The mining industry plays an essential role in the world around you; from the battery in the device you’re using to read this article to the cables that supply power to your home and much more. We rely on the world’s biggest mining companies to extract and supply critical metals and minerals like copper, nickel, iron, and zinc.

This article from Business2Community brings you important insights into the top 10 mining companies in the world, sorted by market cap. They have a combined market cap of $831.6 billion and are headquartered in five different continents, with operations globally.

The World’s Biggest Mining Companies

The global mining industry was worth over $2.1 trillion in 2023, according to Brunel, and is forecast to grow to almost $2.8 trillion by 2027, achieving a CAGR of 6.7%.

Let’s take a look at how the largest mining companies are involved in the sector and what has contributed to their success.

1. BHP Group Limited – $150.3 Billion

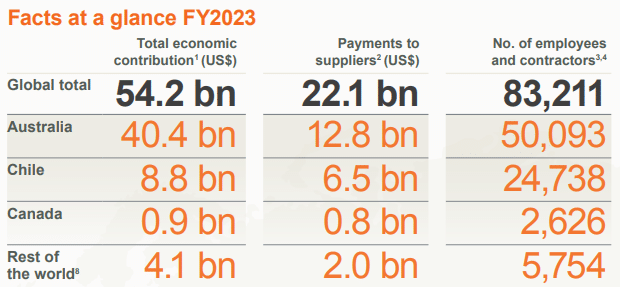

BHP is the largest mining company in the world by market cap, worth just over $150 billion. It was formed in 1885 as Broken Hill Proprietary Company Ltd and in 2001 merged with the Billiton mining company. It rebranded as BHP in 2017.

This Australian mining firm has operations in over 90 countries and hires more than 80,000 employees and contractors. Its mining operations focus on:

- Iron ore and metallurgical coal, used in the steel-making process

- Copper, used in a wide range of products and applications for its conductivity, ductility, and antimicrobial properties

- Nickel, used to manufacture stainless steel and lithium-ion batteries, which are in high demand for electronics of all kinds, especially EVs

- Potash, used by agriculture companies for fertilization and sustainable land use and in manufacturing glass, soap, and other essential items

BHP holds the world’s largest copper mineral resources and is developing one of the largest potash mines in Canada.

In FY2023, BHP recorded profits of $53.8 billion, down from $65.1 billion the previous year, predominantly due to lower prices for raw materials. Its underlying attributable profit was $13.4 billion, down from $23.8 billion.

| Company Name | BHP Group Limited |

| Headquarters | Melbourne, Australia |

| Founded | 1885 |

| Market Cap | $150.3 billion |

| Traded On | NYSE (BHP) |

2, Rio Tinto Group – $111.3 Billion

Rio Tinto, the oldest mining company on this list, takes its name from the Rio Tinto (“Red River”) mines in southern Spain where its operations began. The mines were purchased from the Spanish government in 1873 by a group led by British businessman Hugh Matheson.

The company began investing in copper mines in Northern Rhodesia (now Zambia) in the 1920s and now has global operations in 35 countries, with most of its assets held in North America and Australia.

In 2023, Rio Tinto’s revenue by commodity was:

- Iron ore: $32.2 billion

- Aluminum: $12.3 billion

- Copper: $6.7 billion

- Minerals (iron ore, titanium dioxide, borates, diamonds, uranium, and others): $5.9 billion

The company came under criticism in 2012 when it was selected to supply the metals for the London Olympic Games medals. Most of the metals came from its Kennecott mine in Salt Lake City, Utah, which releases millions of pounds of toxic chemicals into the environment every year.

Rio Tinto is the highest-ranked of these ten mining companies on the Forbes 2024 Global 2000 list, coming in at #110.

| Company Name | Rio Tinto Group |

| Headquarters | London, UK |

| Founded | 1873 |

| Market Cap | $111.3 billion |

| Traded On | NYSE (RIO) |

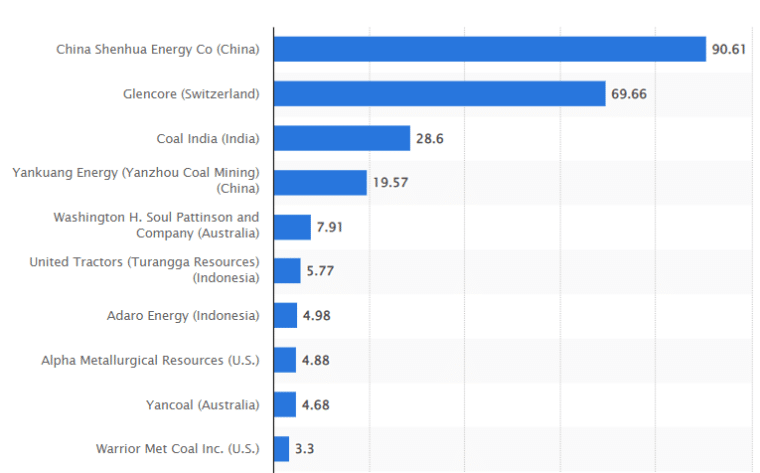

3. China Shenhua Energy Company Limited – $110.9 Billion (CN¥805 Billion)

This Chinese mining corporation is the only one of the 10 top mining companies in the world to have been founded this century – 2004 to be precise. It is a state-owned subsidiary of the Shenhua Group, which itself was founded in 1995.

China Shenhua is the world’s largest coal mining company, with a capacity of 350 million tonnes. It is one of the leading polluters in the world as coal is generally considered the dirtiest major fuel, releasing unbelievable amounts of greenhouse gasses and other pollutants.

The company owns power plants with a capacity of 44.63 GW, 43.16 GW of which are coal-powered. Its other business segments include a 2,400km railway network and three port terminals which are used to distribute coal within mainland China.

China Shenhua reported revenues of $47.3 million (CN¥343 million) in 2023, with profits of $10.4 million (CN¥75 million).

| Company Name | China Shenhua Energy Company Limited |

| Headquarters | Beijing, China |

| Founded | 2004 |

| Market Cap | $110.9 billion (CN¥805 billion) |

| Traded On | SSE (601088.SS) |

4. Southern Copper Corporation – $90 Billion

Southern Copper Corporation (SCC) was founded in 1952 in the state of Delaware as Southern Peru Copper Corporation (SPCC). It became SCC to reflect its international presence after acquiring the Mexican mining business Minera México.

Today, SCC is 88.9% owned by Grupo Mexico through Americas Mining Corporation.

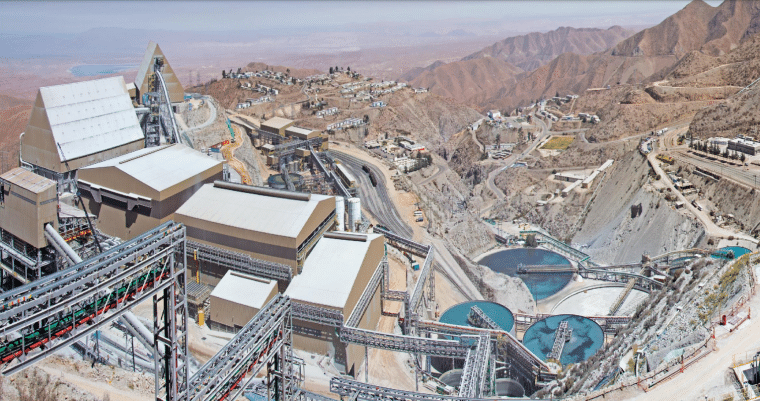

The company operates mines and smelters in Peru and Mexico and holds the world’s largest copper reserves, totaling 97 billion pounds as of December 2023. It produced over 911 tons of copper in 2023 and achieved a net income of $2.43 billion on net sales of $9.90 billion.

SCC also mines molybdenum, silver, and zinc, and smelts copper, zinc, and silver. The company employs 15,000 direct and 60,000 indirect workers.

| Company Name | Southern Copper Corporation |

| Headquarters | Phoenix, Arizona, USA |

| Founded | 1952 |

| Market Cap | $90 billion |

| Traded On | NYSE (SCCO) |

5. Glencore plc – $74.8 Billion

Swiss firm Glencore is the only one of the 10 top mining companies to be based in Europe. Its name is abbreviated from “Global Energy Commodity Resources” and, as the name suggests, it also specializes in commodity trading.

The company has over 150,000 employees and contractors with operations in more than 35 countries, including emerging and developing countries.

Glencore’s industrial activities cover three main areas:

- Metals and minerals: Producing over 60 commodities including copper, cobalt, nickel, zinc, lead, aluminum, and iron ore.

- Energy: Producing coal, crude oil, natural gas, and refined oil products.

- Recycling: Processing end-of-life electronics and lithium-ion batteries to recover critical and precious metals for reuse.

Industrial activities accounted for $60.4 billion of the company’s revenue in 2023. A further $186.7 billion came from its marketing activities, which involve sourcing commodities and transporting them to meet demand worldwide. These earnings were down 23% and 13% year-on-year, respectively. 2022 was a record year for the business and Chairman Kalidas Madhavpeddi described the 2023 results as a “return to normal”.

| Company Name | Glencore plc |

| Headquarters | Baar, Switzerland |

| Founded | 1974 |

| Market Cap | $74.8 billion |

| Traded On | OTC (GLCNF) |

6. Freeport-McMoRan Inc. – $73.7 Billion

Freeport Sulphur Company was formed in 1912 to mine sulfur along the US Gulf Coast. The company formed the town of Freeport, Texas to house its workers and serve as a port.

A 1981 merger with McMoRan Oil & Gas Company formed Freeport-McMoRan Inc.

Freeport has mining operations in three regions:

- South America: Copper mines in Cerro Verde, Peru, and El Abra, Chile. The Cerro Verde mine also produces molybdenum and silver.

- Indonesia: Several copper and gold mines in the Grasberg minerals district in Papua. This is the largest gold reserve on earth; it produced 2 million ounces of gold in 2023.

- North America: Seven open-pit copper mines and two molybdenum mines across Colorado, Arizona, and New Mexico.

In 2013, a tunnel in Freeport’s Grasberg mine in Indonesia collapsed and killed 28 workers. After an investigation, The Indonesian National Human Rights Commission claimed that the company could have prevented the incident, but didn’t.

| Company Name | Freeport-McMoRan Inc. |

| Headquarters | Phoenix, Arizona, USA |

| Founded | 1987 |

| Market Cap | $73.7 billion |

| Traded On | NYSE (FCX) |

7. Zijin Mining Group Company Limited – $67.2 Billion (CN¥488 Billion)

Zijin is a multinational mining group headquartered in mainland China. It deals primarily in prospecting, exploration, and mining of gold, zinc, copper, lithium, platinum, silver, lead, and molybdenum.

The corporation was founded in 1986 as Shanghang Minerals Company and rebranded as Shanghang Zijin Mining Company in 1993, taking its name from the Zijinshan Mine where it was operating.

Zijin operates mines in 14 Chinese provinces and 11 other countries spanning Africa, Europe, South America, Asia, and Oceania.

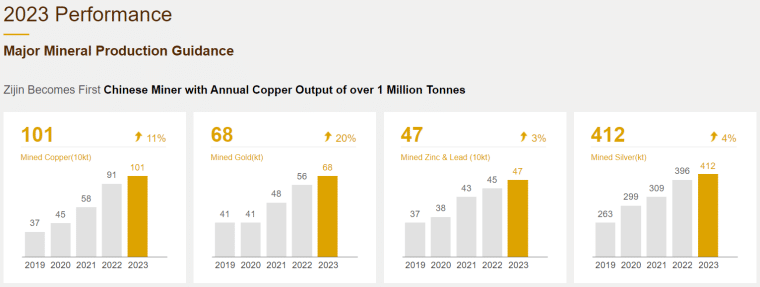

In 2023, it became the first Chinese miner to achieve copper output of over 100 million tonnes. Its revenues of $404 million (CN¥2.93 billion) represented a 9% year-on-year increase.

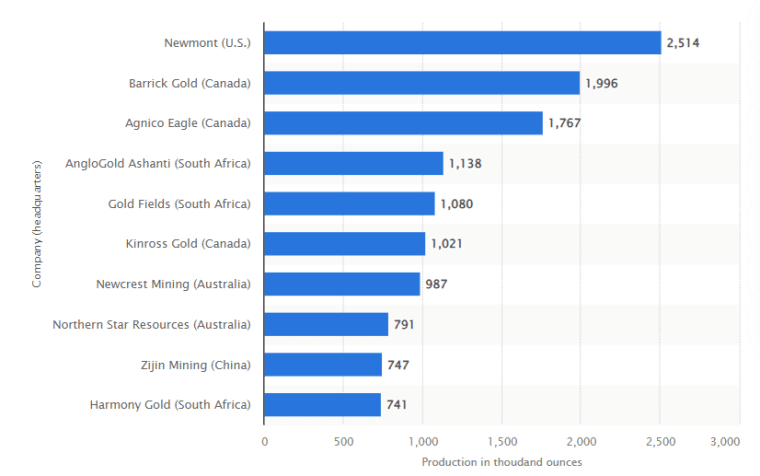

Zijin is the highest-ranked gold mining company on the Forbes 2024 Global 2000 list, at #267.

The company’s goal is “To be a green, high-tech, leading global mining company”. Reflecting this, it has a team of 5,000+ R&D personnel and spent $220 million (CN¥1.6 billion) on R&D in 2023.

| Company Name | Zijin Mining Group Company Limited |

| Headquarters | Longyan, China |

| Founded | 1986 |

| Market Cap | $67.2 billion (CN¥488 billion) |

| Traded On | SSE (601899.SS) |

8. Newmont Corporation – $54.8 Billion

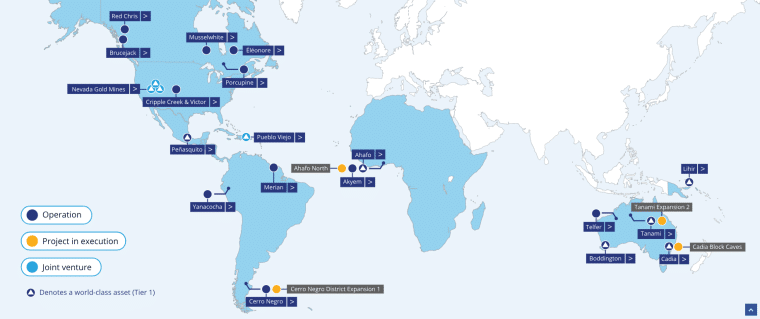

Newmont is the world’s leading gold mining corporation, with operations in Africa, Australia, North America, Papua New Guinea, and Latin America and the Caribbean.

The firm cemented its position as the world’s largest gold miner when it acquired Goldcorp for $10 billion in 2019. Initially rebranding as Newmont Goldcorp after the acquisition, the company returned to the name “Newmont” in 2020. A further major acquisition took place in 2023 when Newmont purchased the Australian company Newcrest Mining for $19.2 billion.

As well as being a major producer of gold, Newmont mines copper, silver, lead, and zinc.

Newmont achieved sales of $11.8 billion in 2023, of which $10.6 billion (90%) was from gold. The remainder of its sales came from:

- Copper: $575 million

- Silver: $335 million

- Zinc: $213 million

- Lead: $96 million

In the first half of 2023, Newmont mined over 2.5 million ounces of gold; 26% more than its nearest competitor, Canadian firm Barrick Gold.

The company has been publicly traded on the New York Stock Exchange since 1940 and is the only gold producer listed in the S&P 500 Index.

| Company Name | Newmont Corporation |

| Headquarters | Denver, Colorado, USA |

| Founded | 1916 |

| Market Cap | $54.8 billion |

| Traded On | NYSE (NEM) |

9. Grupo México, S.A.B. de C.V. – $49.4 Billion

Grupo México is a Mexican conglomerate with mining, transportation, and infrastructure divisions.

Mining is its largest division, accounting for 75.6% ($10.9 billion) of the company’s 2023 revenues. This division is operated through the holding company Americas Mining Corporation with the following subsidiaries:

- Southern Peru Copper Corporation: Peru (Southern Peru Copper Corporation) and Mexico (Minera Mexico)

- Asarco LLC: United States

- AMC Mining Iberia, S.L.U.: Spain

Grupo México’s transport division operates 11,137 km of track across Florida and Texas in the US and 24 Mexican states. It owns 74% of Ferromex, the largest railway in Mexico by length. Transportation contributed $3.1 billion (21.7%) of the company’s 2023 revenue.

Its infrastructure division engineers, constructs, and operates various projects including oil wells, wind farms, and toll roads. This is the smallest division, making up just 2.7% ($393 million) of annual revenue.

| Company Name | Grupo México, S.A.B. de C.V. |

| Headquarters | Mexico City, Mexico |

| Founded | 1890 |

| Market Cap | $49.4 billion |

| Traded On | OTC (GMBXF) |

10. Vale S.A. – $49.2 Billion

Brazilian company Vale (pronounced ‘vali’ in Portuguese) is one of the largest producers of iron ore and nickel globally. It owns two of the largest iron ore mines in the world, Serra Norte Mining Complex and Carajas Serra Sul S11D Project, both located in Para, Brazil.

Vale has around 66,000 direct employees and 167,000 contractors working throughout its operations.

In addition to its activity in the mining sector, Vale operates logistics systems and research projects. It currently has ports in Malaysia, Indonesia, Oman, Brazil, and Canada to help transport its resources worldwide.

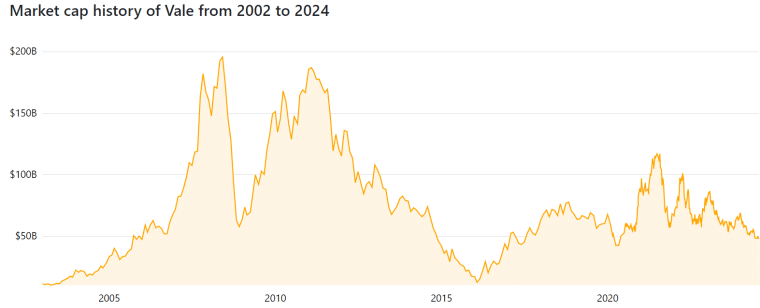

Vale’s market cap has fallen to around 25% of its peak in 2008, and is less than half its value of $116 billion in June 2021.

Two of Vale’s dams have collapsed in the past decade, both in the state of Minas Gerais in Brazil. The first, in 2015, killed 19 people. The second, in 2019, killed 270 and resulted in Vale paying out $7 billion in compensation.

This video shows how two mine workers survived the 2019 dam collapse despite their vehicle being hit by the tide of sludge that it created:

| Company Name | Vale S.A. |

| Headquarters | Rio De Janeiro, Brazil |

| Founded | 1942 |

| Market Cap | $49.2 billion |

| Traded On | NYSE (VALE) |

Learning From the Biggest Mining Companies in the World

Mining is one of the world’s oldest industries, dating back at least 7,000 years, and there is evidence of coal mines in Africa as old as 20,000 years.

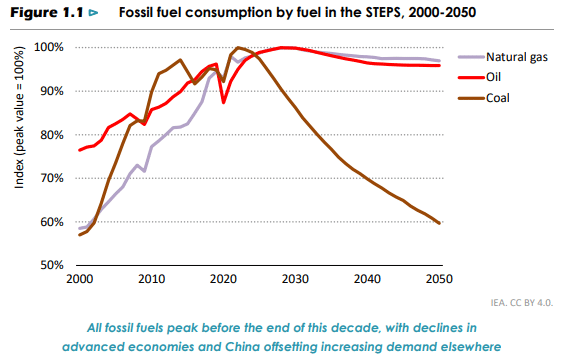

However, the current era marks a turning point for the mining industry; according to the IEA’s World Energy Outlook 2023, demand for coal has already peaked and natural gas and oil will follow by 2030.

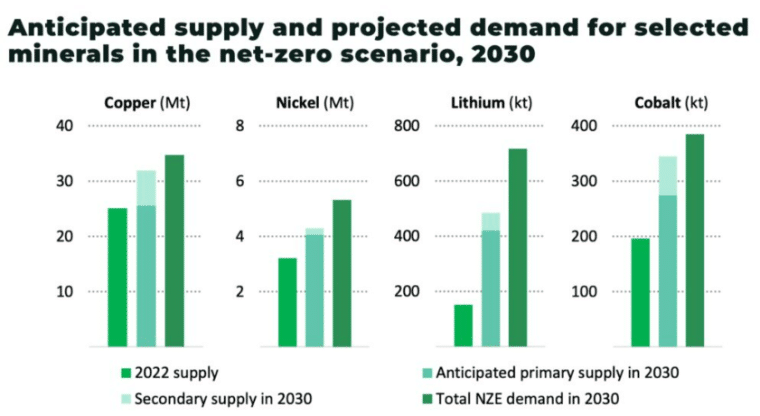

At the same time, there is rising demand for minerals used in clean energy production and electric vehicle batteries, especially copper, nickel, lithium, and cobalt.

Mining companies that already have reserves in these commodities are most likely to benefit from the transition to clean energy. Keeping ahead of the curve and securing rights to minerals early in their lifecycle of usefulness has kept these businesses growing, and being aware of what new tech is going to need will secure them into the future.