Tesla (NASDAQ:TSLA) shareholders had a difficult year in 2022, after years of gargantuan growth, the stock price plummeted from a high of $381 in April to just $109 in December. However, in 2023 so far, the Tesla stock price has clawed its way back up to around the $200 mark.

That makes now a particularly interesting time for those considering investing in Tesla stock. So here’s everything you need to know about how to buy Tesla stock in 2023.

Step 1: Decide Where to Buy Telsa Stock

In order to buy Tesla stock online, you will need to first select a broker. We’ve put together a few of the top trading apps to help you choose the best platform to buy Tesla stock.

1. Webull – Buy Stocks for as Little as $5

Webull is a low-cost option for investors, with fractional trading available for as little as $5. WeBull also doesn’t require a minimum deposit, and all trades are commission-free.

Webull is a low-cost option for investors, with fractional trading available for as little as $5. WeBull also doesn’t require a minimum deposit, and all trades are commission-free.

Although spreads at Webull are typically higher, the broker is still very competitive. Webull allows you to buy Tesla stock via fractional investing. The minimum trade size being $5 means investors can slowly work their way up from fractional shares to full shares over time.

In addition to Tesla, Webull is home to more than 5,000 other stocks. Other than a few ADRs, the vast majority of stocks offered by Webull are US-based.

You can also buy cryptocurrency at Webull, starting from just $5 per trade. For funding your Tesla stock purchase, Webull accepts ACH transfers and US bank wires. The bank wire option costs $8 per transaction, while ACH transfers are free. Webull has a simple mobile app, allowing you to trade stocks and other assets while on the go.

| Number of Stocks | 5,000+ |

| Deposit Fee | ACH – free / Bank wire – $8 |

| Fee to Buy Tesla Stock | Commission-Free |

| Minimum Deposit | $0 |

Your capital is at risk.

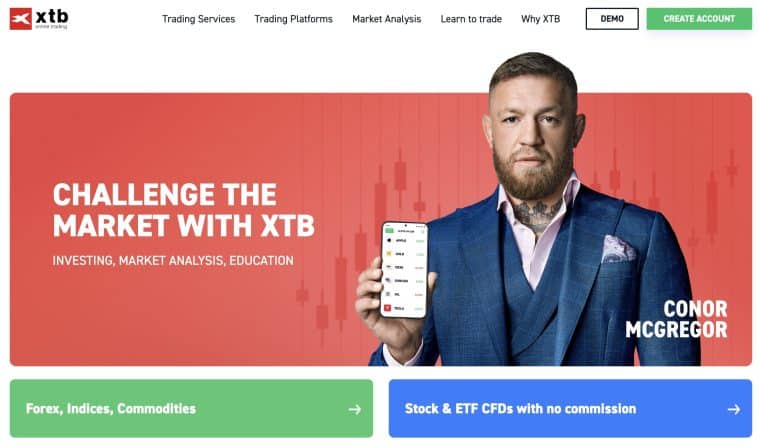

2. XTB – A Beginner Friendly Commission-Free Platform

XTB is one of the best trading platforms for beginners. The popular platform offers a wealth of information, including articles and eBooks, for those who want to get acquainted with investing. The useful resources can also be paired with a free demo account that lets users practice trading with £100k in virtual funds.

Once new investors are ready to jump in with real money, XTB offers trading in over 5700 global markets. The platform also offers a range of commission-free investing, including stocks, ETFs, Forex, indices, and commodities.

XTB also offers fee-free deposits from bank transfers and credit/debit cards. Deposits in Euros, Dollars, and British Pounds are all free of charge using either of the aforementioned methods.

On the app side of things, XTB has one of the best app designs that makes learning how to trade a breeze. The intuitive app has everything that long-time investors can want while presented in a package that isn’t overwhelming for newcomers.

| Number of Stocks | 1,900+ |

| Deposit Fee | None for EUR, USD, and GBP |

| Fee to Buy Tesla Stock | Commission-Free |

| Minimum Deposit | $0 |

Your capital is at risk.

Step 2: Is Tesla Stock a Good Investment?

Now that we’ve looked at how and where to buy stock in Tesla, the next step is to consider Tesla as a company.

Tesla has been one of the outstanding growth stocks of the last decade. Even when taking into account the massive stock price drop of 2022, the lowered stock price today still means it is up by an incredible 780% in the last five years.

In fact, the price of Tesla stock has grown so rapidly that it far outpaced the financial fundamentals of the company. At its peak, the price-to-earnings (P/E) ratio of Tesla was a mindboggling 359. To put that in perspective, Apple, Alphabet, and Microsoft all have P/E ratios between 20 and 30. Fellow car makers are even lower. Ford has a P/E of around 6.5, General Motors is 6.6, and Toyota sits at 10.4.

It’s no wonder then that during the run-up to Tesla’s $381 stock price in April 2022, there were cries of a bubble. The question now is, has Tesla stock reached a level where it’s now a good time to buy in? As of February 2023, the company is currently sitting at a still high but far more reasonable P/E of around 55. That’s still not great, but it means Tesla stock is much better value than it was a year ago.

There’s still a lot of hype baked into the Tesla stock price. In order to meet its current valuation, the company needs to ship more cars than it currently does and, crucially, it needs to maintain its current technological EV edge over the traditional auto manufacturers.

Anyone asking themselves, “Should I buy Tesla stock?” first needs to ask themselves, do they think the likes of Ford, GM, VW, and Toyota will catch up in the EV space? If the answer is no, then the Tesla stock price today per share, makes the company a good investment. However, if the traditional manufacturers are able to catch and even surpass Tesla in the EV market, it will be very hard for the current king of EVs to meet its valuation.

What is Tesla?

This means that Tesla, in terms of market cap, is now bigger than established car companies like Ford – which has been trading for over 100 years. In fact, Tesla’s market cap is larger than the next five most valuable car companies combined.

- Tesla has ridden the wave of green energy conversion by offering class-leading electric vehicles way ahead of the competition.

- This is why Tesla has the largest EV market share of any company, spearheaded by its more affordable Model 3.

- The most successful Tesla models to date are the Model 3, Model S, and Model X.

- In addition to its electric car fleet, Tesla is also behind a number of other innovative products and services.

- The company expanded into solar panels and its solar roof, which can replace tiles directly while providing solar power.

Tesla is also leading the way with its self-driving software. Although cars cannot be self-driven at present, Tesla is the manufacturer with the most automation currently available in a production vehicle.

As climate activists and governments ramp up their efforts to reduce carbon emissions, Tesla stands as one of the most popular ethical stocks for its drive toward the electrification of the automotive industry.

Tesla Stock Price History – How Much is Tesla Stock Worth?

Tesla first went public in 2010, with the electric car company opting for the NASDAQ exchange. During its IPO campaign, Tesla priced its stocks at $17, which valued the company at approximately $2 billion. With that said, Tesla has had two stock splits. The first was a 5-for-1 stock split, which it executed in 2020. Tesla then had a second stock split in 2022 which was a 3-for-1 split. As such, its original IPO price should now be viewed at a price of roughly $1.28 per share.

Notably, when Tesla first went public, there was a lot of skepticism about the firm. After all, in 2003, electric cars were still viewed as a fad, and the technology wasn’t as good as it is today. As we now know, Tesla went on to become one of the most popular stocks of all time. In fact, had you invested in Tesla’s IPO back in 2010 and held onto your stocks until 2023, you would have been looking at gains of over 12,200%.

Tesla stock price history chart:

To put that in perspective, an original investment of $10,000 during the IPO campaign would be worth over $1.7 million today. At Tesla’s April 2022 peak, the stock would have been worth over $3.3 million. It’s no wonder that Elon Musk became the richest person in the world off the back of his Tesla stock.

More recently, Tesla stock has increased in value by around 780% in the last five years. In comparison, the broader NASDAQ Composite has grown by just 56%. However, over the past year, Tesla’s share price has fallen by around 22%. In comparison, the NASDAQ Composite is down by around 12%.

Tesla Market Capitalization

When it comes to market capitalization, Tesla became a trillion-dollar company back in 2021. This made it one of the largest companies in the US – alongside the likes of Apple, Microsoft, and Amazon. At the time of writing, Tesla’s market cap now sits at over $600 billion, following the recent share price decline.

When will Tesla Stock Split?

As noted above, Tesla executed its first stock split in August 2020, at a rate of 5-for-1. This was followed by a 3-for-1 stock split that occurred in August 2022. It’s unlikely that there will be another split so soon after the 2022 one.

Tesla Index Funds

Tesla was first added to the S&P 500 index in October 2020. This was a major achievement for the firm, as it took just 10 years for Tesla to go from its IPO campaign to an S&P 500 company.

Tesla EPS and P/E Ratio

As per its annual reports, Tesla’s earnings per share (EPS) over the last five years are as follows:

- 2022: $3.62

- 2021: $1.63

- 2020: $0.64

- 2019: $-0.98

- 2018: $-1.14

As you can see, it wasn’t until 2020 that Tesla was able to move its EPS into positive territory. And the reason for this is simple – Tesla did not report its first full-year profit until January 2021, a total of 18 years after the firm was founded. However, since then, the company has been able to grow its profits quite quickly, with the 2022 EPS sitting at $3.62.

The P/E ratio for Tesla, as of February 2023, is 55.4, that’s the company’s lowest since early 2020.

Tesla Stock Dividends

Like many growth stocks, Tesla, to date, has never paid a dividend to shareholders. After all, it wasn’t until early 2021 that Tesla was able to report its first full-year profit.

With that said, Tesla clearly has sufficient levels of free cash flow when you consider that in late 2020, the electric carmaker invested $1.5 billion from its balance sheet to buy Bitcoin.

However, many high-growth companies opt to reinvest profits, rather than distribute them as dividends. Although this means investors don’t get a recurring income stream, it does provide scope for higher capital gains in the future.

As a prime example, fellow NASDAQ stock Apple has grown by over 234% in the past five years, which has been made possible due to the company’s low dividend payout ratio.

Tesla Stock Price Forecast

The price forecast for Tesla stock depends on a few key factors. The next few years will be key for the company as it tries to stay ahead of increasing competition. Unlike 5-10 years ago, when Tesla was the only serious EV manufacturer, established car companies have made great strides to catch up in the EV space.

As of early 2023, Tesla is still the biggest producer of electric cars, but its competition is closing in fast. Ford dropped the prices of its EV lineup at the start of the year, and Tesla was forced to react by doing the same. Five years ago, that would have been unthinkable.

If Tesla can increase its production output, and continue to lead the technology race, then the stock forecast for 2025 and 2030 looks very good. However, if Tesla falters and relinquishes the lead it built up, any long-term stock prediction for 2025 or 2030 becomes a lot less certain.

The next two years for Tesla are critical. The company may have been able to grow its profits in recent years, but the current levels aren’t enough to support its high stock price. For investors to see the kind of return that they have over the past five years, Tesla will need to fix its production issues, compete with rivals on pricing, and maintain or grow its technical edge.

Strong Quarterly Earnings Report

Tesla’s Q4 2022 earnings report provided some strong results. First and foremost, revenues were up over 33% year-on-year, with an EPS of $1.19 for the quarter vs $0.85 the year before.

During the earnings call, the company said the key to continuing its strong results would be making cars more affordable. Elon Musk predicted that the company could ship up to 2 million cars in 2023. That would be quite the jump, as the company shipped just over 1.3 million in 2022.

Vehicle Delivery Figures Continue to Rise

A 700k unit increase from 2022 to 2023 might sound rather outlandish. However, Tesla has been successful in making large year-on-year shipment jumps since 2020. Over the last three years, Tesla shipped 499k cars in 2020, 935k in 2021, and 1.3m in 2022. When considering the trajectory the company has been on for the last few years, a 700k increase in 2023 doesn’t seem out of reach.

To meet its production goals, Tesla has opened new plants in Texas and Germany. The increased production and reduced cost of its cars will be key to it meeting the lofty goal of 2 million cars sold in a single year.

Tesla Competition

Tesla stock may have had a bad 2022, but its competitor’s shares haven’t necessarily been a better place to invest.

- For example, fellow EV stock Nio, which is a Chinese manufacturer listed on the NYSE, has lost 52% of its stock price value in the last 12 months, compared to a loss of 22% for Tesla.

- Then there’s US-based EV stock Rivian, which, since its November 2021 IPO listing, has lost 85% of its value. For more details on how to buy Rivian stock read our guide here.

It’s also worth looking at traditional car companies like Ford and General Motors – both of which are investing heavily in the growth of their electric vehicle divisions.

Over the last 12 months, Ford stock is down by 29%, while General Motors shares have fallen by 15.9%.

Is Tesla Stock a Buy?

Tesla stock has had an incredibly rocky 12 months. However, things appear to be looking up for the company. It exceeded its Q4 earnings objectives, the company is ramping up production, and it still has a sizeable lead over its EV competitors. As the Tesla stock price recovers from its December 2022 low, now could be a great time to get in while the price is relatively low.

If the company meets its goals, then Tesla could be one of the best stocks to buy in 2023.

Conclusion

In summary, Tesla is one of the most popular stocks available on the market. That popularity also means the stock attracts high volatility levels as well. Therefore, users should carefully review and analyze the stock before opening new positions. Make sure to follow news and events surrounding Tesla stock because it is can be affected more than other companies due to its volatility.

For investors who are confident in Tesla’s ability to maintain its EV lead, now could be the best time in years to buy Tesla stock.

If you decide to buy Tesla stock, make sure to use our recommended platform Webull for 0% commission trades and a great suite of investment tools to monitor your portfolio on the go.

Frequently Asked Questions on Tesla Stock

How do I buy Tesla stock?

Did Tesla split their stock?

Can I buy one dollar of Tesla stock?

How much is Tesla stock per share?

Will Tesla stock split in 2023?

Is Tesla a buy or sell right now?

Is Tesla still a good buy?

Can you buy Tesla stock directly?

Read More:

- How to Invest in Stocks Online for Beginners

- Best Stocks to Watch on Reddit – Most Popular Reddit Stocks