Peloton (NYSE: PTON) has announced that it is cutting 500 positions. This is the fourth round of layoffs this year from the home fitness company whose stock price fell to an all-time low recently.

After the current round of layoffs, Peloton would have only around 4,000 employees which are less than half of what it had at its peak last year. Earlier this year, Peloton’s co-founder and CEO John Foley quit as the CEO. Barry McCarthy, who has previously worked with Netflix, took over as the CEO in February and has since been trying to restructure the business.

The restructuring has been painful, especially for Peloton employees as the company has fired employees across verticals. It has also mandated employees to return to the office from November 14, failing which they risk losing their jobs.

McCarthy has said multiple times that corporate turnarounds are easier said than done. In an employee memo after the layoffs, he said, “I know many of you will feel angry, frustrated, and emotionally drained by today’s news, but please know this is a necessary step if we are going to save Peloton, and we are.”

He added, “together, we have dramatically restructured Peloton’s business. You should be incredibly proud of what we have accomplished. This has not been easy.”

Peloton Announces Layoffs as Slowdown Bites

Peloton has taken several decisions which have helped it lower its workforce requirements. It has shut its manufacturing operations, moved to third-party logistics providers, and also shut down some of its stores.

The company has changed its business strategy and has partnered with third parties to sell its equipment. It announced a deal with Amazon in August. Recently, it partnered with Dick’s Sporting Goods to sell its products. Peloton is also putting its bikes in all the Hilton Hotels in the US.

Peloton also scrapped the Ohio factory, where it was set to invest $400 million to manufacture products in the US. The company would now be selling the plant in order to raise cash.

It is working to preserve cash and is looking to become free cash flow positive in the back half of the 2023 fiscal year.

JPMorgan Sees Peloton Stock as a Buy After the Crash

Former stay-at-home winners like Peloton, Chegg, Teladoc Health, and Zoom Video Communications have been feeling the heat as the economies have reopened and these companies are finding it hard to repeat the stellar growth of 2021. A slowing economy does not bode well for Peloton either as consumers have shunned many discretionary products amid high inflation.

While PTON stock has plunged, many analysts continue to remain bullish and have maintained their buy rating on Peloton stock. JPMorgan is bullish on PTON as the company transitions from a fixed to a variable cost structure. Notably, while Peloton’s equipment sales are coming down, its subscription revenues are rising.

It posted subscription revenues of $383.1 million in the most recent quarter which was ahead of the $295.6 million that it got from product sales – it was the first time in the company’s history that its subscription revenues surpassed product sales.

Can McCarthy Save PTON?

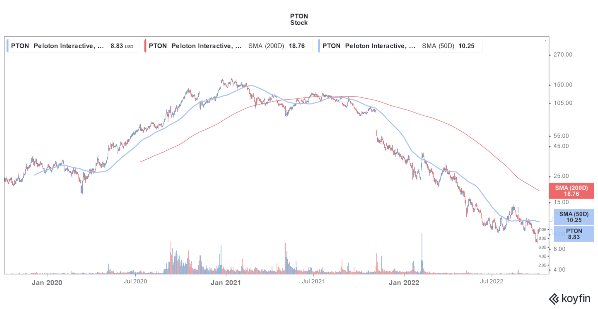

While Peloton stock has recovered from its all-time lows, it is still a fraction of its all-time highs. McCarthy said that in the next six months the company needs to show that its strategy is working.

However, he later clarified that he does not mean that PTON would not survive beyond six months. In a message to employees he said, “There is no ticking clock on our performance and even if there was, the business is performing well and making steady progress toward our year-end goal of break-even cash flow.”

Meanwhile, the demand for Peloton’s equipment has come down as is visible in its recent earnings report. At the same time, its losses have been widening while its cash has dwindled. McCarthy has a tough road ahead as he tries to “save” the once hot stay-at-home darling.

Related stock news and analysis

- How to Buy Amazon Stock in 2022

- TikTok Parent ByteDance is Losing Billions Each Year despite Rapid Growth

- How to Buy Stocks with a Regulated Broker in 2022

IMPT - New Eco Friendly Crypto

- Carbon Offsetting Crypto & NFT Project

- Industry Partnerships, Public Team

- Listed on LBank, Uniswap

- Upcoming Listings - Bitmart Dec 28, Gate.io Jan 1st