Concerns are rising that the relentless rally in US stocks may be nearing an unsustainable peak, with strategists sounding alarms about lofty valuations and crowding behavior that could precipitate a severe market downturn.

These worries heated up Thursday as the S&P 500 tumbled 1.5% in just 2 hours after opening up 1.1%.

Let’s take a look at what top analysts are saying about the current state of the US stock market and the odds of a crash or at least a sizable correction.

Key Highlights: Concerns Over U.S. Stock Market Sustainability

- High Valuations and Market Warnings: Analysts like Jeremy Grantham and JPMorgan have expressed concerns over the U.S. stock market’s elevated valuations, which are among the top 1% historically. They suggest that the current market could be on the verge of a significant correction due to its dependence on a small group of tech stocks .

- Flash Crash Risks and Concentration: JPMorgan’s analysts warn that concentrated investments in tech giants could trigger a “flash crash” if investors quickly unwind positions. Crowded trades, particularly in AI and tech sectors, are seen as a potential vulnerability .

- Diverging Views and Resilient Fundamentals: While some anticipate a downturn, others highlight robust corporate profits and strong consumer balance sheets that might mitigate the impact. Nonetheless, analysts advise caution, noting that timing the market is challenging and recommending a balanced investment approach .

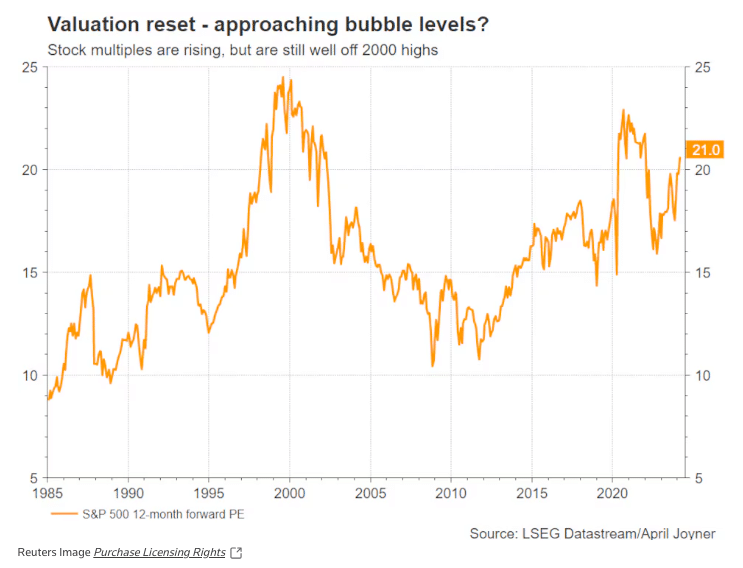

Record Valuations Signal a Stock Market Bubble Is in the Making

Veteran investor Jeremy Grantham doesn’t mince words – he believes the stock market is a “superbubble” showing signs of being “just as crazy” as the biggest bubbles in history.

The benchmark S&P 500 is trading at valuations in the top 1% of historical ranges based on the Shiller P/E (price-to-earnings) ratio.

Grantham argues that the current conditions are completely opposite to how major bull markets typically start with low valuations, depressed profit margins, and high unemployment. He warns that the markets are in “double jeopardy” with the potential for both profits and valuations to plunge from today’s elevated levels.

The market historian pointed to past examples like 1929 and 1999 when huge rallies during booming economic periods “ended incredibly badly”. He suggests that today’s high-flying mega-cap tech leaders could suffer a similar fate as the “Nifty Fifty” of the 1970s crash.

Crowded Trades Raise Risk of a “Flash Crash”

JPMorgan’s chief equity strategist Dubravko Lakos-Bujas also sees ominous signs of overheating in the concentration of investor capital into a handful of the market’s biggest tech names. He warns that this crowding behavior sets up the possibility of a “flash crash” with no clear trigger other than funds rapidly unwinding overlapping positions.

“You might not need a catalyst, it can just come one day out of the blue and this has happened in the past, we’ve had flash crashes”, the market strategist stressed. It’s possible that even a small decline in growth of generative AI or cloud computing could bring the valuations of top players crumbling.

Lakos-Bujas says that severe market corrections have followed the three prior instances since 2008 when crowding reached such extreme levels. Momentum reversals become self-reinforcing as funds rush for the exits. “… the next thing you know, you start having a bigger and bigger momentum unwind”, the investment professional cautioned.

He urged investors to diversify away from the “magnificent seven” stocks that have driven returns or, otherwise, they may end up standing on the wrong side of the trade when the current trend inevitably reverses.

Meanwhile, Paul Dietrich, chief investment strategist at B. Riley Wealth, points to what he calls the “smart money” like billionaires Jeff Bezos and Warren Buffett selling shares as a major warning that the market is approaching a peak.

While some sales are scheduled in advance, he argues that these investors likely “know it’s just completely overvalued and if they sell now, they can buy back cheaper later.”

Dietrich says that the combination of historically extreme valuations across multiple measures and the exit of sophisticated investors into cash is clear evidence of a “historic, historic bubble” preceding a “major, major correction.” He warned that this is not the right time for investors to be putting new money into an overheated market.

“It’s hard to look at that and say that we’re not going to see a major, major correction coming. Now is not the time to be putting new money in the market”, Dietrich told Yahoo Finance during a recent interview.

Excessive Debt and Fiscal Risks Are Looming on the Backdrop

Not all analysts are focused on valuations and investor behavior as precursors to a crash.

For example, Ron Surz, president at PPCA Inc., argues that the $3.5 trillion excess in the US money supply could cause renewed cost-push inflation on top of current demand-driven price pressures. Sticky inflation would likely force the Fed to continue to push off rate cuts, hampering the market for months and months.

Surz cites the Federal Reserve’s operating losses from fighting inflation, the risks of more bank failures, and defaults on loans for office buildings and stores going out of business. The confluence of economic and banking system stresses leads him to warn that “it’s ugly” for the US central bank with “no way out” for them.

Similarly, the Congressional Budget Office’s fiscal watchdog highlighted the “unprecedented” growth of U.S. government debt, now rising at $1 trillion every 100 days with politicians ignoring any form of fiscal rectitude.

Meanwhile, Blackrock’s CEO Larry Fink worries that “there’s a bad scenario where the American economy starts looking like Japan’s in the late 1990s and early 2000s, when debt exceeded GDP [gross domestic product] and led to periods of austerity and stagnation.”

A warning sign from the head of a company that controls a large portion of the biggest US companies through exchange-traded funds (ETFs) and other similar investment products should not be completely ignored.

The Stock Market is Inflated by AI Hype and Dovish Fed Bets, BMO CIO Says

For BMO Wealth Management’s CIO Yung-Yu Ma, the market’s blistering start to 2024 was driven by a “wobbling” narrative of imminent Fed rate cuts and inflated by AI stock froth that could both soon deflate.

Ma argues that the latest data on oil prices, inflation, and wage growth don’t yet support the aggressive rate-cut forecasts that markets seem to be pricing in. If the Fed maintains a hawkish stance for longer, it could undercut the “goldilocks” scenario markets have embraced.

The BMO strategist expects a “bifurcated” earnings environment where market leaders outperform but many companies – typically the smallest ones – struggle with higher rates and economic pressures.

This could lead to choppy overall returns as valuations come back in line.

Market Dislocations from Geopolitical Shocks

Other voices highlight the potential for destabilizing external shocks to an overly complacent market environment.

Geopolitical flare-ups like the Russia-Ukraine war last year demonstrated how supply shocks can rapidly upend inflation expectations.

With ongoing conflicts in Gaza and Ukraine, plus rising US-China tensions, more commodity shocks or interrupted trade cannot be ruled out. Any such disruptions could force the Fed off its expected policy path and punish a market that is wrongly positioned for lasting disinflation.

The potential for a highly contentious US presidential election in November 2024 also looms as an unpredictable event risk that could catalyze market turmoil if the outcome is disputed and sends the political system into crisis.

Resilient Economic Fundamentals Argue Against Crash

While the warnings are manifold, not all analysts are sounding the sirens on an imminent market crash. Some point to the huge cash stockpiles and healthy consumer balance sheets arguing against the depth of the dotcom bust.

Corporate profits remain at record levels, particularly among the mega-cap tech leaders.

Moreover, revenue forecasts for 2024 are robust in the double digits and the economy, while slowing, has not yet fallen into the typical preconditions associated with bear markets like high unemployment.

Hugh Johnson at Graypoint LLC notes that even with extended valuations, equities rarely trade at textbook “fair value” for long before breaking higher or lower. Major stocks tend to push further above or below estimated fair value in either direction.

Stay the Course? Advisors Caution Investors Against Market Timing

When it comes to advice for investors worried about a potential crash, strategists broadly recommend staying the course with a long-term, diversified asset allocation strategy aligned to their individual risk tolerance.

Mitch Bodenmiller at Buckingham Advisors says that investors’ biggest mistake is trying to time market peaks and valleys.

“Trying to predict market highs or lows is one of the most common errors individual investors make, and it more often than not leads to returns that fall far short of those of investors who have properly allocated investment portfolios and the patience to ride out short-term market volatility,” Bodenmiller told US News this week.

Others make similar stay-the-course recommendations despite this growing chorus of doomsday market calls. BMO’s Ma reminds investors that the market’s torrid five-month rally has been “an exception, not the norm.” Simply allowing fundamentals to slowly realign with elevated valuations may be the path forward.

Meanwhile, Jim Baird at Plante Moran Financial Advisors sums it up: “Taken as a whole, the combination of data doesn’t yet look weak enough to prompt Fed policymakers to shift to an easier policy stance in the near term.” As long as the Fed stays on its tightening path, markets may grind higher or simply consolidate recent gains.

History Provides Little Guidance to Predict Stock Market Crashes

As Brett House from Columbia Business School points out, equity market bubbles are exceedingly rare events outside the dot-com craze around 2000. Other major drawdowns like 1987 and 2008 were triggered by external shocks that are just too hard – if not impossible – to predict.

With the economy still growing, earnings still rising, and the Fed likely to cut rates this year, there is little historical precedent for an immediate, self-reinforcing market collapse. House argues that, if fundamentals can justify today’s valuations, “it may be that the scale of any subsequent correction is smaller and the length of the correction is shorter.”

Jeremy Grantham and others may eventually be proven right that we are witnessing historic speculative excesses in need of a severe unwinding. But pinpointing the catalyst and timing remains more art than science, a guessing game based on instinct rather than data.

Analysts can point to elevated risk metrics, crowding behavior, rich valuations, and other financial system vulnerabilities.

However, until a tangible shock manifests – a deep recession, financial crisis, policy error, or unforeseen geopolitical event – markets can remain elliptical and untethered to fundamentals for far longer than observers expect.