Since 1907, Shell’s net worth has been a major indicator for the global oil and gas industry, with a reputation as one of the world’s largest and most innovative energy companies. Shell’s net worth is £158.60 billion ($208.63 billion) in September 2024 and the company’s journey to this value is an important lesson for business owners and investors as a story of exploration, innovation, and a pioneering spirit.

At Business2Community, we’ve consulted a wide range of sources to provide a comprehensive history of how Shell went from selling oriental seashells to becoming a multi-billion global energy giant. Keep reading to discover Shell’s revenue, dividend history, key milestones, and more.

Shell Net Worth: Key Data

Shell Net Worth: £158.60 billion ($208.63 billion)

Date Founded: 1907, following a merger of British and Dutch companies

Founded By: Henri Deterding Marcus Samuel

Current CEO: Wael Sawan

Industries: Oil and gas

Shell Stock Ticker:LON: SHEL

PepsiCo Dividend Yield: 4.16%

What is Shell’s Net Worth?

Shell’s net worth, or market cap, is £158.60 billion ($208.63 billion) as of September 2024. This is based on a share price of £2,554.50 ($3360.28).

Shell’s financial year ends on 31st December each year and the annual reports are released in March of each year. Shell first took its stock public in 1981 on the London Stock Exchange and Amsterdam’s Euronext.

Shell’s share price saw a drastic fall during the oil price collpaose in 2014-16. Oil prices in that era dropped 70%, one of the biggest declines since WW2. The price drop was down to increased US domestic production a relatively more stable geopolitical situation. Shell’s full-year earnings for 2015 were down nearly 75%, from $19 billion in 2014 to $3.8 billion in 2014, feeding into the decline in share price in early 2016.

Prices inevitably dropped in 2020 due to the pandemic and much reduced demand for oil. Profits for 2020 were down 71% to $4.8 billion, although the company did announce an increased dividend for 2021.

Shell Revenue

In recent years, Shell’s revenue and profits have seen significant fluctuations. In 2019, revenue dropped due to changes in oil prices while the significant falls in 2020 were down to the demand shock from the pandemic, as we’ve noted. Earnings dropped 30% from 2022 to 2023due to tightened margins for refining activities and sluggish global growth rates and so lowered demand.

| Year | Revenue ($ billions) | Net Income ($ billion) |

| 2017 | 305 | 12.9 |

| 2018 | 388 | 23.3 |

| 2019 | 344 | 15.8 |

| 2020 | 180 | -21.6 |

| 2021 | 261 | 20.1 |

| 2022 | 381 | 42.3 |

| 2023 | 316 | 19.3 |

| Dividend Date | Amount (GBP£) |

|---|---|

| Aug 15, 2024 | 0.2615 |

| May 16, 2024 | 0.2694 |

| Feb 15, 2024 | 0.269 |

| Nov 16, 2023 | 0.2631 |

| Aug 10, 2023 | 0.26297 |

| May 18, 2023 | 0.23236 |

| Feb 16, 2023 | 0.24125 |

| Nov 10, 2022 | 0.21117 |

| Aug 11, 2022 | 0.21105 |

| May 19, 2022 | 0.19848 |

| Feb 17, 2022 | 0.18258 |

| Nov 11, 2021 | 0.18139 |

| Aug 12, 2021 | 0.17133 |

| May 13, 2021 | 0.12218 |

| Feb 18, 2021 | 0.12133 |

| Nov 12, 2020 | 0.12353 |

| Aug 13, 2020 | 0.1223 |

| May 14, 2020 | 0.12581 |

| Feb 13, 2020 | 0.35211 |

| Nov 14, 2019 | 0.3627 |

Who Owns Shell?

As a public company, Shell is owned by various shareholders. As of September 2024, Shell’s largest shareholders of its London stock were Paradigm Asset Management, Slivercrest Asset Management, Principal Street Partners, and Gamma Investing.

Shell’s beginnings can be traced to a shop selling oriental shells and antiques. Shell founder Marcus Samuel Senior was a London-based businessman whose sons, Marcus Junior and Samuel, continued his legacy after he passed away in 1870. The Samuel brothers diversified into importing and exporting oil, giving rise to the Shell Transport and Trading Company in 1897.

In 1907, the Shell Transport and Trading Company merged with competitor Royal Dutch to form the Royal Dutch Shell Group. Due to his contributions to the company’s early successes, Henri Deterding is also often cited as a Shell founder.

Following a nearly century-old partnership, Royal Dutch Petroleum and Shell Transport and Trading merged in 2005 and Shell unified its corporate structure under a single new holding company, Royal Dutch Shell plc. Trading in Royal Dutch Shell shares commenced on the London Stock Exchange, Euronext Amsterdam, and New York Stock Exchange on July 20, 2005.

Who is the Shell CEO?

The CEO of Shell is Wael Sawan, who has held the position since September 2022. During his 25-year tenure at Shell, Sawan has worked in Europe, Africa, Asia, and the Americas, and held roles across all of Shell’s businesses.

Prior to being appointed CEO, Sawan joined the Executive Committee in 2019 as Upstream Director, and then, in 2021, he became Shell’s Director of Integrated Gas, and Renewables and Energy Solutions.

Sawan was appointed as CEO to lead Shell safely and profitably through its next phase of transition and growth. Under his leadership, Shell has abandoned its modest climate goals in favor of fossil fuels and maximizing shareholder payouts.

In June 2023, Shell announced that it would hold its oil and gas production steady until 2030, backtracking on its pledge to cut output by about 1-2% each year. Sawan is said to have made this decision to take advantage of lucrative fossil fuel prices caused by the Russia-Ukraine war.

A month after the announcement, Sawan came under fire for defending Shell’s plans and ongoing oil and gas operations. The CEO was criticized for saying that cutting fossil fuel production would be “dangerous and irresponsible”. His claims contradicted global scientific consensus that continued reliance on fossil fuels was very likely to drive global temperatures to levels that would trigger catastrophic climate change and widespread loss of life, especially in developing countries.

Due to its complex structure, Shell has a long history of leaders who have successfully steered it through the decades. Between 1946 and 2005, Shell had a committee of Managing Directors led by a Chairman. The official title of CEO was created in 2004, with Jeroen van der Veer taking up the position in July 2005.

| Period | CEO Name |

|---|---|

| 1907-1936 | Henri Deterding |

| 1937-1940 | Ir. J. E. F. (Frits) de Kok |

| 1941-1946 | No single leader during the Second World War |

| 1946-1948 | Ir. Jean Baptist August Kessler (II) |

| 1949-1951 | Dr. Barthold T. W. van Hasselt |

| 1952-1965 | Dr. Johan Hugo Loudon |

| 1965-1970 | Ir. L. E. J. (Jan) Brouwer |

| 1970-1972 | (Sir) David Haven Barran |

| 1972-1977 | Gerrit A. Wagner |

| 1977-1979 | Carmichael Charles Peter Pocock |

| 1979-1982 | Dirk de Bruyne |

| 1982-1985 | (Sir) Peter Brian Baxendell |

| 1985-1992 | Ir. Lodewijk Christiaan van Wachem |

| 1992-1993 | (Sir) Peter Fenwick Holmes |

| 1993-1998 | Drs. Cornelius A. J. (Cor) Herkströter |

| 1998-2001 | (Sir) Mark Moody-Stuart |

| 2001-2004 | (Sir) Philip Beverley Watts |

| 2004-2009 | Ir. Drs. Jeroen van der Veer |

| 2009-2014 | Peter Voser |

| 2014-2022 | Ben van Beurden |

| 2022-Present | Wael Sawan |

Growth and Development of Shell

Headquartered in London, England, Shell is one of the largest energy companies in the world. The company operates in every vertical of the oil and gas industry and its business is divided into 3 core areas, namely:

- Integrated gas and upstream: Explores and extracts hydrocarbons; produces and markets liquefied natural gas; and converts natural gas into GTL fuels.

- Downstream, renewables, and energy solutions: Provides products and services to over 1 million business customers, including chemicals, products, and mobility, which serves around 33 million retail customers through a Shell filling station network of over 47,000.

- Projects and technology: Manages major projects, driving Shell research and innovation, and providing leadership in safety, environment, procurement, emissions management, R&D, performance products, and AI.

A History of Shell – Key Dates

- Shell was founded in 1907 when the Shell Transport and Trading Company merged with the Royal Dutch Company.

- At the end of the 1920s, Shell was the largest oil company in the world and controlled its entire supply chain.

- By the 1980s, Shell had ventured into chemicals, made critical key tech advancements, and expanded into more territories.

- In the 2000s, Shell took on a unified organizational structure and went public on the LSE, NYSE, and Euronext Amsterdam.

- As of June 24, 2024, Shell had a market capitalization of $224.69 billion, placing it among the world’s top oil and gas companies.

Below, we track 185 years of Shell’s history, exploring how it became a key player in the oil and gas industry.

1907-1913: Pre War Expansion

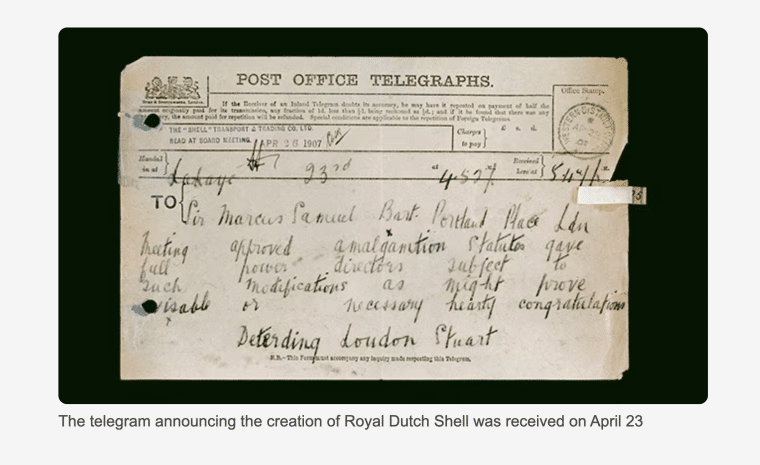

On April 23, 1907, the Royal Dutch Shell Group (now Shell) was founded when the British-owned “Shell” Trading Company (founded in 1897) and Royal Dutch formed a partnership to compete with Standard Oil.

Royal Dutch Petroleum claimed a 60:40 advantage in the alliance and control over management but the combined entity presented itself as British, adopting the Shell brand and logo for its worldwide products and operations.

The period between 1908 and 1913 was one of rapid expansion and innovation. First, Shell launched operations in Europe and parts of Asia. Then, the company ventured into exploration and production in Russia, Romania, Venezuela, Mexico, and the US.

In the US, Shell Oil Company was established in 1912 as the largely independent American subsidiary of the Royal Dutch Shell Company.

1914-1929: Shell Expands After World War I

As a crucial partner to the Allies in both world wars, Shell’s development was heavily influenced by both conflicts. The wars were catalysts for great innovation, with major advances in fuel and chemical research.

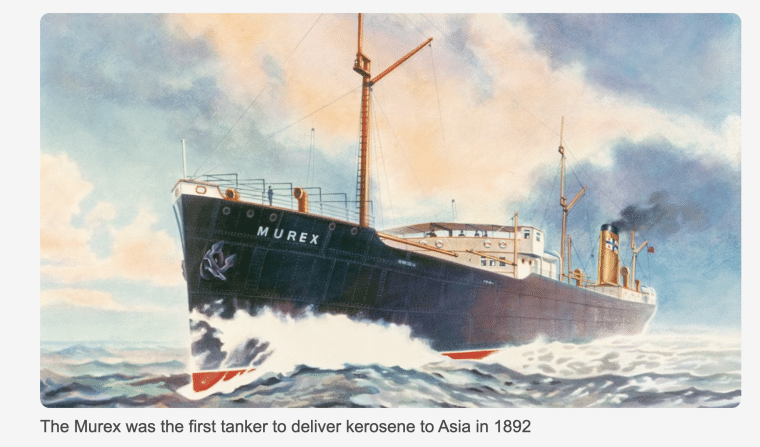

During World War I, Shell was the main fuel supplier for the British Army. The company also offered all of its ships, including the Murex, to the British Admiralty.

Unfortunately, Shell suffered crippling losses. The German invasion of Romania in 1916 destroyed 17% of the company’s production capacity in a couple of days. All its assets in Russia were confiscated after the revolution and equipment-related challenges meant that production in Venezuela was put on hold until late in the conflict.

However, this period remained a time of rapid expansion for Shell and other oil companies, particularly as the use of motor cars and the demand for petrol increased.

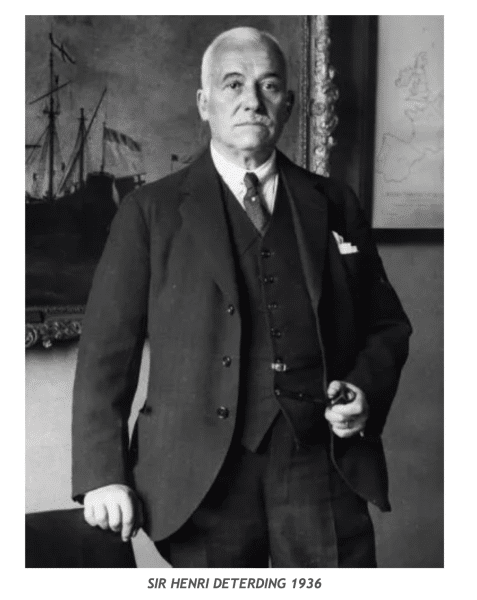

Under the stern leadership of Sir Henri Deterding and access to British financing, Shell emerged as the largest oil company in the world in the 1920s. It controlled the entire supply chain from production, transport, and refining down to marketing, selling, and distribution. Note that while this is very impressive, the oil industry was a fraction of the size it is today. The second world war would be a massive driver of oil demand, helping to build the industry into a global staple.

Output increased during the inter-war years and saw the oil company establish new subsidiaries. Shell also expanded its refinery operations and set up more bunkering stations in ports worldwide. By the end of the decade, the company’s operations made up 11% of global crude oil production and the company owned 10% of world tanker tonnage.

1930-1945: Shell Ventures into Chemicals

The 1930s were defined by the company’s strategic move into research and chemicals. At the beginning of the decade, Shell had founded Shell Chemicals to advance the refinement of chemicals from oil.

The company’s revenues had increased from new oil finds in California, Venezuela, and the Middle East. The company had also become involved in chemicals through the Dutch NV Mekog and the Shell Chemical Company in the US.

While Deterding had been instrumental in turning Shell into one of the world’s most powerful enterprises, frictions emerged within the Group as he pushed new strategies and developed sympathies for Nazism and fascism. Deterding retired in 1936 and died in February 1939 before the second war broke out.

When World War II began in 1939, Shell’s refineries in the USA produced aviation fuel to support the Allied Air Forces, and all the company tankers came under government command.

Shell lost major assets in the Far East, important oil fields in Romania, and 87 ships during the conflict. When the war ended, great efforts were put into restoring capacity and output. Fortunately, Shell’s expansion strategy into the Middle East, Siberia, the United States, Mexico, and Venezuela paid off, ensuring that the company had sufficient resources to regroup.

1946-1969: Shell Rebuilds After World War II

As Shell embarked on costly reconstruction, a new management and organizational structure was created in 1946. It eased tensions between British and Dutch managers and ushered in a new era of cohesion.

Shell also launched new exploration programs in Africa and South America and built new refineries in the UK. Investments were made into larger and higher-powered ships (supertankers) to carry more oil in bulk.

In 1947, the first commercially viable offshore well was drilled in the Gulf of Mexico, and within 8 years Shell had over 300 wells. New discoveries were made in Borneo and the Niger Delta, and commercial production of oil in Nigeria began in 1958.

With the discovery of oil in Yibal, Oman at the start of the 60s, Shell strengthened its presence in the Middle East. Additionally, some of the world’s largest gas discoveries were made in the Netherlands and the North Sea.

During this period, the oil industry experienced impressive growth, overtaking coal as the main source of energy. With the Middle East as the most important oil-producing region, Shell managed to maintain a strong competitive position.

Apart from oil and gas, chemicals fueled the group’s success. Following the rapid growth in chemical production after 1945, several hundred compounds had been developed by Shell in more than 30 locations.

1970-1999: Shell Explores New Frontiers

The 1970s proved to be turbulent years that began with the OPEC embargo of 1973. High oil prices and the nationalizations of the 1970s forced the company to venture into unchartered territories such as the North Sea. The company also diversified into metals, coal, and nuclear energy.

In 1978, Shell was embroiled in the largest oil spill at the time. Technical problems caused the Amoco Cadiz tanker, carrying Shell cargo, to wreck on the French coast, spilling 240,000 tonnes of crude oil and polluting 200 kilometers of shoreline.

The 1980s and 1990s saw Shell grow through acquisitions, the creation of enhanced drilling techniques, and 3D seismic technology. These developments allowed Shell to search for new oil and develop offshore projects in more challenging environments. Following its giant leaps in biomass and gas-to-liquid technologies, Shell took a pioneering step and opened the world’s first commercial GTL plant in Bintulu, Malaysia.

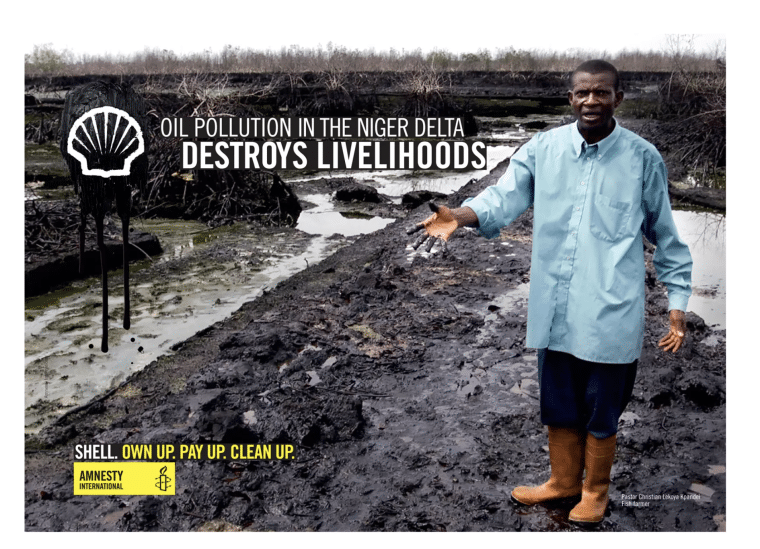

During this period, the company’s reputation took a significant knock due to its controversial presence in apartheid-regime South Africa, protests against the sinking of the Brent Spar, an oil storage installation in the North Sea, and concerns about its environmental and human rights transgressions in Nigeria.

In response to shifting market conditions, developments in information technology, and the growth of the global economy, Shell began the long and complicated process of restructuring in the mid-1990s. The company:

- Embarked on a major overhaul of its organizational structure

- Cut costs and personnel

- Divested from the chemical business

- Centralized its global operations

In 1998, Shell agreed to pay $1.5 million to settle federal charges against its refinery in Roxanna, Illinois, for illegally discharging pollutants into the Mississippi River. That same year, the company was also fined £20,000 ($33,200 at the time) for an oil spill in the Manchester Ship Canal in Britain.

Due to pressure from critics and its tarnished reputation, Shell also revised its Statement of General Business Principles. To show its commitment to human rights and sustainable development, the company backed the move with a new system of controls. The Shell Foundation was also established with initial funding of $250 million towards two key programs: sustainable energy and sustainable communities.

2000-2009: Shell Ushers In a New Era

At the beginning of the 2000s, Shell acquired Pennzoil-Quaker State for $1.8 billion. Through its acquisition of Pennzoil, Shell became a descendant of Standard Oil and inherited multiple auto part brands including Jiffy Lube, Rain-X, and Fix-a-Flat.

Shell was also fined $2 million by the United Nations for shipping Iraqi oil in violation of the then-international embargo against Iraq.

In 2004, Shell was thrown into turmoil by the revelation that it had been overstating its proven oil reserves for several years. This led to a loss of investor confidence, damaging the company’s reputation and its financial standing.

Following the scandal, senior executives Sir Philip Watts, chair of the board, and Walter van de Vijver, CEO of Shell Exploration and Production, were forced to resign with immediate effect. Shell was also fined £17 million ($31.4 million at the time). To regain the trust of the financial markets, the Group overhauled its governance structure and formally merged Royal Dutch and Shell into Royal Dutch Shell PLC in 2005.

In 2007, Shell had operations in more than 110 countries and territories worldwide. Exploration for oil and gas was underway in frontier territories such as the Beaufort Sea.

New supplies were also brought on-stream through major projects in challenging environments, such as Sakhalin in Russia and Athabasca in Canada. In China, Shell’s Nanhai petrochemical complex celebrated a successful first year of operations.

Shell generated record-breaking revenues of $470 billion in 2008, over three times what the company had made in 2000.

June 2009 saw Shell settle a human rights suit for $15.5 million over allegations of its role in the executions of activist Ken Saro-Wiwa and other civilians in 1995. However, Shell denied any wrongdoing and stated that it hoped the settlement would contribute to reconciliation efforts.

By the end of the decade, Shell had ventured into ethanol production through Raizen, its 50:50 partnership with Cosan in Brazil. It had also secured a lucrative contract to redevelop the Majnoon field in Iraq, estimated to hold 12.6 billion barrels of oil.

2010-2019: Shell Consolidates to Drive Profitability

With annual revenues now consistently exceeding $250 billion, Shell set out to expand strategically. However, its operations in the Niger Delta cast a long shadow.

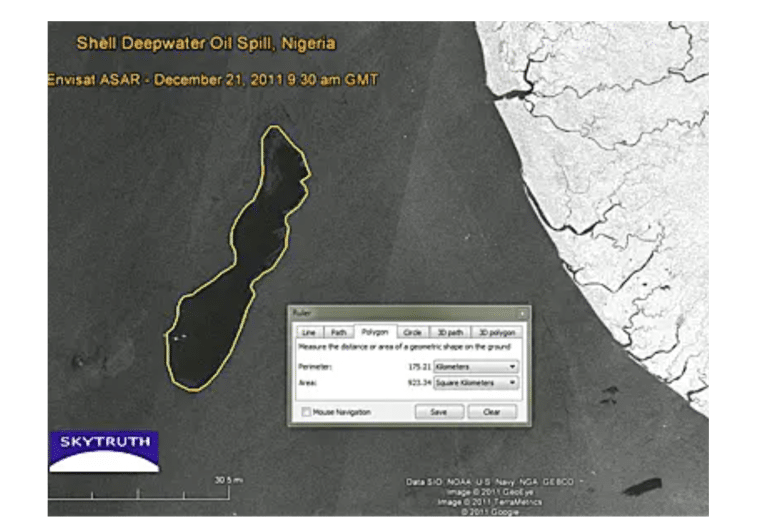

In December 2011, Shell announced that 40,000 barrels of crude oil had spilled 75 miles off the coast of the Niger Delta. The spill, one of the worst off the coast of Nigeria in 10 years, came only four months after a major UN study found that it would take Shell and other oil companies 30 years and $1 billion to clean spills in Ogoniland, one small part of the oil-rich delta.

Meanwhile, in 2012, the company completed Pearl GTL, in Qatar, the world’s largest source of GTL products.

Throughout the early and mid-2010s, Shell prioritized cost-cutting measures. In a further effort to streamline operations and bolster profitability, Shell divested several assets, including:

- Its liquefied petroleum gas (LPG) business.

- Its US shale gas holdings.

- The majority of its Australian assets, encompassing refineries and petrol stations, for $2.6 billion to Swiss company Vitol.

- An additional $15 billion worth of assets in the period leading up to 2015.

In 2015, Shell became the first company to successfully capture CO2 via CCS technology at the Quest CCS site in Canada. The project now permanently captures over 1 million tonnes of CO2 annually or the equivalent output of 250,000 cars.

The company strengthened its portfolio in North American tight gas with the $4.7 billion acquisition of East Resources in 2016. Shell also announced that it would be buying BG Group, a UK oil and gas production company. The acquisition was completed in February 2016, expanding the company’s oil and gas portfolio.

That same year, Shell created its New Energies business to focus on exploring and developing commercial opportunities in renewable energy, such as wind and solar. Production started at Shell’s Stones field, the world’s deepest oil and gas project.

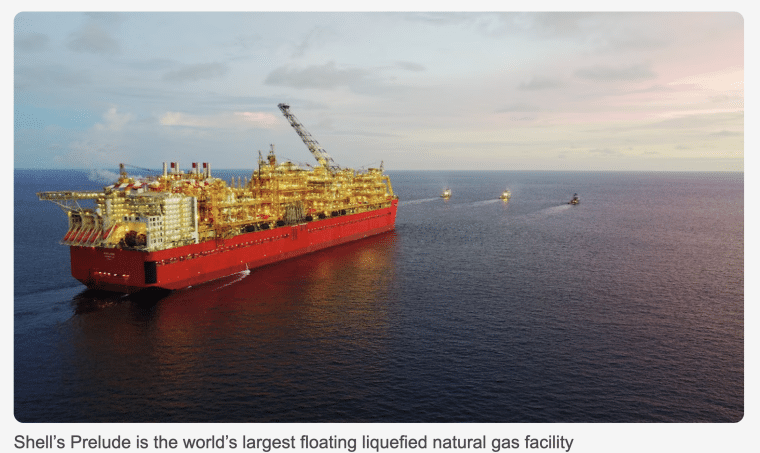

In 2017, Prelude, the world’s biggest floating liquefied natural gas facility, sailed from a shipyard in South Korea to its new home in Western Australia.

To signal its commitment to environmental responsibility, Shell announced its goals to align the reduction of its products’ net carbon footprint with society’s broader efforts to curb greenhouse gas emissions. This included a 50% reduction in the net carbon footprint of its energy products by 2050 and increasing its investments in renewable energy sources.

Subsequently, Shell divested from its North Sea and Canadian Oil Sands assets in 2018 and formed joint ventures to build wind farms off the New Jersey and Massachusetts coasts. The company also made investments in renewable power by acquiring ERM Power, an Australian commercial and industrial electricity retailer, in 2019.

In addition to wind power, Shell ventured into the solar energy sector, acquiring a 49% interest in Cleantech Solar, a provider of solar power solutions for commercial and industrial customers in Southeast Asia and India.

2020-2024: Shell Doubles Down on Renewables

Shell faced a challenging year alongside many other companies in 2020, reporting a significant loss of $21.7 billion due to the pandemic. In addition to implementing a major corporate overhaul and reducing operating expenses by 12%, or $4.5 billion, the company also made the difficult decision to reduce its workforce by over 10% to adapt to the global transition towards cleaner energy.

In 2021, Shell announced that it had hit peak oil production in 2019, and as a result, would divest around $4 billion a year in oil and gas while accelerating its transition to net-zero emissions energy products.

That same year, the company received a Dutch court order to cut emissions from its oil and gas by 45% by 2030. Led by Friends of the Earth and more than 17,000 co-plaintiffs, the case argued that the company had been aware of the dangerous consequences of carbon emissions for decades and that its climate targets were unsatisfactory.

On March 4, 2022, Shell bought discounted Russian oil despite the ongoing war in Ukraine. Even though the company faced criticism, Shell defended the purchase, stating it was a short-term necessity and that it would donate profits to humanitarian aid in Ukraine. However, on March 8, Shell reversed course and announced that it would halt all Russian oil and gas purchases and close its service stations in Russia.

As global energy prices soared following Russia’s invasion of Ukraine in 2022, Shell more than doubled its annual profits, raking in $40 billion compared to $19 billion for the previous year. 2023 was a slightly less profitable year for the company.

Still, Shell made significant strides in expanding its energy portfolio. Shell began production at the Vito floating production facility in the Gulf of Mexico and restarted operations at the Pierce field in the UK North Sea. The company also celebrated a major milestone in its renewable energy efforts when the Hollandse Kust Noord offshore wind park in the Netherlands delivered its first electricity in June 2023.

Despite the company’s sustainability progress, ClientEarth, an environmental law organization, filed a lawsuit against the directors of Shell that same year. The case, backed by prominent investors, argued that Shell’s slow transition to low-carbon energy threatened the company’s success and would waste investor funds on unnecessary fossil fuel projects.

Shell reported a $7.7 billion profit in the first quarter of 2024, despite a dip in global energy prices. Critics slammed these profits, highlighting the inequality of a system that benefits fossil fuel companies while leaving consumers to face high energy costs.

History of the Shell Logo

Shell boasts one of the most recognizable brands in the world. Here, we trace the distinctive logo’s origins and evolution over the years.

1907-1929: The Black and White Mussel Shell

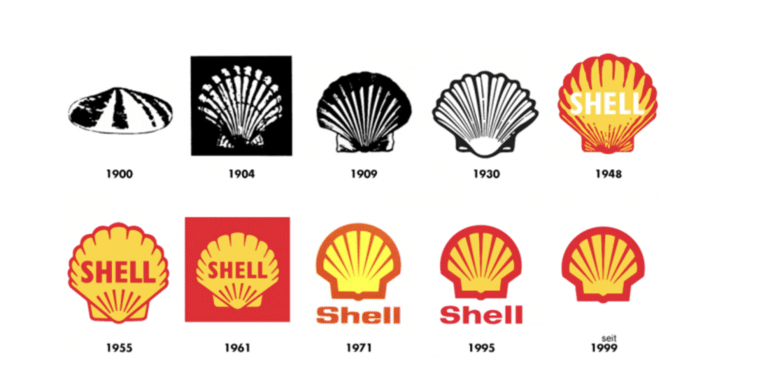

Shell’s first logo was a black and white mussel shell. This design was trademarked in 1900 and is the oldest of 22,000+ trademarks owned by Shell. During this period, the logo is said to have evolved into a scallop after a businessman, whose family crest featured three scallops, imported Shell kerosene into India.

1930-1954: The Formal Pecten

In 1930, the Shell “Pecten” logo, inspired by the Pecten maximus (giant scallop) seashell, took on a more formal design, incorporating the colors red, white, and yellow. Hand-drawn variations of the logo were applied to packaging, signage, and vehicles. While the change wasn’t universally applied, the “Shell” name was added to the Pecten logo in 1948.

1955-1970: The Simple Pecten

Following the development of a new generation of printed transfers in the 1950s, a simpler Pecten logo was introduced. The new logo was applied to everything from petrol pumps to shop signs, with basic variations appearing in the brand’s signature colors throughout the 50s, 60s, and 70s.

1971-1992: The Modern Pecten

In 1971, renowned industrial designer Raymond Loewy crafted the iconic Pecten logo that has become synonymous with the Shell brand. While red and yellow were retained as the primary brand colors, the “Shell” name was removed from the center of the symbol and placed below in a specially designed typeface.

1992-Present: The Updated Pecten

The early 90s saw the logo receive a subtle update, with its colors shifting to a warmer yellow and red. This created a softer feel and gave the brand a broader appeal.

In 2015, Shell introduced its sonic logo, The Sound of Shell. Today the signature sound comprises nine variations and more than 600 iterations ranging from a full orchestral rendition to a holiday medley.

The Future of Shell

The history of Shell highlights the importance of adaptability, innovation, and diversification. Adapting to market conditions, prioritizing innovation, and diversifying into various energy and chemical projects has allowed Shell to enjoy long-term success.

On the other hand, the numerous environmental, human rights, ethical, and political controversies in its history file are a lesson in:

- Balancing people, planet, and profit

- Managing reputational risk

- Prioritizing ethical and sustainable practices

Looking ahead, Shell maintains that it supports a balanced energy transition, where “the world does not dismantle the current energy system faster than the clean energy system of the future can be built”.

For instance, Shell intends to prioritize the businesses where it has a competitive advantage. The company will invest approximately $40 billion in oil and gas by 2025 while simultaneously boosting its LNG portfolio capacity by roughly 11 million tonnes per year in the second half of the decade.

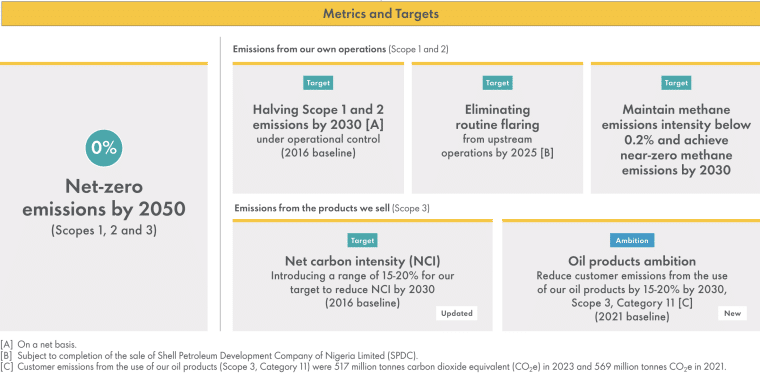

Meanwhile, Shell’s Powering Progress strategy aims to generate shareholder value while meeting the target of net-zero emissions by 2050.

Despite its long history of success, Shell will need to navigate its future cautiously, especially in the face of rising criticism and the push for greener operations. As the world’s energy system transforms, balancing profitability with sustainability will be critical for the company.