With a rich history spanning nine decades, Lidl has grown into one of the world’s leading discount retailers. As of November 2024, Lidl’s net worth, which is closely tied to Dieter Schwarz — the owner of its parent company, Schwarz Group — is over $46.4 billion.

We consulted a wide range of sources to provide a comprehensive overview of Lidl’s net worth and history. Read on as we explore the company’s key milestones, revenue, controversies, and more.

Lidl Key Company Data

Lidl Net Worth: $46.4 billion (via owner of parent company Schwarz Gruppe)

Date Founded: June 1973

Founded By: Josef Schwarz

Current CEO: Joel Rampoldt

Industries: Retail, consumer goods

Lidl Stock Ticker: N/A

Dividend Yield: 0%

What is Lidl’s Net Worth?

As of November 2024, there are no exact figures for Lidl’s net worth or market cap, nor for the Schwarz Group, which owns both Lidl and Kaufland discount supermarket chains.

However, the company’s valuation is closely linked to the personal wealth of its owner, Dieter Schwarz. In 2023, Dieter Schwarz’s net worth was around $46.4 billion according to Forbes, making him the wealthiest man in Germany.

Dieter Schwarz was born in Heilbronn, Germany, where he still resides with his wife, Franziska Weipert. The billionaire prefers to keep his personal life private. As such, he avoids media attention and rarely makes public appearances.

Lidl Revenue

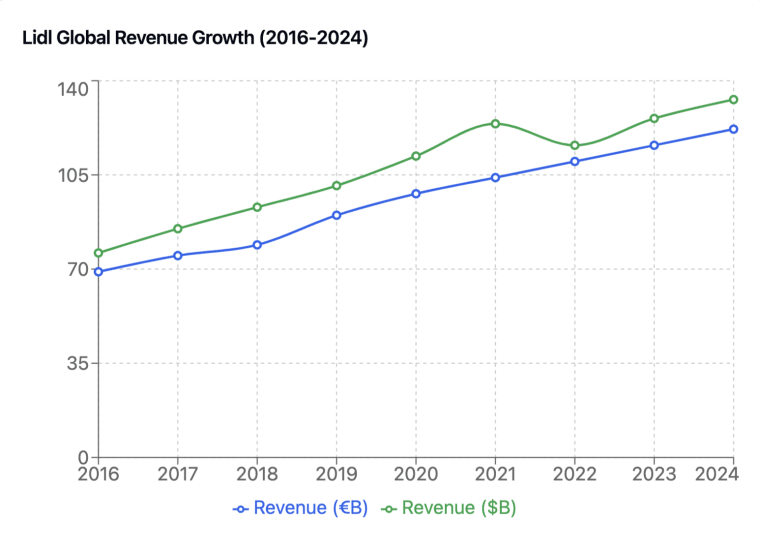

Over the years, Lidl’s global revenue has increased, reflecting the company’s growing footprint in Europe and other global markets.

In 2016, Lidl’s revenue stood at €69 billion ($76.36 billion at the time). By 2018, it had risen to €79 billion ($93.22 billion at the time), with the company’s new US operations contributing a modest $492 million, or about 0.53%, of that total.

Lidl achieved the largest year-over-year increase in revenue in 2019. That year, global sales jumped from €79 billion ($93 billion) to €90 billion ($100.08 billion).

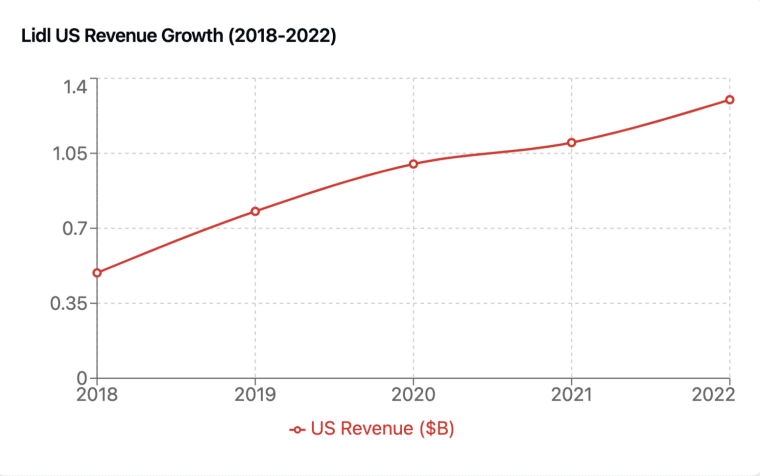

Through the pandemic, the global chain maintained its revenue growth, reaching $112 billion in 2020 and $124 billion in 2021. Meanwhile, Lidl US revenues also saw notable gains, surpassing the $1 billion mark in 2020. As Lidl strengthened its presence in the US, sales climbed further, reaching $1.3 billion in 2022 — a 160% increase from 2018.

| Year | Revenue (€ billions) | *Revenue ($ billions) |

|---|---|---|

| 2016 | 69 | 76 |

| 2017 | 75 | 85 |

| 2018 | 79 | 93 |

| 2019 | 90 | 101 |

| 2020 | 98 | 112 |

| 2021 | 104 | 124 |

| 2022 | 110 | 116 |

| 2023 | 116 | 126 |

| 2024 | 122 | 133 |

*At that year’s average EUR to USD conversion rate

Can I Buy Lidl Stock?

You can’t buy Lidl stock as the company is privately owned and therefore not listed on any stock exchange. As of October 2024, the Schwarz Group has not announced any plans to take Lidl public.

Who Owns Lidl?

Lidl is owned by the Schwarz Group (Schwarz Gruppe). The Schwarz Group is Europe’s largest retailer and boasts over 13,300 discount supermarkets across Europe, the US, and other global markets. The Group’s operations are wholly managed by the Dieter Schwarz Foundation, a limited liability company (LLC) with a charitable purpose.

After Josef Schwarz died in 1977, his son Dieter Schwarz took control of the business. After successfully growing it into a discount chain spanning several European countries, Dieter founded the Dieter Schwarz Stiftung in 1999.

Dieter transferred his Lidl and Kaufland hypermarket chain shares to the tax-exempt foundation and has since managed the company through the entity while supporting education, daycare, and research projects.

Who is the Lidl CEO?

The CEO of Lidl US is Joel Rampoldt. After Lidl’s rocky start in the US, the company, which had a history of promoting internal executives, appointed US consultant Joel Rampoldt in 2023 to replace Michal Lagunionek. Rampoldt became the first American CEO of Lidl US and the fifth CEO since Lidl’s initial entry into the US in 2013, reflecting the high turnover rate of executive leadership at Lidl US.

Throughout his tenure, Rampoldt plans to focus on a three-pronged approach to establish a stronger presence in the US and create an experience more tailored to the US consumer. This includes:

- Conducting a commercial transformation of the business and ensuring the retailer has the right products to appeal to the US customers.

- Building a high-performing team of the best possible people in key roles such as purchasing and marketing.

- Maintaining operational efficiency.

The global CEO of Lidl is Ignazio Paterno, who has been in position since 2019.

| Year | Lidl US CEO |

|---|---|

| 2015-2018 | Brendan Proctor |

| 2018-2020 | Johannes Fieber |

| 2020-2021 | Kenneth McGrath |

| 2021-2023 | Michal Lagunionek |

| 2023-Present | Joel Rampoldt |

Lidl’s Company History

Headquartered in Neckarsulm, Lidl is a German international discount retailer chain that operates over 12,200 stores across the European Union, Serbia, Switzerland, the UK, and the US. In the following section, we track for you Lidl’s growth and entry into new markets.

1973-1989: The First Lidl Discount Store Opens

Lidl’s history can be traced back to 1858 when it was founded as an exotic fruit wholesaler called Südfrüchte Großhandlung Lidl & Co. It was later renamed to Lidl & Schwarz KG in 1930 and expanded into a food grocery by German entrepreneur Josef Schwarz.

However, World War II brought his expansion to a halt. It wasn’t until 1954 that Schwarz returned to Heilbronn, where he opened a warehouse in Northern Württemberg and started rebuilding the business.

The first Lidl store opened in Ludwigshafen, Germany in 1973. Copying the Aldi concept of efficiency, minimal costs, and low prices, it only employed 3 people and only carried around 500 product lines.

In 1977, Dieter Schwarz joined his father’s company and to avoid a legal battle, secured the rights to use the Lidl name from Ludwig Lidl. In 1979, Lidl opened 6 more stores, taking its total to 30 stores.

In the 1980s, Lidl opened 300 stores across Germany. The company kept its lean model, with each store employing seven people and stocking around 900 product lines.

By 1988, 15 years after its launch, Lidl operated more than 450 stores in Germany and had over 5,000 employees. The next year, Lidl took its operations international, opening the first Lidl store in France.

1990-2014: Lidl Expands Internationally

Throughout the 1990s, Lidl continued its expansion to other countries. In 1992, Lidl opened its first stores in Italy. Then in 1994, Lidl entered the UK, opening its first 10 stores across the country. By the early 2000s, Lidl had established itself as a leading retailer in Europe, employing around 80,000 people.

In 2006, Lidl became the first discount retailer to consistently offer a dedicated line of fair trade products under its own brand, “Fairglobe”. That same year, Lidl launched Lidl Asia, a sourcing arm for the company operating in Hong Kong, China, and Bangladesh. Its main roles included production, quality assurance, and delivery.

Following the 2008 financial crash and the resulting shift towards budget-friendly options, Lidl’s market share increased in key markets like the UK.

In 2012, Lidl launched bakeries across its stores in Europe. This and other improvements further strengthened the discount retailer’s hold in the region. In the UK alone, the company’s market share and annual sales increased by 20% year-over-year in 2014.

2015-2019: Lidl Makes it US Debut

In 2015, Lidl established its US headquarters in Arlington, Virginia. By 2017, Lidl had over 10,000 stores in 27 countries. That year, Lidl opened its first 20 stores in the US stretching across Virginia, North Carolina, and South Carolina.

With its unique model, the retailer aimed to offer top-quality goods and groceries at up to 50% less than other supermarkets in the US, directly competing against German discount retailer Aldi.

The company announced plans to open 100 stores in 2018, and as part of this expansion, Lidl acquired 27 Best Market stores in New York and New Jersey.

However, as the company’s model failed to take the US, market plans for new stores stalled. While the chain had hoped 100 US stores would open by 2018, Lidl barely managed half before realizing it wasn’t working.

In May 2018, Lidl announced a “new beginning” after speculation that it might exit the American market due to slow initial store traffic and sales. To lead this transition, the company appointed Johannes Fieber, former CEO of its Sweden division.

In 2019, Lidl unveiled plans to open 25 new US stores across seven states by spring 2020. Lidl also agreed to buy six Shoppers Food & Pharmacy stores from United Natural Foods, Inc. That year, the company’s revenue approached the $800 million mark.

By 2020, Lidl US boasted 95 stores and was generating over $1 billion in revenue — a whopping 103% increase from $492 million in 2018. Despite this growth, Lidl had yet to turn a profit, and the retailer acknowledged that it would likely take at least a decade to fully establish itself in the US.

2020- Present: Lidl Strengthens its US Presence

Lidl continued its expansion throughout the eastern US and had opened a total of 100 stores by the end of 2020. In 2021, Michal Lagunionek, former head of Lidl’s Poland division, was appointed the fourth CEO of Lidl’s US division. The change came as Lidl planned to open 50 stores by the end of the year and bring the company’s total number of stores to more than 150.

2022 saw Lidl implement rotating price cuts on more than 100 items across its 170 stores. By lowering prices, Lidl aimed to boost customer loyalty and attract value-seeking shoppers amid rising inflation.

In February 2023, Lidl US initiated corporate restructuring to strengthen its financial position after years of rapid job growth outpaced the expansion of its stores. Part of these changes included laying off around 200 employees at its Arlington headquarters. It also included appointing the company’s first American CEO in August 2023. By the end of the year, Lidl had closed 11 stores across six states due to underperformance.

As of 2024, Lidl had 173 stores in the US. While it was successful in regions like New York City and Washington, D.C. where it had multiple stores, the high real estate costs in these areas has hindered the company’s growth.

Meanwhile, in lower-cost areas like North Carolina, South Carolina, and Georgia, Lidl faced a harder time convincing shoppers to try an unfamiliar brand.

With Lidl US struggling to establish its presence due to high costs and comparisons with rival Aldi, the company appointed a team of four senior executives familiar with the US retail market in March 2024. This included the company’s first chief customer officer. The company also cut corporate jobs across three business units.

Why is Lidl So Cheap?

Lidl is so cheap because it prioritizes keeping operating expenses to a minimum and eliminating unnecessary costs. Like rival German discount supermarket chain Aldi, Lidl has a no-waste, zero-frills business model.

This means that compared to other retailers in the US, Lidl is at least 25% cheaper.

Each Lidl store offers a simple, intuitive experience, keeping real estate and operating costs low. Unlike traditional retailers that stock over 30,000 products, Lidl stocks only around 4,000 items.

@kerry.daehn6 If you have a Lidl near you I highly recommend you check it out! Its like a bigger Aldi #groceryhaul #oneincomefamily #oneincomehousehold #stayathomemom #momsunder30 #momsintheir30s #groceryasmr #lidlhaul #budgetgroceries #budgetgroceryshopping #shoppingtips #groceryshoppingtips #toddlermom #averagemom

Instead of restocking shelves item by item, products are stored in the boxes they arrive, allowing the company to cut back on labor expenses.

80% of Lidl’s products are private label, ensuring the lowest prices for shoppers. Further, Lidl’s “bring-your-own-bag policy” ensures that the costs of bags aren’t passed down to shoppers.

Lidl Controversies

Rather than outright scandals, Lidl US has faced expansion challenges that have resulted in layoffs, store closures, and frequent leadership changes. Globally, however, Lidl has attracted harsh criticism in the past over its poor treatment of employees. For example, Lidl has historically discouraged workers from unionizing and was fined for spying on employees in Germany. Below, we cover some of Lidl’s most recent controversies.

Lidl Germ Scandal

In June 2024, an independent German laboratory claimed that over half of Lidl UK’s fresh chicken products contained antibiotic-resistant superbugs. The study, commissioned by animal welfare charities including Open Cages, examined 40 Birchwood British chicken products from five UK stores.

The lab found multi-resistant bacteria in 57.5% of products, E-Coli in 47.5%, and Listeria in 30%.

In response to Open Cage’s allegations, which Lidl characterized as “false and inaccurate”, the retailer accused the organization of “scaremongering and misleading the public”. Lidl subsequently initiated legal proceedings against Open Cages in what it termed a “defamatory” investigation linking its fresh chicken products to antibiotic-resistant “superbugs”.

In statements to the press, Lidl highlighted several inconsistencies in Open Cage’s claims and specifically questioned its testing methodology. Lidl cited concerns about the efficacy of the tests, insufficient details in the results, and no comparisons with competitors.

Lidl Animal Cruelty Controversy

In July 2023, activists from Open Cages protested outside 30 Lidl stores across the UK after a whistleblower released footage of animal abuse by chicken supplier Birchwood Farm. While Lidl initially denied any connection to the supplier, Open Cages found evidence that Birchwood Farm chickens were sold in Lidl stores as recently as June 2023.

The footage in question showed chickens being crushed to death and revealed other major welfare problems, which workers admitted were routine occurrences.

Protestors accused Lidl of deception and tolerating animal cruelty. They also called for the retailer to sign the Better Chicken Commitment.

Lidl Supplier Treatment Scandal

In December 2022, Proctor & Associates, a long-time supplier of fruit and vegetables to Lidl filed a lawsuit against the chain for £2.6 million ($3.2 million).

According to Deane Proctor, Managing Director of Proctor & Associates, Lidl destroyed its business by delisting several of its products without reasonable warning and poaching its suppliers.

We built our business for and around Lidl’s needs. Despite that, I feel like Lidl stabbed us in the back. They took our suppliers and delisted us without notice.

Proctor revealed that while this happened frequently, many suppliers chose not to take action out of fear that Lidl would delist them. The director argued that Lidl’s actions violated the Groceries Supplies Code of Practice, which regulates how large retailers interact with suppliers.

Although the Groceries Code Adjudicator (GCA) is responsible for investigating such violations and imposing fines up to 1% of UK sales, Proctor & Associates opted for private legal action through law firm Gordons to seek compensation for its significant financial losses.

What Can We Learn From Lidl?

Lidl’s success reflects the power of a low-cost operating model for driving long-term growth. By maintaining a no-frills discount strategy and creating value for cost-conscious consumers, Lidl has managed to attract and retain customers across key markets in Europe and the rest of the world.

The company’s private ownership structure has enabled Lidl to focus on long-term growth without external pressure. It’s also allowed Lidl to preserve its vision, build a strong international presence, and diversify its revenue, reducing its dependence on a single market.

While Lidl has successfully replicated its low-cost model across several markets, its underwhelming entry into the US underscores the challenges of entering new markets and the importance of tailoring operations to local tastes.

In Europe, Lidl stores are heavily streamlined, with an average footprint of only about 10,000 square feet. About 90% of its products are private label and stores stock between 1,000 and 1,500 products.

In contrast, Lidl’s US stores are about twice the size of their European counterparts and carry an average of about four times as many products. As a result, they’re more costly to operate and have slowed down the company’s expansion into the US.

Adding to Lidl’s challenges, frequent shifts in executive leadership at Lidl US have led to constant adjustments, disrupting long-term planning and consistency. This turnover has slowed Lidl’s expansion, highlighting the importance of stable leadership.

Finally, the recent scrutiny Lidl has faced over its meat products and supplier treatment highlights the importance of balancing profitability with ethical practices.