LinkedIn, which began as a professional social network 20 years ago, has grown into a diverse business that earns money from different sources like membership fees, ads, sales, and hiring solutions. With over 1 billion users in 200 countries, LinkedIn is clearly the largest and most valuable professional network worldwide.

From its history, users, and more, there’s a lot to explore, which is why we’ve compiled over 90 LinkedIn statistics and insights. In this report, we cover everything you need to know about LinkedIn.

So, keep reading to discover what makes this professional networking and recruitment giant tick in 2024.

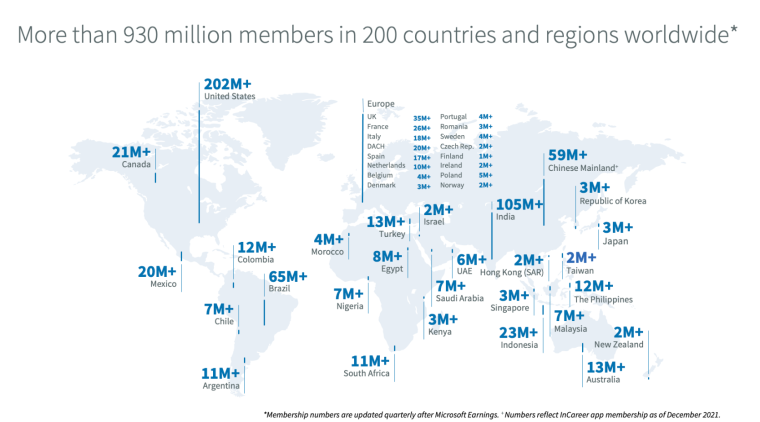

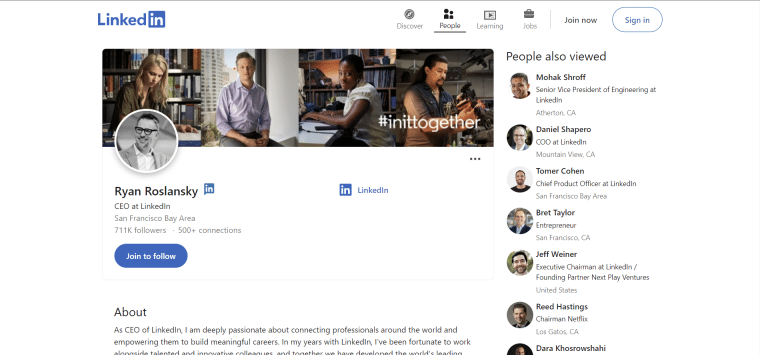

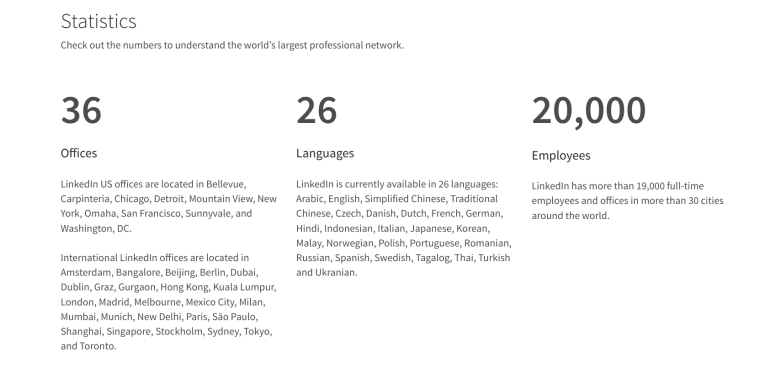

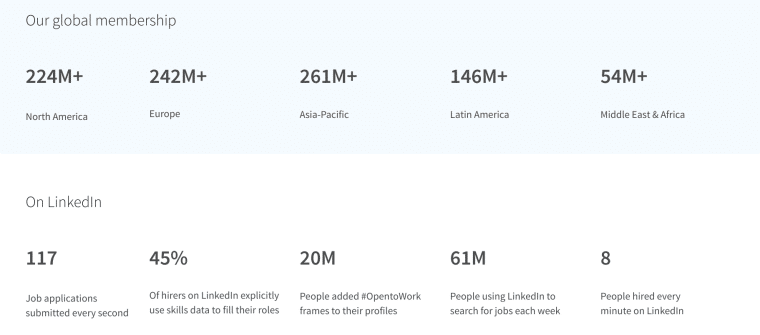

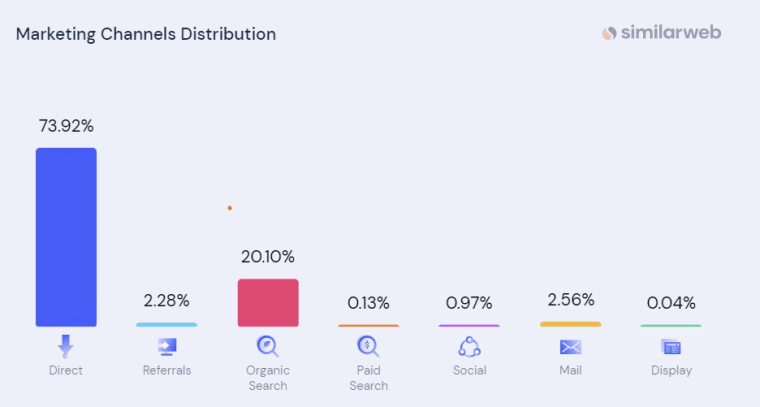

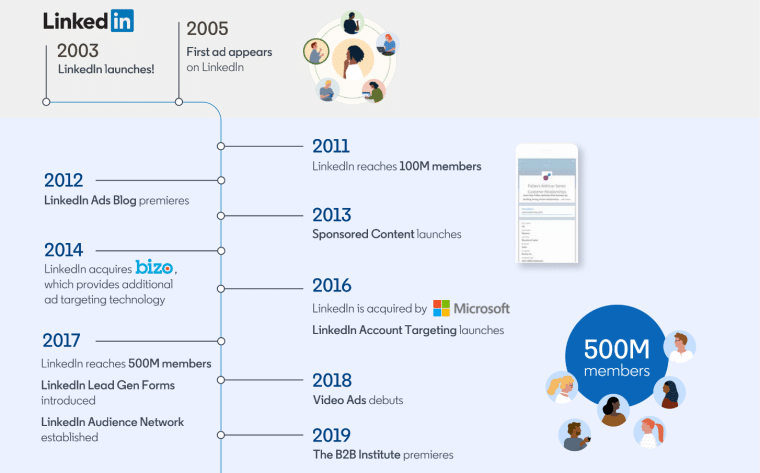

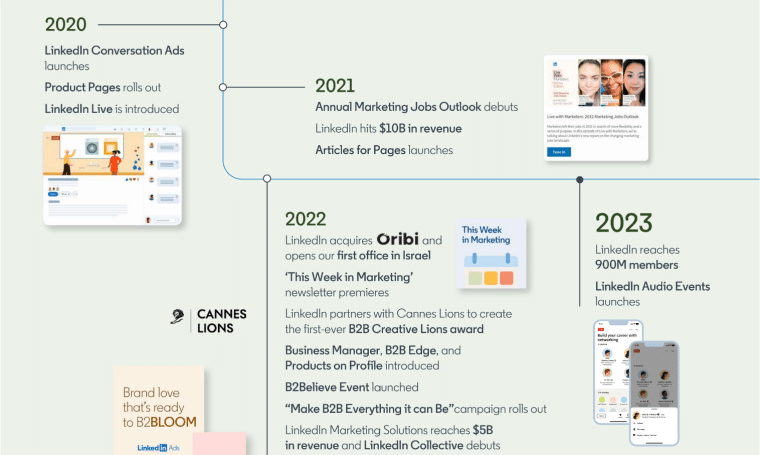

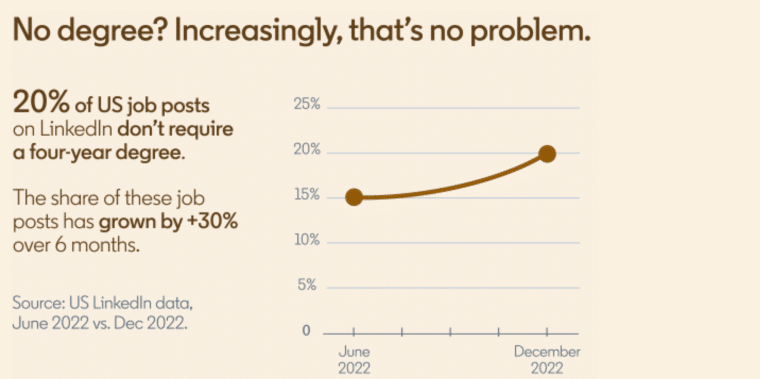

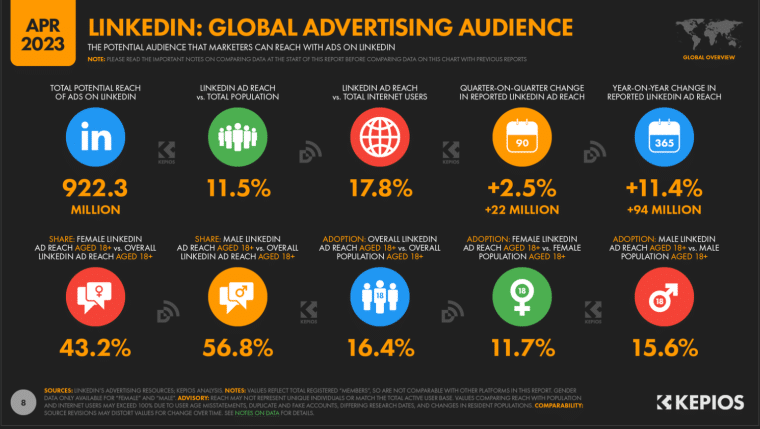

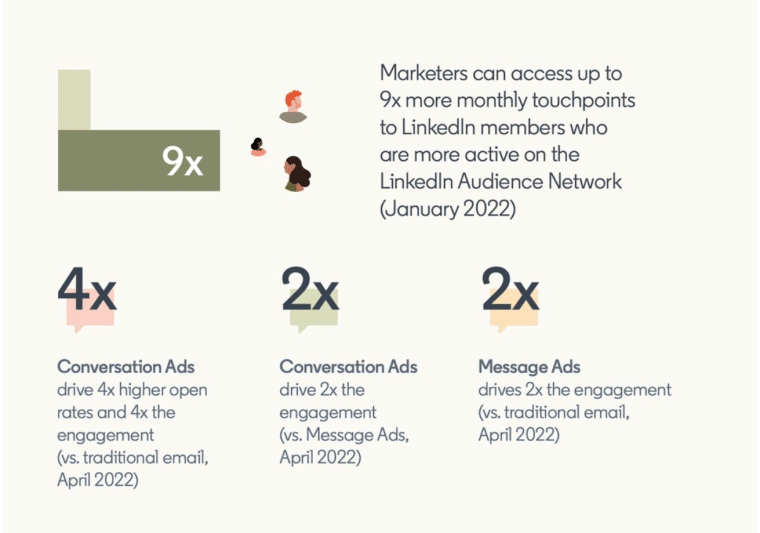

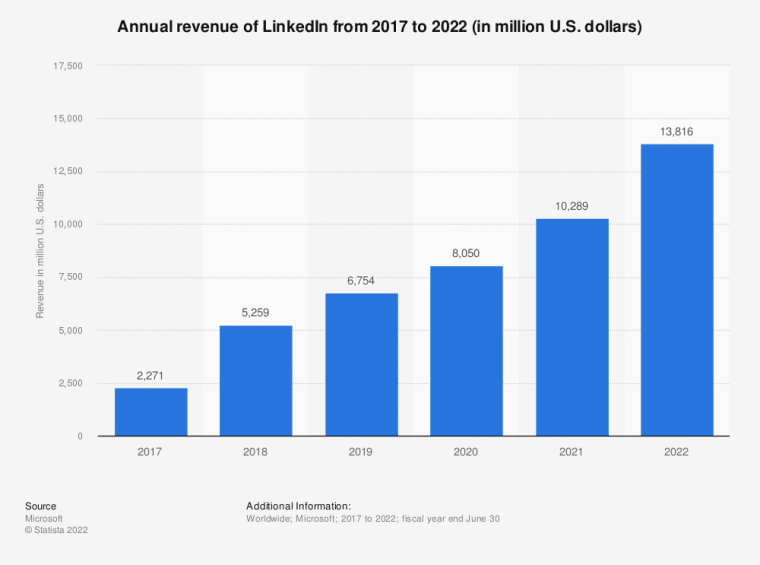

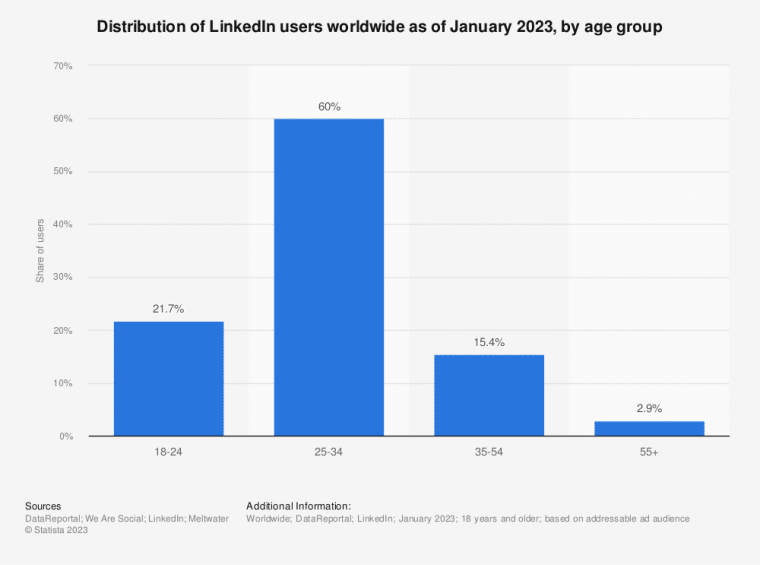

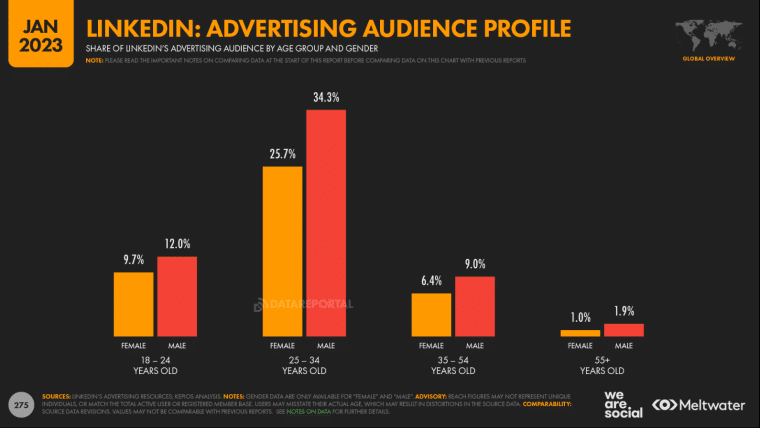

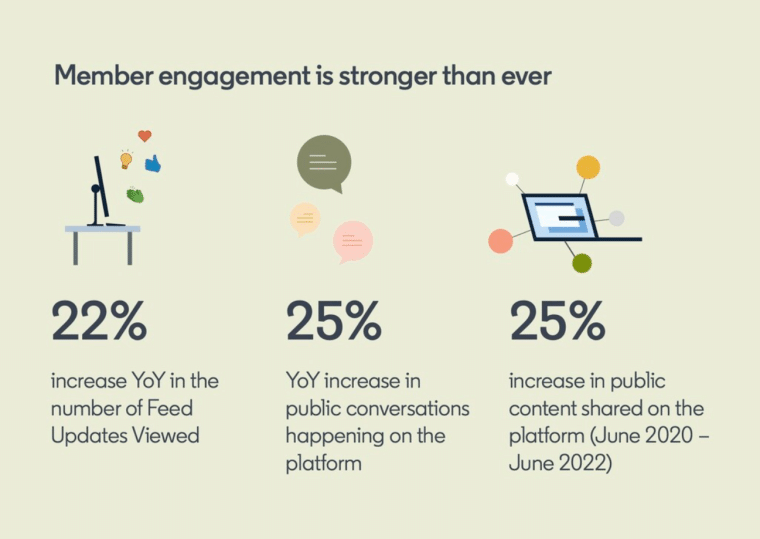

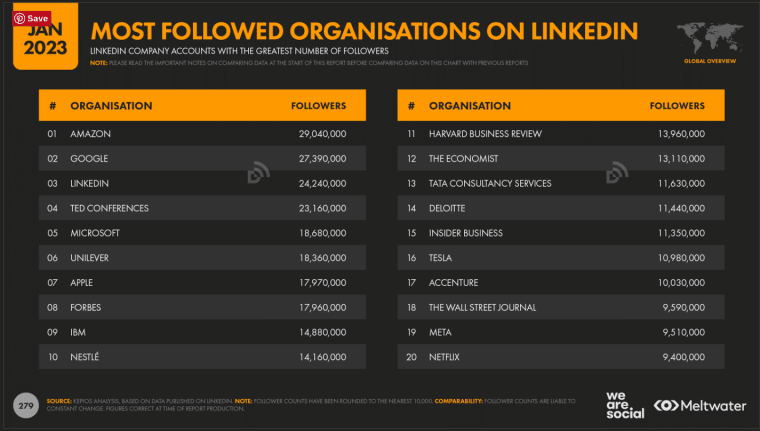

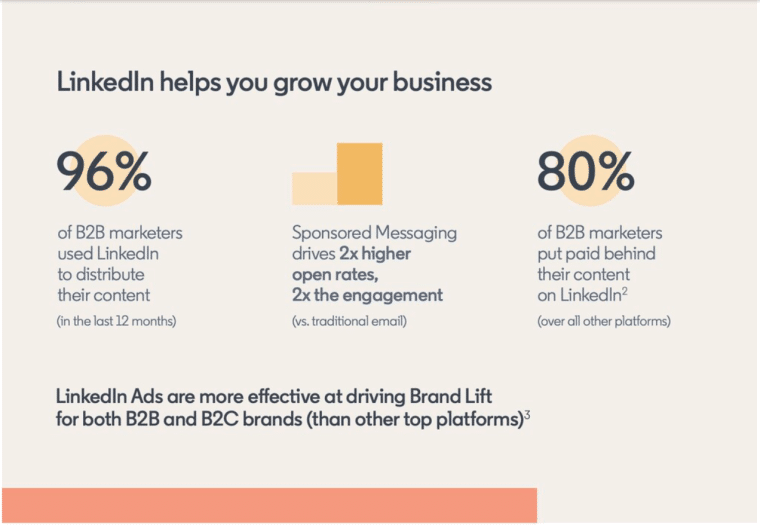

LinkedIn has secured millions in funding from multiple rounds, went public in 2011 with a successful IPO, and was eventually acquired by Microsoft in 2016, marking one of the largest technology deals of all time. In 2003, LinkedIn raised $4.7 million in a Series A funding round. This funding round was led by venture capital firm Sequoia Capital, with Greylock Partners and other investors also participating. The funds raised helped LinkedIn develop its platform and grow its user base. In 2004, LinkedIn raised $10 million in a Series B funding round. The funding round was led by Greylock Partners and included Sequoia Capital and other investors. With the funds secured, LinkedIn was able to expand its operations and develop new features on its platform. In 2007, LinkedIn raised $27 million in a Series C funding round. This round was led by Bessemer Venture Partners and included the European Founders Fund, Sequoia Capital, and Greylock Partners, among others. The funding allowed LinkedIn to continue its expansion and develop more features. In 2011, LinkedIn went public and raised over $350 million. LinkedIn filed for its IPO in January 2011 and listed its first shares at $45 in May, under the New York Stock Exchange (NYSE) symbol “LNKD”. The stock opened at $83 and quickly climbed above $90 to hit a high of $122.70. Shares closed at $94.25 a share, valuing LinkedIn at around $9 billion. LinkedIn raised more than $350 million, making it one of the largest tech IPOs since Google in 2004. In 2012, LinkedIn’s Post IPO share price breached $100. A year post-IPO, LinkedIn’s shares were trading at $100, 137% above its strike price of $32. LinkedIn’s share price started the year at about $77 and fluctuated throughout the year, reaching a high of around $127 in September 2012, before settling at around $112 at the end of the year. Hitting the $100 per share mark was a significant milestone for the company and reflected its success as the leading player in the professional networking and the recruitment industry. In early February 2016, LinkedIn’s shares experienced their sharpest decline. LinkedIn’s share price fell by over 40% to a three-year low, wiping out billions of dollars in market value. The decline was due to lower-than-expected revenue guidance for the first quarter of 2016, which led to concerns about the company’s growth prospects. LinkedIn traded its shares for the last time in December 2016. Following a $26.2 billion acquisition deal by Microsoft, LinkedIn shares traded for the last time on 8 December 2016, officially closing at $195.96. The merger saw each share of Class A LinkedIn common stock converted into $196 in cash. LinkedIn became a wholly-owned subsidiary of Microsoft, and its shares were delisted from the NYSE. LinkedIn has played a key role in the evolution of professional networking and the recruitment industry and has helped facilitate greater connectivity and collaboration among professionals worldwide. LinkedIn continues to expand, revolutionizing the way businesses hire, market, and sell. Microsoft acquired LinkedIn for $26.2 billion in 2016. The $196 per share all-cash acquisition aimed to accelerate LinkedIn’s growth and integrate it with Microsoft’s other professional service offerings. The acquisition also provided Microsoft access to LinkedIn’s massive user base and data, which would enhance its products and services. Additionally, the acquisition allowed Microsoft to tap into LinkedIn’s advertising and recruiting businesses. As of April 2023, LinkedIn operates under Microsoft’s Productivity and Business Processes segment. The company operates alongside Office and other business tools. Moreover, Microsoft has allowed LinkedIn to retain its distinct brand, culture, and independence. Ryan Roslansky is the CEO of LinkedIn. Ryan joined LinkedIn in 2009 and worked in various leadership positions before taking over from Jeff Weiner in 2020. LinkedIn is headquartered in Sunnyvale, California, US. LinkedIn has 36 offices globally, with 10 in the US and the other 26 located across Europe, Asia, North America, South America, and Australia. As of May 2023, LinkedIn has just under 20,000 employees. LinkedIn is down 720 employees as a result of changes to its global business organization (GBO) and China strategy. Black and Latino leaders increased by 35% and 20.3%, respectively, in 2021. LinkedIn continues to focus on becoming more diverse and inclusive. As a result, the number of Black and Latino leaders, managers, and senior employees increased by 35% and 20.3%, respectively, in 2021. As of 2022, women made up nearly 42% of LinkedIn’s leadership. LinkedIn continues to make efforts to reduce gender inequality. This figure is a significant step up compared to previous years and proves the company’s dedication to diversity and inclusivity. As of May 2023, LinkedIn has made 30 acquisitions. To expand its reach and range of product offerings, LinkedIn has spent over $2.29 billion acquiring businesses in sales force automation, HR tech, marketing tech, and more. The company’s most recent (2022) acquisitions include Edubrite and Oribi. Other notable acquisitions over the years include: As of 2023, 80% of LinkedIn’s office footprint is powered by wind and solar power. Additionally, 70% of the company’s office footprint is green building certified. LinkedIn pledges to be carbon negative by 2030, reducing its carbon footprint (including Scope 3 emissions from travel and suppliers) by 55% and offsetting all remaining and historic emissions. LinkedIn connected over 400,000 members to mentoring opportunities throughout 2022. To help mentors and mentees get the most value out of the mentorship experience, LinkedIn continues to provide free mentorship resources via its Resources page. 87.4% of fake accounts were blocked by LinkedIn between July and December 2022. The remaining 12.6% of fake accounts were stopped by LinkedIn’s manual investigations and restrictions. The professional network continues to enhance its defenses to prevent and remove malicious accounts. LinkedIn’s automated defenses stopped 99.3% of spam and scam content. Teams manually dealt with the rest. LinkedIn aims to take swift action against spam or scam content, which tends to include inappropriate commercial activity and repetitive communications or invitations. There are 117 job applications submitted every second on LinkedIn. Additionally, 8 people are hired and 9,000 connections are made every minute on LinkedIn. In 2022, job postings that don’t require a four-year degree increased by 33%. 2022 Insights by LinkedIn revealed that one in five job posts on the platform doesn’t require a college degree. This is up from 15% in 2021. There are over 131,000 schools listed on LinkedIn. On LinkedIn’s own learning platform, more than 100 hours of learning content were consumed in 2022. As of Q1 2023, there are now over 150 million subscriptions to newsletters on LinkedIn. This is up from 37.5 million subscribers or over four times year over year. There are more than 36,000 newsletters actively published on LinkedIn. This includes newsletters from influential individuals like Melinda Gates, Arianna Huffington, and Richard Branson, as well as publishers like The Economist. The most significant source of traffic to LinkedIn is direct traffic, accounting for 73.92% of desktop visits. According to Similar Web’s April 2023 data, direct traffic was the largest source of traffic for LinkedIn. The second-largest traffic source is organic search, which accounted for 20.10% of traffic. LinkedIn began in co-founder Reid Hoffman’s living room in 2002 and was officially launched on May 5, 2003. Since then, the platform has evolved into the world’s most prolific professional network. Let’s track LinkedIn’s 20-year journey to mass adoption below: LinkedIn’s mission remains to connect creators with their communities, job seekers with jobs, learners with skills, and marketers with buyers. The platform aims to achieve this through a combination of free and monetized solutions that help members and customers stay connected and informed, advance their careers, and work smarter. Around 39% of LinkedIn users pay for LinkedIn’s premium services, which include: LinkedIn’s Talent Solutions include Hiring and Learning & Development products. Hiring provides innovative recruiting tools to help users become more successful at talent acquisition and professional development. Learning & Development tools provide online education courses that help professionals learn new skills and accelerate their careers. As of October 2022, over 700,000 companies use LinkedIn to source and hire. In addition, LinkedIn data shows that over 4.9 million talent professionals actively use LinkedIn to source and target the right candidates in 2023. LinkedIn’s Global Talent Trends Report shows that hiring has slowed down since 2022. In 2024, skills-based hiring continues to be a priority, with 45% of recruiters using skills data to source candidates. Hiring professionals using skills data are 60% more likely to make a successful hire. Based on data from 17 countries, LinkedIn’s May 2023 Global Trends Report revealed that hiring has slowed down. The largest drops are in Singapore, Canada, and India where hiring rates have decreased by more than 40%. The UK has seen a 34% decline, while the US has seen a 28% decrease. Businesses using skills data are 60% more likely to make a successful hire in 2023. Skills-first hiring remains a priority in 2023, with 75% of recruiting professionals stating that it will be part of their hiring processes this year. LinkedIn data also revealed that recruiters using skills to find talent are 22% more likely to receive InMail acceptances. Because it grants them access to a wider pool of candidates, recruiters who filter their LinkedIn searches by skills get better response rates. There are over 40,000 skills listed on LinkedIn. Over 45% of recruiters on the platform use skills data to fill their roles. In Q1, 2023, LinkedIn announced new integrations between Viva and LinkedIn Learning. These integrations will help companies invest in their current employees by providing access to courses directly in the flow of work. Over 13,000 organizations around the world use LinkedIn Learning. LinkedIn Learning provides a modern learning experience featuring over 20,000 courses in seven languages. LinkedIn’s Marketing Solutions help businesses reach, engage, and convert audiences at scale. The professional network remains the second-most popular social media platform used by B2B marketers, ranking only behind Facebook. According to LinkedIn’s internal data: As of January 2023, LinkedIn has an impressive advertising audience reach of 102.4% in Bermuda. LinkedIn’s audience reach is 97% in the Cayman Islands, 75% in the US, and 65% in the UK. LinkedIn’s advertising audience reach increased by 11.4% between 2022 and April 2023. This means that advertisers can now reach 94 million more members on LinkedIn in April 2023. Analysis by Data Reportal indicates that LinkedIn’s advertising reach has grown faster than Facebook’s advertising reach over the past 12 months. As of April 2024, LinkedIn’s global advertising audience is as follows: 97% of B2B marketers use LinkedIn for their content marketing efforts. Additionally, four out of five B2B marketers have identified LinkedIn as the most effective channel for driving high-quality leads. Audiences on LinkedIn are six times more likely to convert. According to LinkedIn data, advertising audiences exposed to brand and acquisition messages on the platform are more likely to convert. B2B brands advertising on LinkedIn experience double in their brand attributes. LinkedIn Data shows that businesses experience a lift in brand attributes when advertising on LinkedIn. In addition, brands tend to see a 33% increase in purchase intent from advertising exposure on LinkedIn. 80% of LinkedIn members drive business decisions. LinkedIn advertising gives advertisers access to over 65 million business decision-makers. Marketers see up to 2x higher conversion rates on LinkedIn. With an audience of over 1 billion members and 57 million companies across 200 countries and territories, LinkedIn allows marketers to tap into a broad and powerful audience. LinkedIn’s premium subscriptions allow professionals to manage their professional identity, grow their network, and use additional services like premium search. With premium services, LinkedIn users can increase their search results, send messages on LinkedIn’s InMail system, contact members outside their networks, and see information about people who have viewed their profiles. Premium members are 2.6x more likely to get hired on LinkedIn. LinkedIn Premium gives subscribers insights into 20 million open jobs, allowing members to explore valuable resources to help with their search. LinkedIn’s InMail service is 2.6x more effective than emails alone. Premium subscribers can contact peers, industry leaders, or potential partners more effectively through InMail. Sales Solutions help companies strengthen customer relationships, empower teams with digital selling tools, and acquire new opportunities. In Q1 FY 2023, LinkedIn launched the next generation of Sales Navigator. This new feature helps sellers increase win rates and deal size by better understanding and evaluating customer interest. Sellers who use Sales Navigator close 45% larger deals. According to a Dec. 2022 LinkedIn analysis of global CRM-synced customers, sellers who use Sales Navigator close larger deals, and their win rates improve by 4%. LinkedIn’s Sales Navigator can boost a company’s Social Selling Index (SSI) by 20% in six months. Sales Navigator helps companies leverage real-time insights and B2B data to maximize their SSI scores. Since its acquisition in 2016, LinkedIn’s financials have been consolidated with Microsoft’s. LinkedIn’s primary source of revenue is generated through: In Q3 of FY 2023, LinkedIn’s revenue increased 8% year-over-year. According to LinkedIn, the increase in revenue between Q1 and Q3 of 2023 is largely due to its Talent Solutions, which continues to connect hirers to job seekers and help professionals build the skills they need to access opportunities. Over the fiscal year 2022, LinkedIn generated 34% more revenue. LinkedIn’s revenue for FY 2022 was $13.8 billion. This was up from $10.2 billion in 2021 and $8.07 billion in 2020 and was driven by higher demand for talent and marketing solutions. LinkedIn generated more than $3.8 billion in advertising revenue in 2021. This figure is projected to hit $7.7 billion by 2026. LinkedIn accounted for 7% of Microsoft’s revenue in 2022. LinkedIn’s total revenue was $13.8 billion in 2022, which is 7% of Microsoft’s total revenue. This is up from 6% in 2021. LinkedIn Marketing Solutions breached $5 billion in revenue for the first time in July 2022. By 2024, eMarketer projects LinkedIn will capture nearly 50% of all display ad spending and 25% of all digital ad spending. LinkedIn has over 1 billion members in over 200 countries and territories worldwide. With over 261 million members, Asia Pacific is home to the highest number of members. In second and third place are Europe and North America, with 242 million and 224 million members, respectively. Member growth showed positive growth for the seventh consecutive quarter. According to Microsoft’s Q3 FY 2023 results, members in India increased by 100 million or 19% between January and April 2023. LinkedIn’s international user base increased at double the pace of its US user base in Q1 of 2023. LinkedIn continues to expand into global markets, with its international user base growing at twice the pace of its US user base in Q1 2023. As of 2024, 34.2% of the user base being aged 25-34, as of 2024. Also, 60% of U.S. LinkedIn users now earn over $100,000 annually, emphasizing LinkedIn’s high-value demographic Users belonging to the 18 to 24-year age group made up 21.7% of LinkedIn’s user base, while users over 55 accounted for 2.9% of LinkedIn’s audience. LinkedIn saw a 73% year-over-year increase in student sign-ups. The increase comes as Gen Z enters the workforce. The US has the most LinkedIn members. Between April and January 2023, LinkedIn had an audience reach of 200 million users in the US. The country was by far LinkedIn’s largest market. Runner-up India had an audience reach of 99 million. In 2022, the US accounted for 31.2% of web visits to LinkedIn. The US ranked first while India ranked second with 7% and the UK came in third, accounting for 6% of all web visits. Over 25% of US adults are LinkedIn users, according to Pew Research Center. LinkedIn’s penetration levels in the US are a testament to its power as a professional network and recruitment platform. 56% of LinkedIn users are male. LinkedIn’s user base is predominantly made up of men aged 25 to 34. Additionally, men are 30% more likely to use LinkedIn than women. In December 2022, one-third of LinkedIn members had a bachelor’s degree. Another 23% held a master’s degree or its equivalent, while 2% had a secondary-level education. 44% of LinkedIn users take home over $75,000 per year. According to US Census data, this is above the national median household income of $70,784 per year in 2021 and $71,186 per year in 2020. This means LinkedIn’s audience has two times the buying power of the average web audience. According to LinkedIn’s internal data: Amazon is the most followed company on LinkedIn. With over 29 million users, Amazon leads the pack in terms of subscribed followers. In second place is Google with 27.4 million followers, and in third place is LinkedIn with just over 24 million followers. LinkedIn users have added over 365 million skills to their profiles since Q3 2022. This is up 43% year-over-year. With LinkedIn’s acquisition of EduBrite, members across the globe will soon be able to earn professional certificates from trusted partners directly on the platform. As of 2021, there has been a 362% increase in LinkedIn members posting about flexible work. According to LinkedIn’s Global Trends Report, there has also been a 35% increase in posts about well-being and a 15% increase in posts about company culture. 13% of US LinkedIn users used the platform to get news in 2022. According to Pew Research, this is down 2% from 15% in 2020. Additionally, users aged between 30 and 49 made up over 40% of social media news consumers on LinkedIn. According to GWI’s 2022 Social Trends report, consumers aged 16 to 64 use LinkedIn for the following additional reasons: As of May 2024, the average time a LinkedIn user spends on the platform is 7 minutes and 40 seconds. According to Similar Web, LinkedIn users spend just over 7 minutes on the platform per visit. On average, they also visit seven pages per visit. As of April 2023, 59 million companies have a LinkedIn Page. According to LinkedIn’s internal data, 2.7 million of these pages post at least weekly. In 2024, LinkedIn expanded its suite of AI-powered tools to enhance user experience, increase engagement, and streamline professional networking and recruitment. These tools use generative AI, natural language processing, and machine learning to personalize content, improve hiring processes, and create more targeted advertising campaigns. LinkedIn introduced AI-driven content tools for creators, helping businesses and individuals generate personalized posts, articles, and updates. By analyzing engagement metrics, follower demographics, and trending topics within industries, these AI tools suggest tailored content ideas, headlines, and messaging formats to optimize engagement. Users can also input specific goals, and the AI engine will generate content recommendations aligned with their audience’s preferences. The platform now integrates AI tools to streamline the recruitment process, making it easier for recruiters and HR professionals to source top candidates. AI in LinkedIn’s Talent Solutions can now automate candidate searches, prioritize applicants based on skill match, and analyze applicant data for better cultural and skills-based fit. LinkedIn Learning integrates AI to provide personalized learning paths for users. By analyzing job histories, current skills, and career goals, LinkedIn’s AI recommends courses and learning modules tailored to individual needs, making professional development more intuitive and accessible. AI now plays a critical role in LinkedIn’s Marketing Solutions, offering businesses advanced targeting tools for advertisements. By analyzing user profiles, content consumption, and engagement data, AI helps brands create hyper-targeted campaigns, improving conversion rates and ROI. LinkedIn’s main competitors in the professional networking and recruitment space include other online job search and career networking platforms such as: These online platforms provide similar services to LinkedIn, such as job postings, resume hosting, and professional networking tools. Additionally, LinkedIn also competes with social media platforms, such as Facebook and Twitter, which have their own professional networking features. LinkedIn, however, remains the largest and most popular platform in the professional networking and recruitment space, with over 1 billion members in over 200 countries and territories worldwide. LinkedIn is considered the leading platform for B2B lead generation. Accurate and up-to-date professional data, combined with a vast business-oriented user base and advanced advertising tools, make LinkedIn an invaluable part of a modern B2B marketing strategy. In fact, over 40% of B2B marketers consider LinkedIn to be the most effective channel for driving high-quality leads. 96% of B2B marketers use LinkedIn for organic social marketing. With most B2B marketers relying on LinkedIn’s platform for paid advertising, it comes as no surprise that they also find the network effective for organic brand engagement. This puts LinkedIn ahead of Facebook and Twitter as the top network for B2B marketing. In 2022, LinkedIn ranked seventh in the top ten fastest-growing brands worldwide. This was based on its brand value growth of 68%. LinkedIn and YouTube were the only two social media networks in the rankings. LinkedIn had a total of 1.6 billion visits between April and May 2023. This is down 10.6% from the previous month and puts LinkedIn in 18th place in terms of global website traffic rankings. As of March 2022, LinkedIn was the leading platform used to research businesses by job seekers in the US. LinkedIn remains the most popular employment-related social network in the US, with Glassdoor following closely behind. LinkedIn – Key Statistics

LinkedIn Investment Data

LinkedIn Business Data

LinkedIn Timeline and History

LinkedIn Product Statistics

LinkedIn Product Offering

Features & Services

Free Solutions

Ubiquitous Access

Talent Solutions

Marketing Solutions

Premium Subscriptions

Talent Solutions

Marketing Solutions

Premium Subscriptions

Sales Solutions

LinkedIn Revenue Statistics

Year

LinkedIn Revenue (in billions)

Year-on-Year change

2010

$0.24

N/A

2011

$0.52

115%

2012

$0.98

86%

2013

$1.53

56%

2014

$2.21

44%

2015

$2.99

35%

2016

$2.30

-23%

2017

$2.28

-1%

2018

$5.25

130%

2019

$6.75

29%

2020

$8.05

19%

2021

$10.28

27%

2022

$13.81

34%

LinkedIn Demographics Data

LinkedIn Usage Statistics

AI-Powered Tools and Features on LinkedIn in 2024

1. AI-Powered Content Generation

2. AI-Enhanced Recruitment Tools

3. AI for Learning and Development

4. AI in Advertising and Marketing

LinkedIn vs Competitor Stats

LinkedIn Product Offerings

Competitors

Free Solutions

Talent Solutions

Marketing Solutions

Premium Subscriptions

FAQs

Can you view LinkedIn profiles without an account?

Do people use LinkedIn for dating?

Who should you connect with on LinkedIn?

References