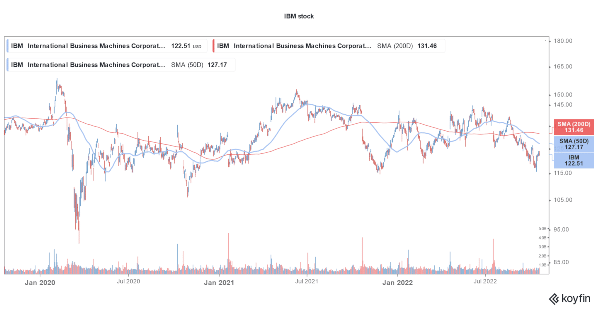

IBM stock is trading higher in US premarket price action today after the company reported better-than-expected earnings for the third quarter of 2022 and also raised its full-year guidance.

IBM reported revenues of $14.11 billion which easily surpassed analysts’ estimate of $13.51 billion. The revenues increased 6% YoY. In constant currency terms, sales increased by 15%. The relentless rise in the US dollar against most major currencies has negatively impacted US tech companies.

Even Tesla, which released its earnings yesterday took a hit from the stronger dollar. However, while IBM’s earnings surpassed estimates, Tesla’s revenues fell short of estimates. Tesla stock is down over half from its 52-week highs but Elon Musk has predicted that the company’s market cap can rise significantly higher from these levels.

Coming back to IBM, its software revenues increased by 7% while consulting revenue was up 5% in the third quarter. IBM’s infrastructure revenues increased by 15%. “Both our revenue growth and operating profit profile for the first three quarters of the year align to the investment thesis we outlined last fall,” said James Kavanaugh, IBM’s CFO.

He added, “Our portfolio mix, business fundamentals, strong recurring revenue stream, and solid cash generation allow us to invest for continued growth and return value to shareholders through dividends.”

IBM Stock Rises After Earnings Beat

Notably, IBM has an attractive dividend yield of 5.4%. The stock is outperforming markets this year as investors have sought solace in companies with good dividend yields. We have a list of companies that pay attractive dividends to investors.

IBM reported EPS of $1.81 in the quarter which was slightly higher than the $1.77 that analysts were expecting. The company also raised its full-year revenue guidance and CEO Arvind Krishna said during the earnings call that “With our year-to-date performance, we now expect full-year revenue growth above our mid-single digit model.”

IBM’s third-quarter earnings report is in stark contrast to its Q2 earnings release. That quarter, the stock had slumped despite the earnings release as it spooked markets by cutting its full-year cash flow guidance. It reaffirmed the annual cash flow guidance during the third quarter earnings call.

IBM Is Focussing on AI and Hybrid Cloud

IBM has been restructuring its business and as part of the efforts it spun off Kyndryl, its managed infrastructure business. The company is also a play on Web3, AI, and blockchain and analysts expect these businesses to drive its long-term growth.

IBM sees strong growth in new businesses. During the third quarter earnings call, Krishna said, “Technology remains a fundamental source of competitive advantage, and we continue to see solid demand for our hybrid cloud and AI solutions.”

IBM continues to add new clients and during the third quarter, it added leading companies like Bank of America, Bharti Airtel, and Samsung Electronics for hybrid cloud.

US Stocks Have Whipsawed in 2022

Meanwhile, US stock markets have whipsawed this year. After the crash in September, US stocks have been quite volatile in October. While stocks have rebounded from their lows, many market observers doubt the sustainability of the rally. Over the next couple of weeks, earnings might drive the markets as investors access the impact of the economic slowdown on corporate earnings.

Related stock news and analysis

- Best Tech Stocks to Buy in 2022 – How to Buy Tech Stocks

- After Healthcare, Amazon Bets on Finance with UK Healthcare Insurance Store

- How To Invest in Mutual Funds in 2022 – With Low Fees

Tamadoge - The Play to Earn Dogecoin

- '10x - 50x Potential' - CNBC Report

- Deflationary, Low Supply - 2 Billion

- Listed on Bybit, OKX, Bitmart, LBank, MEXC, Uniswap

- Move to Earn, Metaverse Integration on Roadmap

- NFT Doge Pets - Potential for Mass Adoption