Almost all the EV (electric vehicle) companies have long been saying that they are supply-constrained and can only sell as many cars as they can produce. However, of late, markets are getting apprehensive about the demand for electric cars, at least for some companies.

In the first half of the year, cars, both electric as well as ICE (internal combustion engine), were in short supply amid the supply chain challenges.

EV companies were able to raise car prices at will amid the demand-supply mismatch. Car companies might anyways have had to increase prices amid rising input costs but the supply shortfall made their job easier.

While the supply chain challenges haven’t fully withered away, things have got a lot better now. However, EV companies now face new trouble.

There are several instances that show that amid rising competition and slowing car sales, the demand for EVs is not as strong as it was a few months back.

Lucid Motors is Offering Discounts on its Cars

Lucid Motors is offering an $18,000 discount to employees who buy a Lucid car this year. Barron’s reported that the startup EV company is also offering discounts to those customers who had canceled their orders. The discount could be a sign that the company is facing demand troubles.

Furthermore, the prices of used Lucid cars have plunged which is another sign of a demand slowdown. Incidentally, used Rivian cars sell at a premium to the new car, a sign that buyers are willing to pay a premium to get quick delivery.

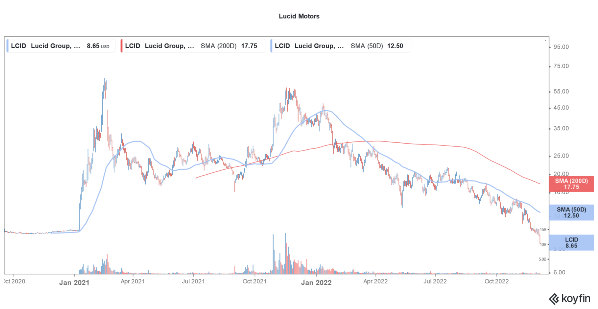

During the Q3 2022 earnings call, Lucid Motors said that it has 34,000 orders for Lucid Air which was 3,000 less than what it had in the previous quarter. The company said that net orders dropped due to customer deliveries and cancelations.

While Lucid Motors tried to downplay the fall in orders, markets were visibly perturbed. Incidentally, Rivian, which also went public last year, reported an increase in its order volumes while releasing its Q3 earnings. While LCID stock has fallen to new lows, Rivian is comfortably above its 2022 lows.

Tesla is Also Offering Credit to EV Buyers in December

Tesla is another case in point. The company recently said on its website that it would offer a credit of $3,750 to US buyers who take delivery of Model 3 and Model Y in December.

Tesla has lowered car prices in China and offered additional insurance incentives in November. There are rumors that the company is looking to cut EV production in China. While Tesla might have called reports that it is cutting production in China “untrue,” connecting the dots shows that the company is facing some pressure as it strives to scale up year-end deliveries.

During Tesla’s Q3 2022 earnings call, its CEO Elon Musk categorically denied that Tesla is witnessing any slowdown in demand and emphasized that the fourth quarter would be “epic.” He also refuted that Tesla would lower production. Musk said, “we’re very pedal to the metal come rain or shine. So, we are not reducing our production in any meaningful way, recession or not recession.”

Tesla stock has fallen sharply from its 2021 highs and several brokerages like Morgan Stanley find the stock attractive now. We have a guide on how to buy Tesla stock.

Xpeng Motors Reported a Fall in Its EV Deliveries

Xpeng Motors’ deliveries also plunged in October and November. More than any supply-side issue, analysts see it as a sign of tepid demand.

Citi double-downgraded the stock from a buy to a sell. Jefferies also downgraded Xpeng Motors stock to underperform and lowered its target price to a mere $4.2. In their note, Jefferies analysts led by Johnson Wan said, that the “honeymoon stage” for EVs is coming to an end in China.

They added, that XPEV “faces tough competition with existing models reaching the end of their life cycles and a weak product pipeline that will likely continue to drag sales into 2023. They warned that the recently launched G9 SUV wasn’t received well in China and blamed Xpeng Motors’ “missteps in product and pricing strategy” for market share losses.

Bernstein says Tesla needs to cut car prices

Bernstein analyst Tony Sacconaghi, who is a long-time Tesla bear believes that the company would need to cut EV prices to spur demand. He emphasized that Tesla seems to be facing demand issues.

After Tesla’s Q3 earnings call also, Sacconaghi said that the company is facing demand issues in China, pointing to the almost nil lead time for its cars.

Markets have also derated EV stocks over the last year and all of them have slumped. Meanwhile, despite the slump in EV stocks, Vietnam’s VinFast has filed for an IPO in the US. It however hasn’t specified the issue price and size and said it would depend on market conditions.

Overall, as more electric cars hit the roads, EV demand would receive increased scrutiny. Legacy automakers have big plans for electric vehicles based on the assumption that EV demand would continue to soar in the coming years.

Related stock news and analysis

- Best Sustainable Investing Funds to Watch in 2022

- 9 Most Eco-Friendly Crypto Coins 2022

- Is Demand a Concern for Tesla? Elon Musk Disagrees

Dash 2 Trade - New Gate.io Listing

- Also Listed on Bitmart, Changelly, LBank, Uniswap

- Collaborative Trading Platform Token

- Featured in Bitcoinist, Cointelegraph

- Solid Proof Audited, CoinSniper KYC Verified

- Trading Community of 70,000+ Members