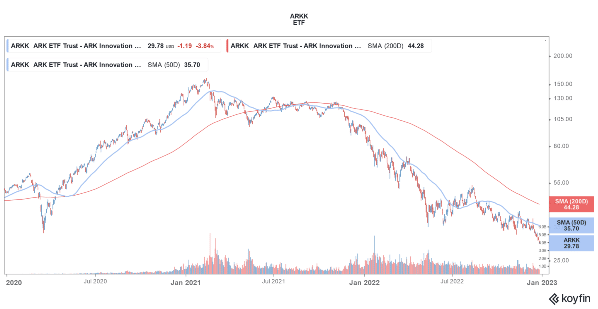

Cathie Wood, who rose to prominence in 2020 as her ARK ETFs outperformed the markets by a wide margin, had a terrible 2022, to say the least. Her funds are among the top losers this year and have underperformed badly.

ARK runs several ETFs which are a mix of both active and passive funds. However, its flagship fund is the ARK Innovation ETF (NYSE: ARKK) which typically has Tesla as among its top holdings. Incidentally, while Tesla stock has crashed and even Elon Musk has sold billions of dollars worth of Tesla shares, Wood bought the dip.

Looking at the YTD price action of ARK ETFs, ARK Next Generation ETF is the worst performing of the lot and is down 69.2%. ARKK has not done much better and is down 68.5%. Other Wood ETFs too have fared poorly. The best-performing ARK Fund is actually the Space Exploration & Innovation ETF which is down just under 37% YTD.

Incidentally, many including Jim Cramer were critical of Wood for the Space Exploration ETF. The ETFs portfolio does not exactly mimic what investors would expect from a space-focused fund.

ETFs have emerged as an attractive choice for investors given their low costs. We have a guide on how to invest in ETFs.

ARK Funds’ Assets Have Fallen amid the Crash

Wood is probably the most well-known growth fund manager. In 2020, ARK Innovation ETF more than doubled amid the splendid rally in growth stocks. The ETFs assets almost hit $28 billion at the peak. Currently, its assets are around $6.5 billion, thanks to the crash in the value of its holdings.

Wood is known to back up the companies where she has high conviction. The strategy paid off well in the past as names like Block (formerly Square) and Tesla soared to new highs. The latter went on to become a trillion-dollar company. However, it has slumped and the market cap has now fallen below $350 billion.

Wood meanwhile continues to have high conviction in Tesla and bought more shares. She also added more Coinbase stock which is the worst-performing Wood stock and is down 87.1% YTD. With a 4.3% stake, ARK Investment Management is the third largest Coinbase stockholder.

The continued crypto winter has taken a toll on Coinbase stock also. However, many believe that the crypto industry would eventually bounce back—just as it has done multiple times previously. There is a guide on how to buy cryptocurrency safely with low fees.

‘Buy the Dip’ Did Not Work for Wood in 2022

Wood kept on buying the dip in 2022. However, the year was like no other for growth stocks and Wood’s favorite names continued to fall from one low to the other. Tesla is the most recent example. The stock is on track to have its worst month, quarter, as well as the calendar year.

The sell-off in Tesla stock has deepened amid demand concerns. While Tesla has sought to portray a rosy picture of demand, its price cuts, discounts, and production suspension represent a different picture. The Elon Musk-run company is on track to become the worst-performing major tech stock of 2022.

The crash in Tesla stock has also hit ARK Innovation ETF. The stock’s weightage in the ETF is now also down to around 6%. Currently, Zoom Video Communications is the top holding for the ETF followed by Exact Sciences and Roku.

ARK Funds Fall Prey to Rising Interest Rates

Growth stocks have cratered amid the Fed’s rate hikes. The Fed raised rates by seven times in 2022. Currently, the Fed fund rate is 4.25-4.50%. After the December meeting, the FOMC upwardly revised the dot plot which shows that the median projections of Fed fund rates at the end of 2023 are 5-5.25%.

Wood has criticized the Fed publicly and believes that the US economy is headed for deflation. The Fed meanwhile is in no mood to give up its fight against inflation.

Rising interest rates work to the nemesis of growth stocks which have their cash flows skewed to the future.

Many Economists Predict Rate Cuts in 2023

Many economists believe that the Fed would need to pivot to rate cuts in 2023. Wharton professor Jeremy Siegel believes that the Fed would start cutting rates in 2023 and predicts that US stocks would rise 15% next year. There is a guide on how to buy stocks through PayPal.

Tom Lee of Fundstrat also believes that the Fed would not raise rates in 2023. JPMorgan also believes that a possible Fed pivot in the back half of 2023 could trigger a rally in US stocks.

A Fed pivot to rate cuts would help propel growth stocks and by its extension ARK ETFs. However, amid rising rates, ARK ETFs are headed for their worst year on record, just like many of Wood’s favorite names.

Related stock news and analysis

Wall Street Memes (WSM) - Newest Meme Coin

- Community of 1 Million Followers

- Experienced NFT Project Founders

- Listed On OKX

- Staking Rewards