Rumble Inc. is an online video-sharing platform and cloud services provider popular with conspiracy theorists and far-right politicians and influencers. Headquartered in Toronto and Longboat Key, Florida, the firm was founded in 2013 by Canadian entrepreneur Chris Pavlovski.

As of November 2024, Rumble’s net worth sits at $1.74 billion.

Pavlovski claims that his site is an uncensored alternative to mainstream social media platforms, aiming to provide technologies that are “immune to cancel culture”. As such, Rumble is popular among those with more extreme opinions and the tech firm is no stranger to controversy (for obvious reasons).

At Business2Community, we’ve reviewed a range of sources to provide a comprehensive overview of factors contributing to Rumble’s net worth and financial performance. Read on to find out more about the “alt-tech” firm’s milestones, revenue history, biggest controversies, and more.

Rumble Key Company Data

Date Founded: October 2013

Founded By: Chris Pavlovski

Current CEO: Chris Pavlovski

Industries: Social media and cloud services

Rumble Net Worth: $1.74 billion

Rumble Stock Ticker: NASDAQ: RUM

Dividend Yield: 0%

What is Rumble’s Net Worth?

Rumble’s net worth, or market capitalization, was $1.74 billion as of November 2024. This is based on a Rumble Inc. stock price of $6.15.

Rumble went public on the Nasdaq under the ticker symbol RUM in September 2022. It did so through a special-purpose acquisition company (SPAC) in a deal that valued the tech firm at around $200 million. A SPAC is simply a holding company with a large sum of cash (also known as a blank-check company) that goes public with the intent to buy a private company, effectively listing that company publicly.

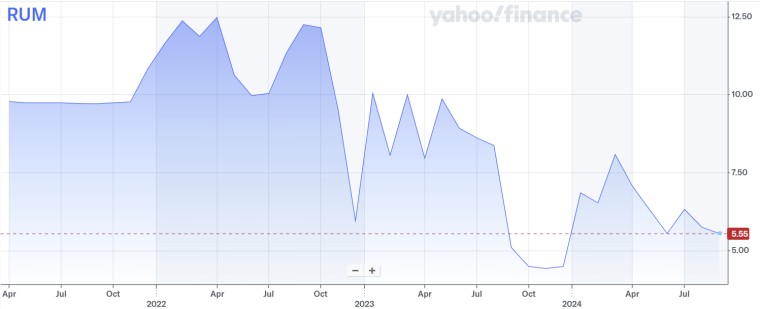

Despite a strong start following Rumble’s listing, the stock dropped dramatically in mid-to-late 2022 after the organization posted bigger-than-expected losses despite strong earnings growth. Rumble’s annual financial results are released at the end of December each year.

When Rumble went public, insiders owned a significant number of shares that they couldn’t sell for a year under what’s known as a lock-up period. Rumble’s stock dropped once again in autumn 2023 after the lock-up period expired. For Rumble, this included over 140 million shares held by Chris Pavlovski. This was somewhat unusual as his stake represented 44.6% of shares outstanding.

Rumble Revenue

Rumble’s appeal to users increased slowly following its 2013 launch. However, the COVID-19 pandemic accelerated its growth, with many conspiracy theorists and opposers to strict lockdown measures seeking somewhere to share their less-welcome views when platforms like Facebook banned them.

In just one year, Rumble’s monthly visitors increased from 1.6 million in 2020 to 31.9 million in 2021. By the end of the 2021 financial year, Rumble’s earnings had grown to almost $9.5 million compared to $4.5 million the previous year. However, gross profit decreased from $1.8 million in 2020 to a mere $1.6 million in 2021.

Since then, Rumble’s earnings have soared, reaching almost $81 million in 2023, but the organization remains unprofitable. Despite this impressive income growth, the organization posted a loss of $65 million in its 2023 full-year results. According to its balance sheet, its free cash flow reached -$110 million, and its net income was -$116.4 million.

The company’s 2023 annual report states:

Our focus in 2023 was to grow users and usage consumption and experiment with monetization levers, which may not maximize profitability in the immediate term, but which we believe positions our business for the long term.

In August 2024, Rumble reported Q2 revenue of $22 million which was ahead of analyst expectations. Losses were also better than analysts had predicted. As a result, analysts upgraded their full-year earnings estimates for investors but lowered their price targets, which hints at ongoing doubts about future performance, the business’s intrinsic value, and its ability to drive profits.

As of August 2024, based on a current stock price of $5.55 for the company’s outstanding shares, Rumble’s market cap was $1.57 billion.

The organization generates revenue through a range of streams, including:

- Advertising on websites, in videos, and through sponsorships.

- Subscriptions, Pay-Per-View, and tips given to creators by users.

Rumble shares income from advertising, subscriptions, pay-per-view, and tipping with creators.

Here’s a rundown of Rumble’s earnings since 2020:

| Year | Revenue |

| 2023 | $80.96 million |

| 2022 | $39.38 million |

| 2021 | $9.47 million |

| 2020 | $4.46 million |

Rumble Dividend History

Rumble is yet to declare a dividend for its shareholders. According to the organization’s 2024 annual report, it doesn’t have any plans to declare or pay any cash dividends in the near future. Instead, the management states that the firm plans to use its earnings in ongoing operations.

Who Owns Rumble?

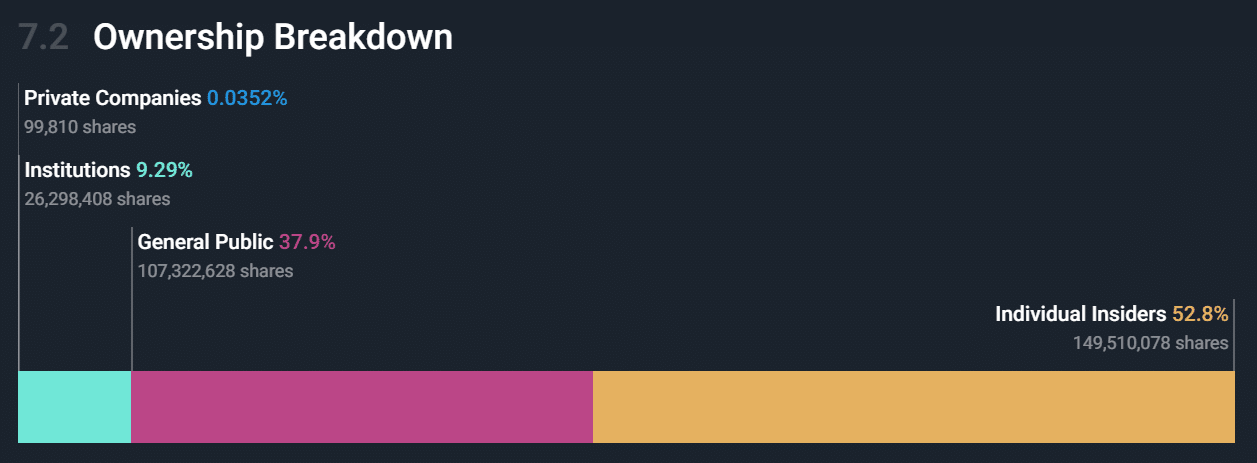

Rumble is a publicly traded company on the NASDAQ stock exchange using the ticker symbol RUM. Almost 53% of its shares outstanding are held by individual insiders, with around 38% held by the general public, and just 9% held by institutional investors.

Current CEO Chris Pavolvski founded Rumble in October 2013 in a bid to provide a YouTube alternative for independent vloggers and smaller content creators. The firm has headquarters in both Toronto and Florida. The online video-sharing platform is popular among conspiracy theorists and politically conservative Americans.

While the site got off to a slow start, by 2021 the business had grown enough to attract the attention of VC and Vice Presidential candidate JD Vance and his venture capital firm Narya Capital. The invested capital amount was undisclosed, but was reported that the investment gave Rumble a total market value of around $500 million.

Who is the Rumble CEO?

Chris Pavlovski is Rumble’s founder and CEO. He is also the organization’s largest shareholder. He founded the organization in 2013 as an alternative online video-sharing option for independent content creators who he felt were being pushed out by big tech in favor of influencers and corporations on YouTube and other sites.

Despite Rumble’s success, Pavlovski continues to campaign against tech giants, such as Google. In 2024, he filed a second lawsuit against Google for what he claims are monopolistic practices.

Rumble’s Company History

Rumble is an online video platform and internet services provider with headquarters in both Toronto and Longboat Key, Florida. Rumble was founded in 2013 by Canadian entrepreneur Chris Pavlovski and is popular among conservative and far-right Americans.

The organization is split across two segments:

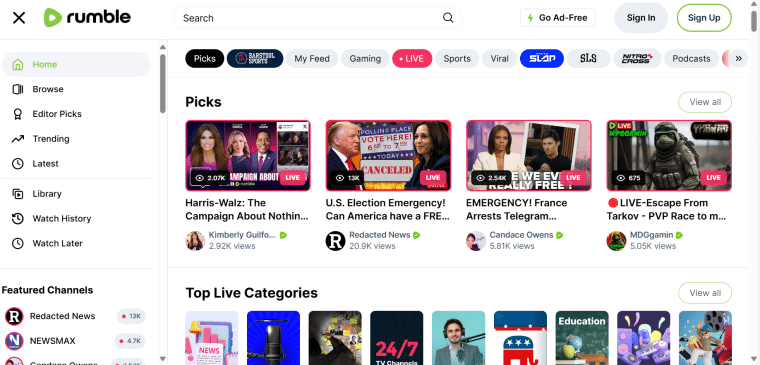

- Rumble Services, which includes its video-sharing platform, a livestreaming and monetization service for creators enabled by Rumble Studio, and the Rumble Advertising Center, an advertising marketplace and network.

- Rumble Cloud, an infrastructure-as-a-service offer. Rumble Cloud services are host to Truth Social, the controversial social network owned by Trump Media and Technology Group.

A 2022 Pew Research study found that 76% of people who said they regularly sought news content on Rumble identified as Republicans or leaned toward the Republican Party, while 22% identified as Democrats.

Rumble has been labeled as “alt-tech”, a term used to refer to online services and social media sites that are used by conspiracy theorists and the far right.

Here’s a rundown of the video-sharing site’s rise to prominence:

2013-2020: A Slow Start For the Alternative Video Sharing Platform

Chris Pavlovski founded Rumble in 2013 as an alternative to YouTube and other video-sharing sites. He saw an opportunity to increase the reach of independent content creators who he felt were being overlooked in favor of influencers and big corporations on other platforms.

The tech company’s website states:

We are for people with something to say and something to share, who believe in authentic expression and want to control the value of their own creations. We create technologies that are immune to cancel culture.

While the site’s users increased slowly for several years, it wasn’t until 2020’s US election campaign and the onset of the COVID-19 pandemic that Rumble’s audience really began to grow. Between 2020 and 2021, the site’s monthly visitors increased from 1.6 million to 31.9 million. By the end of the 2021 financial year, Rumble’s revenue had grown to almost $9.5 million.

Much of this success has been attributed to Devin Nunes, a Republican who claimed YouTube was censoring his content. As a result, he began to share content on Rumble, closely followed by several other conservative political influencers and content creators such as Dan Bongino, Russell Brand, and Kim Iversen.

2021-2024: Rumble Rallies to Take on The Tech Giants

In May 2021, Rumble Inc. received undisclosed funding from Narya Capital, JD Vance’s Cincinnati-based venture capital firm, and Peter Thiel, an influential billionaire who is well-known for founding Palantir and investing in upcoming tech companies such as PayPal and Facebook. While the figure invested remains unknown, it was widely reported that the investment valued the company at around $500 million.

Donald Trump joined Rumble in June 2021 in the run-up to his first campaign rally after the Capitol riots in January that year. Following the riots, Trump had been banned from mainstream social media sites such as Twitter, Facebook, and YouTube over fears his words may incite further violence.

Later that same year, Rumble acquired Locals, a Florida-based content site that enables video creators to create OTT feeds and make money from subscriptions. The value of the deal is undisclosed.

“We are building the rails to a new tech ecosystem that will free everyone from the restraints of editorial control. Locals will provide our Rumble users a new way to generate revenue, one that is not influenced by corporate advertisers and special interests”, said Chris Pavlovski, Rumble CEO.

At the end of 2021, Trump Media and Technology Group announced that it had partnered with Rumble as a cloud services provider to host its Twitter alternative, Truth Social. Rumble also challenged a New York law in 2021 that banned hate speech on social media.

Moving into 2022, a Rumble advertising center was announced, known as Rumble Ads, and Truth Social was confirmed as its first publisher. As of August 2022, Rumble claimed it had increased traffic up to 78 million monthly active users.

Rumble merged with a special-purpose acquisition company to go public in September 2022, trading on the NASDAQ under the ticker symbol RUM. The company opened its first day at $12.04 per share, climbing to $16.81 by the time the markets closed.

In 2023, Rumble announced the acquisition of Callin, a San Francisco-based podcasting and live-streaming platform for an undisclosed amount. Later that year, Rumble became the exclusive online live-streaming platform for the Republican presidential debates. Interestingly, Google seemingly suppressed the Rumble stream after suggesting to Rumble that it would promote it in search results.

By the end of 2023, Rumble’s user base had grown from 21 million active users in 2020 to 67 million.

In 2024, the US Securities and Exchange Commission revealed that it had launched an investigation into Rumble but declined to confirm on what grounds. It’s thought that the investigation was linked to overstated user metrics but was closed in the same year.

Rumble Controversies

Rumble has faced several controversies since its rise to prominence. With a user base that often felt censored or marginalized by mainstream platforms, a major criticism of the firm relates to its highly relaxed content moderation policies. Many claim that this leniency has enabled the spread of misinformation and fake news, particularly in relation to the COVID-19 pandemic and the 2020 US presidential election.

The site is also home to various conspiracy theories and industry critics argue that Rumble’s approach has led to an environment where dangerous content can thrive, influencing public opinion and undermining the public’s trust in reliable sources of information and news.

Another area of criticism is around Rumble’s partnerships and investors. The firm has reportedly received financial backing from a number of figures, such as JD Vance, who are linked to conservative and far-right ideologies, raising concerns about its ability to remain politically neutral.

Some argue that Rumble is a haven for alt-right content creators and extremists who have been banned from mainstream content-sharing sites. In 2022, for example, Rumble offered Joe Rogan, who had been accused of using racial slurs and spreading misinformation about the COVID-19 vaccine, $100 million to bring his podcast onto the platform. Russell Brand, who has been investigated for sexual abuse allegations in the UK, also uses Rumble as his platform.

What Can We Learn From Rumble?

Rumble’s journey over the last decade offers valuable insights into navigating the complex digital media industry. On the one hand, Rumble successfully identified and catered to a market seeking alternative options for content sharing, demonstrating the importance of understanding market opportunities and how to meet customer demands. Its aggressive marketing strategies and high-profile partnerships helped to accelerate user growth and increase visibility in what remains a highly competitive space.

However, Rumble’s experience also highlights several pitfalls. The platform’s lenient content moderation policies, while promoting free speech, have led to the spread of misinformation and attracted criticism. Its story highlights the need for balanced and responsible corporate oversight. By relying on investment from one side of the political landscape, Rumble has also raised questions about neutrality, suggesting that diverse and transparent funding sources are crucial.

Overall, Rumble teaches us that while rapid expansion and market differentiation are important, maintaining ethical standards and inclusive practices may also be essential for long-term success and credibility.