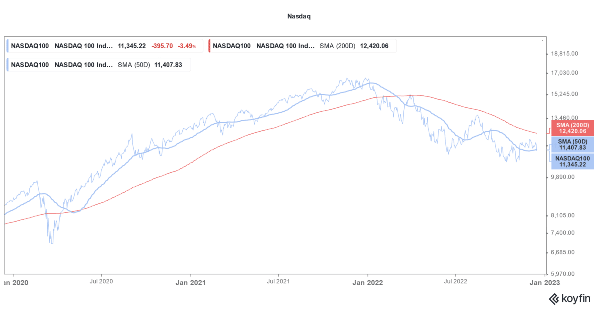

2022 turned out to be a bad year for US stocks and unless we see a Santa Claus rally, whose probability is fast fading, the US stock market looks set for double-digit losses this year. Wall Street analysts have divergent expectations from US stock markets in 2023 as well.

Notably, most analysts got their 2022 stock market projections wrong. Mike Wilson of Morgan Stanley is a notable exception though. After getting his predictions mostly right in 2022, he has made another bold forecast for 2023.

Wilson expects the S&P 500 to fall towards 3,000 in the first four months of 2023 but then predicts a rally. His year-end 2023 target for the S&P 500 is 3,900 and advises buying the dip. You can also buy stocks with a credit card.

JPMorgan also has modest expectations for US stock markets in 2023. In its report, it stated, “In the first half of 2023, the S&P 500 is likely to revisit the lows of 2022, but a shift from the Fed could lead to a recovery later in the year, bringing the S&P 500 to 4,200 by the end of the year.”

It stated that the global economy is not likely to enter a recession in 2023. Concerns about a recession have also increased in the US. In his press conference after the December FOMC meeting, Fed chair Jerome Powell mentioned that a soft landing for the US economy could still happen if inflation decreases.

Recession Fears Rise amid Fed’s Rate Hikes

He added, “I just don’t think anyone knows whether we’re going to have a recession or not. And if we do, whether it’s going to be a deep one or not … it’s not knowable.” While recession impacts most sectors of the economy, some of the investments are largely recession-proof.

The Fed’s so-called dot plot predicted another 100-basis point of rate hikes for 2023. The US central bank has already raised rates by 4.25% this year making, the steepest pace of hike since the 1980s.

Wharton professor Jeremy Siegel believes that the Fed is erring in being so hawkish. He expects the Fed to start cutting rates in 2023 and predicts that US stocks would rise 15% next year.

Analysts Have Mixed Views on US Stock Markets Heading into 2023

Fundstrat is also bullish on US stock markets in 2023 and its year-end S&P 500 target of 4,750 is currently the most bullish on Wall Street. Fundstart’s Tom Lee is betting on a soft landing for the US economy in 2023.

He said, “US economy remarkably resilient in the face of rapid Fed hike cycle. The plurality of equity investors expect an inevitable recession as Fed hikes until it breaks something. But if above assessment [falling inflation, end of rate hikes] is correct, a ‘soft landing’ is the highest probability.”

Meanwhile, hopes of a Santa Claus rally in US stocks have fallen flat after the Fed meeting. Todd Sohn, technical analyst at Strategas sees the fall in US stocks on Thursday as a sign that more pain lies ahead.

As for 2023, analysts are pinning their hopes on a soft landing for the US economy and possible rate cuts by the Fed later in the year. The Fed has meanwhile made it amply clear that it is not pivoting to rate cuts unless it wins the fight against inflation

Related stock news and analysis

- Key Earnings & Economic Indicators Investors Would Watch Next Week

- Best TikTok Crypto – Cryptocurrency Trending on TikTok

- What to Invest in Right Now? Top 10 Picks

Wall Street Memes (WSM) - Newest Meme Coin

- Community of 1 Million Followers

- Experienced NFT Project Founders

- Listed On OKX

- Staking Rewards