With a legacy spanning nearly five decades, Oracle Corporation is a global leader in enterprise software, consulting, and cloud services.

As of November 2024, Oracle’s net worth is $532.85 billion.

Our experts have examined a wide range of sources to provide you with a comprehensive overview of Oracle’s net worth and its evolution from a small database company to a tech giant. Read on to explore the company’s key milestones, strategic acquisitions, and controversies, and gain insight into what makes Oracle a powerhouse in the tech industry.

Oracle Key Company Data

Oracle Net Worth: $532.85 billion

Date Founded: June 1977

Founded By: Larry Ellison, Bob Miner, Ed Oates

Current CEO: Safra Catz

Industries: Technology

Oracle Stock Ticker: NYSE: ORCL

Dividend Yield: 0.86%

What is Oracle’s Net Worth?

As of November 2024, Oracle’s net worth, also known as market capitalization, is $532.85 billion.

The Oracle Corporation went public on the NASDAQ in 1986. On July 15, 2013, the company moved to the New York Stock Exchange where it trades under the ticker symbol ORCL. In the company’s initial public offering (IPO), its shares were priced at $15 each. Oracle Corporation typically releases its annual financial results in June, following the end of its fiscal year on May 31.

Following the IPO, Oracle’s growth was rapid. By 1987, it had become the fastest-growing software company in the world. Over the years, Oracle’s share price has grown substantially, driven by its leadership in database technology and strategic acquisitions.

In the early 2000s, Oracle’s stock price soared, rising to $46 a share in summer 2000 compared to just $10 a year earlier. This was put down to Oracle’s strategic move away from desktop software, a move that saw it steal a march on competitors such as Azure. This enabled it to capitalize on the growth of the internet and take its market cap to over $200 billion.

However, a temporary slump in the price of technology companies’ stock in 2002 saw Oracle’s market cap and stock price tumble. The slump didn’t last long and Oracle’s net worth steadily increased over the following two decades, driven by solid financial results.

Oracle’s stock price surpassed $100 a share in early 2023 and has been on a sharp upward trajectory ever since. As of November 2024, Oracle’s stock is valued at $192.29 per share compared to around $85 in 2022.

The dramatic increase in the company’s market capitalization has been driven by strong financial results as well as its significant progress in expanding its cloud infrastructure and Software-as-a-Service (SaaS) offer. In the first quarter of 2024, Oracle Corporation reported that its cloud services revenue had increased by 30%, with a focus on AI-driven applications and databases, which boosted investor confidence.

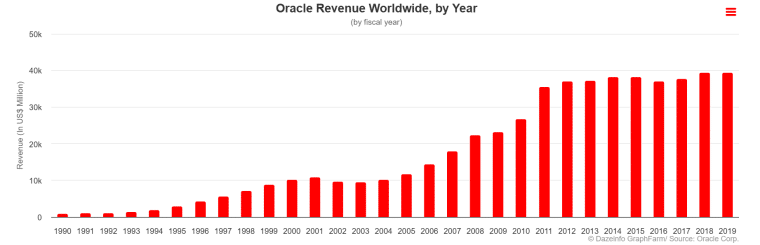

Oracle Revenue

In the 1990s, Oracle became one of the leading software companies, surpassing $1 billion in annual revenue by 1991. Throughout the 2000s, Oracle Corporation expanded and made several strategic acquisitions, which helped it push its revenue above $15 billion by 2007. Some of Oracle’s key acquisitions in this period included:

- PeopleSoft for $10 billion in 2005

- Siebel Sytems for $5.85 billion in 2005

- BAE Systems for $8.5 billion in 2008

- Sun Microsystems for $7.4 billion in 2009

By the 2010 fiscal year, Oracle’s annual revenue had exceeded $25 billion, driven by its dominance in the database industry. The company consistently posted profits during this period, with $6 million in profit in 2010.

A major revenue shift occurred in the 2010s as Oracle began focusing on cloud services in response to growing market demand and to compete with established players like Amazon Web Services (AWS). Despite originally downplaying the cloud, Larry Ellison seemed to recognize its potential for future growth.

Oracle acquired several cloud-focused companies to strengthen its portfolio, including:

While Oracle’s traditional software licensing business faced growing pressure in the period, cloud services grew rapidly. Oracle crossed the $40 billion revenue mark in the 2021 fiscal year, reflecting its successful shift into cloud computing.

Oracle’s landmark acquisition of Cerner Corporation in 2022 has also contributed to its recent growth. The deal was valued at $28.3 billion, making it Oracle’s largest acquisition to date. Cerner is a leading provider of healthcare information technology solutions and the acquisition marked Oracle’s major entry into the healthcare sector.

In the 12 months ending 31 May 2024, Oracle reported total revenues of almost $53 billion, with net income over $10 billion. Here’s a breakdown of Oracle’s annual revenue over the past decade:

| Fiscal Year | Revenue ($ billions) | Net Income ($ billions) |

| 2015 | 38.226 | 9.938 |

| 2016 | 37.047 | 8.901 |

| 2017 | 37.728 | 9.335 |

| 2018 | 39.831 | 3.825 |

| 2019 | 39.506 | 11.083 |

| 2020 | 39.068 | 10.135 |

| 2021 | 40.479 | 13.736 |

| 2022 | 42.440 | 6.717 |

| 2023 | 49.954 | 8.503 |

| 2024 | 52.961 | 10.467 |

Oracle Dividend History

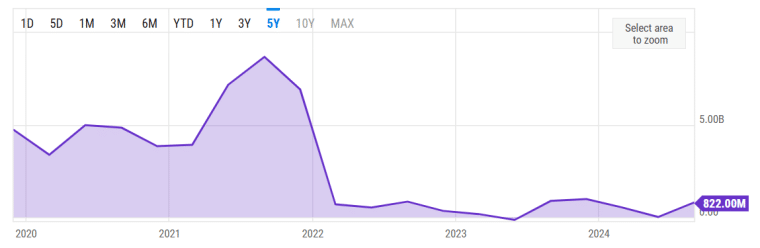

Oracle has had a consistent history of paying dividends, typically paying quarterly dividends which have steadily increased over time. The company has also conducted several stock splits, the most recent being a 2-for-1 split in 2000. However, despite its significant growth in share price, Oracle hasn’t had any stock splits since then.

Oracle has engaged in many stock buyback programs, using its cash reserves to repurchase shares and return value to shareholders. Over the years, Oracle has spent billions on buybacks, reducing the number of outstanding shares, which has helped boost earnings per share. The company completed its most recent buyback of 822 million shares in August 2024.

| Date | Stock Price ($) | Dividend Payout ($) | Yield (%) |

| 01/08/2020 | 50.35 | 0.89 | 1.76 |

| 04/08/2020 | 48.72 | 0.89 | 1.83 |

| 07/14/2020 | 53.68 | 0.89 | 1.67 |

| 10/07/2020 | 57.09 | 0.89 | 1.57 |

| 01/06/2021 | 59.18 | 0.90 | 1.53 |

| 04/07/2021 | 70.36 | 0.98 | 1.40 |

| 07/14/2021 | 84.16 | 1.06 | 1.26 |

| 10/08/2021 | 90.29 | 1.14 | 1.26 |

| 01/06/2022 | 82.89 | 1.22 | 1.47 |

| 04/07/2022 | 78.59 | 1.23 | 1.56 |

| 07/11/2022 | 69.29 | 1.23 | 1.78 |

| 10/11/2022 | 60.73 | 1.24 | 2.04 |

| 01/09/2023 | 84.41 | 1.24 | 1.47 |

| 04/10/2023 | 91.97 | 1.33 | 1.44 |

| 07/11/2023 | 113.08 | 1.41 | 1.25 |

| 10/11/2023 | 108.32 | 1.49 | 1.38 |

| 01/10/2024 | 103.06 | 1.58 | 1.53 |

| 04/09/2024 | 122.61 | 1.58 | 1.29 |

| 07/11/2024 | 142.22 | 1.59 | 1.12 |

| 10/10/2024 | 175.41 | 1.59 | 0.91 |

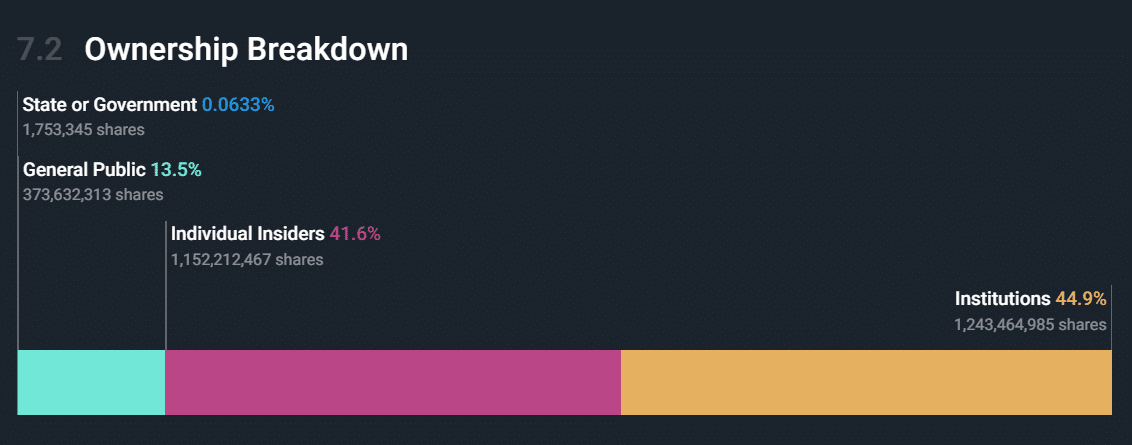

Who Owns Oracle?

Oracle is a publicly traded company, listed on the New York Stock Exchange. However, founder Larry Ellison still owns around a 40% stake in his company. A further 45% is owned by institutional investors such as The Vanguard Group (5.6%), BlackRock (4.64%), and State Street (2.54%).

Oracle was founded in 1977 by Larry Ellison, Bob Miner, and Ed Oates under the name Software Development Laboratories (SDL). Oracle’s early funding came primarily from Larry Ellison’s savings and revenues from the company’s early contracts including building a database for the CIA, codenamed Oracle.

The company also secured venture capital funding, including investments from Sequoia Capital. By 1986, Oracle had grown substantially, leading to its IPO.

Who is the Oracle CEO?

Oracle’s CEO, Safra Catz, has been a key figure in the company’s leadership since she joined in 1999. She was appointed co-CEO alongside Mark Hurd in 2014 after Larry Ellison stepped down to take on the role of executive chairman and chief technology officer (CTO).

After Hurd passed away in 2019, Catz became the sole CEO. Under her leadership, Oracle has continued its cloud transition and maintained strong profitability. Catz is one of the highest-paid executives in the tech industry.

Before Catz, co-founder and former CEO, Larry Ellison was known for his bold personality and controversial decision-making. Under his leadership, Oracle faced criticism for aggressive sales tactics and licensing audits. Ellison’s larger-than-life persona often made the headlines, but his vision was instrumental in building Oracle into a global powerhouse.

| CEO | Tenure |

| Larry Ellison | 1977-2014 |

| Safra Catz and Mark Hurd | 2014-2019 |

| Safra Catz | 2019-Present |

Oracle’s Company History

Known for its powerful database solutions and aggressive acquisition strategy, Oracle is a major player in cloud services, serving businesses worldwide. Here’s a walk-through of Oracle’s rise to the top:

1977-2000: Becoming the World’s Largest Database Management Company

Oracle Corporation was founded in 1977 by Larry Ellison, Bob Miner, and Ed Oates. The company’s first major contract was to build a database for the CIA. The project was codenamed Oracle, which would later become the company’s name.

Based on IBM’s research into relational databases and its invention of structured query language (SQL), Ellison and Miner began to create their own program to deliver a similar result for clients. In 1978, they launched the world’s first relational database using SQL, the Oracle RDBMS (relational database management system). A year later, Oracle began to sell the system to organizations, beating IBM to the table.

In 1986, Oracle went public on the NASDAQ stock exchange. By the late 1980s, Oracle was the world’s largest database management company, with annual revenues reaching $100 million. In 1989, Oracle headquarters relocated from Belmont, California to a new office complex on the San Francisco Peninsula in the Redwood Shores area of Redwood City.

Oracle’s rapid growth also led to challenges, including an earnings restatement in 1990. Oracle had initially posted record annual sales of $970.8 million and profits of $117.4 million. However, the company’s stock price fell after an internal audit forced it to restate earnings for three of the four quarters. Oracle was forced to take $250 million in credit from a bank syndicate before reporting a quarterly loss of nearly $36 million – its first-ever loss.

Led by the charismatic Larry Ellison, Oracle fought back by continuing to expand its range of products and streamlining its operations. The company diversified its offer to include enterprise resource planning (ERP) and customer relationship management (CRM) software. Despite its challenges, in the 1991 fiscal year Oracle reached $1 billion in annual revenue.

By 1992, Oracle’s finances were in better shape and the company reported significant revenue growth, surpassing $2 billion in 1994. Much of the growth was driven by the release of Oracle 7, a groundbreaking upgrade of its database management system that cemented Oracle’s dominance throughout the 1990s.

As Oracle prepared to release Oracle 8, in 1995 it unveiled its WebSystem software which would enable it to take advantage of the rise of the internet. WebSystem was designed to allow users to manage their data over the internet.

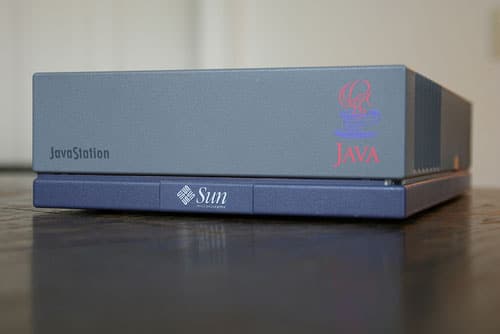

With revenue exceeding $4 billion, in 1996 Oracle announced details of the launch of its Network Computer hardware product. The Network Computer was a direct challenge to the dominance of traditional personal computers (PCs), offering a simplified device that relied on a network connection for its software and processing power.

The much-anticipated Oracle 8 was launched in 1997. By this point, Oracle was reporting annual sales of $5.7 billion and boasted a 30% annual growth rate. However, Oracle’s PC manufacturing rivals reacted quickly to the announcement of the Network Computer, putting Oracle’s plans at risk.

2000-2024: Acquisition-Driven Growth and a Shift to the Cloud

The early 2000s marked a period of aggressive acquisitions, with Oracle focusing on consolidating the software market:

- Oracle acquired PeopleSoft for $10 billion in 2005, entering the human capital management sector.

- The purchase of Siebel Systems in 2006 for $5.85 billion solidified Oracle’s leadership in CRM software.

- Oracle’s acquisition of Sun Microsystems in 2010 for $7.4 billion brought the popular Java programming language and the Solaris operating system into its portfolio. Sun also sells hardware products such as servers and mainframes.

These acquisitions boosted Oracle’s revenue to $26 billion by 2010 and strengthened its position against its competitors.

Oracle also shifted its focus to cloud computing in the 2010s, recognizing the need to compete with AWS and Microsoft Azure. In 2012, Oracle Cloud was released, providing servers, storage, network, applications, and services through a global network of data centers.

Acquisitions such as RightNow Technologies for $1.5 billion in 2011 and NetSuite for $9.3 billion in 2016 gave Oracle access to an expanded SaaS portfolio, enabling it to target the enterprise cloud community.

Oracle moved from the NASDAQ to the New York Stock Exchange in July 2013. The decision to switch exchanges was a strategic one, allowing Oracle to align itself with other major tech companies that had also moved to the NYSE.

By the end of the decade, cloud services accounted for a significant portion of Oracle’s $39.5 billion in annual revenue. However, the company faced criticism for lagging behind AWS and Azure in its cloud innovation.

In recent years, Oracle has significantly increased its cloud investment, with cloud services becoming one of the company’s fastest-growing segments. In 2022, Oracle acquired Cerner, a major healthcare IT provider, for $28.3 billion. This acquisition, the biggest in Oracle’s history, demonstrated the company’s commitment to using cloud solutions for industry-specific applications.

Oracle’s cloud division saw 30% growth by 2024, driven by its growing customer base and expanding cloud infrastructure footprint. Although Oracle remains behind the leaders AWS and Azure in terms of market share, it has found its niche by targeting enterprise customers with specific needs, especially in database management, healthcare, and ERP systems.

Oracle Layoffs

Oracle has faced several rounds of layoffs over the years, often tied to strategic shifts in its business. During its transition to cloud computing in the 2010s, Oracle cut jobs in its traditional hardware and on-site software divisions as the company began to focus more heavily on cloud-based services.

In 2022, Oracle announced layoffs in the US and Canada in its customer experience and marketing divisions. The announcement came in the context of Oracle’s acquisition of Cerner and was part of broader cost-cutting efforts aiming to streamline operations and, again, focus on cloud growth.

In 2023, more layoffs followed, reportedly impacting thousands of employees across multiple departments, including sales and engineering. These layoffs were seen as part of Oracle’s ongoing efforts to reduce costs, improve efficiency, and reallocate resources.

Oracle Controversies

Despite its success, Oracle has been the center of several high-profile controversies, including:

Legal Disputes with the US Government

In 2011, Oracle paid $199.5 million to settle a lawsuit with the US government, which accused Oracle of overcharging for software under a General Services Administration contract. The lawsuit alleged that Oracle gave better discounts to commercial customers while charging the government higher prices, violating federal procurement rules.

The settlement was one of the largest in a False Claims Act case at the time and cast a shadow over Oracle’s government contracting practices.

Java and Google Lawsuit

After Oracle acquired Sun Microsystems in 2010, it sued Google for copyright infringement, claiming that Google used Java code in its platform without proper licensing. The case went through several courts, and in 2021, the US Supreme Court ruled in favor of Google, deciding that its use of Java APIs was protected under fair use. The case highlighted legal complexities in software development and intellectual property rights.

Aggressive Software Licensing and Audits

Oracle has long been criticized for its aggressive software licensing audits and enforcement. Many customers have complained about surprise audits and hefty fines, with Oracle accused of using these tactics to generate revenue. This has damaged Oracle’s relationships with some customers, with companies opting for competitors that offer more flexible licensing arrangements.

Oracle and SAP Rivalry

SAP and Oracle have had ongoing tensions, primarily due to competition in their key sectors. The rivalry escalated in 2007, with Oracle launching a lawsuit against SAP. The case alleged that TomorrowNow employees used the accounts of former Oracle clients to download patches and PDF documents from its support site. In 2007, SAP admitted that TomorrowNow employees had downloaded documents from the site.

Data Tracking Allegations

In September 2024, Oracle settled a $115 million lawsuit with the US Securities and Exchange Commission (SEC) based on allegations that it tracked consumer activity. The investigation focused on whether the company had violated regulations by failing to disclose the extent of its data tracking and if customers had been sufficiently informed about how their data was being used.

What Can We Learn From Oracle?

Oracle’s growth story offers valuable lessons in adaptation and innovation. The company successfully pivoted from its roots in database software to become a dominant force in cloud computing through acquisitions and a focus on scalable solutions.

Oracle’s focus on long-term customer relationships and its ability to evolve with market trends – such as the rise of cloud services – demonstrates the importance of agility in a fast-changing tech landscape. Oracle’s persistence and resilience after early controversies and its ability to tap into new markets highlight the value of bold decision-making and maintaining a clear vision for future growth.