Shein’s net worth isn’t easy to pin down since it’s currently a privately held company that doesn’t disclose its financial information, meaning, its value is determined by factors like estimated revenue, funds raised, and assets.

In 2024, Shein’s net worth was valued at $66 billion ahead of its planned UK IPO.

Here at Business2Community, our experts have prepared this detailed report about Shein’s rise to be a global fast fashion phenomenon in just 15 years. We’ll go through Shein’s net worth, history, and business moves to dissect its effective operational tactics and what you can learn from them.

Shein Key Company Data

Shein Net Worth: $66 billion, estimated

Date Founded: 2008

Founded by: Chris Xu

Current CEO: Chris Xu

Industries: Clothing

Shein Stock Ticker: N/A

Dividend Yield: N/A

What is Shein’s Net Worth?

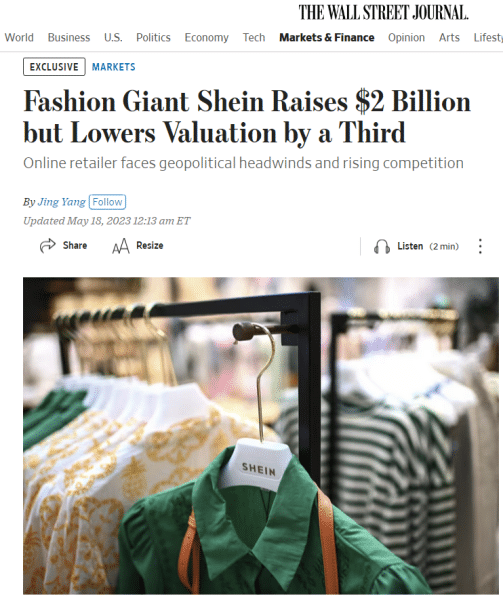

In November 2024, Shein’s net worth is an estimated $66 billion. The figure is based on its last fundraising round in early 2023, which raised $2 billion. In June 2024, UK news outlet Sky News reported that Shein targeted this private net worth valuation for its UK IPO, which is now expected to happen in 2025.

Shein began its journey in 2008 as a drop-shipping company called ZZKKO before changing its name to Shein in 2016 and operating on a global scale. In 2019, Shein’s net worth was valued at $5 billion.

Between 2019 to 2022, Shein’s valuation shot up exponentially due to its cheap products and social media strategies. When COVID-19 shut down most physical fashion stores in the US, the fashion market’s value shrunk by 20% overall. Yet, Shein continued to soar in sales because of its use of social marketing and influencers. Its revenue tripled from $3.15 billion in 2019 to $9.81 billion in 2020.

It skyrocketed to becoming one of the most valuable private companies in the world in 2022 with an estimated net worth of $100 billion, more than the value of H&M and Zara combined. The valuation was based on a funding round in spring that raised between $1 billion and $2 billion.

The quick rise of Shein alarmed governments around the world, especially due to its questionable production ethics and environmental concerns, which eventually led to a drop in valuation.

A British documentary exposed illegal working conditions inside Shein factories in 2022. Two years later in 2024, the French government passed a bill to curb the growth of fast-fashion brands, directly targeting Shein and Temu, to alleviate their environmental impacts. US senators have also called for new regulations to block tax loopholes exploited by Shein and similar retailers the same year.

@julianadeliberais As consumers are becoming more conscious of how bad fast fashion is, brands like Shein have been amping up the Greenwashing. Please don’t fall for their pretty words and empty promises. Just remember that fast fashion can NEVER be sustainable. #shein #greenwashing #evolusheinxanitta #evolushein #sheinxanitta #greenwashing #greenwashingalert #fastfashion #fastfashionsucks #sustainablefashion #ethicalfashion #fastfashionisntcute #sustainability

The series of negative news diminished investor confidence and Shein’s net worth. When Shein filed for an IPO in the US in November 2023, it tried to push for a $90 billion valuation, much higher than the $66 billion estimated by analysts. However, the Securities Exchange Commission never moved the IPO forward, possibly due to Shein’s controversial image.

In 2024, Shein transferred its IPO plan to the UK with the forecasted $66 billion valuation. Since its peak in 2022, Shein’s net worth has been slashed by a third. As of November 2024, an IPO date has not been set.

Shein’s Revenue

Shein has never publicly revealed its revenue history, therefore, figures are estimated based on factors like usage, shipping volumes, and growth.

In 2016, the year after the brand changed its name to Shein and expanded its international domain, Shein’s revenue was $610 million. Its cheap clothing appealed to international consumers, doubling its sales within one year to $1.55 billion in 2017.

COVID-19 turned people to online shopping, which benefitted retailers like Amazon and Shein greatly. Shein’s revenue was $9.81 billion in 2020, three times more than its 2019 figures. Its income further grew to $22.70 billion in 2022 with a company valuation of $100 billion.

Despite the concerns surrounding its IPO applications and government sanctions, Shein still had an advantage in offering the most competitive prices. Its 2023 revenue was believed to have increased to $30 billion. However, sources told CNBC that Shein made “a lot more than $30 billion”, suggesting a year of stronger-than-expected growth amid all the controversies.

| Year | Revenue ($ billions) |

| 2016 | 0.61 |

| 2017 | 1.55 |

| 2018 | 1.99 |

| 2019 | 3.15 |

| 2020 | 9.18 |

| 2021 | 15.70 |

| 2022 | 22.7 |

| 2023 | 30 |

Who Owns Shein?

Founded by Chinese entrepreneur and SEO specialist Chris Xu in 2008, Shein (pronounced She-In) is a fast fashion company that sells wedding dresses, women’s clothing, accessories, cosmetics, household items, and other fashion and lifestyle products at affordable prices to international consumers.

Xu, also known as Sky Xu, originally named the company ZZKKO before changing it to SheInside and eventually to Shein.

As Shein grew its international presence, it fully moved its headquarters from China to Singapore in 2022 for regulatory and financial reasons. Shein’s parent company, Lingtian Information Technology Co., remains registered and headquartered in China at the time of writing.

As of April 2024, Shein remained a privately held company and therefore, was not publicly traded and is not obliged to publicly disclose its company structure. There is precious little information about the full ownership and structure of the Chinese ecommerce retailer that is available in the public domain.

Who is the Shein CEO?

Shein’s founder, Chris Xu (or Xu Yangtian in Chinese media), is the CEO of the company. Despite the media attention, not a lot is known about the background of Chris Xu. It was reported that the founder was born in China and is believed to have studied in the US at one point.

Shein’s success made Chris Xu one of the richest men in China with an estimated net worth of $11.2 billion.

The Chinese fast fashion retailer is notorious for its opaque structure. The public only knows a few names associated with the brand.

Molly Miao, one of the earliest key figures on the Shein team, is the Chief Marketing Officer of the company.

Growth and Development of Shein

With over 11,000 employees and thousands of new designs daily, Shein offers a wide variety of product ranges that capture the latest trends and consumer preferences.

In just a little over a decade, Shein has successfully become an icon in the fast fashion industry in the US. According to the Wall Street Journal, the company made approximately $24 billion in 2022, making it a top competitor to traditional fashion retailers like Zara – owned by Armancio Ortega – and H&M.

Alongside the company’s success, Shein has been embroiled in legal disputes and a series of accusations, damaging its brand image and reputation over the years. Studying the development of the Chinese lifestyle retailer allows you to refine your marketing strategies and gain insights about running a sustainable business while avoiding backlash.

A History of Shein – Key Dates

- Shein was originally founded by Chinese entrepreneur and SEO specialist Chris Xu in China in 2008 as ZZKKO.

- Between 2012 and 2020, Shein recorded over 100% sales growth for 8 consecutive years.

- Since the 2020s, Shein has faced a number of controversies regarding its practices, such as copyright infringements, forced labor accusations, and exploiting tax loopholes.

- In 2023, Shein was the second-most downloaded shopping app globally with 262 million downloads, just right after its main rival, Temu.

- Shein plans to go public in either the UK in 2025, subject to regulatory approval.

2008 – 2011: Early Days of Shein, Cheap Wholesale Guangzhou Products

In its early days, Shein didn’t have an in-house clothing line or fashion designers. Instead, it acted as a drop-shipping company that sourced clothing products from third-party wholesalers directly in the Guangzhou area in China before listing these products online and shipping them to customers.

Its founder Chris Xu worked as an SEO specialist at Nanjing Aodao Information Technology Co. before creating Shein. Xu’s experience in SEO and marketing in general gave the fashion startup an edge over competitors and helped the firm fully utilize search to promote its products.

In March 2011, SheInside.com, the platform that would later become Shein, went live. According to the company bio at the time, it was “a leading worldwide wedding dresses company” that sold affordable clothing items.

2012 – 2020: Shein’s International Annual Revenue Explodes

During the early 2010s, Shein began expanding its overseas markets to Russia, Spain, Germany, France, etc., after seeing the commercial value of cheap Chinese products in overseas markets. It also started selling different kinds of products like cosmetics, pet supplies, bags, accessories, and shoes on its shopping app.

Social media was gradually becoming one of the most effective marketing tools at that time.

To catch the latest trends and stay ahead of the competition, Shein began advertising on various social media platforms like Facebook, Instagram, and Pinterest as early as 2012.

It allowed the online fashion retailer to establish its brand name among international Gen Z customers. It often provided discounts for its online followers to increase signup rates and sales.

#SheInside Valentine's Day Giveaway

Follow @sheinsider,reply and retweet the tweet.

5 winners! pic.twitter.com/jmcbxoPqu3— SHEIN (@SHEIN_Official) January 28, 2014

As Shein began to gain exposure in the international fashion industry, formulating its own supply chain became a priority.

It started working with its own designers to push out Shein clothes in 2014, making itself a fully integrated retailer.

That same year, Shein bought one of the biggest clothing brands in China at the time, Romwe. Because the company was privately owned, little info was released regarding the acquisition details.

The acquisition of its rival allowed the growing firm to combine assets and further expand its market reach by introducing a more diverse product range to customers.

In 2015, Shein officially changed its platform name from SheInside to Shein and used “She In Shine Out” as its new slogan. The change raised a few questions from customers as changing its company name during such a vital growth stage may bring obstacles to its expansion strategies.

Shein explained the main reason behind the name change is to bring a better user experience by using an easy-to-remember name that would help with recognizability, SEO, and online search results.

The decision worked in the fashion retailer’s favor with annual sales continuing to grow more than 100% each year.

To enhance its product quality, Shein got rid of many of its sub-standard supply chain partners in 2016. It transformed into a clothing shopping app with its own models and designs.

Shein had around 800 in-house designers and creative professionals for its women’s wear line and other household items to ensure a smooth and fast production process.

One of Shein’s major supply chain partners once told the Chinese media that when the ecommerce company first tried to manufacture its own products, it faced a few challenges as it only wanted to produce new batches in small quantities, a requirement that many suppliers were reluctant to follow.

However, the supplier claimed that Shein had always been one of the most reliable in terms of payments, and therefore attracted more loyal factory partners as it grew.

By 2016, its key suppliers were receiving $ 7.7 million or more each year.

Being a Chinese-owned fashion brand suppressed the full potential of the company as political tensions was high between China and the Western world.

To pave the way for its future initial public offering (IPO), Shein started moving its headquarters from China to Singapore in 2019 to develop a better international image.

2020 – Present: Facing Multiple Controversies and Challenges in Going Public

When people were confined to their homes during COVID-19 in 2020, leading ecommerce platforms all saw significant boosts in sales – and Shein was no exception. Its 2020 revenue reached $10 billion, marking the 8th year in a row Shein experienced over 100% annual revenue growth.

In 2022, Shein reached $100 billion in estimated company worth, making it one of the most valuable private companies in the world at the time. It raised somewhere between $1 billion to $2 billion in a funding round to accelerate its services and global coverage.

That same year, the Chinese fashion brand launched 40 pop-up stores in countries like Spain, Italy, and France to further strengthen its presence in the European market.

As Shein gained popularity globally, responsible buyers and governing bodies began questioning its ethical standards.

Shein began facing a tremendous amount of online backlash and criticism over its labor practices, use of tax loopholes, and repeated copyright infringement.

A 2022 British documentary accused Shein of labor law violations as some of its factories were set up illegally while workers were forced to work 75 hours a week with a salary of just a few cents per clothing piece.

The horrible conditions featured led to widespread criticism against the leading Chinese ecommerce company.

While the fast-fashion retailer denied most of the accusations, it promised to invest $15 million into the business to ensure all factories and third-party vendors it worked with would be up to its standards.

The incident also led to the public questioning the existence of forced labor or child labor in Shein’s supply chain, prompting US policymakers to request the government to launch an independent investigation to make sure the business was following US laws.

@pdsbiz The Internet is calling out several influencers for defending Shein and “dispelling myths” about the controversial company. #Shein Even though the influencers reportedly claim they were not paid to attend the trip or post about what they saw, you have some saying the trip itself is the compensation. Though you also had outlets like Mashable calling out She-in for turning to marginalized influencers for this trip. Right, most of the influencers on this trip were people of color, some were plus-size, with Mashable adding that: “Non-white creators are, historically, offered fewer opportunities than white creators and make less money(opens in a new tab) when they do get opportunities. That makes an offer from a brand like Shein a very exciting prospect, and much harder to turn down.” And DaniDMC, who has kind of become the main character of this controversy, posted a now-deleted video where she said that, as a plus size creator, she does have fewer opportunities, this was the first company to take her on a brand trip. #Business #DaniDMC #FastFashion

In June 2023, the US House Select Committee on the Chinese Communist Party released a report about the possible risks associated with Chinese fast fashion brands like Temu and Shein.

It criticized Shein for exploiting tax loopholes in the US to avoid paying import tariffs by almost exclusively sending small parcels into the country. This isn’t really a loophole, however.

The law explicitly only charges tax on packages worth more than $800 so Shein sends smaller packages under the threshold to avoid the fee.

Its huge production volume also posed a threat to global warming as it emitted around 6.3 million tons of carbon dioxide each year as of 2023, which prompted the French government to pass a bill to suppress the growth of fast fashion in order to fight climate change the year after.

You can read more details about Shein’s many controversies and the consequences here.

Despite the many negative reports surrounding Shein, the company was still actively expanding its business in the US. It formed a joint venture with Forever 21’s parent company in 2023 to absorb new customers from each other.

Although Shein never revealed its official revenue for the 2023 fiscal year, reports believed the company generated $45 billion. It was also the second-most downloaded shopping app globally in 2023, just after its main rival, Temu, with 262 million downloads.

For a company as big and successful as Shein, going public would seem to be a natural progression. However, its poor public image has put it in unfavorable conditions for getting listed in the US and the UK.

In November 2023, it was reported that Shein filed a confidential IPO application to the Securities Exchange Commission.

Since then, politicians and policymakers have raised their objections against having the Chinese ecommerce platform go public unless Shein could provide transparent data on its operations.

Seeing that it was not quite welcome in the US, Shein began considering London as an alternative in early 2024.

However, given the volatile situation and people’s distrust in Shein, its plans to become publicly listed were not generally well-received in both the US and the UK. No IPO date had been confirmed at the time of writing.

Shein Faces a Major RICO Charge

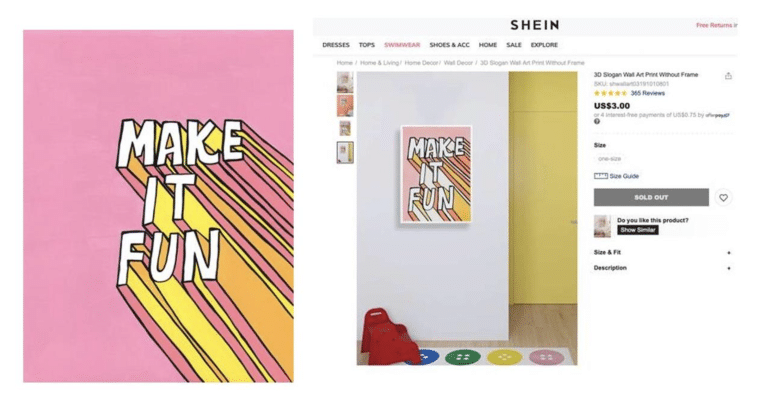

In July 2023, three artists – Krista Perry, Larissa Martinez, and Jay Baron – filed a lawsuit against Shein for RICO violations, an anti-racketeering act in the US used to take down gangs, cartels, and other criminal enterprises.

These fashion designers and artists alleged that Shein directly copied their designs on their products without consulting or compensating them, adding that the company had a history of copyright infringements in order to support its ultra-fast production to push out nearly 6,000 new fashion designs per day.

One artist, Perry, stated in the court filing that she found her “Make It Fun” design on the fashion giant’s website without her consent.

When she tried to complain to the company, she got a $500 offer to resolve this matter, which she refused.

Perry called the company’s action “incredibly disheartening, insulting and downright evil to profit off of artists without their knowledge or permission”.

The other two artists recalled similar encounters with Shein.

At the time of writing, the case hadn’t progressed through the legal system.

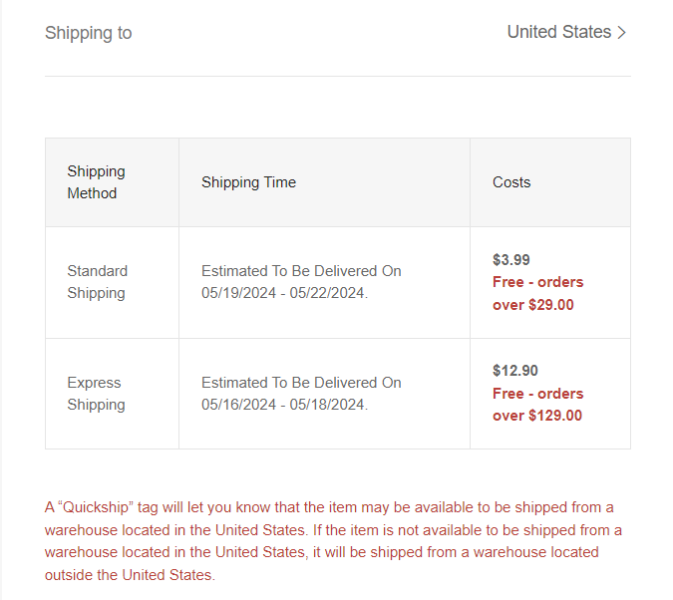

Where Does Shein Ship From?

For most international customers, parcels from Shein will be shipped from warehouses in China, where the majority of production activities happen.

The company also owns warehouses in other countries around the world to offer express shipping services to compete with retailers like Amazon.

Shein products available locally at any US warehouses will have a “Quickship” tag on them.

To speed up the delivery time, the online fashion retailer enlists chartered cargo planes to ship its products directly to consumers at low prices, skipping the need for warehouses domestically.

Shein offers free standard shipping to all purchases and free express shipping for orders over $129 or at a fee of $12.90.

History of the Shein Logo

Over the years, the Shein logo has gone through a range of changes. It has always adopted a design with a white background and black letters of the company name.

In 2011, when the website SheInside.com was launched, its logo featured a simple “Sheinside” with the “S” stylized with one thick and one thin stroke.

A year later, the “I” was capitalized to make it easier for the audience to understand how to read the company name.

Then, Shein changed its logo back to the original version after another year but made small modifications by slightly elongating the letters vertically.

After the fast fashion company changed its name to Shein officially in 2015, it reverted to the 2012 design but shortened the name to “SheIn”. In 2016, it adjusted the stylizing to include italicized letters.

A year later in 2017, the company would arrive at its present logo. The name “SHEIN” is capitalized with the “N” stylized with sharp angles. The minimalistic design is modest and iconic, leaving a deep impression on viewers at first look.

The Future of Shein

In just over a decade, Shein has managed to grow from a small drop-shipping business to one of the largest fashion brands worldwide.

Its affordable clothing items quickly gained the love of international buyers.

It even went from a small, online-only fashion brand to dominant ecommerce platform hosting pop-up stores around the world to strengthen its brand image among consumers.

However, its questionable business ethics have put the company into a number of crises in recent years. From forced labor accusations to copyright infringement, its opaque operational strategies do not align with modern, sustainable, and reputable business practices.

As a forward-thinking business owner, you need to carefully analyze customer expectations and preferences to deliver the best services.

Nowadays, consumers are seeking more than just cheap products, ethical standards and transparency are the driving forces behind a company’s growth as well, as Shein is learning to its detriment.

Shein’s history is a prime example of how ethics can adversely impact a company, stunting its growth as it struggles to list on a major stock exchange.

By learning from Shein, you can now build better expansion strategies while keeping your brand image in mind.