Founded in 1957 in Chicago, Hyatt Hotels quickly became synonymous with luxurious resorts through resilience and meticulous expansion strategies. In November 2024, Hyatt’s net worth reached $15.44 billion.

In this article, our expert team at Business2Community has highlighted key information about Hyatt’s net worth history and analyzed its forward-thinking business plans. Drawn from a multitude of sources, our report offers the most up-to-date and reliable statistics for your next investment planning session.

Hyatt Hotels Key Company Data

Hyatt Hotels Net Worth: $15.44 billion

Date Founded: March 1957

Founded by: Jay Pritzker, Robert Pritzker, and Donald Pritzker

Current CEO: Mark Hoplamazian

Industries: Hospitality

Hyatt Stock Ticker: NYSE: H

Dividend Yield: 0.39%

What is Hyatt Hotels’ Net Worth?

As of November 2024, Hyatt Hotels’ net worth, AKA market cap, is $15.44 billion with a stock price of $153.89 and 99.10 million shares outstanding.

Hyatt first went public in 1962. However, only 17 years later in 1979, the Pritzker family, which founded the company, decided to privatize the growing hospitality brand to regain control.

It wasn’t until November 2009 that Hyatt held its next initial public offering (IPO) on the New York Stock Exchange. At that time, the global economy still felt the lingering effects of the 2008 financial crisis. Reuters reported that Hyatt’s revenue saw an 18.5% decline in the first half of 2009. Going public was a strategy to raise funds and recover from the turmoil.

The Hyatt IPO offered 38 million shares at $25 per share, raising around $950 million, which went to the Pritzker family. Its underwriters, led by Goldman Sachs, bought 5.7 million additional shares, pushing up the total value of the IPO to $1.09 billion.

Following the 2008 financial crisis, the forward-thinking brand decided to continue its international expansion to diversify risks and its portfolio. However, it proved to be another risk as key economic leaders like China showed signs of slowing down in the mid-2010s.

In 2015, most international hotel chains including Hyatt, Hilton, and Starwood recorded lower-than-expected occupancy rates due to the uncertainty brought about by China’s economic situation in terms of global tourism. As a result, Hyatt’s net worth fell from $8.98 billion in February 2015 to $5.27 billion in January 2016.

To cope with the situation, Hyatt expanded its portfolio through acquisitions to consolidate its market share. Its market cap climbed back up to $9.83 billion in January 2018.

Just like competitors in the hospitality sector, Hyatt was hard hit by COVID-19. Hyatt’s net worth went down from $9.17 billion at the beginning of 2020 to $4.48 billion at its lowest point in March that year.

The company suspended most of its operations while showing great support for healthcare workers in the US by offering them sponsored vacations together with American Airlines. The move demonstrated its financial strengths, placing confidence in its investors.

As COVID restrictions eased, the hotel chain titan was on a steady road of recovery. Between its low point in March 2020 to November 2024, Hyatt’s net worth tripled to $14.70 billion.

Hyatt’s financial year ends on December 31 with a full financial report published on its website within the next quarter.

Hyatt Hotels’ Revenue

Before Hyatt went public in 2009, it wasn’t required to publicly disclose its earnings. In the year of its IPO, the company recorded a revenue of $3.33 billion.

In 2017, as China gradually recovered from its 2015 recession that impacted the hotel industry, Hyatt pushed out the good news that it would continue its partnership with Expedia as well as better-than-expected interim financial reports. The Chicago-based hotel provider also made a statement to sell $1.5 billion worth of properties to increase liquidity and distribute more cash back to investors.

The series of positive company news nourished revenue growth. Together with strong growth in global tourism in the late 2010s, Hyatt’s revenue saw a rise from $4.33 billion in 2015 to $5.02 billion in 2019.

However, the world’s optimistic outlook for tourism growth in 2020 was destroyed by COVID-19. Hyatt’s income shrunk by more than half within one year, down to $2 billion in 2020. It would take the company two full years to return to its pre-pandemic scale, hitting $5.89 billion in 2022.

In 2023, Hyatt’s full-year revenue was $6.67 billion.

| Year | Revenue ($ billions) |

| 2015 | 4.33 |

| 2016 | 4.43 |

| 2017 | 4.53 |

| 2018 | 4.45 |

| 2019 | 5.02 |

| 2020 | 2.07 |

| 2021 | 3.03 |

| 2022 | 5.89 |

| 2023 | 6.67 |

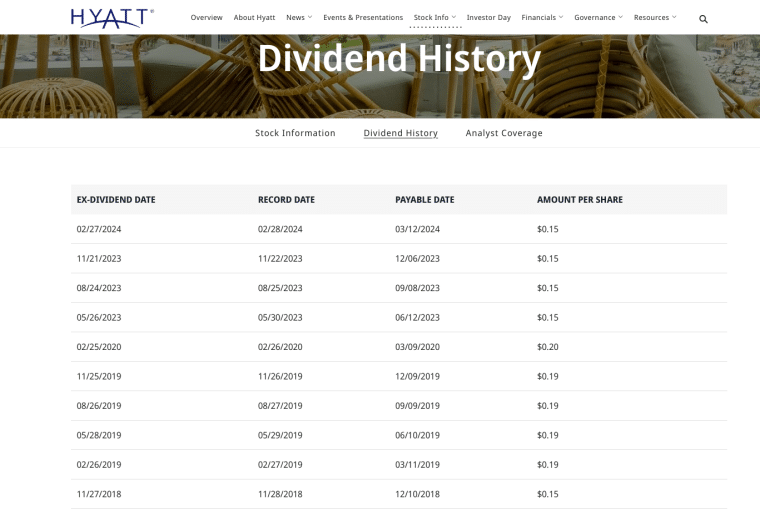

Hyatt Hotels Dividend History

For the first 9 years after it became publicly listed on the NYSE, Hyatt Hotels didn’t pay dividends in order to retain earnings for further development and business expansion plans.

It paid its first dividend on March 21, 2018, at $0.15 per share. The company paid dividends four times in 2018 and 2019.

Hyatt managed its last dividend payout of $0.20 per share in February 2020 before COVID put a 3-year pause on it. Its dividend payouts resumed in May 2023 at $0.15 per share. Since then, it has paid dividends regularly, 3 times in 2023 and 4 times in 2024.

| Date | Dividend Payout ($) |

| 05/28/2019 | 0.19 |

| 8/26/2019 | 0.19 |

| 11/25/2019 | 0.19 |

| 2/25/2020 | 0.20 |

| 5/26/2023 | 0.15 |

| 8/24/2023 | 0.15 |

| 11/21/2023 | 0.15 |

| 2/27/2024 | 0.15 |

| 5/28/2024 | 0.15 |

| 8/16/204 | 0.15 |

| 11/22/2024 | 0.15 |

Who Owns Hyatt Hotels?

Hyatt Hotels Corporation has a dual-class ownership structure and is predominantly owned by the Pritzker family.

The Pritzkers hold over 81% of the company’s shares. Meanwhile, the largest institutional shareholder of class A stock is BAMCO, Inc., which owns 12.8% of the company. The next highest ownership is in the hands of BlackRock with 9.93% and Vanguard Group with a 9.83% holding.

This allows the family to maintain significant control over the company’s direction, making it one of the few major hospitality chains still primarily family-owned.

Their influence is felt not just in operations but also in long-term strategic initiatives.

Who is the Hyatt Hotels CEO?

Mark Hoplamazian has been the CEO of Hyatt Hotels Corporation since 2006 when he took over from Thomas Pritzker.

He has steered Hyatt through some of the most turbulent times in modern history, including the global financial crisis of 2008 and the COVID-19 pandemic.

Under his leadership, Hyatt implemented critical cost-cutting measures, expanded its portfolio with wellness brands, and invested in technology to adapt to changing customer needs.

His leadership continues to focus on customer-centric innovations and operational efficiency, helping Hyatt thrive in an ever-changing industry.

Throughout his tenure, he has focused on creating value for guests, customers, colleagues, owners, and stockholders by:

- Maximizing Hyatt’s core business

- Integrating new growth platforms

- Optimizing capital deployment

Under his leadership, Hyatt Hotels annual revenue increased from $3.4 billion in 2006 to over $6.67 billion in 2023.

In 2022, Hyatt Hotels CEO received compensation of $16.6 million in 2022, down from $24 million in 2021. In 2020, when the pandemic significantly impacted global activity, Hoplamazian waived 100% of his salary.

There have been four other CEOs prior to Hoplamazian:

| Period | CEO Name |

| 1957 -1986 | Jay Pritzker & Donald Pritzker |

| 1986 – 1994 | Darryl Hartley Leonard |

| 2004 – 2006 | Thomas Pritzker |

| 2006 – Present | Mark Hoplamazian |

Growth and Development of Hyatt Hotels

Headquartered in Chicago, Hyatt Hotels Corporation is a leading global hospitality company with a mission to care for guests, all while providing distinctive experiences.

Hyatt’s portfolio of properties consists of full-service hotels and resorts, select-service hotels, all-inclusive resorts, and other properties, including timeshare, fractional, and other forms of residential and vacation units.

Hyatt Hotels Corporation generates revenue mainly through:

- Management and hotel services

- Licensing its portfolio of brands to franchisees

- Owned and leased hotel operations

- Distribution and destination management services

- A paid membership program

Let’s run through the significant milestones for the company so you can understand how the company developed a global brand.

The History of Hyatt Hotels – Key Dates

- The first Hyatt Hotel opened its doors in 1957.

- In 1962 Hyatt first went public.

- Jay Pritzker bought out public shareholders, taking Hyatt Corporation and Hyatt International Corporation private in 1979 and 1982, respectively.

- By 1992, Hyatt had transformed from a single hotel into one of the world’s largest hotel chains, boasting more than 200 hotels and resorts worldwide.

- As of 2024, Hyatt’s portfolio included more than 1,300 hotels and all-inclusive properties in 77 countries across six continents.

1957- 1967: Strong Foundations

Hyatt’s story began when Jay Pritzker bought Hyatt House, a small motor lodge near the Los Angeles International Airport (LAX) in 1957.

Over the next decade, Jay Pritzker and his brothers Robert Pritzker, who earned an industrial engineering degree at the Illinois Institute of Technology in Chicago, and Donald Pritzker who finished law school in 1959, put their expertise together to establish the company as a market leader.

With three successful divisions – Hyatt House hotels, Hyatt Chalet motels, and Hyatt Lodges – Hyatt went public in 1962.

Strategically shifting its focus from the West, the company moved east with a property in Lincolnwood, Illinois, near the Pritzkers’ home.

Hyatt opened three new regional sales offices in 1964 to strengthen its presence in key markets. The company also set up a toll-free, direct reservation line to Hyatt House Hotels across 36 major cities.

In 1967, Hyatt opened the first park Hyatt hotel with an atrium tower lobby.

Designed by architect John Portman, the Hyatt Regency Hotel in Atlanta featured a unique concept where each hotel room entered directly into a high-rise open space, instead of an impersonal hallway.

The contemporary atrium-style hotel was created by John C. Portman Jr. for Hyatt Regency Atlanta. His revolutionary design influenced hotel creation for decades after its opening in 1967. pic.twitter.com/h3KrEvqvx8

— Hyatt Regency (@hyattregency) February 29, 2024

The revolutionary architecture was recreated in hotel lobbies around the world, reshaping the lodging industry and positioning Hyatt as a global hospitality leader for decades to come.

1968 – 1978: Hyatt Goes Global and Diversifies Interests

Hyatt’s global plans took shape in 1968 with the formation of Hyatt International, a separate public company designed to support international expansion.

Boasting 12 hotels in the US, Hyatt opened its first international hotel, the Hyatt Regency Hong Kong in 1969. The international deal was structured as a management contract for the existing President Hotel in Hong Kong.

Domestic growth continued, with the Hyatt Regency O’Hare opening its doors in 1971. To streamline customer service, Hyatt opened a central reservations office in Omaha, Nebraska in 1972.

The same year, Hyatt formed Elsinore Corporation, a subsidiary that operates the Four Queens Hotel and Casino, and the Hyatt Regency Lake Tahoe Resort, Spa & Casino. Just a year later, the Hyatt Regency San Francisco opened its doors.

By 1976, the company’s impressive growth saw the company managing more than 50 hotels. This period of expansion also marked the debut of the first Regency Club offering exclusive amenities and services.

1979 – 1989: Privatization and Strategic Shifts

The Pritzker family consolidated their ownership of Hyatt in the early 1980s. Jay Pritzker bought out public shareholders, taking Hyatt Corporation private in 1979 and Hyatt International Corporation private in 1982.

Hyatt’s portfolio expanded in 1980 with the opening of the Park Hyatt in Chicago and the Grand Hyatt in New York. The Grand Hyatt New York was co-owned by property mogul and former US President Donald Trump until 1996 when he sold his share to the Pritzkers for $140 million. It has since been slated for redevelopment.

A tragic incident occurred on July 17, 1981, when the Kansas City Hyatt Regency Hotel walkway collapsed, resulting in 114 deaths and over 200 injuries.

In November 1986, the company announced a shift in strategy. They planned to build 40 smaller hotels for $750 million in suburban markets, diversifying from their focus on catering to business travelers in major urban areas. This was also the year Darryl Hartley-Leonard was appointed Chief Executive Officer.

To broaden its appeal, Hyatt introduced the Camp Hyatt program in 1987, aiming to attract more families to its somewhat business-oriented facilities.

In 1988, the Pritzkers’ brother-in-law, Skip Friend Jr., was brought in to oversee Hyatt’s growth as the Chairman. However, it was later revealed that Friend misused company money for personal expenses.

That same year, the Equal Employment Opportunity Commission ruled that Hyatt Hotels engaged in racial discrimination by prohibiting black female workers from wearing their hair in cornrows.

1990 – 2000: Digital Evolution and Franchising

1990 saw a turning point for Hyatt, as it introduced the Feel the Hyatt Touch tagline and the new Hyatt crescent logo symbolizing Hyatt’s “sunrise-to-sunset service.”

The year 1994 marked another shift, with the company moving into franchising for the first time. The first two franchised Hyatts were the Hyatt Sainte Claire in downtown San Jose and the Hyatt Regency Pier Sixty-Six in Fort Lauderdale.

Hyatt further diversified in 1994, venturing into the riverboat gambling industry with the opening of the Grand Victoria Casino in Elgin, Illinois. This venture was an immediate success, generating revenues of $37 million in just a fraction of the year.

Hyatt continued its expansion in 1995, entering the vacation ownership market with the Hyatt Sunset Harbor in Key West, Florida. The company also launched its website, Hyatt.com, and established the Hyatt Residence Club.

In 1996, Darryl Hartley-Leonard left the company to continue running Regency Productions, a Hyatt affiliate specializing in sports events production.

Building on the success of its franchising model, the company opened a third franchised Hyatt in 1997: a new downtown convention hotel called the Hyatt Regency Wichita.

Hyatt made headlines in 1998 when the Grand Hyatt Shanghai was named the world’s highest hotel, occupying floors 53 to 87 of an 88-story tower.

By mid-1998, Hyatt had further strengthened its portfolio, purchasing the Grand Hyatts in New York and San Francisco along with the Hyatts in Deerfield, Illinois, and Miami. The company also owned about a third of the rooms in various Hyatt properties.

The chain experienced a profound loss in January 1999 when Jay Pritzker died. Under his leadership, Hyatt transformed from a single hotel to one of the world’s largest hotel chains, boasting more than 200 hotels and resorts worldwide.

2001 – 2011: Consolidation and Digital Expansion

On December 31, 2004, the Pritzker family consolidated their hospitality holdings under a single entity: Global Hyatt Corporation. This move brought Hyatt Corporation and Hyatt International Corporation together.

That same year, Hyatt acquired AmeriSuites (later branded as Hyatt Place in 2006), an upscale chain of all-suite business class hotels.

In 2006, Hyatt acquired Summerfield Suites, marking its entry into the extended stay market.

The year 2007 saw several significant developments. Hyatt debuted its Andaz brand on Liverpool Street in London. It also sold Microtel Inns & Suites and Hawthorn Suites hotel brands to Wyndham Worldwide.

Hyatt’s Park Hyatt, Shanghai, also received the title of the world’s highest hotel for the second time. This time, it occupied floors 79–93 of the 101-story Shanghai World Financial Center.

To reflect its brand and core business, Global Hyatt Corporation changed its name to Hyatt Hotels Corporation in 2009. This move positioned Hyatt Hotels Corporation as the parent entity of around 380 hotels and resorts globally.

Shortly after announcing plans to go public in August 2009, the hotel chain became embroiled in a housekeeping scandal. 98 room cleaners were fired and replaced with cheap labor.

This sparked national outrage as well as calls for a nationwide boycott.

By 2011, Hyatt’s select service brands had expanded internationally.

The company also acquired a portfolio of assets from LodgeWorks, L.P., and its private equity partners, adding twenty hotels and the management or franchise rights to an additional four hotels to Hyatt’s portfolio.

2012 – 2022: Expansion and Diversification

2012 marked the rebranding of Hyatt Summerfield Suites as Hyatt House. Drawing on insights gained over a year of research, Hyatt Hotels Corporation launched a new Hyatt.com website to enhance the guest experience.

In 2013, Hyatt opened the Hyatt Ziva and Hyatt Zilara brands in Mexico, entering the fast-growing segment of all-inclusive resorts.

The Hyatt Centric brand was launched two years later with a location in Chicago, pioneering accessible, chic lodgings in prime city locations.

Hyatt revealed that between August 13 and December 8, 2015, information-stealing malware infected nearly 50% of its hotels (250 out of 627). The cyberattack that potentially compromised customer financial data.

By 2016, Hyatt welcomed its 12th brand, The Unbound Collection by Hyatt, which introduced guests to a whole new range of experiences. That same year, Hyatt entered the well-being space with its acquisition of the Miraval brand.

In 2018, the hospitality giant completed its acquisition of Two Roads Hospitality, expanding its hotel and resort portfolio with brands like Alila, Destination by Hyatt, JdV by Hyatt, and Thompson Hotels.

The company also announced two new hotel brands: Caption by Hyatt and UrCove, a joint venture with BTG Homeinns Hotels Group to serve China’s expanding upper-midscale market. Hyatt also expanded its Small Luxury Hotels of the World destinations and made new alliances with American Airlines and Lindblad Expeditions.

During the pandemic, Hyatt announced a global well-being collaboration with Headspace, offering members access to meditations and sleep exercises through the World of Hyatt app and in-room at participating hotels.

Hyatt also became the first hospitality brand to commit to the Global Biorisk Advisory Council® (GBAC) STAR™ accreditation, enhancing its existing safety and cleanliness protocols.

In 2021, Hyatt announced its acquisition of Apple Leisure Group (ALG), a leading luxury resort-management services, travel, and hospitality group.

Through this deal, the company gained a unique collection of resort brands consisting of more than 100 hotels and resorts across 10 countries.

That same year, people called for a boycott of Hyatt for hosting the Conservative Political Action Conference (CPAC) at its Hyatt Regency Hotel in Orlando, Florida.

2023 – Present: Challenges and Expanding Horizons

In 2023, Hyatt’s vast global presence included more than 1,300 hotels and all-inclusive properties in 77 countries across six continents. The company’s offering included well-known brands which include:

- Park Hyatt

- Grand Hyatt

- Hyatt Regency

- Hyatt

- Hyatt Vacation Club

- Hyatt Place

- Hyatt House

- Hyatt Vivid Hotels & Resorts

- Alua Hotels & Resorts

That same year, Hyatt’s reputation took a hit when Texas Attorney General Paxton sued the company for deceptive trading practices. According to Paxton, the company misled consumers by charging illegal fees and advertising hotel rooms at artificially low rates.

More controversy followed the chain into 2024. In January, unsealed court documents linking Tom Pritzker, Executive Chairman of Hyatt Hotels, to convicted sex offender Jeffrey Epstein sparked outrage and more calls for a boycott of Hyatt hotels on social media platforms.

That same month Penny Pritzker, now a Harvard Corporation senior fellow, also faced calls for her resignation due to involvement in Harvard President Claudine Gay‘s plagiarism scandal – a campaign against the academic by activist investor Bill Ackman.

2009 – 2014: IPO and Beyond

In August 2009, Hyatt Hotels Corporation announced its intention to raise up to $1.15 billion through an initial public offering (IPO).

On November 10, 2009, Hyatt completed its IPO, pricing 38,000,000 shares of Class A common stock at $25 per share, and began trading on the New York Stock Exchange under the symbol H.

Shares opened at $27.00, reaching a high of $28.26, and closing at $28.00 on the first day. The trading volume was notably high at 19,384,900 shares, indicating significant interest in the stock.

Following the IPO, Hyatt’s stock showed volatility but trended upwards, reflecting the company’s growth and recovery after the 2008 financial crisis. On December 29, 2010, Hyatt shares hit a high of $46.25.

Despite a dip to $37.74 by June 21, 2013, the share price surged to a new high of $64.52 on September 19, 2014.

2015-2019: Growth and Dividends

Hyatt continued its global expansion and portfolio diversification during this period, with its stock price reflecting market fluctuations and operational performance. The share price reached $58.05 on December 19, 2016, and a new high of $70.48 on November 2, 2017.

On March 29, 2018, Hyatt paid its first dividend of $0.15 per share, with the share price surpassing $77. The company has since paid dividends three times a year (except for 2020).

2020-2024: Pandemic Resilience

From pandemic lows of $40 in April 2020, Hyatt’s shares rebounded to $97.15 on December 29, 2021, and $108.10 on February 16, 2022. Further growth followed, with shares reaching $133.62 in December 2023.

With a closing price of $155.47 as of April 3, 2024, Hyatt’s stock price represents a 522% growth rate since its IPO.

History of the Hyatt Hotels Logo

From the beginning until 1990, the original Hyatt logo was characterized by a monochromatic theme and featured the brand’s name in a sophisticated and clean sans-serif typeface with the “Hyatt” parts separated from “Hotels & Resorts” by a circular emblem of a white four-petal flower placed on a black background.

Hyatt Hotels changed its logo in September 1990, eliminating the circular, “insect-like” logo that employees called ”the bug.”

The bug logo, created in 1971, was originally only meant for the Hyatt Regency O`Hare Hotel, which opened that year. It wasn’t until five or six years later, that it was adopted for all Hyatt hotels and resorts worldwide.

However, according to consumer research, customers considered the old logo ”tired, old-fashioned, stodgy and boring.”

Additionally, when Hyatt customers were shown the old symbol minus the Hyatt name, more than half didn’t know what it stood for.

So, Hyatt spent a whopping $1 million on a logo that was modern, colorful, and more recognizable.

The updated logo, above, also showcased a stylized version of the Hyatt name within a rectangular frame of red, white, gray, and dark blue — colors aligned with the chain’s stylish and contemporary image.

Meanwhile, the crescent in the new design symbolized the “relaxing and enjoyable sunrise-to-sunset experience” that Hyatt strived to provide its guests.

The 2013 redesign updated the logo’s blue and red color palette to light blue and white. The lettering was also made bolder and more modern to convey the brand’s quality and reliability.

The Future of Hyatt Hotels

Having navigated economic downturns, internal restructuring, and the pandemic, Hyatt stands as a model of resilience over the decades. For businesses seeking sustainable growth and resilience, the history of Hyatt holds valuable insights:

- Diversification is crucial: Hyatt’s diverse portfolio and various revenue sources showcase the importance of spreading risk. This adaptability has allowed the chain to remain resilient, and competitive in the face of challenges.

- Innovation drives success: Hyatt’s journey highlights the power of innovation. From its approach to design, guest services, and technology, Hyatt has always been at the forefront of shaping industry trends. This forward thinking has positioned the hotel chain as a global leader, pushing others toward improvement and innovation.

- Focus on customers: Hyatt’s commitment to understanding and exceeding customer needs through personalized services, loyalty programs, and unique experiences highlights the importance of putting customers first. This focus has fostered loyalty and sustained success for Hyatt.

According to Statista, the global hospitality industry is set to exceed $5.8 trillion in 2027. With its proven resilience, commitment to innovation, and unwavering customer focus, Hyatt is well-positioned to take advantage of growth opportunities.

Hyatt’s journey offers valuable lessons for businesses of all sizes. Its commitment to innovation, customer-centric services, and strategic adaptability demonstrates that growth requires balancing tradition with a forward-looking mindset.