Alphabet (NYSE: GOOG) has led a $1 billion investment round into Verily which is its subsidiary focused on healthcare. Healthcare is the new battleground for tech companies and several other tech giants have invested in the space.

Commenting on the Alphabet investment, Verily said, “The new capital will be used to support a variety of the company’s core initiatives focused on real world evidence generation, healthcare data platforms, research and care, and the underlying technology that drives this work, which all share the goal of making health care better and more tailored to individuals.”

It added, “The company will also consider further investment in strategic partnerships, global business development and potential acquisitions.”

Verily used to form part of Google X until 2015. Thereafter, it became an independent subsidiary. Alphabet has also acquired other companies in the healthcare industry including Nest Labs, Fitbit, and Senosis Health.

Verily Announced Senior Management Changes

Verily also announced senior management changes. Its founder Andy Conrad would transition to the role of executive president and Stephen Gillett, who is currently a president and a board member would become the new CEO.

The company’s CFO Deepak Ahuja would quit the position but remain an advisor. Ahuja was Tesla’s first CFO and would next join as the CFO with logistics startup Zipline. Tesla meanwhile is now looking to enter lithium refining, months after its CEO Elon Musk termed it a “money minting” business.

Recently Wolfe upgraded Tesla stock to a buy and raised its target price, joining the list of other brokerages who have been turning bullish on the EV company after Biden signed the Inflation Reduction Act of 2022.

Coming back to Verily, it did not specify if any other investor apart from Alphabet participated in the funding round. That said, over the last few months, several tech companies have announced acquisitions in the healthcare space.

Big Tech Goes Big on Healthcare

In July, Amazon announced the acquisition of telehealth company One Medical for $3.9 billion. The One Medical acquisition is the first major deal under Andy Jassy who took over as Amazon’s CEO last year only. The company was also rumored to be interested in Signify Health. However, CVS Healthcare is acquiring the company.

Amazon has always been interested in the healthcare space and acquired online pharmacy PillPack. It also acquired Health Navigator to complement its healthcare business.

TikTok parent ByteDance recently acquired a hospital chain in China. The acquisition had raised eyebrows as China has been against tech companies entering into other industries.

Among other tech companies, Apple, and Microsoft have also acquired tech companies. Apple believes that healthcare would be its “greatest contribution to mankind.” Apple has been gradually increasing its presence in the healthcare industry.

AAPL is the best-performing FAANG stock of 2022. Warren Buffett also bought more Apple shares in both the first and second quarters of 2022. It was the first time since Q3 2018 when Buffett bought Apple stock.

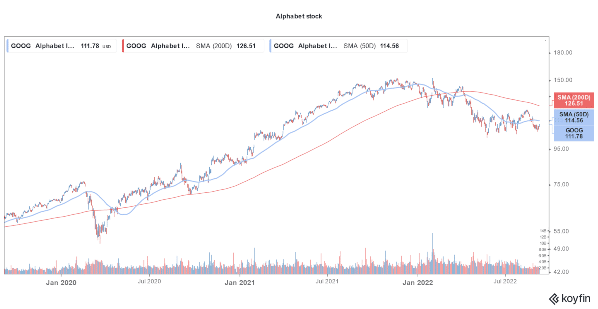

Alphabet is Looking at Cost Cuts as Growth Sags

Alphabet is reportedly looking at cost cuts and has cracked down on social events and travel. It has also gone slow on hiring like other Big Tech peers. Alphabet posted mixed earnings in the second quarter of 2022.

It posted revenues of $69.5 billion in the quarter which was 13% higher than the corresponding period last year. On a constant currency basis, Google-parent’s revenues increased by 16%.

Alphabet’s advertising revenues increased 12% to $56.3 billion in the quarter. The digital ad industry is suffering from a sharp slowdown. Companies like Snap and Meta Platforms have been hit even hard by the slowdown.

In Q2 2022, Meta Platforms reported a YoY fall in revenues, the first revenue decline since it went public. While Wall Street analysts are mixed on Meta Platforms, famed value investor Mohnish Pabrai sees Meta Platforms as a buy and forecasted that the stock would more than double.

Related stock news and analysis

- Alphabet Stock Rises despite Earnings Miss: Key Takeaways

- How to Buy Alphabet Stock in 2022

- How to Buy Amazon Stocks in 2022

Tamadoge - The Play to Earn Dogecoin

- '10x - 50x Potential' - CNBC Report

- Deflationary, Low Supply - 2 Billion

- Listed on Bybit, OKX, Bitmart, LBank, MEXC, Uniswap

- Move to Earn, Metaverse Integration on Roadmap

- NFT Doge Pets - Potential for Mass Adoption