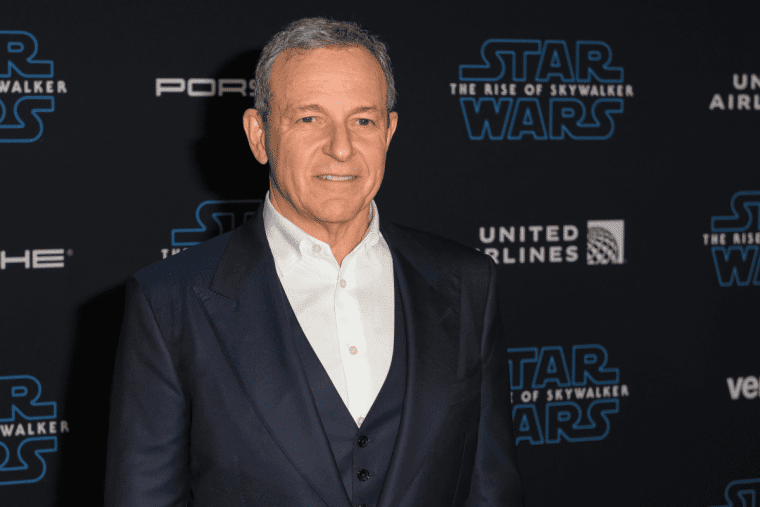

Earlier this month, Bob Iger returned as Disney (NYSE: DIS) CEO and took over the baton from Bob Chapek. Iger is driving several changes at the company and wants it to focus on streaming profits rather than subscriber growth.

At a Town Hall, he said, “We have to start chasing profitability,” and added, “It will be demanded of us.” Notably, it was Iger who launched the company’s streaming business in 2019. Under his watch, the company focused on profitability rather than going all out to chase subscriber growth.

However, in 2020, Chapek restructured Disney’s business and put streaming at center stage. He outlined aggressive growth plans and the company added millions of streaming subscribers.

DIS added a total of 14.6 million streaming subscribers in the fiscal fourth quarter of 2022, of which 12.1 million were Disney+ subscribers. At the end of the quarter, Disney+ had 164.2 million subscribers which was ahead of the 160.45 million that analysts expected. Of these 102.9 million were core Disney+ subscribers and the remaining 61.3 million are Disney+ Hotstar subscribers.

ESPN had 24.3 million subscribers at the end of the quarter while Hulu had a total of 47.2 million subscribers. Overall, Disney had 235 million streaming subscribers across formats. Netflix only had about 223 million streaming subscribers at the end of September.

However, the subscriber gain has come at a massive loss and Disney’s streaming business has been losing money consistently.

Disney Streaming Business is Still Unprofitable

Disney’s DTC (direct-to-consumer) business lost $1.47 billion in the September quarter as the streaming business continued to post losses.

Disney has said multiple times that its streaming business will become profitable in the fiscal year 2024. It reiterated the views in the fiscal fourth-quarter earnings call. Chapek said during the fiscal fourth quarter 2022 earnings call that the operating losses at the DTC business have “peaked” and would decline going forward.

Notably, next month, Disney would start offering an ad-supported platform in the US at $7.99 per month. It would simultaneously increase the price of the ad-free tier by $3 to $10.99 as the company strives to make its DTC business profitable.

Netflix launched its ad-supported tier earlier this month only and priced at $6.99 per month, $1 below what Disney would offer. Some analysts see the ad-supported tier as a positive for Netflix stock and advise buying the streaming giant. There is a guide on how beginners can buy Netflix stock.

Iger Wants Disney to Focus on Streaming Profits Rather than Subscriber Growth

Netflix pointed out during its Q3 2022 earnings call that the streaming industry might post $10 billion in operating losses this year. In contrast, Netflix would post an operating profit of between $5-$6 billion this year.

While several new players including many legacy media companies have entered the streaming business they are struggling with profitability. Iger now wants Disney to focus on streaming profits and not merely chase subscriber growth.

In 2020, Disney said forecast a streaming subscriber count of between 230-260 million by the fiscal year 2024. Earlier this year, it lowered the projection to 215-245 million. It remains to be seen whether Iger continues with the same forecast.

Iger Says Hiring Freeze to Continue at DIS

Iger is also looking to change Disney’s organizational structure which became too centralized under Chapek. However, he has no plans to lift the hiring freeze which was put in place by Chapek. Also, Iger said that for now, he does not want to alter the company’s work-from-home policy even as he believes that the in-person model works better for creative business.

DIS stock rallied after Iger was appointed the CEO. JPMorgan however believes that the rally wasn’t justified even as it maintained its overweight rating on the stock.

Analysts Advise Buying Disney Stock After Iger Took Over as the CEO

However, some other analysts see Iger’s return as a positive for DIS stock. MoffettNathanson analyst Michael Nathanson upgraded DIS stock from market perform to outperform after Iger took over as the CEO.

Among other brokerages, Wells Fargo and Needham also believe Iger’s return would help the company. We have a guide on how to buy Disney stock.

All said, most analysts agree that it won’t be easy for Iger to make Disney’s streaming business profitable in a hurry. However, given his previous track record of being profit-focused, Wall Street is mostly positive about his return as DIS CEO.

Related stock news and analysis

- Apple Stock Falls on iPhone Production Woes: What’s Next?

- Best Way to Invest $10k – Top Methods Compared

Dash 2 Trade - New Gate.io Listing

- Also Listed on Bitmart, Changelly, LBank, Uniswap

- Collaborative Trading Platform Token

- Featured in Bitcoinist, Cointelegraph

- Solid Proof Audited, CoinSniper KYC Verified

- Trading Community of 70,000+ Members