The world’s top aerospace companies are involved with designing, developing, manufacturing, and maintaining aircraft, spacecraft, and the systems used to operate them. The IATA predicts that the air transport industry is expected to exceed pre-pandemic traveler levels in 2024, so it’s a good time to take a snapshot of the biggest companies currently operating in this sector.

In this article, our experts at Business2Community rank the largest aerospace companies by market capitalization. We’ll take a detailed look at what they do, how they are performing, and what the future holds for each business and for the industry as a whole.

The World’s Top Aerospace Companies

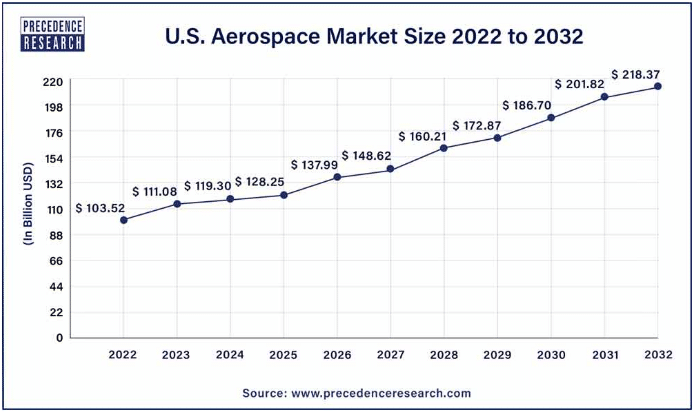

The aerospace industry was worth an estimated $321.5 billion in 2022, according to Precedence Research, and is projected to grow to $678.17 billion by 2032; a CAGR of 7.80%. Within this, the commercial aircraft segment holds a 43.5% market share.

North America dominates the market, with a share of 46%. This aligns with the fact that 7 of the top 10 aerospace companies are currently US-based, with the remaining 3 in Europe. However, Asia-Pacific is expected to be the fastest-growing region over the next decade, so we may well see this landscape shifting.

Now, let’s take a look at the biggest companies in the aerospace industry, which have a combined market value of over $1 trillion.

1. GE Aerospace – $201.01 Billion

General Electric (GE) was formed in 1892 and began manufacturing locomotive engines and household appliances.

Its work in the aerospace industry began during World War I when it was contracted by the US government to develop an airplane engine turbosupercharger. GE manufactured America’s first jet engine, the I-A engine, in 1942. Later, its J47 jet engine became the most-produced jet engine in history.

Despite this initial success, the history of GE has suffered great turbulence, most notably as a result of the 2008 financial crisis which brought to light unsustainable business practices.

GE underwent a major restructuring in 2022, spinning off its healthcare and energy businesses as GE HealthCare and GE Vernova. Its aerospace and defense operations, previously known as GE Aviation, remained in the original company and rebranded as GE Aerospace.

2023 was a promising year for the company, with revenue growth of 22% from $26.1 to $31.8 billion. Similarly, profit increased by 28% from $4.8 billion to $6.1 billion.

Looking to the future, GE Aerospace continues to develop commercial and military aircraft, but with a mandate to make the aviation industry more sustainable.

| Company Name | GE Aerospace (GE) |

| Founded | 1892 |

| Headquarters | Evendale, Ohio, USA |

| CEO | H. Lawrence Culp Jr. |

| Market Cap | $201.01 billion |

2. RTX Corporation – $160.15 Billion

RTX operates in the aerospace and defense industries and is the world’s largest defense contractor by market cap.

The company in its current form was incorporated in 2020 when United Technologies Corporation (originally founded in 1934) merged with the Raytheon Company and changed its name to Raytheon Technologies Corporation. The RTX rebrand came in July 2023.

RTX has three divisions as of January 2023:

- Collins Aerospace: Designs and manufactures parts and systems for military and commercial applications, as well as technologies for space exploration.

- Pratt & Whitney: Designs and manufactures advanced aircraft engines for private, commercial, and military aircraft.

- Raytheon: Specializes in integrated defense systems, including missiles, cybersecurity, and radar systems.

In 2023, these three divisions had roughly equal adjusted net sales of $26.2 billion, $23.7 billion, and $26.4 billion, respectively.

RTX has been the target of protests in recent months because of its involvement designing and supplying Israel’s Iron Dome defense system. In November 2023, protesters targeted RTX’s Tuscon facility with a “die-in” protest that blocked the road for commuters for over an hour, local media reported.

RTX’s share price had been falling in the second half of 2023, but began to bounce back on 7th October, the day that Hamas attacked Israel. The shares are now trading at an all-time high of $120.39.

| Company Name | RTX Corporation (RTX) |

| Founded | 1934 |

| Headquarters | Arlington, Virginia, USA |

| CEO | Gregory J. Hayes |

| Market Cap | $160.15 billion |

3. Lockheed Martin Corporation – $138.81 Billion

Two companies founded in 1912, the Glenn L. Martin Company and the Lockheed Aircraft Company, went through a series of mergers to become Lockheed Martin in 1995.

Lockheed Martin is primarily known for its military aircraft and security and defense systems, although it does also supply commercial airliners.

In 2023, 73% of its net sales were from the US government, including 64% from the Department of Defense (DoD). 26% came from international customers (including foreign military sales), and 1% were from other US customers.

Revenue from its four business units was as follows:

- Aeronautics: $27.5 billion

- Missiles and fire control: $11.3 billion

- Rotary and mission systems: $16.2 billion

- Space: $12.6 billion

Lockheed Martin has been another company targeted by protesters for its supply of weapons to Israel. Activists protested outside its offices in Arlington, Virginia for several weeks in October and November 2023.

As of July 2024, Lockheed Martin’s stocks are trading at an all-time high of $582.86. The company announced revenue of $67.6 billion in 2023, with $7.4 billion (10.9%) segment operating profit.

| Company Name | Lockheed Martin Corporation (LMT) |

| Founded | 1912 |

| Headquarters | Bethesda, Maryland, USA |

| CEO | James D. Taiclet |

| Market Cap | $138.81 billion |

4. Honeywell International Inc. – $135.21 Billion

Aerospace technology is one of four business units of Honeywell International Inc., and the one that accounted for the largest share of its revenue in 2023:

- Aerospace: $13.6 billion

- Building technologies: $6 billion

- Performance materials and technologies: $11.5 billion

- Safety and productivity solutions: $5.5 billion

Honeywell has 140,000 air turbine starters in operation, powering commercial and military aircraft as well as industrial and naval systems. Its space technology has been on board every NASA mission since the 1950s.

Although the name Honeywell only came about in 1906, the company itself has roots dating back to 1885 as The Butz Thermo-Electric Regulator Company.

In 2000, General Electric CEO Jack Welch made an offer to acquire Honeywell for $45 billion, which the company accepted, but the deal was eventually blocked by the European Commission over competition concerns.

Honeywell reported a record operating income of $ 7.08 billion in 2023, up from $ 6.43 billion the previous year.

The company is investing in advanced air mobility to provide technology solutions for the growing population. This includes things like air taxis, autonomous drone delivery, and vertical takeoff aircraft.

| Company Name | Honeywell International Inc. (HON) |

| Founded | 1885 |

| Headquarters | Charlotte, North Carolina, USA |

| CEO | Jim Currier |

| Market Cap | $135.21 billion |

5. Airbus SE – $117.89 Billion (€105.52 Billion)

Airbus is technically the youngest of the largest aerospace companies on this list, having been legally formed as a new entity, the European Aeronautic Defence and Space Company (EADS), in 1998. However, this was the result of a merger of three other companies, all of which were founded earlier in the 20th Century.

Airbus is also the first of these companies headquartered outside of the US. Its legal headquarters are in Leiden, the Netherlands, but its head office is in Toulouse, France, where it employs 28,000 people in the region.

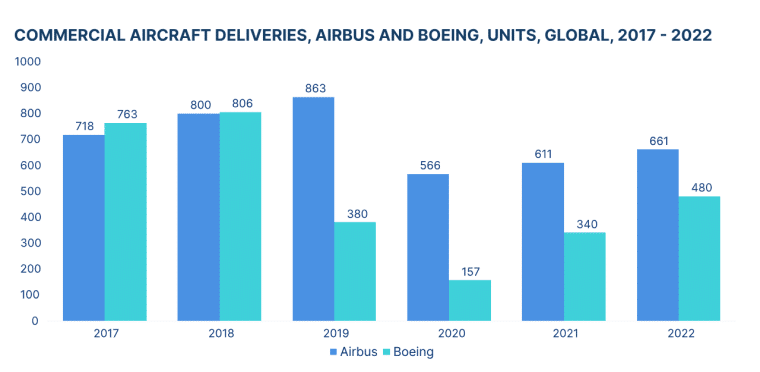

Airbus overtook Boeing as the world’s largest commercial aircraft manufacturer in 2019 and has retained the position ever since.

It also held 48% of the global helicopter market share, as of 2020.

Airbus’ 2023 revenue of $71 billion (€65.4 billion) was distributed as follows:

- Airbus: 72%

- Airbus Helicopters: 11%

- Airbus Defence and Space: 17%

| Company Name | Airbus SE (AIR.PA) |

| Founded | 1998 |

| Headquarters | Leiden, the Netherlands |

| CEO | Guillaume Faury |

| Market Cap | $117.89 billion (€105.52 billion) |

6. Safran SA – $102.82 billion (€92.03 Billion)

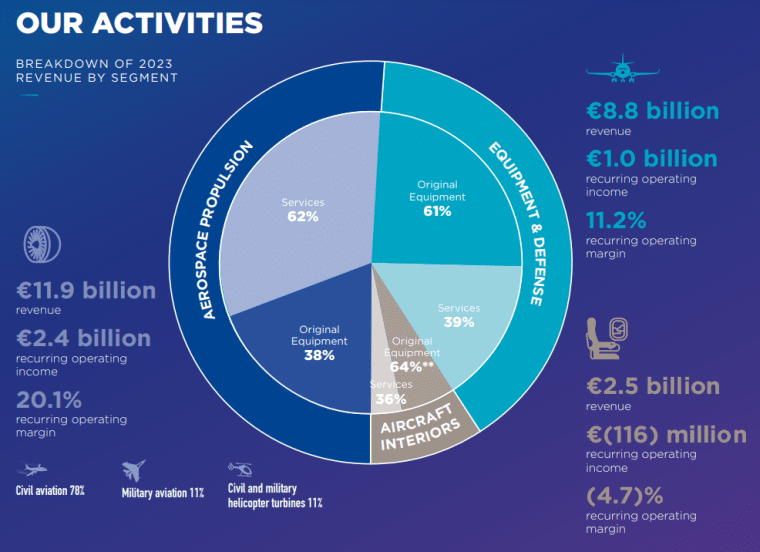

Safran is a global aerospace and defense company headquartered in Paris, France. Its main business units are:

- Aerospace and propulsion

- Equipment and defense

- Aircraft interiors

Safran’s aircraft systems range from pilot control systems to waste management to in-flight entertainment. There are over 1 million Safran seats in use globally, and their services include retrofitting cabin interiors to give passengers access to better technology and comfort.

Safran is in partnership with a number of other top aerospace and defense companies, including:

- CFM International, a 50/50 joint venture with GE founded in 1974 to produce aircraft engines

- ArianeGroup, a 50/50 joint venture between Airbus to develop and supply civil and military space launch systems

- Europrop International, a consortium between Safran, Rolls Royce, and two other European engine manufacturers to produce turboprop engines

| Company Name | Safran SA (SAF.PA) |

| Founded | 1896 |

| Headquarters | Paris, France |

| CEO | Olivier Andriès |

| Market Cap | $102.02 billion (€92.03 billion) |

7. The Boeing Company – $96.32 Billion

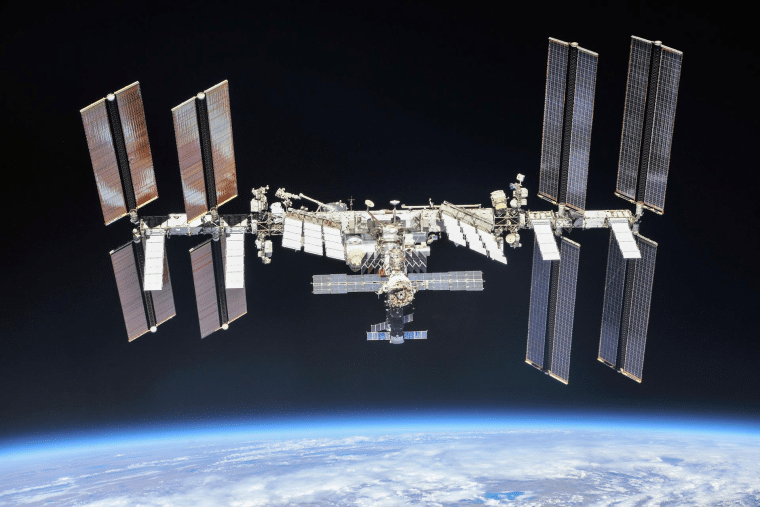

Boeing is a household name in commercial air travel but also has a strong presence in the defense and space industries. It was a prime contractor on the International Space Station (ISS) in 1993 and is still involved with the maintenance and development of the spacecraft.

However, the century-long history of Boeing has been marred by its recent safety incidents; firstly, two fatal Boeing 737 MAX crashes in 2018 and 2019 which killed 346 people, grounded 387 aircraft, and cost the company over $2.3 billion in compensation to victims and airlines.

Then, in January 2024, a 737 Max 9 had to make an emergency landing when a cabin panel fell off mid-flight. Although there were no fatalities, the incident raised fresh safety concerns and led to whistleblower allegations, calling the company’s future into question. It was mostly luck that saved the passengers on that flight as the panel fell of when the plane was at a low altitude and no one was seated directly next to it.

Adding to the company’s woes, in June 2024 Boeing’s Starliner ship sent two NASA test pilots to the ISS for what should have been a short mission last around two weeks. At the time of writing, the mission was on its 50th day and the company has been scrambling to find a way to fix the docking mechanism and bring the astronauts home.

The fallout from these incidents, combined with the effect of the pandemic, have led to Boeing posting an operating loss for five consecutive years.

Boeing increased its investment spending to $5 billion in 2023; a 20% increase from the previous year. Areas of innovation include autonomous capabilities for unmanned systems, digital transformation, and sustainable aviation.

| Company Name | The Boeing Company (BA) |

| Founded | 1916 |

| Headquarters | Arlington, Virginia, USA |

| CEO | Dave Calhoun |

| Market Cap | $96.32 billion |

8. TransDigm Group Incorporated – $78.72 Billion

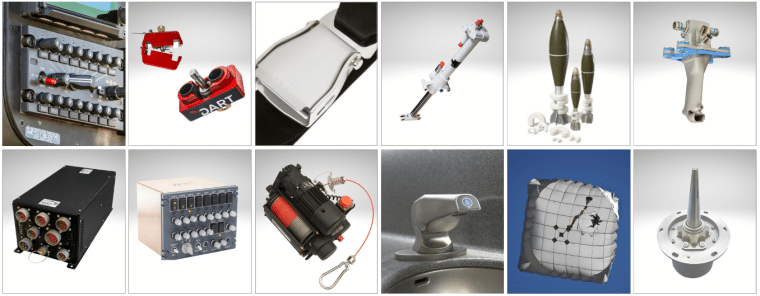

TransDigm was founded in 1993 through the acquisition and consolidation of four separate aerospace companies. It designs, produces, and supplies components that are in use on almost every aircraft operating today.

Although the company has 50 distinct operating units, they are grouped into 3 segments:

- Power and control: Components that provide or control power to an aircraft such as ignition systems, pumps, valves, batteries, and chargers.

- Airframe: Components used in the body of aircraft such as latches and locks, hydraulics, sealing solutions, cockpit safety systems, and interior surfaces.

- Non-aviation: Products for non-aviation markets including ground transportation, space technology, mining, and energy.

90% of its revenues come from proprietary products.

TransDigm has come under scrutiny for price gouging on several occasions, with one investigation finding that it had sold components to the Defense Department with a profit margin 4,436% above a reasonable level. Unfortunately, this kind of price gouging is all too common in the defense industry.

TransDigm Co-founder and CEO Nicholas Howley has a reported net worth of $1.1 billion. Hear him speak about his company’s success and values in this podcast:

| Company Name | TransDigm Group Incorporated (TDG) |

| Founded | 1993 |

| Headquarters | Cleveland, Ohio, USA |

| CEO | Nicholas Howley |

| Market Cap | $78.72 billion |

9. Northrop Grumman Corporation – $77.04 Billion

Northrop Grumman is another global leader in the defense industry, developing and producing aeronautics, missions, space, and defense systems.

Its main customer is the US government, accounting for 86% of its $39.3 billion sales in 2023. Supplies to government sectors were broken down as follows:

- Aerospace systems: 85% of $10.8 billion

- Missions systems: 73% of $10.9 billion

- Space systems: 95% of $13.9 billion

- Defense systems: 60% of $5.9 billion

13% of its sales were to international customers, and the remaining 1% to other US customers.

In the area of space technology, Northrop Grumman pioneered the design and manufacturing of the James Webb Space Telescope, the world’s first deployable space telescope, which launched in December 2021.

In 2023, the firm was awarded the National Aeronautic Association’s Robert J. Collier Trophy for its revolutionary work on the project.

| Company Name | Northrop Grumman Corporation (NOC) |

| Founded | 1939 |

| Headquarters | Falls Church, Virginia, USA |

| CEO | Kathy J. Warden |

| Market Cap | $77.04 billion |

10. BAE Systems plc – $50.67 Billion (£37.89 Billion)

British BAE Systems is best known for its security, aerospace, and defense systems. Its team of around 100,000 employees works in over 40 countries, but predominantly in the UK and the US.

BAE Systems recorded revenue of $29.7 billion (£23.1 billion) in 2023, split into the following five sectors:

- Electronic systems: 22%

- Platforms and services: 15%

- Air: 32%

- Maritime: 22%

- Cyber and intelligence: 9%

The organization spent $2.96 billion (£2.3 billion) on research and development in 2023, focusing on technologies to support its customers’ changing needs. Key areas of innovation include digital integration for military and security, machine learning and AI, and autonomous products for land, sea, and air.

In February 2024, BAE Systems acquired Ball Aerospace for $5.5 billion, its largest acquisition to date.

| Company Name | BAE Systems plc (BA.L) |

| Founded | 1970 |

| Headquarters | Camberley, UK |

| CEO | Charles Woodburn |

| Market Cap | $50.67 billion (£37.89 billion) |

Learning From the Top Aerospace Companies in the World

From looking at the top players in the aerospace industry, we can see that it takes time to succeed. In fact, you have to go all the way down to 29th place to find the largest aerospace company founded this century: California-based Joby Aviation, founded in 2009, now with a market cap of $4.46 billion.

Most of these companies operate in both the aerospace and defense industries, with several defense companies relying heavily on government contracts to support their business.

Working with governments to win defense contracts is a solid path the growth in the aerospace industry. This can give a company space for innovation, such as Northrup’s work on the James Webb Telescope. It can become contentious and draw negative media to your company, such as RTX and Lockheed have experienced since October 2023.

A major trend on this list of the best-performing aerospace companies is mergers and acquisitions. As with many successful global brands, the organizations that have reached the top of the aerospace industry have grown through buying out or merging with others that complement their work. This is a solid business lesson to learn for any entrepreneur looking for quick growth paths.