Wells Fargo’s history is one of strong heritage, nationwide and international growth, and major scandals. Starting out in 1852 as a bank and express company, Wells Fargo used stagecoaches to transport mail, money, and valuables across the US.

Years later, it became one of the biggest banks in the world, holding on to its heritage of traditional stagecoaches.

Key Takeaways: The History of Wells Fargo [1852 -2024]

- Founding: Established in 1852 by Henry Wells and William Fargo.

- Major Mergers: Acquired by Norwest Corporation in 1998; merged with Wachovia in 2008.

- Scandal: Unveiled cross-selling scandal in 2016, leading to significant fines and leadership changes.

- Asset Caps: Federal Reserve imposed $1.95 trillion asset cap in 2018.

- CEO: Charles W. Scharf, CEO since 2019, focuses on regulatory issues.

- Global Reach: Operates in 22 countries with 68 million customers.

- Digital Initiatives: Investing in quantum computing and AI-powered virtual assistant, Fargo.

- Dividend Payments: Quarterly dividends with a history of fluctuations, particularly during economic stress.

- Logo Evolution: Modernized stagecoach logo symbolizing heritage and progress.

- Future Goals: Aims for growth post-2025 once asset caps are lifted, focusing on technological innovation.

According to the company, stagecoaches symbolize moving forward.

Indeed, the company’s history has required a lot of change and adaptation. Especially after the 2016 banking scandal, Wells Fargo experienced leadership transformation and asset caps, changing its company culture and operations.

Our experts at Business2Community analyzed the company’s important milestones, mergers and acquisitions, product launches, and the key changes it made after 2016 to bring you a holistic history of Wells Fargo.

A History of Wells Fargo – Key Dates

- Henry Wells and William Fargo founded Wells Fargo in 1852.

- In 1998, Norwest Corporation acquired Wells Fargo, and both companies took Wells Fargo’s name.

- During the 2008 financial crisis, Wells Fargo acquired Wachovia, the fourth-largest banking organization in the US in terms of assets.

- Wells Fargo’s cross-selling scandals came to the surface in 2016, as the bank opened 3.5 million fraudulent accounts on behalf of its customers between 2011 and 2015.

- In 2018, the Federal Reserve imposed a $1.95 trillion asset cap on Wells Fargo.

Who Owns Wells Fargo?

Wells Fargo is a publicly traded company, with its shares mostly owned by various institutions. As of 2024, Vanguard Group Inc. held the most shares of Wells Fargo at over 8%, followed by Blackrock Inc. with over 7%, and FMR, LLC in third place with over 4%. After Norwest Corporation purchased Wells Fargo in 1998, they both adopted the name Wells Fargo Company, making it the seventh largest bank holding company in the US.

Wells Fargo’s history dates back to the 1800s before the Civil War. In 1845, Henry Wells hired William Fargo as a messenger. He aimed to expand his express business to Cleveland, Chicago, and other cities in the Midwest.

By 1850, Wells, Fargo, and other messengers formed a network known as the American Express Company. This network included messengers and offices that served the East Coast and the Midwest. At the same time, gold was discovered in California, raising the need for dependable communication and transport between the far East and West coasts.

In 1852, Wells and Fargo proposed an idea to the American Express board: expanding their services to the Pacific Coast. The board declined so Wells and Fargo started their own company, Wells Fargo & Co. Both founders remained connected to the Wells Fargo Company until the end of their lives, serving as board members.

Since 1863, Wells Fargo has been operating under Charter Number 1, the first national bank charter issued by the Office of the Comptroller of the Currency in the US. Wells Fargo’s express and banking businesses were separated in 1905 as the company merged with Nevada National Bank. The 1998 Norwest Corporation acquisition has been key in Wells Fargo’s history, as it changed its company culture and business operations.

Who is the Wells Fargo CEO?

Charles W. Scharf has been Wells Fargo’s CEO since 2019. Before Scharf, the financial services firm had several CEOs and presidents, including co-founders Henry Wells and William Fargo in the bank’s early days.

It is important to note that the company has gone through various changes, and the Wells Fargo Bank we know today is a merger between Wells Fargo and Norwest Corporation in 1998. Once the $34.4 billion merger took place, the amalgamation of both companies took Wells Fargo’s name. Then, Norwest Corporation’s CEO Richard Kovacevich became Wells Fargo’s new CEO.

Here is a list of the Wells Fargo CEOs since the 1998 Norwest Corporation merger.

| Wells Fargo CEO Name | Period |

| Paul Hazen (CEO of Wells Fargo during the Norwest Corporation merger) | 1995-1998 |

| Richard Kovacevich (CEO of Norwest Corporation and Wells Fargo after the merger) | 1998-2007 |

| John G. Stumpf | 2007-2016 |

| Timothy J. Sloan | 2016-2019 |

| Charles W. Scharf | 2019-present |

Growth and Development of Wells Fargo

One of the oldest and largest banks in the US, Wells Fargo has survived various disastrous historical events, including World War I, World War II, the Great Depression, the 2008 financial crisis, and more recessions than you can count. Throughout the years, the bank went through many leadership changes, mergers, and acquisitions.

1850s: Early Years of Wells Fargo

Henry Wells and William Fargo founded Wells Fargo in 1852. This was during the California gold rush, when demand for reliable freight shipping and payment services increased tremendously. From its beginning, Wells Fargo was designed as an international company, opening its first office outside the US in Panama the same year it was founded.

A key gold transit point, the Panama office helped transport gold from California. In addition to expanding globally, Wells Fargo had an international mindset in other ways. For example, it enabled immigrants to send money back to Europe. As the gold rush era ended, Californians got used to the new California banking system with financial institutions in the picture.

In 1861, Overland Mail Company took control over the Pony Express, making Wells Fargo responsible for deliveries between Sacramento and Salt Lake City. The Pony Express was a faster alternative to the Overland stagecoach.

Back then, it took up to 25 days for mail to reach its final destination with stagecoaches. The Pony Express reduced the delivery time by more than half, with riders carrying mail in a leather saddlebag. As the Overland Telegraph became more popular, the Pony Express ended.

Wells Fargo upgraded its stagecoaches in 1868, as it remained responsible for the long-distance stagecoach lines in the western US. Stagecoaches have always remained an important part of Wells Fargo’s brand.

1900-1960s: Wells Fargo Separates its Express and Banking Services

In 1905, Wells Fargo & Co. separated its express and banking businesses, merging with Nevada National Bank to form the Wells Fargo Nevada National Bank.

The next year, the city of San Francisco suffered from the deadly 1906 earthquake. Wells Fargo Nevada National Bank building was also severely damaged, yet the company used its express operations to help evacuate patients from St. Mary’s Hospital.

As influential as Wells Fargo’s express business was, it ended in 1918. Between 1914 and 1918, during World War I, Wells Fargo transferred all its equipment to American Railway Express to help with the costs of the war. This meant closing over 10,000 express offices in the US.

Wells Fargo Bank continued to grow after the war, becoming a leading commercial bank on the Pacific Coast. It went through another merger, as Wells Fargo Nevada merged with Union Trust Company.

Years later, in 1967, Wells Fargo, then just a San Francisco bank operating only in California, managed to inspire other banks with a simple move: publishing full-colored checks. Wells Fargo had noticed the gap in the market and wanted to make the dull bank checks more interesting, so it created full-colored stagecoach check designs. A commercial success, the checks were advertised on billboards and television, inspiring people from all over the US to buy them. Soon, other banks started publishing more creative checks.

Along with three other California banks, Wells Fargo founded Master Charge in the late sixties. By 1969, Master Charge had become one of the largest credit cards in the US, with 21 million cardholders and 600,000 retail accounts in 49 states. An all-purpose charge card, consumers used Master Charge for retail purchases, travel, personal loans, entertainment, and other purposes. In 1979, Master Charge was renamed to Mastercard.

1970s-1990s: Wells Fargo Acquires Other Banks

In 1974, Wells Fargo started testing ATMs in its California branches, offering its customers easier ways of making deposits and withdrawing cash. Four years later, the bank launched a new generation of ATMs called the Express Stop. By 1981, there were 208 express stops in California.

Between the 60s and 80s, Wells Fargo expanded its international offices around the world. It also went on to acquire other institutions, namely banks.

Below is a table showing the banks Wells Fargo acquired during this period.

| Bank Name | Acquisition Date by Wells Fargo |

| Crocker National Bank | 1986 |

| Bank of America’s Personal Trust Business | 1987 |

| Barclays Bank of California | 1988 |

| Wells Fargo Nikko Investment Advisors (Joint venture with Nikko Securities) | 1989 |

| 130 California branches of Great American Bank | 1991 |

| First Interstate Bancorp | 1996 |

In 1995, Wells Fargo became the first major bank to offer internet banking services. At first, customers were only able to view their account statements. Soon, Wells Fargo added new features enabling money transfers and recurring bill payments. By 1999, one million Wells Fargo customers were using the bank’s online platform.

1990s: Norwest Corporation Merges With Wells Fargo Bank

In 1998, Norwest Corporation, the largest mortgage lender in the US at the time, announced a $34.4 billion deal to merge Wells Fargo’s bank with Norwest Corporation. The merged business took Wells Fargo’s name, with Norwest’s CEO Richard Kovacevich becoming the new company’s CEO. Paul Hazen, Wells Fargo’s former CEO, became the chairman of the combined bank.

As a result of the merger, Wells Fargo adopted Norwest Corporation’s business strategy: cross-selling. It involved selling multiple financial services to the same people, focusing on relationship banking. In 1999, Wells Fargo announced that it wanted each of its 15 million customers to sign up for eight different products, while the industry standard was two.

Despite its initial success, the cross-selling strategy put immense pressure on the bankers as they struggled to meet impossible sales goals. This pressure would eventually lead to one of the worst scandals in the history of banking.

2000s: Wells Fargo Acquires Wachovia

By 2007, Wells Fargo launched its mobile banking system and reached 10 million online banking customers. In the next five years, it continuously increased the number of its online banking customers and started offering its online services in Spanish.

In 2008, during the financial crisis, Wells Fargo acquired Wachovia for $15.1 billion in stock. Wells Fargo was based in San Francisco, on the West Coast of the US, and Wachovia in Charlotte, NC, on the East Coast. The purchase provided Wells Fargo with geographic expansion, as it now had a diverse network of coast-to-coast branches.

At the time of acquisition, Wachovia had assets of $812 billion, making it the fourth-largest banking organization in the US. Another major bank, Citigroup, was also interested in acquiring Wachovia. It had proposed $2.2 billion at about $1 per share, which Wachovia declined in favor of Wells Fargo.

Although Wells Fargo was mostly known for retail banking, it grew its investment banking operations after the Wachovia acquisition. By Q2 2009, the bank’s investment revenue had increased by 29%. The same year, it became the top mortgage lender in the country.

Besides Wachovia, Wells Fargo acquired other companies during this period, including Placer Sierra Bancshares (2007), Greater Bay Bancorp (2007), CIT Construction (2007), United Bancorp of Wyoming (2008), and Century Bank (2008).

2010s: Wells Fargo Faces Major Scandal

Three banks, including Bank of America, JP Morgan Chase, and Wells Fargo Bank, started clearXchange in 2011 as a person-to-person payment platform. A competitor to PayPal and Venmo, clearXchange allows users to send money using their friends’ names and phone numbers from their bank app. Six years later, the company changed its name to Zelle.

Wells Fargo’s cross-selling scandal was unveiled during this decade when the Consumer Financial Protection Bureau (CFPB) fined the company $185 million (a pittance for the multi-billion dollar conglomerate).

Between May 2011 and July 2015, Wells Fargo employees created over 2 million bank accounts or lines of credit on behalf of its customers without their knowledge. Given this number, 85,000 accounts resulted in fees worth approximately $2 million, and 14,000 credit card accounts generated fees worth more than $400,000 for the bank.

According to CNBC, the roots of the Wells Fargo scandal lay in the management of its sales department. Known for its strong sales culture, the bank reportedly pressured its employees into meeting extreme sales goals. A former Wells Fargo employee told the LA Times that if they couldn’t manage to open enough accounts on a given day, they had to stay until late.

As a result, employees invented customer accounts and signed up existing customers for products they weren’t even aware of. In 2013, an average Wells Fargo customer household had over six products in its account, four times higher than the industry average.

Researchers at Harvard Business Review found that Wells Fargo Bank opened at least 3.5 million fraudulent accounts. Besides illegal accounts, the bank was found to have violated laws protecting US military members and to have charged its customers unauthorized late fees.

The CFPB required Wells Fargo to reimburse all customers, hire an independent consultant to review its sales practices and pay the Civil Penalty Fund $100 million.

John G. Stumpf, who was Wells Fargo’s CEO between 2007 and 2016 when the scandal happened, resigned. He was later fined $17.5 million by the US government and banned from ever working at a bank again. Timothy J. Sloan took over as CEO and apologized for the bank’s sales practices, aiming to build trust again. The bank also fired four senior managers and 5,300 employees.

In 2018, Wells Fargo sold 52 physical bank branch locations in Indiana, Michigan, and Ohio to Flagstar Bank. Charles Scharf, former chairman and CEO of Bank of New York Mellon, became Wells Fargo’s new CEO in 2019, taking over as an outsider. Scharf acknowledged that it would take multiple years to make all the necessary changes to make Wells Fargo a better company.

2020s: Wells Fargo Continues its Operations Under Growth Restrictions

Wells Fargo has been continuing its operations under asset caps and growth restrictions. In 2018, the Federal Reserve imposed asset caps on Wells Fargo Bank, restricting it from growing any larger than its total asset size as of the end of 2017, which was $1.95 trillion.

Before Charles Scharf came into office, Wells Fargo executives had predicted the bank would satisfy the Federal Reserve’s requirements. Charles Scharf took a more prudent approach, prioritizing the bank’s regulatory issues moving forward. Executives expect the cap to be still in place in 2025, but Scharf highlighted the importance of not giving specific dates and taking time.

Wells Fargo’s bank does business in 22 countries, managing over 5,600 branches and 12,000 ATMs. It has over 200,000 employees and 68 million customers, remaining one of the biggest banks in the US. Despite its asset cap, it is the fifth-largest bank worldwide by market cap as of 2024. It ranks behind JPMorgan Chase, Bank of America, the Industrial and Commercial Bank of China (ICBC), and the Agricultural Bank of China.

Wells Fargo provides personal banking, investment and wealth management, as well as small business, commercial, and corporate banking services. It also runs the Wells Fargo History Museum in San Francisco’s financial district, telling the story of the brand over the two hundred decades it existed. Inside, visitors can see original stagecoaches, vintage banking machines, and historic coins.

Among Wells Fargo’s 16 business divisions, the banking-related ones include:

- Wealth & Investment Management: Proposing personalized wealth management, investment, and retirement products to clients.

- Consumer and Small Business Banking: Serving customers on digital channels, ATMs, and Wells Fargo’s retail network.

- Commercial Banking: Offering banking solutions to businesses that have annual sales of over $5 million.

- Corporate and Investment Banking: Providing commercial real estate, government, and institutional clients with transactional banking, commercial real estate lending, and investment banking services.

- Consumer Lending Business: Helping customers with their money-related goals, such as buying a house and taking a loan.

- Corporate Risk: Analyzing the credit risk, operational risk, and market risk for businesses to make smarter decisions.

- Strategy, Digital, and Innovation: Improving the online banking system to provide customers with a better digital experience.

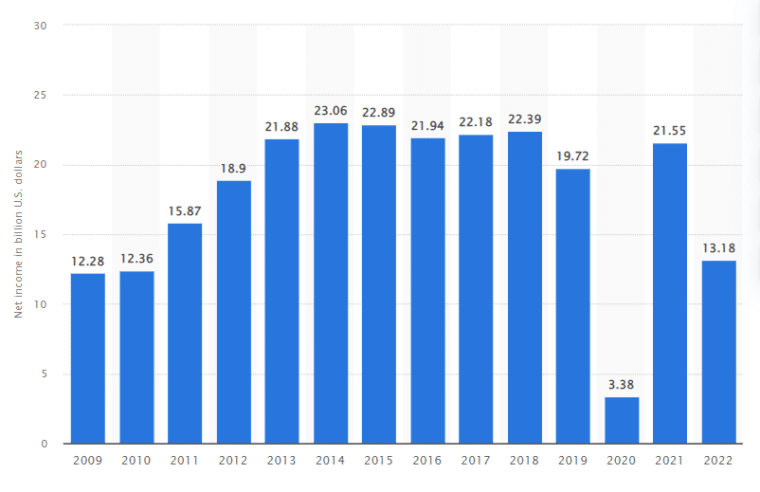

In 2022, the bank generated a net income of $13.2 billion, which is significantly lower than the previous year’s income of $21.55 billion. Over the past decade, its net income has fluctuated:

Wells Fargo Dividend History

Wells Fargo pays quarterly dividends to attract investment. In Q1 2024, it paid a quarterly dividend of $0.35 per share, increasing from Q3 2023’s $0.30 per share. This amounts to an annual dividend yield of 2.88%. In Q3 2020, it had to cut its dividends by over 80%, decreasing from $0.51 to $0.10, due to the Federal Reserve’s stress test during the COVID-19 pandemic.

Here is how much Wells Fargo paid at the end of the last quarter of the year between 2013 and 2023.

| Period | Dividend Paid Per Share |

| Q4 2013 | $0.30 |

| Q4 2014 | $0.35 |

| Q4 2015 | $0.375 |

| Q4 2016 | $0.38 |

| Q4 2017 | $0.39 |

| Q4 2018 | $0.43 |

| Q4 2019 | $0.51 |

| Q4 2020 | $0.10 |

| Q4 2021 | $0.20 |

| Q4 2022 | $0.30 |

| Q4 2023 | $0.35 |

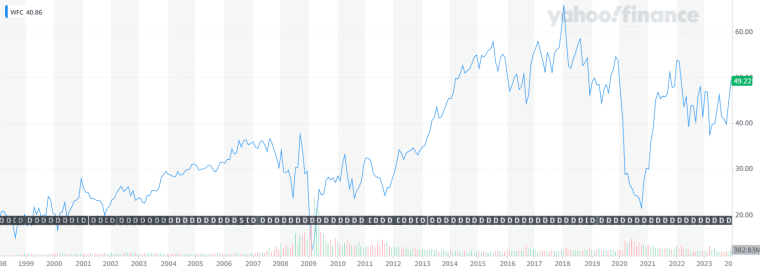

The Wells Fargo stock has experienced several declines throughout its history, especially in 2008-2009 during the financial crisis, in 2016 after the cross-selling scandal, and in 2021 during the Federal Reserve’s stress test.

Its highest end-of-day price was in 2018 at $65.93 per share on 26 January 2018.

History of the Wells Fargo Logo

For Wells Fargo, stagecoaches are both part of its heritage and a symbol of moving forward. Since 1852, the company has used them in its logo for both these reasons.

Between 1852 and 2009, for over a century, Wells Fargo’s logo consisted of a stagecoach and six horses, with the company’s name in capital letters underneath. After the Wachovia acquisition, Wells Fargo changed its logo colors from black to red and yellow, while continuing to use the stagecoach emblem.

In 2019, Wells Fargo went through a brand refresh, updating its logo and visual identity. This change symbolized Wells Fargo’s commitment to progress after the company-wide changes it had made since the 2016 scandal. As a part of the “This is Wells Fargo” campaign, the iconic Wells Fargo stagecoach got a more modern look, and the red and yellow brand colors adopted a digital-friendly tone.

“‘This is Wells Fargo’ and the changes to our stagecoach and logo will pay homage to our history while signaling our transformation to a contemporary, dynamic, and ever more innovative bank,” said Jamie Moldafsky, chief marketing officer.

The Future of Wells Fargo

In 2016, after the cross-selling scandal, Wells Fargo went through a transformation, revising its future goals and company culture. Some of the major changes it made were assigning new leaders, eliminating the product sales goals for retail bankers, launching customer-focused products, working toward employee retention, and firing thousands of people.

The Federal Reserve’s asset caps restrict Wells Fargo’s future growth though they are expected to be lifted in 2025. In the 2023 Goldman Sachs US Financial Services Conference, CEO Charles Scharf said the asset cap did not limit Wells Fargo’s activities, but it could in the future.

As for its activities, the company has been investing in quantum computing and AI in banking. It has formed strategic partnerships with leading institutions like IBM, MIT, and QCWare, publishing research papers on algorithms and software solutions for the future of quantum.

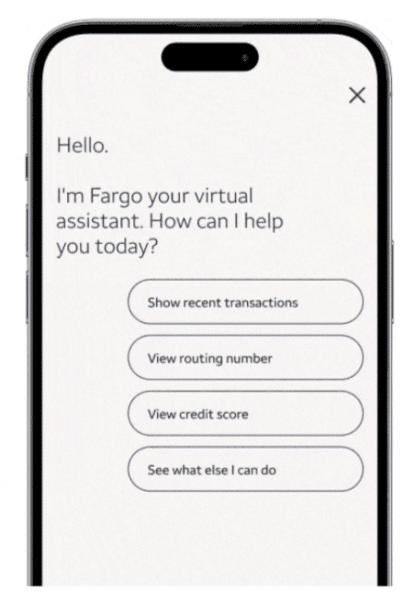

Wells Fargo has an AI-powered virtual assistant called Fargo, aiming to help customers identify spending patterns, manage card limits, provide insights, and more.

In less than a year after its launch in March 2023, Fargo handled 20 million interactions. According to the company’s chief information officer, Chintan Mehta, it will be able to do 100 million or more interactions per year as it gets upgraded.