US stocks have whipsawed amid the crisis at regional banks – while a section of the market believes that the Silicon Valley Bank (SVB) debacle would spill over into the US economy, others are not so certain.

In a matter of days, SVB and Signature Bank collapsed, which were the second and third biggest bank failures in US history. Also, it was the first major bank failure since 2008 when Washington Mutual was shut down.

There are some who believe that just like the crisis at US banks eventually spilled over to the 2008-2009 financial crisis, the current crisis would also have a domino effect on the US economy.

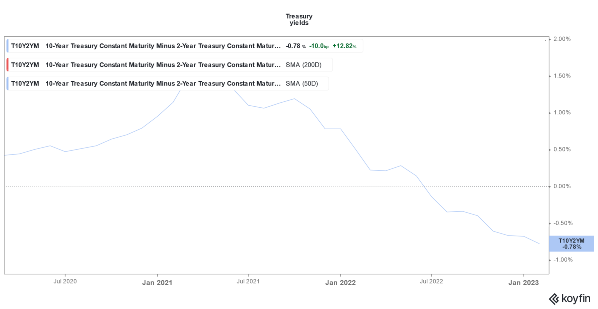

For instance, Jeffrey Gundlach – also known as the bond king – said that a US recession looks “imminent” looking at the movement in treasury yields in the aftermath of the SVB crisis.

The yields on 2-year US Treasury rose to a multi-year high of 5% last year but has now fallen to 5%.

Many traders and fund managers now see a possibility that the Fed would not raise rates at its meeting later this month.

Burry Does Not Believe SVB Debacle Will Have Domino Effect

Michael Burry – who correctly predicted the US housing market collapse of 2008, and over the last couple of years generally has had bearish views about the US economy and stock markets – surprisingly does not see SVB’s failure having a major impact.

In a now-deleted tweet, Burry wrote: “This crisis could resolve very quickly. I am not seeing true danger here.”

Barely days back, he had compared the current crisis to previous economic slumps.

“2000, 2008, 2023, it is always the same. People full of hubris and greed take stupid risks, and fail. Money is then printed. Because it works so well,” he said.

Last year, Burry also predicted a US stock market crash and said that while valuation multiples have corrected, the next round of downfall would be driven by the contraction of earnings estimates.

Larry Fink on the Banking Crisis

In his annual shareholder letter, BlackRock CEO Larry Fink said: “We don’t know yet whether the consequences of easy money and regulatory changes will cascade throughout the US regional banking sector with more seizures and shutdowns coming.”

Pointing to the recent US bank failures, including SVB, Fink added:“It’s too early to know how widespread the damage is.”

He, however, admitted that some banks might step back from lending to focus on their balance sheets. Fink added that amid high interest rates it would be difficult for governments to continue with deficit-financed spending and the private sector would need to step in.

Meanwhile, while the US banking sector is grappling with the SVB debacle, European banks also crashed today amid the slump in Credit Suisse.

The stock hit its all-time lows amid reports that Saudi Arabia does not intend to put more funds into the troubled bank.

All said US stock and bond markets have whipsawed after SVB’s failure. Expectations from the upcoming Fed meeting have also changed dramatically and now nearly half of the traders don’t see a rate hike at all in March.

Related News

- Should You Invest in Crypto During a Recession? 10 Potential Recession-Proof Coins Investors are Backing

- Buybacks, Investing, & More: Here’s What Warren Buffett Said in His Annual Letter

- Best Sectors to Invest in 2023 – Top-Performing Industries Revealed

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops