From humble beginnings to pioneering accessible banking for all, HDFC Bank Ltd continues to transform India’s banking industry. For business owners, marketers or anyone intending to learn from successful business stories, the history of HDFC Bank is one of strong customer focus and innovation.

At Business2Community, we’ve researched the largest private sector bank in India and its key milestones, ensuring you have a clear picture of how it became a key player in the banking industry. Dive in as we explore HDFC Bank’s history, development, future, and more.

A History of HDFC Bank – Key Dates

- HDFC Bank Limited was incorporated in 1994 and began operations in 1995.

- In March 1995, HDFC Bank launched its first IPO of ₹50 crore or $16.1 million.

- By 2001, the bank was listed on the Bombay Stock Exchange, the National Stock Exchange of India Limited, and the New York Stock Exchange.

- In 2019, HDFC Bank recorded a net profit of ₹21,078 crore or $2.9 billion, a 614% increase from 2010.

- As of May 2024, the HDFC Bank had a market capitalization of ₹11,26,936 crore or $135 billion.

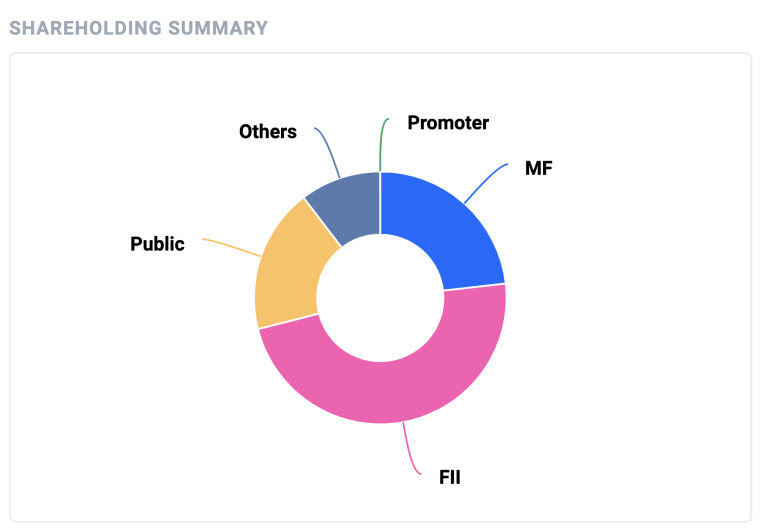

Who Owns HDFC Bank?

As a public limited company, HDFC Bank is owned by a diverse group of shareholders. The largest portion of ownership lies with foreign institutional investors (FIIs) who held 47.8% of the bank’s shares as of March 2024. Domestic institutional investors (DIIs) hold a significant stake as well, at 33.6%. The remaining 18.6% of the bank’s shares are held by the public, which includes individual investors and retail holdings.

Breaking the ownership structure down further, according to HDCF Bank, as of March 2023:

- The HDFC Group held 20.87% of the bank’s equity

- 18.43% of the equity was held by ADS Depositories in respect of the bank’s American depository shares (ADS)

- 26.30% of the equity was held by foreign institutional investors (FIIs)

- The bank had 22,90,092 shareholders.

How Was HDFC Founded?

HDFC Bank’s story began in 1977 when the Housing Development Finance Corporation Limited, or HDFC Ltd., was founded by Hasmukhbhai Parekh, a luminary in the Indian financial sector. Parekh’s understanding of the Indian economic landscape and his vision of providing housing finance to middle and low-income groups in India laid the foundation for HDFC Bank.

Against the backdrop of the Reserve Bank of India’s liberalization of the Indian banking industry in 1994, HDFC Bank Limited was formed by HDFC Ltd. As the premier housing finance institution in India, HDFC Ltd was among the first financial institutions to receive an “in principle” approval from the Reserve Bank of India (RBI) to set up a bank in the private sector.

In March 1995, HDFC Bank launched its first IPO of ₹50 crore (50 million equity shares at ₹10 each) which was about $16.1 million at contemporary exchange rates.

The IPO was successful, with the bank’s shares being oversubscribed by over 55 times. Within two months, HDFC Bank’s share price had increased by 300%.

In May 1995, HDFC Bank was listed on the Bombay Stock Exchange at ₹39.95 (₹ is the symbol for Indian rupees or INR). By November, the bank was listed on the National Stock Exchange of India Limited (NSE).

On July 20, 2001, HDFC Bank was listed on the New York Stock Exchange under the symbol HDB after an IPO of its American depositary shares (ADS) of $172.5 million. Each ADS, representing three underlying shares, was priced at $13.83. On the day of the ADS listing, the bank’s shares closed at ₹225 on the Bombay Stock Exchange.

On February 5, 2015, the bank’s ₹2000 crore (crore simply means ten million) or $324 million share offering was more than four times oversubscribed in India. Shares rose as much as 2.4% to around ₹546.

As of May 9, 2024, HDFC Bank’s share price was ₹1,447.50 ($17.34) and the bank had a market capitalization of ₹11,26,936 crore or $135 billion.

Who is the HDFC Bank CEO?

The CEO of HDFC Bank is Sashidhar Jagdishan, who has held the position since 2020. Jagdishan took over from Aditya Puri, who was CEO when the bank was founded.

During his tenure, Jagdishan has focused on technology adoption and transformation to help drive HDFC Bank’s ambitious future growth plans. Key initiatives under his Technology Transformation Agenda include:

- Infrastructure scalability

- Disaster recovery resiliency

- Security enhancements

- “Always On” monitoring mechanisms

As CEO and Managing Director of HDFC Bank, he received an annual remuneration of ₹10.55 crore or $128,345 for the year ended March 2023. This is up from ₹6.52 crore or $86,933.33 in 2022.

| HDFC Bank CEO | Tenure |

| Aditya Puri | 1994-2020 |

| Sashidhar Jagdishan | 2020-Present |

Growth and Development of HDFC Bank

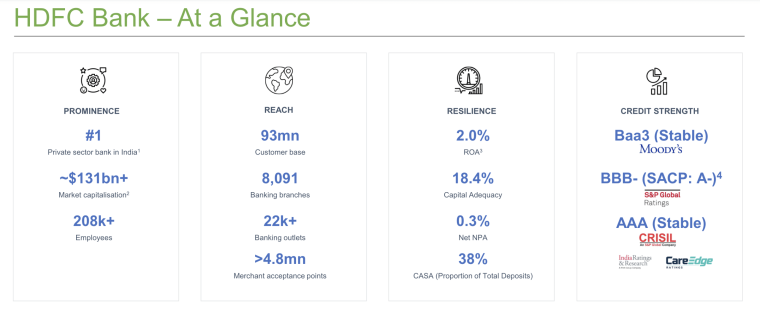

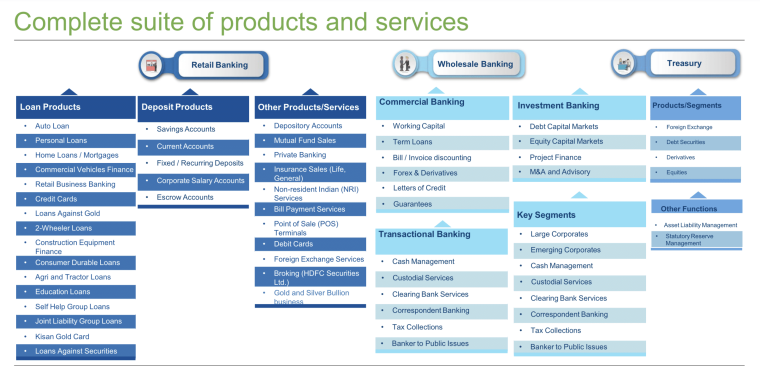

Headquartered in Mumbai, India, HDFC Bank offers a wide range of banking services covering commercial and investment banking on the wholesale side and transactional/branch banking on the retail side.

The bank prioritizes digital services, including:

- Net banking

- Mobile banking

- Various online payment solutions

All while maintaining the highest ethical standards, professional integrity, corporate governance, and regulatory compliance. Below, we explore the bank’s key developments and milestones.

1994 – 2000: Humble Beginnings

HDFC Bank LTD was incorporated in 1994 as a subsidiary of the Housing Development Finance Corporation LTD. The bank received its banking license and officially began operations as a Scheduled Commercial Bank in January 1995 at its Ramon House office in Churchgate, Mumbai.

In February 1995, HDFC Bank had its first corporate office and full-service branch at Sandoz House, Worli, Mumbai, inaugurated by Union Finance Minister Dr Manmohan Singh.

By 1996, HDFC Bank had been appointed as a clearing bank by the NSCCL and was the only bank in the country to provide custodial services, depository participant services, and clearing services on the NSE.

Following a total balance sheet of over ₹1000 crore in 1996 ($279 million at the time), the bank paid its first dividends in 1997.

Throughout 1997, the bank expanded its retail banking services, going from 20 branches in March 1997 to 37 in March 1998 and a total of 25 ATMs. The bank also introduced telephone banking in Mumbai and Delhi and launched its first retail lending product, Loans against Shares (which is rather self-explanatory).

In February 1999, the bank signed a strategic business collaboration deal with The Chase Manhattan Bank, bringing together Chase’s global network and product capabilities with HDFC Bank’s presence and expertise in the Indian market. That same year, it launched online real-time Net Banking and India’s first international debit card in partnership with Visa.

The year 2000 saw HDFC Bank merge with Times Bank. This was the first friendly merger of two private banks in the banking industry and the first done through a share swap deal. In other firsts, HDFC Bank was the first bank in India to launch SMS-based mobile banking.

By the end of the year, the bank’s branch network had grown from 57 to 111 branches nationwide.

2001 – 2007: Expanding Reach

In 2001, HDFC Bank became the first private sector bank authorized to collect income tax for the central government. Today, the bank is the second-largest collector of income tax in India. That same year, the bank launched its credit card business in over 40 cities and got ISO 9001 certification for its depository and custodial services.

During 2002 and 2003, the HDFC Bank’s ATM network expanded from 479 to 732, bringing greater convenience to banking customers throughout the country.

In September 2003, HDFC Bank broke into the housing loan market by partnering with HDFC Ltd.

By July 2004, HDFC Bank was the first bank in the country to offer credit cards in over 100 cities. The Health Plus international card, in particular, was India’s first credit card with free built-in cashless medi-claim (so holders don’t have to pay upfront for medical insurance claims).

In September 2005, the bank increased its stake in HDFC Securities Ltd, a leading stockbroker and financial services provider of products and services such as equity, gold, debt, fixed deposits, hybrid funds, and real estate. HDFC Bank’s stake increased from 29.5% to 55%, making HDFC Securities Ltd a subsidiary of the bank.

By the end of the 2007 financial year, HDFC Bank had increased its distribution network to 684 branches and 1,605 ATMs.

2008 – 2014: Diversifying

In May 2008, HDFC Bank acquired Punjab Ltd’s Centurion Bank for ₹9510 crore or $2.4 billion at the time. It was one of the largest mergers in the Indian financial sector, adding significant value to HDFC Bank in terms of an increased branch network, greater geographic reach, and a wider customer base.

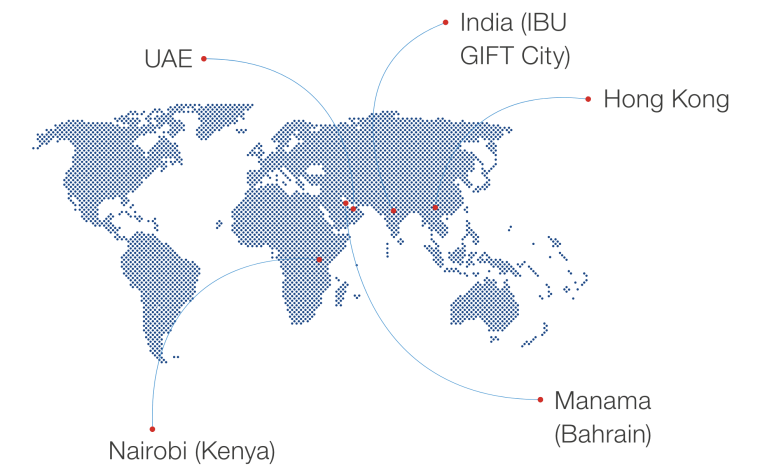

A few months later, the bank opened its first overseas commercial branch in Bahrain. The branch brought banking services such as treasury and trade finance products for corporate clients and asset management within reach for non-resident Indians.

In 2010, HDFC Bank launched a new range of ATMs that were 40% faster and became the first bank in Asia to offer customized ATM transactions such as saving favorite transactions.

Keeping in step with the market, HDFC Bank extended its banking services to auto and personal loans in 2011. The bank set itself apart from its rivals by offering customers flexible repayment options and more competitive interest rates.

Between 2013 and 2014, HDFC Bank became the largest issuer of credit cards in the country, with over 5.5 million outstanding credit cards at the end of October 2014, as per the Reserve Bank of India.

In 2014, the bank introduced the missed call banking service, allowing customers to use banking services without having to visit a bank branch or connect online. Within a few weeks, over a million customers were using the service. Additionally, the bank’s digital services offered over 135 transactions (the largest in India), 75 of which were available through its mobile banking offering, Go Digital.

2015 – 2021: Digital Advancement

By 2015, HDFC Bank was responsible for 55% of all digital banking transactions conducted in India via digital channels. That same year, the bank introduced the 10-second loan, making it the first bank in the retail lending space to fully automate loan approvals and disbursements. For even greater convenience, HDFC Bank introduced loans at ATMs.

Additionally, the bank launched its first-of-the-kind services, Chillr and PayZapp, as part of the Go Digital campaign. The services allowed customers to send and receive instant money on their mobile phones.

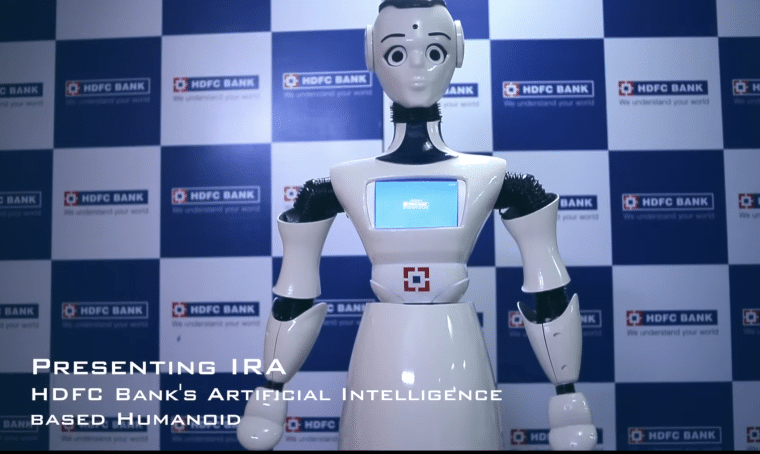

In 2016, the bank launched its missed call mobile recharge service, a simple yet revolutionary way for customers to top up their prepaid mobile numbers. Highlighting its commitment to great customer service, HDFC bank pioneered India’s first artificial intelligence (AI)-based chatbot for customer service, EVA.

In 2017, the bank’s own IRA, or Intelligent Robotic Assistant, was launched. It was another first of its kind in enhanced customer service. HDFC Bank also launched its Digital Loans Against Securities (Digital LAS) service, offering customers a fully streamlined online process of designing loans against shares.

HDCF Bank also became the first bank to introduce the DigiPOS machine in August 2017, offering a complete suite of digital payment options on a Point of Sale machine.

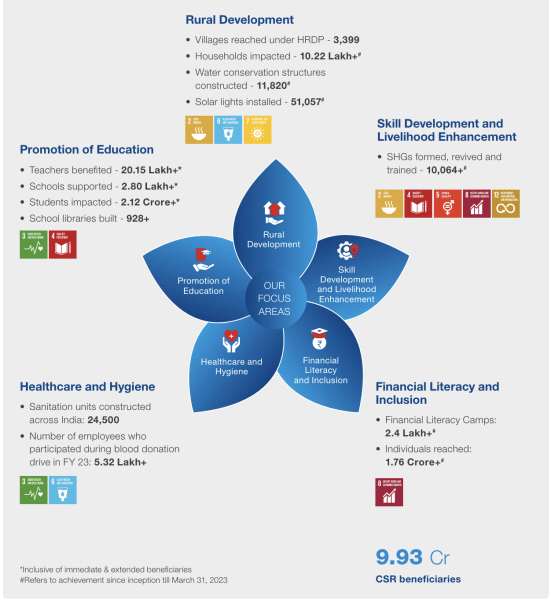

By 2018, HDFC Bank’s flagship rural development program spanned 17 states and had reached over 3.6 lakh (360,000) households across 1,100 villages.

When HDFC Bank celebrated its 25th anniversary in 2019, it recorded a net profit of ₹21,078 crore or $2.9 billion, at the time. This was a 614% increase from 2010 and the highest profit in HDFC Bank’s history to that point. The same year, the Reserve Bank of India handed down a fine of ₹10 million ($144,000) for ignoring Know Your Customer (KYC) rules and anti-money laundering processes for foreign remittances.

On 29 January 2020, RBI imposed a monetary penalty of ₹1 crore or $139,781 on HDFC Bank for non-compliance with KYC policies dating back to February 2016.

HDFC Bank appointed a new CEO that October, replacing Aditya Puri, the bank’s founder CEO. The bank was also ranked as India’s top brand for the 7th consecutive year, with its brand value increasing from $9.4 billion in 2014 to $20.3 billion in 2020.

Citing persistent outages in the bank’s digital services, the Reserve Bank of India directed HDFC bank to stop issuing credit cards and halt the launch of all its planned digital 2.0 initiatives in December 2020.

In 2021, HDFC Bank acquired a 9.99% stake in FERBINE, a pan-India umbrella entity (PUE) specializing in retail payments for ₹49,950. The bank also partnered with Paytm to launch co-branded business and consumer credit cards powered by Visa.

Joining other leading global brands, HDFC bank embarked on Project ‘Future Ready’ and pledged to become carbon neutral by 2032.

2022 – Present: A New Era

In March 2022, the Reserve Bank of India lifted all the restrictions it had placed on HDFC Bank’s planned digital 2.0 initiatives. By November 2022, the bank had launched SmartHub Vyapar, a one-stop merchant solution app for banking and business solutions.

As part of its digital transformation drive, HDFC Bank launched PayZapp App 2.0, providing customers with a seamless user experience and enhanced security features.

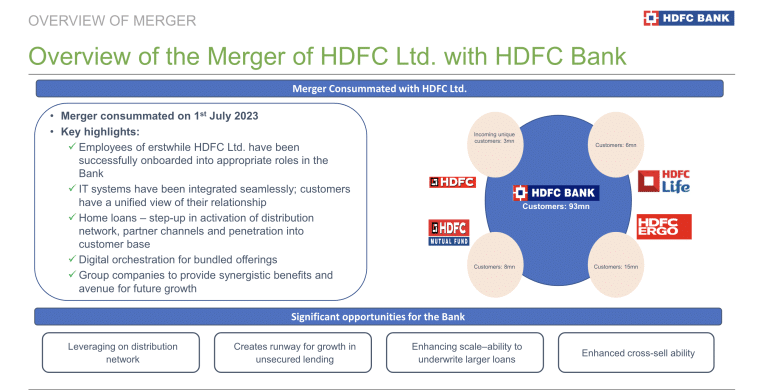

On July 1, 2023, HDFC Bank completed its merger with HDFC Limited. Post-merger, HDFC Bank became a leader in home loans, financial services, asset management, education loans, and more, through key HDFC subsidiaries such as:

- HDFC Securities Ltd.

- HDB Financial Services Ltd.

- HDFC Home Loans

- HDFC Credila

- HDFC Asset Management Company (HDFC AMC)

- HDFC ERGO General Insurance Co. Ltd.

- HDFC Sales

- HDFC Property Fund

- HDFC Life Insurance Co. Ltd.

Offering a full suite of financial services to a customer base of over 120 million, HDFC Bank became the fourth-largest bank in the world by market cap and the second-largest bank in India, after the State Bank of India.

In March 2023, HDB Financial Services, the non-bank lending unit of HDFC Bank, suffered a data breach. The breach exposed the data of more than 70 million customers, including email addresses, names, dates of birth, phone numbers, postcodes, and loan information.

Overall, for the financial year ended March 2023, HDFC Bank’s balance sheet sat at ₹24,66,081 crore or $300.22 billion, and net profit was ₹44,108.7 crore ($5.37 billion). The bank’s distribution network also stood at 7,821 branches and 19,727 ATMs and ash deposit and withdrawal machines (CDMs) across 3,811 locations.

By December 2023, this had increased to 8,091 branches and 20,688 ATMs across 3,872 locations, marking HDFC Bank’s new era of growth and development.

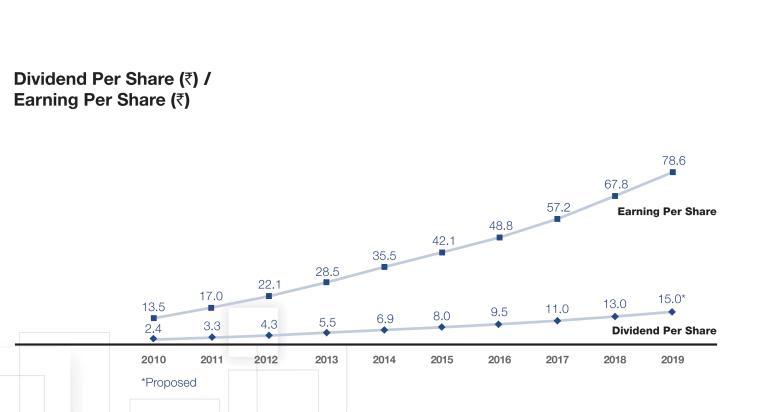

HDFC Bank Dividend History

HDFC Bank’s dividend payout history reflects its continued growth and commitment to increasing shareholder value.

- The late 1990s: The bank paid its first dividend of 8% or ₹0.08 per share in 1997. The average dividend payout in the late 1990s ranged between 8% and 13%. While the bank was still in the early stages of its growth, it still prioritized distributing profits to its shareholders.

- The 2000s: As the bank saw strong growth, the dividend payout increased significantly during the 2000s, going from 20% or ₹0.20 per share in 2001, 45% in 2005 and 100% or ₹1.00 in 2009.

- The 2010s: Throughout the 2010s, dividend payouts continued to trend upward, reflecting the bank’s rising profitability. The dividend payout jumped from 120% in 2010 to 400% in 2015 and then 750% or ₹7.50 per share in 2019.

- The 2020s: Due to heightened uncertainty caused by the COVID-19 pandemic, HDFC Bank didn’t pay any dividends in 2020. Dividend payouts resumed in 2021 with a dividend of 650%. This increased to 1,550% or ₹15.50 per share in 2022. For 2023, the bank paid a dividend of 1,900% or ₹19.00 per share.

History of the HDFC Bank Logo

HDFC Bank’s first logo was a grid-like emblem featuring four black and white cubes surrounding a single red square. The red, white, and black coloring was inspired by parent company HDFC LTD’s own logo.

1997: Out with the Old

HDFC Bank adopted a new logo in 1997. The new logo featured a blue and red grid design to reflect the bank’s modern and efficient persona.

1998: A Fresh Update

In 1998, the logo received a minor update. The grid and the HDFC Bank wordmark were merged into one cohesive logo.

2015: The MOGO

In 2015, HDFC Bank launched its sonic branding MOGO (musical logo) reflecting the bank’s values of trust and progressive change. The vibrant piece was used across multiple touch points such as ATMs, phone banking, the mobile app, and the website. It was designed to form a powerful emotional connection with customers and build recall among stakeholders.

The Future of HDFC Bank

HDFC Bank’s journey highlights the power of innovation. From the outset, the bank embraced India’s rapidly evolving financial landscape and pioneered digital banking. HDFC Bank’s success also highlights the importance of putting customers first. By offering an array of financial services and strategically expanding its footprint through subsidiaries, joint ventures, and associates, the bank built a broad and loyal customer base.

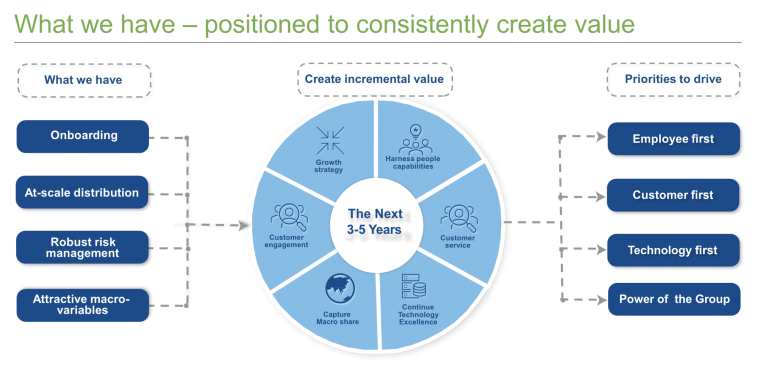

Looking ahead, HDFC Bank plans to return to its 20% growth rate. To achieve this, the bank will open another 1,400-1,500 branches in 2024 and take the number of branches to about 13,000 in 3-5 years. In addition to employee-, customer-, and technology-first strategies, HDFC also plans to exploit compelling opportunities in its macro environment:

- With real GDP growth of 6.3%, India has one of the fastest-growing economies in the world.

- The country’s high credit growth and stable, inter-operable infrastructure means the bank could potentially extend credit to 400-500 million people.

- India’s GDP per capita is up 1.7x from 2014, driving up demand for financial services.

- Increasing digital adoption is creating a potential customer base of 700 million active Internet users.

Overall, based on its history of continuous improvement, HDFC is attractively positioned to achieve its growth goals and capture a larger share of the Indian market.