to tighten belts. There is a guide on how to buy Meta Platforms stock.

US Stocks Crashed on Friday after Alphabet and Amazon’s Earnings

Meta Platforms’ earnings triggered a rally in US tech stocks on Thursday. However, on Friday, tech stocks crashed as Apple, Alphabet, as well as Amazon disappointed markets with their earnings.

Apple’s iPhone sales fell short of estimates and its revenues fell over 5% YoY in the December quarter. The company’s guidance was also mixed as it forecast another quarter of revenue decline.

Amazon also spooked markets with its bottomline miss and provided tepid operating profit guidance. Alphabet also missed both topline and bottomline estimates in Q4 2022.

Ford’s profits also fell well short of estimates and the stock crashed on Friday even as its CEO Jim Farley vowed to fix the execution issues.

Data released on Friday showed that nonfarm payroll surged by 517,000 in January which was way ahead of the 187,000 that analysts expected. The unemployment rate also fell to a multi-decade low of 3.4%.

Key Earnings to Watch Next Week

The earnings calendar takes a slight breather next week. However, we still have plenty of key earnings next week. In the fintech space, PayPal and Affirm would release their earnings next week.

Uber and Lyft also report next week and their earnings would offer more insights into the US economy.

Disney would also report its earnings next week. This would be the first earnings release under Bob Iger who took over as the CEO in November last year. During the earnings call, Iger might list his action plan as the company tries to improve its profitability.

Iger’s predecessor Bob Chapek prioritized streaming growth over profits but Iger wants the company to focus on profits. He has reversed some of Chapek’s decisions and markets would watch out for more color on how he intends to transform the company and revive its sagging stock price.

Disney stock rebounded after Iger took over. Many analysts turned bullish on the stock and advised buying Disney after Iger took over.

Key Economic Indicators to Watch Next Week

We don’t have a lot of economic indicators lined up for the next week. That said, inflation expectation and consumer sentiment would be two key releases next week.

The market rally might need some more fuel to sustain the uptrend. Analysts’ opinion on the 2023 stock market outlook is quite mixed though. While some expect the rally to continue and say that the worst is over, many especially Mike Wilson of Morgan Stanley predict a crash.

So far in 2023, bulls have had the upper hand despite mixed corporate earnings.

Related stock news and analysis

- Best Way to Invest $10k – Top Methods Compared

- Tesla Stock Rises as ‘Teflon’ Musk Wins Yet Another Legal Battle

Wall Street Memes (WSM) - Newest Meme Coin

- Community of 1 Million Followers

- Experienced NFT Project Founders

- Listed On OKX

- Staking Rewards