Software as a Service (SaaS) is a cloud-based software distribution model that allows for seamless scalability, cost-effectiveness, and constant updates without the need for on-premise installations or maintenance. Keeping up with the latest SaaS trends is the edge your business needs to remain agile and secure a competitive advantage in today’s rapidly evolving business landscape.

These trends are scattered across a range of reports and sites, making them incredibly difficult to find, collect, and analyze. That’s where our expertise at Business2Community comes in. We’ve meticulously curated a list of the top 10 SaaS trends for 2025 so that you don’t have to do the meticulous work yourself. Dive in to discover how you can leverage the power of SaaS, strategically positioning your business for success.

Key 2025 SaaS Trends

- The average company uses over 200 applications, with each department using between 40 to 60 tools.

- Over 99% of businesses use at least one SaaS tool.

- The size of the SaaS market is projected to increase from $273.55 billion in 2023 to $908.21 billion by 2030.

- 76% of SaaS businesses are either actively using or exploring AI as part of their operations.

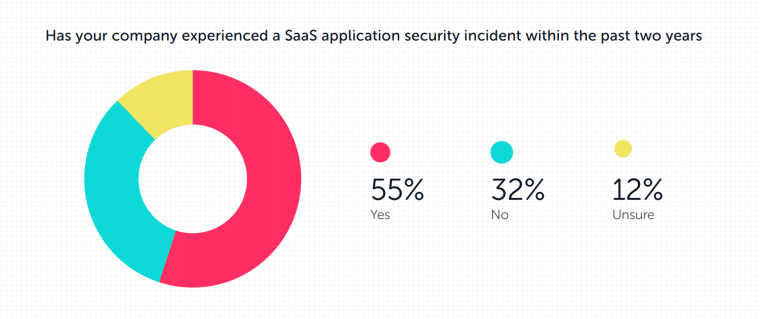

- SaaS security incidents are on the rise, with 55% of organizations experiencing an incident in the past two years.

What are 2025’s SaaS Trends?

With over 30,000 estimated SaaS companies worldwide, SaaS adoption has hit peak levels, with over 99% of businesses using at least one SaaS tool.

However, the average stack is up to 100x larger as companies now depend on hundreds of SaaS tools to streamline their operations, enhance productivity, and stay competitive.

A Harvey Nash survey found that from a list of ten technologies, SaaS was considered the most important technology in helping achieve business success by over 75% of respondents.

The benefits of SaaS include:

- Low barriers to entry: Companies can run SaaS software solutions without installing or running applications on their own computer systems.

- Flexible payment options: Instead of purchasing expensive software and hardware, businesses can pay for the solutions they need through various pricing structures.

- Scalability: SaaS allows businesses to scale with ease, selecting only the features and options they want.

- IT cost savings: SaaS providers handle all the necessary software updates while adding new or better features over time, eliminating hefty software development costs.

- Greater accessibility: Businesses can access SaaS applications from any digital device and location, boosting their productivity.

- Increased adaptability: Leveraging SaaS tools or platforms, businesses can become more agile in the face of change or unforeseen challenges.

- Improved collaboration: SaaS solutions enhance collaboration across teams and departments, contributing to overall efficiency.

Leveraging the many benefits of SaaS involves keeping up with key developments in the SaaS industry and embracing SaaS trends such as AI, low code, vertical SaaS, and more. We break down these SaaS trends for you below.

1. The SaaS Industry Faces Increased Complexity

The SaaS industry faces increased complexity, impacting SaaS providers’ marketing strategies and the availability of competitive, innovative solutions in the market.

The global SaaS market is projected to grow at a CAGR of 18.7% from $273.55 billion in 2023 to $908.21 billion in 2030. SaaS industry growth will be driven by the expansion of emerging technologies such as AI as well as the demand for cloud-based solutions that provide flexibility, scalability, and cost-effectiveness.

Spending on public cloud services is set to grow by 20.4% to $678.8 billion by 2024. Of that, $195 billion will go to SaaS spending according to Gartner, highlighting just how integral SaaS has become in today’s business landscape.

That’s not all. By 2025, Gartner has also predicted that more than 95% of new digital workloads will be deployed on cloud-native platforms, like SaaS.

While numbers remain high, SaaS market growth is the slowest it has been in years, indicating possible stabilization in the SaaS market. According to a 2023 ChartMogul report:

- The top-performing SaaS businesses with annual recurring revenue (ARR) between $1 and $30 million grew 62.1% in 2022 versus 93.4% in 2020 and 78.9% in 2021.

- Early-stage startups with ARR less than $1 million grew 139.1% in the previous 12 months. However, this is only half the pace similar-sized businesses grew in 2020 and 2021.

- Publicly listed SaaS companies experienced a slowdown. The top 10 performing public SaaS companies grew 48% in 2022 compared to 66% in 2021, while the top 25 companies grew 39% in 2022 compared to 54% in 2021.

To stimulate growth, SaaS companies are increasingly relying on expansion revenue. The proportion of ARR gained from expansion has increased from 28.8% in 2020 to 32.3% in 2022. Meanwhile, the proportion of ARR gained from new business has fallen slightly from 62.0% to 57.9%.

Retention continues to be a key driver of growth. In 2022, companies that were able to retain their customers amid a tough economic climate grew at least 1.8x faster than their peers.

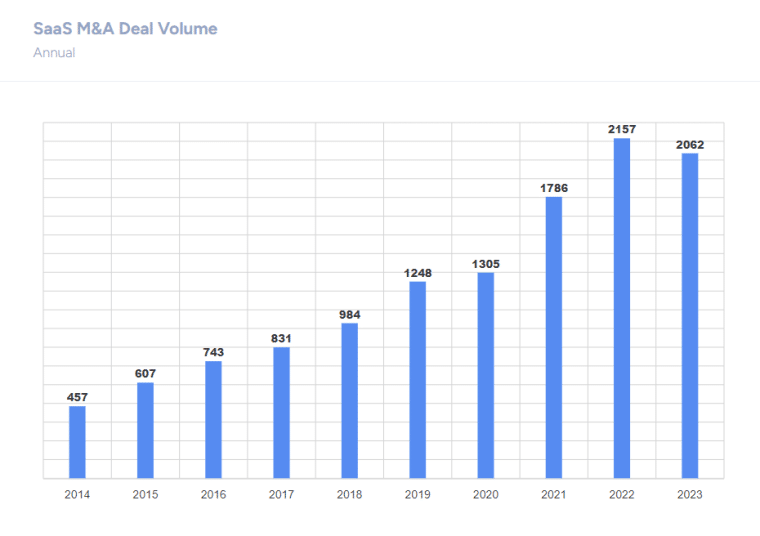

As the SaaS market grows increasingly competitive, SaaS market consolidation is on the rise. According to a Software Equity Group report, SaaS M&A activity in 2023 saw 2,062 deals, a 58% rise from the number of deals done in 2020.

2. SaaS Customer Behavior is Evolving

B2B and B2C customer expectations are changing, with a growing number of SaaS customers:

- Looking to reduce costs

- Prioritizing efficiency

- Scrutinizing offerings and consolidating providers

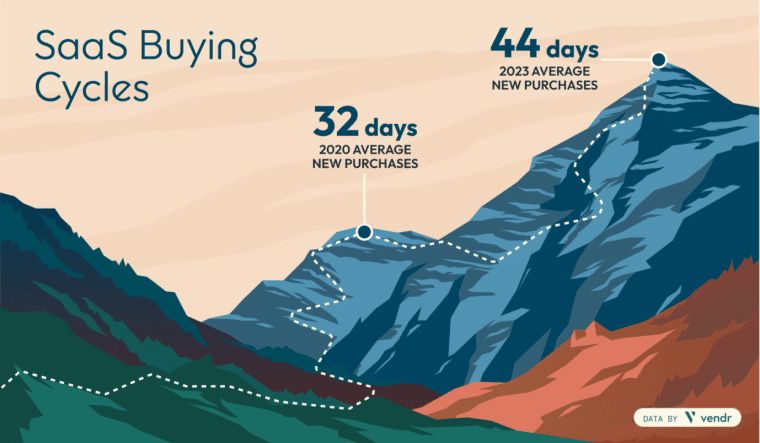

Vendr data in 2023 showed that B2B SaaS buyers are less focused on buying new SaaS software and more focused on making sure they have the best deal possible for all renewals. In 2022, 30% of all purchases were net-new, and 70% were renewals. However, that number is down 37% in 2023, with just 19% of purchases being net new.

As buyers push for better deals:

- Buying cycles, which indicate the typical time frame and stages a customer goes through from initial awareness to making a purchase, have increased by 37% for net new purchases and 8% for renewals.

- Negotiations make up 54% of the buying cycle, with deal times increasing in relation to higher ACVs.

- Renewals on average, now take 15% longer, at 51 days, than net new purchases.

- Multi-year agreements are down 14% for net new purchases and 28% for renewals, compared to 2021, as buyers were weighing their options more carefully.

This means that SaaS suppliers must continuously work to win and maintain buyer trust.

3. SaaS is Getting More Expensive

As B2B and B2C buyers look to cut costs, SaaS suppliers are investing more in customer retention and marketing strategies, driving up acquisition costs.

According to the same Vendr report, the total average yearly value of a customer’s subscription or contract with a SaaS provider or average annualized contract value (ACV), shows a 43% rebound to $89,000 between Q2 2023 and Q3 2023, however, 2023 levels remain lower than the three-year-average of around $95,000.

However, ACV remains highest – above $100k on average – in the following categories:

- Security and compliance

- IT infrastructure

- Collaboration and communication

- Marketing and advertising

In an attempt to maintain ACV levels, providers are raising their prices. Salesforce, Microsoft, and many other major SaaS suppliers have made headlines for price hikes of up to 25% in 2023. Vertice data shows that the average SaaS contract price increased in Q3 2023 by an inflation-busting 12%.

The rising costs of customer acquisition are also driving price hikes. Customer acquisition cost (CAC) is at a three-year high and has more than doubled since 2020.

Rather than 21 months to pay back costs from acquiring a customer it’s taking companies 48 months to pay back their costs from acquiring a customer.

Paddle Data shows that in 2023, churn’s revenue impact was 30%, an all-time high from 2019. Consequently, SaaS vendors are leveraging their pricing and packaging as a way to improve financial performance, with the most sophisticated providers using a value-based pricing approach.

Other pricing trends include:

- Over 94% of pricing leaders update pricing and packaging at least once per year, with almost 40% updating as often as once per quarter.

- Competitor-based pricing remains the most common pricing strategy at 38%, value-based pricing is next at 33%, cost plus pricing follows at 30%

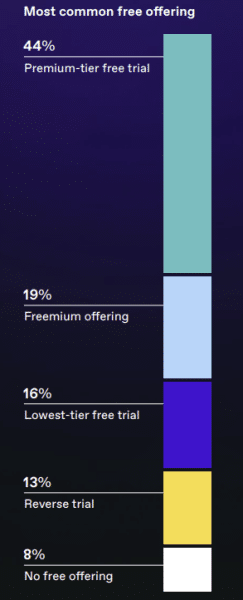

- At 44%, premium-tier free trials remain the most common acquisition tactic used by SaaS providers.

- When it comes to the number of subscription plans, B2B SaaS companies realize that customers want flexibility. As such, 34% have three plans, 27% have four, and 22% have over six plans.

4. Artificial Intelligence-Enabled SaaS is on the Rise

Artificial intelligence (AI) technologies are increasingly being integrated into SaaS products, enabling more personalized, intelligent, and automated solutions for businesses.

In a 2023 Panintelligence report:

- 76% of SaaS businesses were either actively using or exploring AI as part of their operations.

- 67% were offering AI within their products.

- Over 56% of SaaS companies were planning to progress new AI innovations into 2024.

By 2028, 75% of enterprise software engineers will use AI coding assistants, up from less than 10% in early 2023. AI-enhanced software development tools will assist SaaS developers with tasks like writing and updating code as well as application testing.

By reducing the time spent on coding, these tools will allow software engineers to prioritize higher-level tasks like designing compelling applications. Ultimately, this AI-driven approach will enhance developer productivity, enabling SaaS companies to meet the growing demand for business-critical software solutions.

Overall, the AI software market, which was valued at $72.8 billion in 2022, is projected to grow at a significant CAGR of 35.97% to reach $850.6 billion by 2030.

Machine Learning

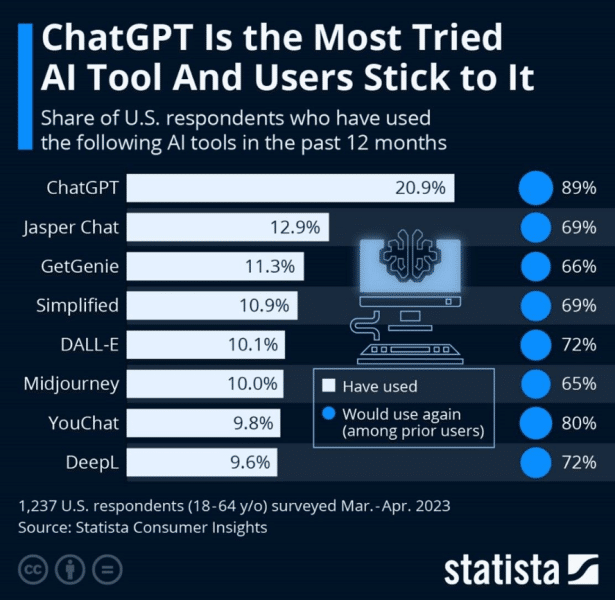

Machine learning is the most widely adopted AI technology, with 43% of SaaS companies using it to power SaaS products that can learn from data and user behavior, and improve their performance and functionality over time, noted the Panintelligence report.

According to the same Vendr we looked at earlier, the machine learning and artificial intelligence SaaS category experienced a notable 85% growth between Q2 and Q3 2023. This points to an increased focus on harnessing ML capabilities such as personalization, fraud detection, and workflow optimization.

Deep learning, a type of machine learning that trains computers to perform human-like tasks such as speech recognition, image identification, and prediction making, is also gaining traction.

15% of SaaS companies have introduced deep learning to products. With 17% of SaaS companies actively testing this form of AI, adoption could double in 2024.

Generative AI

38% of SaaS businesses have already implemented generative AI capabilities. Another 15% are in the experimental phase or planning to roll out generative AI capabilities soon.

Some of the world’s top private cloud computing companies such as:

- OpenAI

- Databricks

- Stripe

- Canva

- ServiceTitan

…and more, are already successfully incorporating generative AI into their products.

While the capital requirements to build and train AI models remain high, APIs and SaaS solutions will democratize access to AI technologies, allowing businesses to leverage sophisticated models and advanced software capabilities without the need for extensive in-house AI expertise.

By 2026, more than 80% of enterprises will have used generative AI APIs, models, and/or deployed generative AI-enabled apps in production environments, an increase from less than 5% today, according to Gartner.

Predictive Analytics

This subset of AI leverages analytics capabilities to analyze data, identify patterns, and make predictions about future trends. 15% of SaaS companies have adopted predictive analytics while 28% are testing predictive analytics to add data-driven functionality to their core products.

As businesses seek to gain a better understanding of their customers and operations, investment in analytics-driven SaaS is expected to soar. SaaS providers are incorporating centralized analytics, robust business intelligence, and data security tools into their platforms. This enables improved:

- Data collection

- Data storage

- Data analysis

- Data visualization

- Data security

As companies place greater value on organized and accessible data for efficient decision-making, innovations such as document management systems and digital asset management solutions are set to expand. Document management tools give employees access to files from a range of sources through one visually digestible and highly functional location such as an online dashboard.

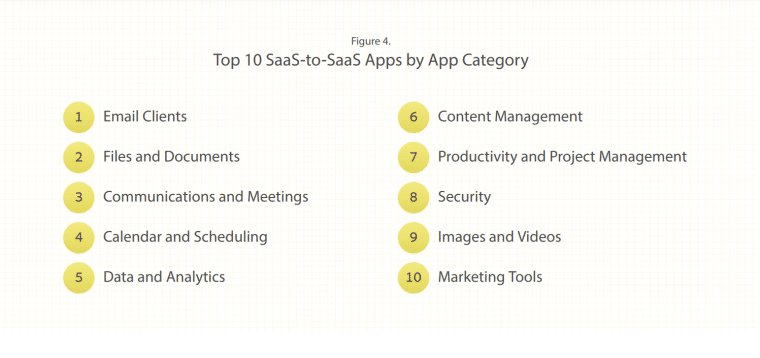

5. SaaS Integrations Continue to Grow

According to a 2023 Knit Whitepaper, 70% of the apps used by organizations are SaaS-based and this is expected to increase to 85% by 2025.

The average company uses over 200 applications with each department using between 40 to 60 tools. However, 70% of these applications remain disconnected from each other, creating costly and time-consuming data silos.

In fact:

- 70% of digital transformation projects fail due to a lack of integration quality.

- 45% of digital leaders believe poor integration is the second main barrier to the effective application of digital technology.

- Poor integrations cost businesses an average of $250,000 to $500,000.

As such, the integration of SaaS products has emerged as one of the most significant SaaS trends in 2023. By combining different SaaS solutions, businesses can create a robust ecosystem that meets their specific needs.

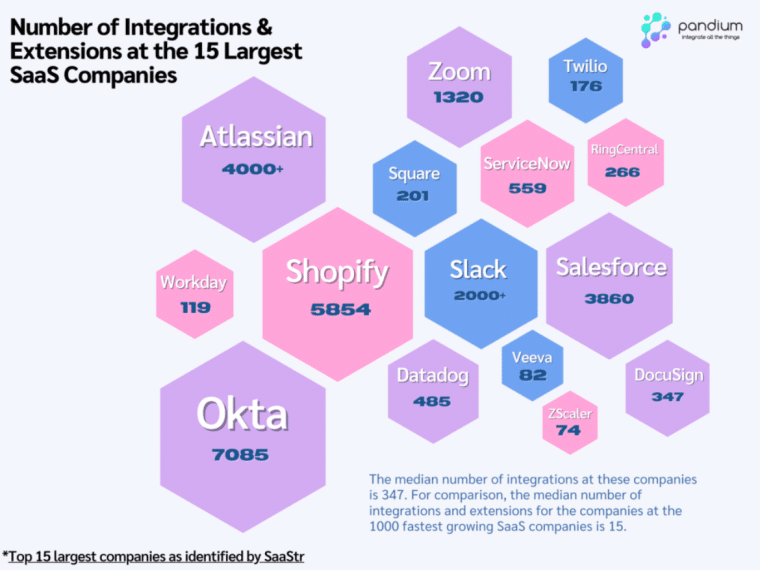

For SaaS providers, incorporating and supporting integrations can be a source of competitive advantage, such as Slack, Atlassian, and Shopify which offer over 2,000 integrations.

With the exponential increase in integrations, new technologies have emerged. Cloud-based integration platforms (iPaaS) and unified application programming interfaces (APIs) are replacing traditional integration methods like Middleware and (normal) APIs.

With pre-built connectors, rules, and maps, iPaaS allows businesses to seamlessly connect different applications. The integration platform as a service (iPaaS) market, which is poised for significant growth, will generate over $9 billion in revenue by 2025.

An API is simply a connector that facilitates interaction between data, applications, and systems. It’s what let’s you scrape data from sites.

A unified API acts as a universal translator, combining APIs from different SaaS applications into a single API for seamless integration with an existing business system. Benefits to businesses include greater efficiency and increased cost savings.

Consequently, the API management market which is worth $5.1 billion in 2023, is expected to grow at a notable CAGR of 34% to exceed $94 billion by 2032.

6. Low-code and No-code Platforms Expand

Low-code and no-code SaaS platforms are on the rise and are set to transform the SaaS landscape. For businesses, these platforms help both professionals and those with minimal coding experience create applications through a visual software development environment.

Low-code, no-code platforms allow businesses to simplify their software setup and optimize existing tools, eliminating the need for multiple software and vendor platforms. As a result, not only are businesses able to optimize their costs, but they are also able to create a flexible software setup capable of adjusting to rapid business changes.

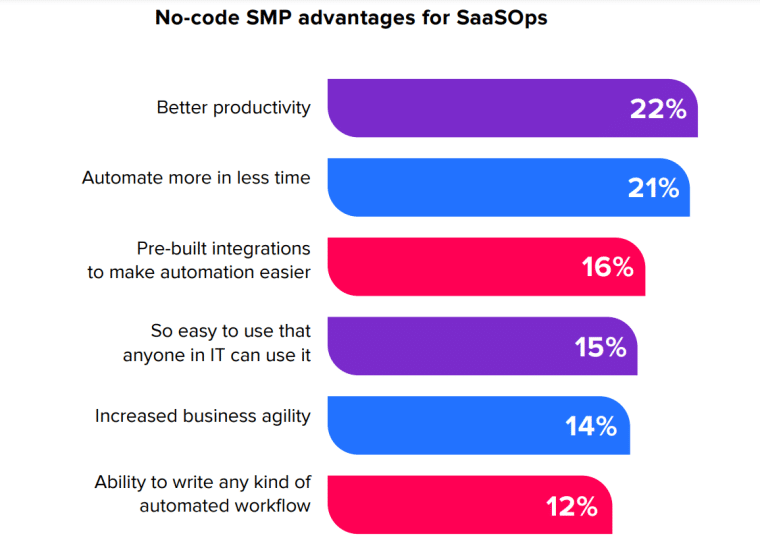

SaaSops professionals surveyed by BetterCloud in 2023 cited the following advantages of no-code SaaS management platforms:

- Better productivity – 22%

- Automate more in less time – 21%

- Pre-built integrations to make automation easier – 16%

89% of CIOs and IT pros surveyed by Microsoft in the same year said that low-code is effective in increasing efficiency, while 87% say low-code is effective in helping reduce costs.

In light of these key benefits, low-code and no-code adoption is gaining momentum, with research by Statista highlighting that:

- 58% of legacy systems are being transformed by low-code apps.

- 38% of organizations are using low code for data modeling and visualization.

- 36% of organizations are using low-code for productivity apps.

Similarly, for SaaS providers, low-code platforms facilitate major cost savings and accelerate app development, allowing for quicker releases, integrations, and updates to meet shifting market demands.

Looking ahead, Gartner reported that organizations will develop 70% of their new applications using low-code or no-code by 2025, and by 2026, non-developers will account for 80% of users of low-code, no-code tools, compared with 60% in 2021.

The global low-code platform market is projected to reach $65 billion by 2027, highlighting the widespread adoption and impact of this technology.

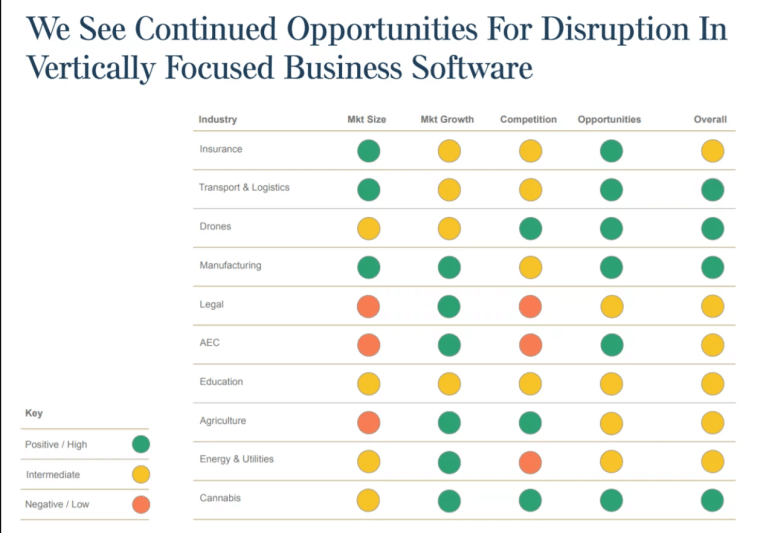

7. Vertical SaaS Takes Hold

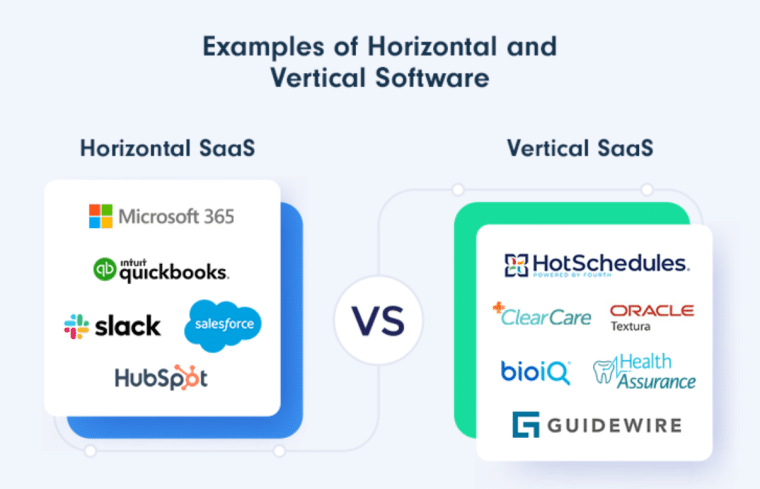

While horizontal SaaS solutions apply to a diverse range of business needs, vertical SaaS solutions address industry-specific needs. As competition in the horizontal SaaS space intensifies and the demand for more specialized, cost-effective solutions grows, vertical SaaS is taking hold.

Vertical SaaS promises to transform the SaaS landscape by solving industry-specific problems and offering businesses more customization and flexibility.

As per a 2023 Fractal Software report, the vertical SaaS industry is expanding at a considerable pace, exceeding pre-pandemic levels.

On the investment front, investors are reaping major returns. There was a 40% increase in vertical SaaS unicorns since in 2022, although only 2 more of these companies joined the ranks of unicorns in 2023.

The same report also showed that the total market cap of the Vertical SaaS Index stood at $324.6 billion as of November 2023.

While this highlights the resilience of vertical SaaS as an industry, it is not without its challenges. Due to their industry-specific focus, vertical SaaS providers face unique challenges due to:

- Having smaller market sizes to work with.

- Industry-specific complexity and regulations.

- The market dominance of legacy products.

Looking ahead, low-code, no-code micro SaaS and AI-powered vertical SaaS solutions are among the most promising vertical SaaS trends.

Just as horizontal low code, no code SaaS tools have made significant inroads, vertical SaaS solutions of this kind are set to take off. The vertical software market is expected to surpass $402.4 billion at a CAGR of 12.6% by 2032.

As the AI industry evolves into three layers, namely foundational models, AI infrastructure, and AI applications, the next significant iteration of vertical SaaS will include vertically focused AI platforms. Gartner has reported that these platforms will be built on top of models uniquely trained on industry-specific datasets.

8. Micro SaaS Solutions are Becoming Vital

In another growing vertical SaaS trend, micro SaaS companies are emerging as affordable, innovative solutions. A micro SaaS is a small-scale software as a service business run by an individual or small team.

Compared to a traditional SaaS company, a micro SaaS business is lean and offers a specialized SaaS solution to a particular market. Due to its size and focus, a micro SaaS business is able to:

- Operate with lower overhead costs.

- Respond to customer needs with agility and increased efficiency.

- Offer customers competitive pricing.

As SaaS costs and competition mount, the micro SaaS model puts businesses in a unique position to meet the growing demand for cost-effective and specialized solutions. This may also give micro SaaS businesses a competitive edge over larger, more established players in an industry.

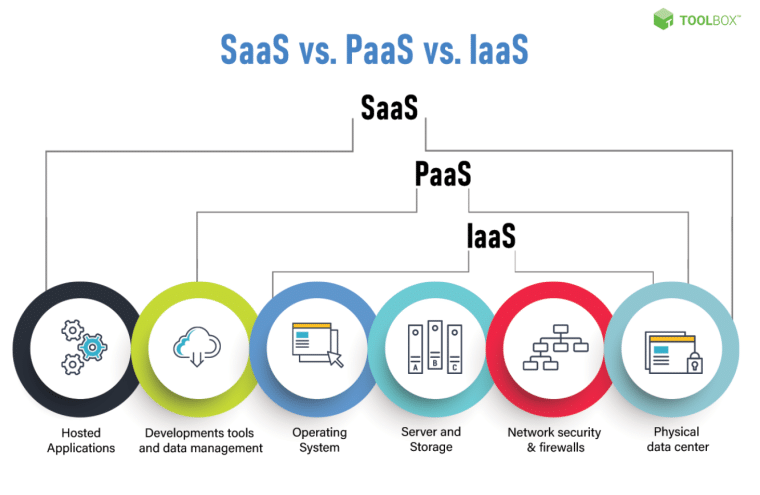

9. Businesses Shift from SaaS to PaaS

As more businesses migrate their operations to the cloud, the demand for custom applications over generic SaaS solutions is increasing and giving way to a new trend: the shift from SaaS to PaaS.

Platform-as-a-Service (PaaS) allows businesses to create, deploy, and manage their own SaaS applications, but without the hassle (and cost) of dealing with the underlying infrastructure or software.

This enables complete flexibility and customization along with:

- Rapid innovation

- Higher cost savings

- Greater ease scaling up or down

In response, the PaaS market, worth $116.9 billion in 2023, is poised to grow at a CAGR of 15% to $244.1 billion by 2028.

This trend forms part of the larger trend of businesses adopting industry cloud platforms (ICPs) that combine SaaS, PaaS, and IaaS (Infrastructure as a Service) into XaaS or comprehensive product offerings with composable capabilities.

XaaS, or Everything-as-a-Service, targets industry-relevant business objectives, driving operational efficiency and enabling a new wave of innovations. According to Gartner, the percentage of businesses using these ICPs to speed up their operations will increase from less than 15% in 2023 to over 70% by 2027.

In a 2023 EY report, the share of organizations that generated more than 80% of their revenue from XaaS is expected to jump from 3% to 19% over the next three to five years.

Similarly, the global XaaS market is expected to expand at a CAGR of 24.4%, or from $700 billion in 2023 to over $3 trillion by 2030.

10. Cost Optimization Initiatives Expand

The overall spend per company on SaaS products has increased by 50% and according to a CloudEagle report in 2023, software spend is the third-largest expense after employee costs and office leases.

As tough economic conditions and cost pressures persist, more businesses are engaging in SaaS consolidation and scrutinizing their software budgets to optimize costs.

In terms of business SaaS spending, cloud providers topped the chart for categories with the highest spend. The collective spend on AWS, Google Cloud, Microsoft, and other cloud-native solutions equaled the total spend on all other SaaS solutions.

Departments that had the highest number of unused or duplicate apps within a year of buying were marketing, sales, and customer support.

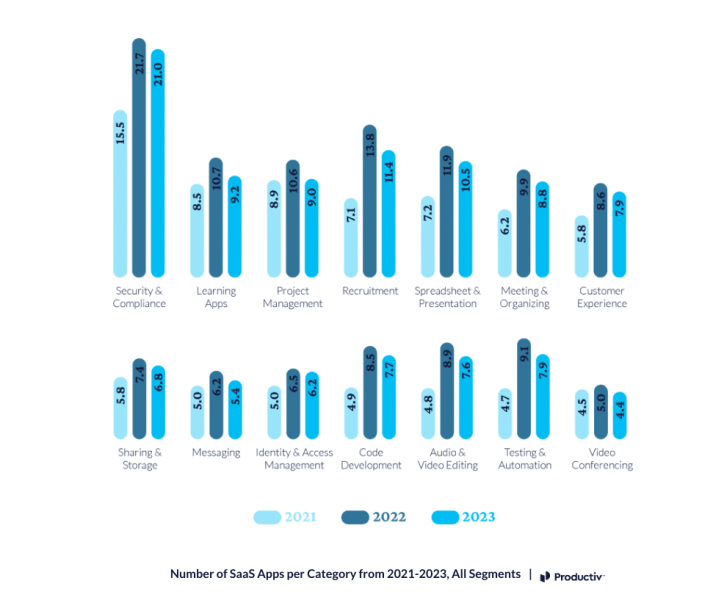

Meanwhile, research from Productiv in 2023 showed a 27% increase in app use to 87 SaaS apps per department. Productiv analyzed over 100 billion app usage data points across nearly 100 million SaaS licenses over 3 years, and found that:

- Between 2021 and 2023, the average SaaS portfolio grew 32%.

- Enterprise portfolios increased 49% from 317 apps to 473.

- Mid-market portfolios increased 41% from 238 apps to 335.

- Small and medium-sized business portfolios increased 5% from 242 apps to 253.

The SaaS applications dominating app stacks for most teams in 2023 include:

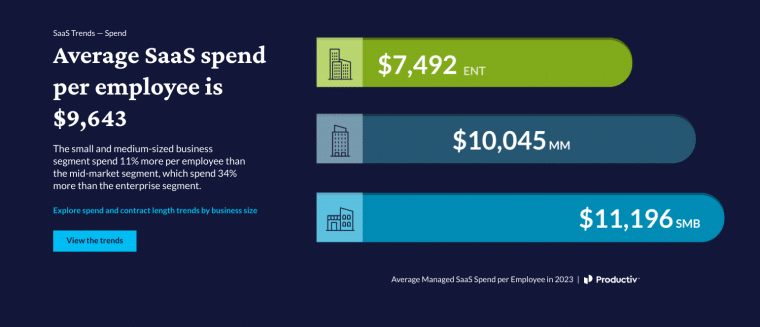

According to the same report, SaaS spending per employee averaged $9,643. SMBs spend $11,196 per employee, mid-market companies spend $10,045, and enterprises spend $7,492 per employee. The inverse relationship in spending is driven by larger volume discounting, enterprise-wide licensing agreements, and efficiencies of scale.

As organizations push to reduce overheads and settle into hybrid or remote work formats, they are:

- Choosing shorter contract term lengths. One-year contracts have increased from 79% in 2020 to 85%.

- Increasingly opting for usage-based pricing as more than 50% of licenses remain unused over a 90-day period in 2023 and the switch from subscription-based SaaS provides more flexibility in challenging and uncertain times.

- More focused on identifying and dealing with duplicate SaaS, with 11% consolidation across key categories occurring between 2022 and 2023.

Lastly, organizations are negotiating more aggressively. In certain categories, SaaS vendors are responding with more flexible pricing. A key driver of this trend is increased competition, with top SaaS providers opting to negotiate over losing out to full-stack providers.

The SaaS categories that are most open to negotiations include:

- Payroll management

- Helpdesk

- Email automation

- Collaboration

- Video conferencing

- Storage

11. SaaS Security Concerns Increase

SaaS security incidents are on the rise, with 55% of organizations reporting that they experienced an incident in the two years from 2024.

The most common SaaS security incidents reported were:

- Data leakage – 58%

- Malicious apps – 47%

- Data breaches – 41%

- SaaS ransomware – 40%

With the average organization managing around 130 SaaS apps, 59% of IT professionals surveyed by Better Cloud report that it’s becoming challenging to manage the sprawl, up from 54% last year.

The same report aggregated the biggest SaaS security concerns and found that the top 5 were:

- Insider threats, either malicious or negligent.

- Sensitive files being shared publicly.

- Unsanctioned SaaS apps that store sensitive data.

- Not knowing where sensitive data exists.

- SaaS apps with read/write access to data.

While SaaS applications are secure by design, the way they are configured and governed poses a risk. Without proper security measures, organizations are vulnerable to data breaches, cyber-attacks, and other security incidents that can result in significant financial and reputational damage.

Third-Party Threats

In a report uncovering the risks of third-party connected apps, Adaptive Shield found that 39% of apps connected to Microsoft 365 and 11% to Google Workspace have “high-risk” permission access.

The number of connected apps also increased significantly in relation to the number of employees. Organizations with 10,000 SaaS users using Microsoft 365 and Google Workspace averaged over 4,371 connected apps beyond the view of the security team.

This poses serious risks for organizations as employees are unable to discern whether a connected app is malicious or legitimate, and they also don’t understand the risks posed by the permissions that they’re granting.

Mobile Threats

Due to factors such as widespread mobile adoption and hybrid work models, mobile SaaS is gaining momentum.

While these apps can be conveniently accessed from anywhere by customers and employees, they increase the attack surface and leave organizations vulnerable to bad actors.

For example:

- Mobile users are 6-10 times more likely to fall for SMS phishing attacks compared to email-based attacks.

- About 20% of successful phishing emails come from mobile devices.

- 14% of mobile apps using cloud storage are vulnerable due to unsecured configurations.

- 80% of phishing sites now either specifically target mobile devices or are built to function on both mobile devices and desktops.

Additional cybersecurity threats associated with mobile SaaS apps include data breaches, Man-in-the-Middle (MitM) or hijacking attacks, and (D)DoS attacks.

Even with these mounting SaaS security risks, a significant number of organizations are falling short when it comes to implementing effective SaaS security measures.

In fact, 58% of organizations in an Adaptive Shield report estimated that their current SaaS security solutions only cover 50% or less of their SaaS applications.

12. SaaS Governance Increases

With the increasing adoption of SaaS applications and related security threats, the importance of implementing SaaS governance cannot be overstated.

In the BetterCloud report we referred to earlier, 57% of IT professionals had increased the number of SaaS apps that are managed and supported by IT in the past 12 months.

By establishing clear guidelines for the acquisition, deployment, and management of SaaS apps, businesses can ensure these apps are providing value and not introducing unnecessary risks.

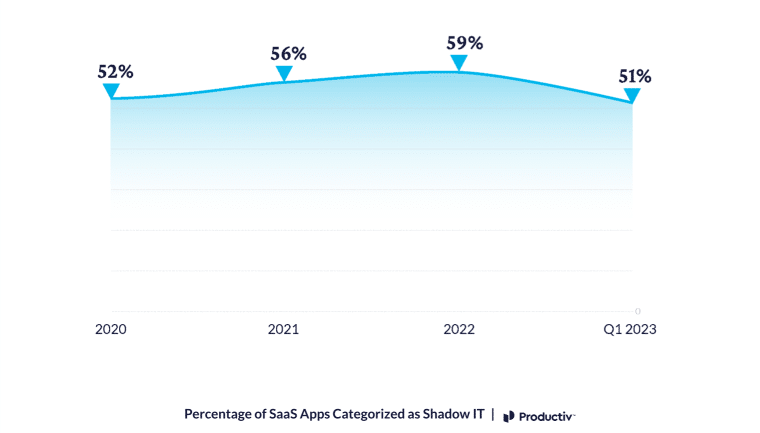

Shadow IT, which refers to the use of software, applications, or devices within an organization without the knowledge or approval of the IT department, continues to account for over 50% of applications in the average SaaS portfolio.

- Evernote appeared as shadow IT in the highest number of organizations in 2022 and 2023.

- Canva increased in prevalence each year to become the third most popular shadow IT in 2023.

- ChatGPT was rapidly being adopted by employees at many organizations.

However, for the first time in four years, shadow IT has dropped from 59% to 51%, signaling a growing trend towards increased SaaS governance.

As organizations increase SaaS governance and take action to deal with the lack of app visibility, underused licenses, poor vendor management, and other significant SaaS-related concerns, SaaS management platform (SMP) use is on the rise.

An SMP is a centralized tool that helps organizations efficiently oversee, optimize, and secure their SaaS applications.

The global SaaS management platform market is expected to grow at a significant CAGR of over 27% between 2023 and 2030.

According to Gartner, 40% of organizations using multiple SaaS applications will use SaaS SMP tools for centralized management by 2027, up from less than 25% in 2022.

13. A Greater Focus on Security

As the threat landscape evolves, businesses are increasing their investment in SaaS security. 71% of organizations have increased their investment in security tools while 68% have ramped up their investment in hiring and training staff on SaaS security noted Adaptive Shield.

According to BetterCloud’s report, SaaS security within organizations is increasingly becoming IT’s responsibility, with 81% of respondents stating that IT is now officially responsible for protecting sensitive data within SaaS apps.

Security and compliance SaaS app purchases have also increased 27% year over year. The ACV for the category has also increased by 27% between Q2 and Q3 2023.

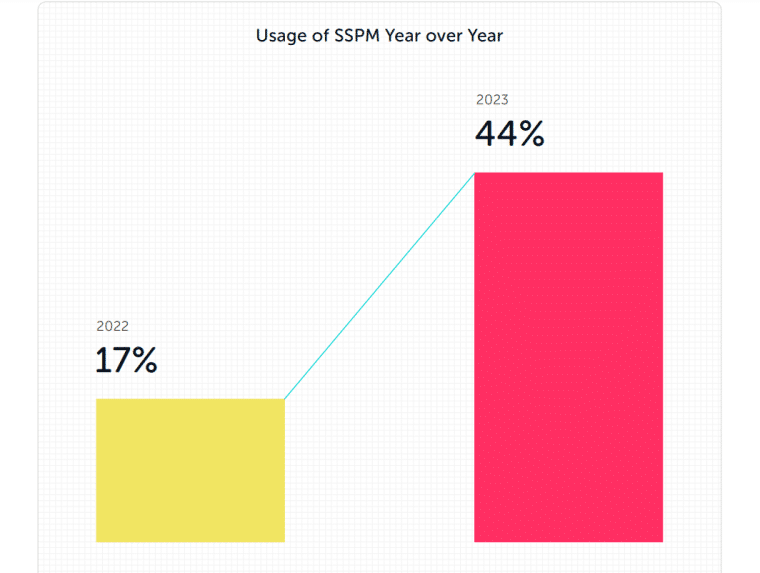

Organizations are also seeking out more advanced SaaS security solutions such as SaaS Security Posture Management (SSPM) with the adoption of SSPM tools surging to 44% in 2023 from 17% in 2022.

SSPM is an automated security tool that monitors cloud-based applications for security risks. It provides more comprehensive protection against various security risks through:

- Combating SaaS misconfigurations: Ensuring proper configuration of SaaS applications to avoid breaches.

- Identity and access governance: Managing and controlling user access to SaaS applications and resources.

- Managing third-party app access: Identifying and managing the risks associated with third-party apps accessing SaaS environments.

- Data loss management: Preventing and mitigating the loss or leakage of sensitive data in SaaS applications.

- Detecting connected malicious apps: Detecting and removing malicious apps that could compromise the security of the SaaS environment.

- Threat detection and response: Proactively identifying and responding to security threats in real time.

- Monitoring SaaS user devices: Monitoring and managing the security risks associated with user devices connecting to SaaS applications.

How to Find SaaS Trends

While we’ve extensively explored 13 key SaaS trends for 2025, it’s important to be able to keep up with the rapidly evolving industry. That’s why we’ve compiled some of the best ways to keep up with SaaS innovations and trends.

From authority sites and blogs to podcasts, newsletters, and YouTube channels, there are many well-established sources dedicated to the SaaS industry. Let’s explore a few below.

SaaS Blogs and Communities

Authority sources from across the web are a great way to stay up to date with developments in the SaaS market. These include:

- Tomasz Tunguz Blog: Tomasz is a venture capitalist at Redpoint Ventures, and is famous and well-respected in the SaaS space. His data-driven blog is considered one of the best sources of SaaS insights freely available today.

- SaaStr: SaaStr is the world’s largest community for business software. Join thousands of SaaS executives, founders, and entrepreneurs as they share, scale, and learn against the backdrop of a shining SaaS future.

- Better Cloud’s SaaSOps Movement: BetterCloud has been at the forefront of SaaSOps or how SaaS tools and apps are discovered, managed, and secured for years. Gain access to case studies, webinars, books, and other resources to help you unlock the promise of Saas for your team or business.

SaaS YouTube Channels

Keep up with the latest SaaS tools and strategies with Stewart Gauld’s YouTube channel. From reviews, tutorials, and more, this channel is built to help individuals or small businesses improve their reach and productivity by leveraging SaaS solutions.

SaaS Podcasts

For industry insights and lessons you can apply to your own business, follow and listen to podcasts like the SaaStr Podcast. This podcast covers the latest and greatest from the world of SaaS, including factors that shape SaaS trends.

The podcast also interviews the most prominent operators and investors to discover their tips, tactics, and strategies for success in the fiercely competitive world of SaaS.

The Future of SaaS

The future of SaaS is characterized by continued growth as well as greater opportunities for innovation and collaboration. The widespread adoption of cloud services will continue to drive demand, while market trends such as AI, vertical SaaS, and enhanced security measures are set to shape SaaS into a powerful catalyst for business transformation. Other trends to watch include:

Edge Computing

Edge computing, which involves processing data closer to its source, is an emerging cloud computing trend. It solves key cloud challenges such as latency, boosting performance, and efficiency. In the SaaS landscape, edge computing will bring SaaS applications closer to the data they need to process, drastically improving their performance and speed.

5G

5G has gained widespread adoption and coverage in 47 of the world’s 70 largest economies. This will power lightning-fast connectivity and lower latency, allowing SaaS applications to operate more efficiently. Additionally, 5G’s increased network capacity will support the growth of IoT and edge computing, further expanding the capabilities and reach of SaaS platforms.

Mobile-First SaaS

Mobile devices generated over 58% of global web traffic in the first quarter of 2023. With the number of mobile internet users only set to increase in the coming years, savvy SaaS businesses will take a mobile-first approach to building their products.