What started as a small local delivery service has grown into a technology company that connects consumers with their favorite local and national businesses in more than 7,000 cities across the US, Canada, Australia, Japan, and Germany. DoorDash is now the leading online delivery platform in the US, with plans to dominate other key international markets.

In this comprehensive report, we’ve put together over 80 DoorDash statistics, ensuring you explore everything you need to know about the company’s revenue, usage, and more. Keep reading for a detailed look at one of the fastest-growing delivery platforms in 2025.

DoorDash Statistics Highlights

DoorDash Investment Data

DoorDash raised a total of $2.5 billion in funding over 8 rounds making it one of the largest recipients of funding in the online food delivery sector worldwide, along with Delivery Hero, Swiggy, and Zomato.

In 2013, DoorDash raised $2.4 million in a seed round led by Khosla Ventures.

Other key investors included Charles River Ventures (Saar Gur), SV Angel, Paul Buchheit (creator of Gmail), Pejman Mar Ventures (Pejman Nozad), Andy Rachleff (co-founder of Benchmark), and Russell Siegelman (former KPCB partner).

In 2014, DoorDash raised $17.3 million in Series A funding.

The funding round was led by Sequoia Capital, with participation from Khosla Ventures, Charles River Ventures, and Pejman Mar Ventures, along with Ted Zagat.

In March 2015, DoorDash raised $40 million in a Series B funding round.

This round was led by Kleiner Perkins Caufield & Byers with participation from existing investors Sequoia Capital, Khosla Ventures, and Charles River Ventures. As part of the financing, KPCB’s John Doerr joined DoorDash’s board.

DoorDash raised $127 million in a Series C round of financing in March 2016.

Sequoia Capital led the round with participation from existing investors including Kleiner Perkins and Khosla Ventures.

DoorDash raised $535 million in a Series D funding round in March 2018.

This round was led by the SoftBank Group with participation from existing investors Sequoia Capital, GIC, and Wellcome Trust. SoftBank’s Jeffrey Housenbold and GIC’s Jeremy Kranz joined Sequoia’s Alfred Lin and Kleiner Perkins’ John Doerr on DoorDash’s board of directors.

In August 2018, DoorDash raised a further $250 million in funding in a Series E round.

This funding round was led by Coatue Management and DST Global and saw the company’s valuation grow from $1.4 billion to $4 billion.

In February 2019, DoorDash raised $400 million in a Series F funding round.

The funding came at a $7.1 billion valuation and was led by Temasek and Dragoneer Investment Group, with participation from previous investors SoftBank Vision Fund, DST Global, Coatue Management, GIC, Sequoia Capital, and Y Combinator.

The company raised a further $600 million in a Series G funding round in May 2019.

The round brought DoorDash’s valuation to $12.6 billion and was backed by Darsana Capital Partners and Sands Capital, along with existing investors Coatue Management, Dragoneer, DST Global, Sequoia Capital, Softbank Vision Fund, and Temasek.

DoorDash made two notable acquisitions in 2019.

- In August 2019, it acquired Scotty Labs, a teleoperations startup company that focuses on self-driving and remote-controlled vehicle technology, for an undisclosed amount.

- In October 2019, it acquired Caviar, a service specializing in food delivery from upscale urban-area restaurants typically not offering delivery for $410 million.

In November 2019, DoorDash received $100 million in an extension of its series G in May.

According to Bloomberg, this round valued the company at $13 billion and was led by T. Rowe Price.

In June 2020, DoorDash raised $400 million in a Series H funding round.

This pre-IPO round was led by Durable Capital Partners and was joined by Fidelity and T. Rowe Price.

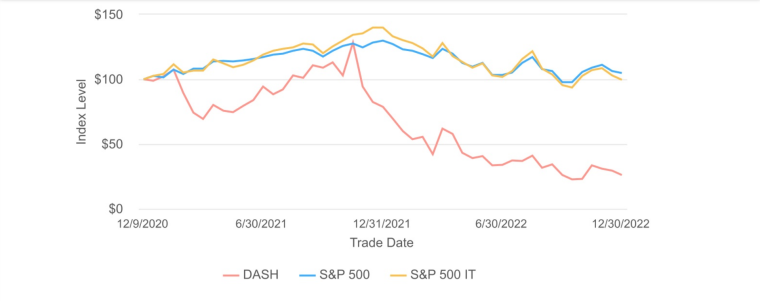

On December 9, 2020, DoorDash went public and hit a valuation of $72 billion.

In 2020, its seventh year of operation, DoorDash made its stock market debut at the public offering price of $102 per share. DoorDash shares surged 86% on their first day of trading to close the day at $189.51. The company raised $3.4 billion, making it one of the largest IPOs of the year.

In 2021, DoorDash announced its acquisition of Chowbotics.

Chowbotics is a robotics company known for its salad-making robots. DoorDash made the move to help merchants expand their current menu offerings and reach new customers in new markets.

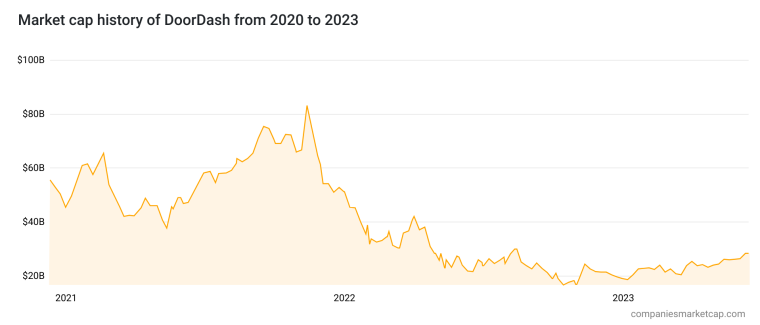

November 2021, a year post-IPO, DoorDash’s shares peaked at $257.25.

However, by March 2022, shares were trading at around $103.

In 2022, DoorDash made two notable acquisitions.

- On March 1, 2022, the company acquired Bbot Inc., a hospitality technology company.

- On May 31, 2022, DoorDash acquired Finnish company Wolt, a key player in the European food delivery market, for more than $8 billion.

As of June 14, 2023, DoorDash shares were trading at $73.10.

DoorDash shares were down almost 72% from their all-time high in 2021, but up around 15% from a 52-week low of around $41.

DoorDash had a market cap of $28.42 billion as of June 2023.

This puts it in the top 700 of the most valuable companies by market cap.

DoorDash Business Data

DoorDash’s mission is to grow and empower local economies by providing logistics, technology, and other services that enable local businesses to address consumers’ needs. The company does this primarily by building products and services that reduce friction in local commerce and by providing incremental earning opportunities.

DoorDash is headquartered in San Fransisco, California.

While headquartered in California, the company connects consumers with their favorite local businesses in more than 27 countries across the globe as of December 2022.

As of December 31, 2022, DoorDash had over 16,800 employees led by DoorDash founders Tony Xu (CEO), Andy Fang (CTO), and Stanley Tang (CPO).

In November 2022, the company laid off 1,250 corporate employees in an effort to cut costs. Additionally:

- 48% of employees identified as female and nonbinary people while 52% identified as male.

- Women and nonbinary people accounted for 44% of the leadership team.

- Underrepresented people of color made up 40% of the company’s US team, 11% of the leadership team, and 20% of managers.

In 2022, DoorDash supported $78 billion in economic activity in the US and $15.7 billion in tax revenues.

By enabling e-commerce and delivery for restaurants, grocery stores, and retailers, DoorDash supports significant economic activity, provides flexible earning opportunities to millions of Dashers, and extends the reach of local businesses of all sizes.

As of December 31, 2022, DoorDash had 206 issued US patents and 6 patents issued in foreign jurisdictions.

In addition, the company had 57 US patent applications pending, and 19 patent applications pending in foreign jurisdictions. DoorDash continues to invest in a patent program to identify and protect its strategic intellectual property in logistics, selection optimization, and other technologies relevant to its business.

As of December 31, 2022, DoorDash held 44 registered trademarks in the US and 122 registered trademarks in foreign jurisdictions.

The company also has common law rights in some trademarks and several pending trademark applications in the US and foreign jurisdictions.

In 2022, Project DASH achieved over 3.5 million lifetime deliveries of food on behalf of food banks, food pantries, and other social impact organizations.

This equates to an estimated 60 million meals delivered to people experiencing food insecurity. Launched in 2018, the project powers delivery on behalf of food banks, food pantries, and other hunger relief organizations.

Over 56 million deliveries were fulfilled by Dashers using low or no-emissions vehicles in 2022.

This resulted in approximately 37,000 metric tonnes of carbon emissions avoided relative to if the deliveries had been fulfilled using a standard gasoline-powered vehicle.

In 2022, DoorDash supported over 60,000 orders with reusable packaging in partnership with hundreds of merchants.

The company supported reusable packaging programs in the US, Estonia, Germany, Finland, and the Czech Republic and helped reduce the amount of single-use takeout containers. DoorDash also worked with TARPREC to recycle more than 2,500 Wolt courier partner delivery bags in 12 Wolt country markets, with a 96% waste diversion rate.

DoorDash Timeline and History

DoorDash is the leading online food delivery in the US and continues to break ground in Canada, Australia, Japan, and over 23 European countries. Below is a brief timeline of the company’s journey to market dominance:

- 2013 – DoorDash is founded by Tony Xu, Andy Fang, Stanley Tang, and Evan Moore in Palo Alto, California, and initially operates as a food delivery service for Stanford University students.

- 2014 – DoorDash expands its delivery service beyond Stanford University and begins serving the wider Bay Area in California.

- 2015 – DoorDash expands its services to Toronto, Canada, marking its entry into the international market.

- 2016 – DoorDash launches on-demand alcohol delivery.

- 2017 – DoorDash acquires Rickshaw and deploys robot delivery in select cities.

- 2018 – Caviar is acquired and the company introduces DoorDash Drive and DashPass.

- 2019 – DoorDash launches in Australia, introduces DashMart, and acquires Scotty Labs.

- 2020 – DoorDash launches Grocery delivery, files for an initial public offering (IPO), and introduces DoorDash for Work.

- 2021 – DoorDash expands its delivery services to Japan, marking its entry into the Japanese market. It also partners with PetSmart to provide on-demand delivery of pet essentials.

- 2022 – DoorDash partners with Sprouts Farmers Market, EG America, Big Lots, DICKS Sporting Goods, Sephora, and more. It also completes its acquisition of Wolt.

- 2023 – DoorDash introduces Package Pickup, launches Summer of Dash Pass, and partners with Lush Cosmetics, Victoria’s Secret, and Party City.

DoorDash Product Statistics

DoorDash’s primary product is the DoorDash Marketplace (now including Wolt) which operates in 27 countries. The platform serves three key stakeholders: Merchants, Consumers, and Dashers. Since its inception, DoorDash has completed over 900 million orders.

Since the beginning of 2020, DoorDash’s Marketplaces have driven over $100 billion in sales for local merchants.

Over 50% of these earnings were generated in the last 15 months and highlight DoorDash’s ability to help local merchants build and grow their businesses in any environment. In Q1 2023, DoorDash generated double-digit same-store sales growth for restaurants on the DoorDash Marketplace.

As per Q1 2023, total orders increased 27% year-over-year to 512 million from 404 million in Q1 2022.

Total orders compromise of all orders completed through its Marketplaces and Platform Services business. Growth in total orders was driven by growth in consumers and consumer engagement and the addition of Wolt.

At the end of 2022, total orders on DoorDash’s platform increased by 25% or 346 million.

Total orders went up by 25% from 1.3 billion to 1.7 billion, primarily due to growth in consumers, increased consumer engagement, and the acquisition of Wolt.

DoorDash experienced 18% growth in same-store orders on DoorDash Marketplace.

In addition, the company experienced 18% growth in same-store delivery orders and 12% growth in same-store pick-up orders on DoorDash Marketplace in 2022.

Consumer Product Statistics

DoorDash product offerings for consumers include access to online delivery or convenient pick-up in the following key categories:

- Restaurants

- Convenience

- Grocery

- Alcohol

- Pets

- Flowers

- Retail

DoorDash Consumer Product Offering

Description

DoorDash App

DashPass

DoorDash Drive

DoorDash Pickup

DoorDash Group Orders

DashMart

Wolt App

Wolt+

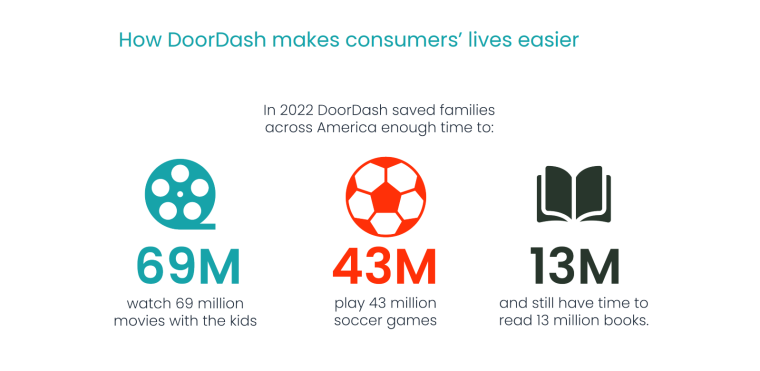

DoorDash saved consumers 378 million hours in 2022.

76% of consumers said that DoorDash helped them be more productive and gave them time back for other activities. In addition, 59% of immigrant consumers said they used DoorDash to find restaurants or merchants that reminded them of home.

75% of US consumers said they used DoorDash in 2022 because it was more reliable than other services.

In addition, 86% of consumers felt good about supporting local restaurants and merchants.

Restaurants

The top items ordered on DoorDash in the US in 2022 were fries, burgers, and pizzas.

However, compared to 2021, consumers are increasingly ordering healthier options such as salads and tacos.

Key highlights from DoorDash’s Restaurant Online Ordering 2023 Trends Report include:

- Menu pricing (51%) and menu selection (55%) are the top two things consumers look for when trying out new restaurants for delivery, takeout, or pickup.

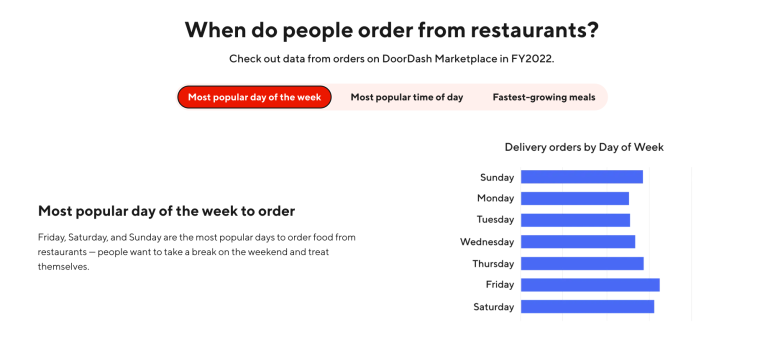

- Friday, Saturday, and Sunday remain the most popular days to order food from restaurants.

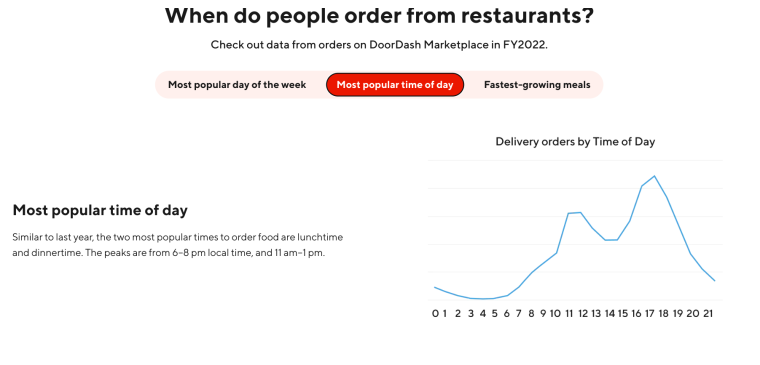

- Similar to 2022, the two most popular times to order food are lunchtime and dinnertime. The peaks are from 6 to 8 pm and 11 am to 1 pm.

- The biggest jump in 2023 was early morning orders between 12 and 5 am, followed closely by breakfast orders between 5 and 11 am. Late-night orders, between 9 and 12 pm, also jumped by 23%.

- 35% of consumers said they use DoorDash to provide gifts and food for special occasions such as birthdays, date nights, and events with friends.

- 41% of consumers said they use DoorDash to send a gift including food, flowers, or a gift card.

In 2022, 34% of customers used DoorDash to discover where to order food for delivery or takeout.

This was ahead of doing an online search (16%), or going directly to a restaurant’s app/website (22%).

According to DoorDash data, 48% of customers ordered from a new store in Q1 2023 compared to Q4 2022.

Customers also choose to order and support local restaurants with 33% preferring to choose from local restaurants and 18% preferring to choose growing restaurants with 2 to 10 locations in their area.

DoorDash continues to help customers discover and support local businesses in their communities.

A customer survey in January 2022 revealed that:

- 54% of customers learned about a local restaurant through DoorDash.

- 74% of those who discovered a new restaurant on the platform reordered on DoorDash visited the restaurant in person.

- 85% of customers used DoorDash as a substitute for going to a restaurant, staying home, and cooking or eating leftovers.

- 39% of customers used deals available on DoorDash or via DashPass to sample a local restaurant they might not have tried otherwise.

Grocery

The non-restaurant business grew roughly 60% in Q4 2022 compared to Q4 2021 on the DoorDash Marketplace in the US.

DoorDash estimated that the number of customers who ordered from a retail store on its platform doubled between December 2020 and December 2021. In 2022, the US grocery business grew by a further 100%.

75% of retail and grocery merchants said DoorDash helped their business increase their overall profitability in 2022.

Further, 77% of retail and grocery merchants stated that DoorDash allowed them to expand their business without high upfront costs. Overall, 93% would recommend DoorDash to other businesses.

Over 20% of customers used DoorDash to order from a retail or grocery store that they would not have otherwise tried.

An additional 20% used DoorDash to purchase grocery items or everyday necessities for someone who could not leave the house.

46% of customers said the reason they used DoorDash to order grocery or retail products was not having the time, energy, or desire to go shopping.

Of these, 24% started ordering groceries for delivery during the pandemic and preferred it to shopping in-store.

Alcohol

There was a 100%+ year-over-year growth for pickup and delivery of alcohol orders on DoorDash from 2021 to 2022.

Delivery emerged as the preferred way for consumers to safely purchase alcohol in 2022. 42% of shoppers cited comfort, convenience, and time savings as the top reasons for using alcohol and delivery services.

The top beverages ordered on DoorDash in 2022 were flavored malt beverages, hard seltzers, and hard cider.

Additionally, there was 5x growth in online delivery orders of ready-to-drink cocktails.

Vodka and tequila were the most popular and fastest-growing alcoholic beverages to purchase online for delivery among DoorDash users in 2022.

Orders for craft beer are also on the rise as the global craft beer industry is forecast to double by 2028 to surpass $200 billion.

Merchant Product Statistics

DoorDash enables merchants to establish an online presence and expand their reach by connecting them with millions of consumers. As part of its Marketplace, DoorDash offers merchants a wide range of services that simplify customer acquisition, demand generation, order fulfillment, merchandising, payment processing, and customer support.

Merchants can also advertise and promote on the DoorDash platform to acquire new consumers and drive incremental sales. As of 2021, DoorDash supported over 500,000 merchant partners.

From December 2020 to December 2021, total active partner merchants across DoorDash Marketplace and Drive grew by over 37%, globally.

Same-store sales also grew 23% for Marketplace partners in the fourth quarter of 2021 compared to the same time in 2020 in all markets.

DoorDash also reported notable growth among new types of merchants beyond the restaurant, convenience, and grocery sectors.

Retail partners on the platform have doubled from December 2020 to December 2021, including new partners like JC Penny and Dollar General, giving consumers more access to a variety of goods on-demand.

In 2022, DoorDash Capital was launched.

This service provides convenient access to revenue-based financing. DoorDash Capital empowers merchants to support expenses like equipment, marketing, rent, hiring, payroll, and more, with access to funds in as little as one day.

DoorDash launched Merchant Benefits, an industry-first program in 2022.

The program is designed to give merchants access to discounted products and services. It connects merchants with third-party providers of

- Educational benefits.

- Healthcare benefits.

- Personal and mental health benefits.

- Hiring and staff management platforms.

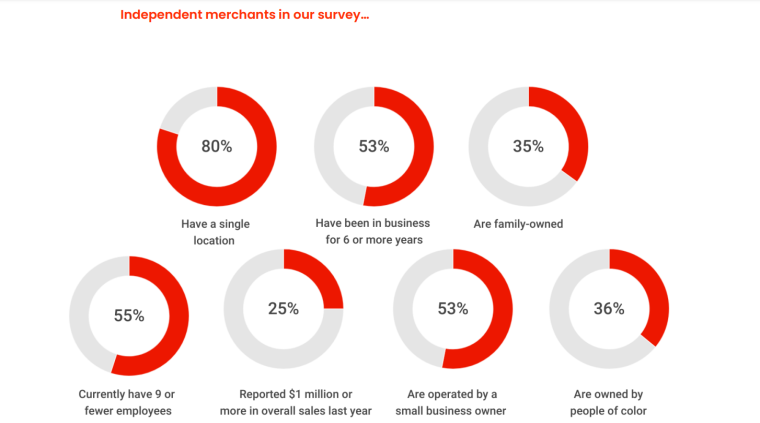

According to DoorDash’s Economic Impact Report 2022, 83% of independent merchants said DoorDash helped them reach new customers they wouldn’t otherwise have reached.

DoorDash continues to invest in products and initiatives to support merchants’ overall experience and success on its platform.

87% of DoorDash merchants want to attract new customers.

DoorDash helps restaurants attract new customers and drive more orders through in-app marketing, including ads and promotions. 90% of surveyed merchants in 2022 would recommend DoorDash to other businesses to reach a wider range of customers, 89% to increase delivery area, and 87% to increase sales volume or revenue.

DoorDash Merchant Product Offering

Description

DoorDash Marketplace

DoorDash Drive

DoorDash Storefront

DoorDash for Work

DoorDash Self-Delivery

DoorDash Storefront+

DoorDash Kitchens

DoorDash Order Manager

DoorDash discovered that over 50% of merchants sought supplemental educational resources to grow their online businesses.

In response to merchant partner feedback, DoorDash unveiled a new Learning Center in 2022. DoorDash’s Learning Center features comprehensive instructions and short video tutorials that merchants can use to grow their businesses on mobile, tablet, or desktop.

Over 65% of independent merchants surveyed by DoorDash in 2022 recommended DoorDash for increasing profitability.

According to the DoorDash Economic Impact Report, merchants had so many ways to reach more customers, boost sales, and meet the growing need for convenience in 2022.

Dasher Platform Statistics

Dashers earn, on average, over $25 per hour on delivery with DoorDash, including tips.

DoorDash continues to expand its purpose to help people achieve their financial goals and live fulfilling lives. According to the company, dashing fills the demand for additional labor not met by traditional jobs, unlocks additional productivity, and increases overall income.

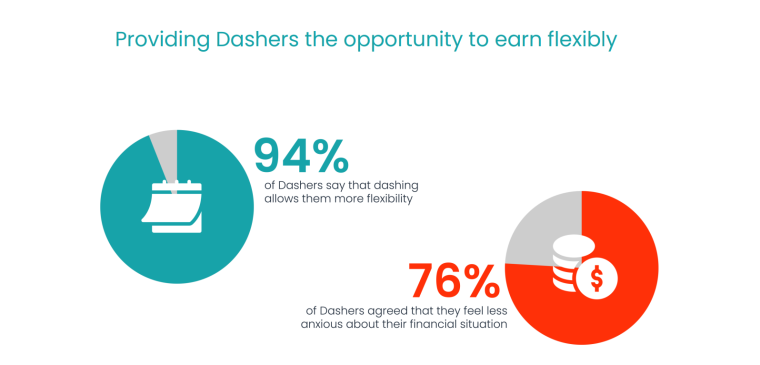

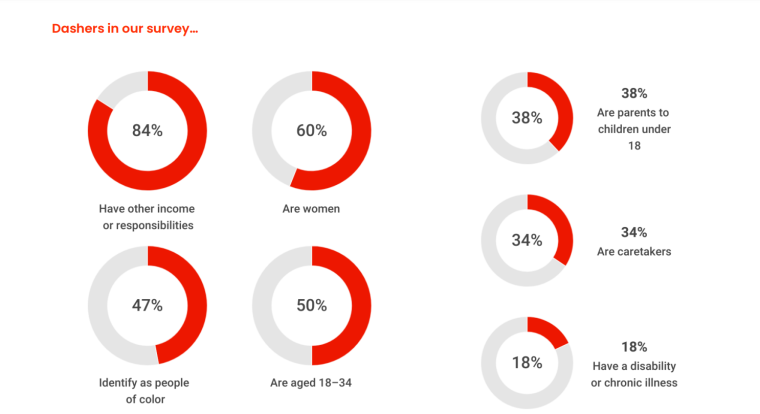

In a March 2023 survey of Dashers, 84% of respondents indicated they had other jobs, other responsibilities like being stay-at-home parents or students, or were retired.

In addition:

- 86% of Dashers said dashing gave them a sense of control over their circumstances.

- 76% said they felt less stressed and anxious about their financial situation because they could dash whenever they needed.

- 17% of Dashers said they dashed to avoid applying for food stamps, unemployment insurance, or other government assistance.

- 25% of Dashers said dashing helped them avoid taking out a payday loan.

In 2022, Dashers’ earnings supported $22.3 billion in additional economic activity.

Dashers balance their time on the DoorDash app with traditional jobs, education, or caring responsibilities. Dashing is supplemental with Dashers spending less than 4 hours per week on delivery in 2022, on average.

DoorDash Revenue Data

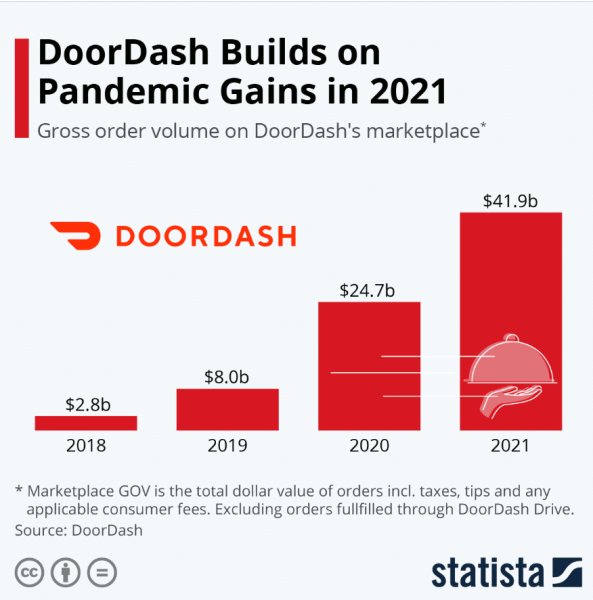

DoorDash tracks its financial performance through two key metrics: Marketplace GOV and Revenue.

Marketplace GOV:

Marketplace GOV is the total dollar value of orders completed on Marketplaces including:

- Taxes, tips, and consumer fees.

- Membership fees related to DashPass and Wolt+.

- Orders completed through Pickup and DoorDash for Work.

Revenue:

DoorDash recognizes Marketplace orders on a net basis as it is an agent for both partner merchants and consumers. Therefore revenue reflects commissions charged to partner merchants and fees charged to consumers excluding:

- Dasher payouts

- Refunds

- Credits

- Promotions including discounts and referral incentives provided to consumers

Q1 2023 Revenue Statistics

In March 2023, DoorDash reported the following quarterly highlights:

Marketplace GOV increased 29% year-over-year to $15.9 billion in Q1 2023 from $12.4 billion in Q1 2022.

Year-on-year growth in Marketplace GOV was driven primarily by organic growth in Total Orders and the addition of Wolt.

Revenue increased 40% year-on-year to $2 billion in Q1 2023 from $1.5 billion in Q1 2022.

This was driven primarily by growth in Marketplace GOV, the addition of Wolt, improved logistics efficiency, and lower credits and refunds as a percentage of Marketplace GOV.

Sales and marketing expenses increased 18% year-over-year to $466 million.

This was driven by an increase in advertising costs and headcount, including advertising costs and headcount associated with the addition of Wolt.

Research and development expenses increased 47% year-on-year to $129 million.

This was driven primarily by growth in headcount, including headcount associated with the addition of Wolt.

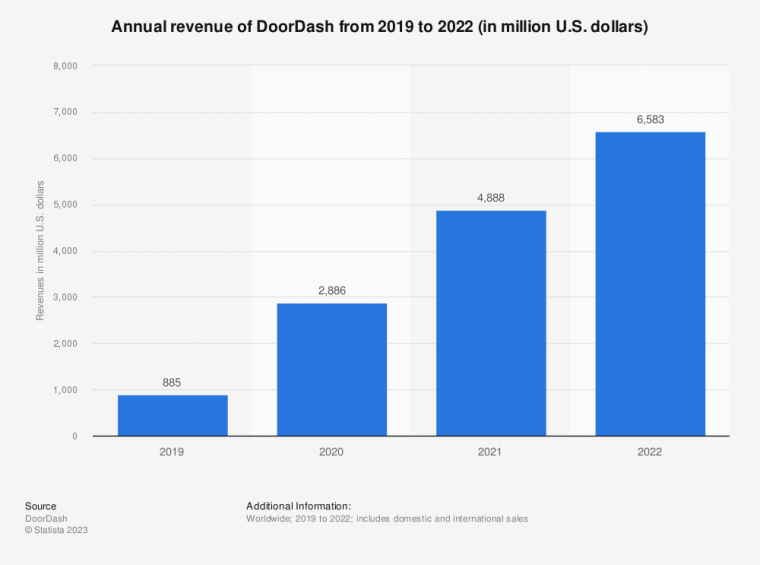

FY 2022 Revenue Statistics

Revenue increased by $1.7 billion, or 35%, in 2022, compared to 2021.

DoorDash’s total annual revenue was $6.6 billion, up from $4.8 billion in 2021 and $2.8 billion in 2022. The increase was primarily driven by the increase in Marketplace GOV. Additionally, revenue grew at a faster rate than Marketplace GOV, mainly due to improvements in Dasher supply.

DoorDash has incurred net losses each year since 2013.

The company incurred a net loss of $468 million and $1.365 billion in 2021 and 2022, respectively, and, as of December 31, 2021, and 2022, had an accumulated deficit of $2.1 billion and $3.8 billion.

The US accounted for 95% of DoorDash’s revenue in 2022.

Revenue generated within the US was $6.2 billion in 2022. This was almost 95% of DoorDash’s total revenue. In 2020 and 2021, the US accounted for 99% of the company’s revenue.

Market GOV increased by 27% or $11.5 billion in 2022.

Marketplace GOV increased to $53.4 billion driven primarily by organic growth in total orders and the acquisition of Wolt. Marketplace GOV excludes orders, taxes, tips, or fees charged to merchants for orders fulfilled through Drive and Storefront.

Sales and marketing expenses increased by 4% in 2022.

Sales and marketing expenses increased from $1.61 billion in 2021 to $1.68 billion in 2022 due to an increase in headcount, personnel-related compensation expenses, and allocated overhead.

Research and development expenses increased by 93% in 2022.

Research and development expenses went up from $430 million in 2021 and $829 million in 2022 driven by an increase in headcount, personnel-related compensation expenses, and allocated overhead.

DoorDash Demographics Stats

DoorDash’s audience is international, and located in several countries.

As of June 2023, DoorDash currently operates in more than 7,000 cities in the US, Canada, Australia, and Japan.

DoorDash launched in Melbourne, Australia in 2019, and as of 2022 covers 80% of the Australian population, with plans for further growth.

The company has secured partnership deals with some of Australia’s largest food and grocery retailers such as Coles and Petstock.

In 2015, DoorDash launched in Canada and increased its reach to more than 50 Canadian cities by 2019.

In 2023, DoorDash came in third place with a 25% market share, after Skip The Dishes and Uber Eats.

As of February 2023, DoorDash dominated the US market with a 65% share.

In 2021, the platform was most popular in San Francisco where it had a reported 74% market share. Other key locations according to McKinsey&Company included:

- San Jose with 77% of the market.

- Houston with 56% of the market.

- Philadelphia with 51% of the market.

- San Antonio with 51% of the market.

According to Similar Web, DoorDash had 209 million web visits between March and May 2023.

DoorDash had an average of 70 million monthly visits over the same period. 66% of these visits were on mobile web, while 33% were on desktop. Additionally, visitors visited 5 pages and spent 7 minutes on the site.

The US held over 90% of DoorDash’s traffic share as of May 2023.

Canada came in second with a 6% share. Australia ranked third with a 3% share. In fourth and fifth position were New Zealand and the UK both accounting for less than 1% of traffic to DoorDash.

30% of deliveries were in rural areas, and 37% were in low-income communities in 2022.

DoorDash increased choice and convenience for people in more areas by expanding its footprint in low-income and rural communities in 2022. In addition, DoorDash continues to target rural markets, suburbs, and smaller urban centers, where food delivery services are usually not available.

DoorDash Customer Demographics Data

DoorDash had over 32 million monthly active users in 2022.

This is up from 25 million monthly active users in 2021 and 20 million monthly active users in 2020.

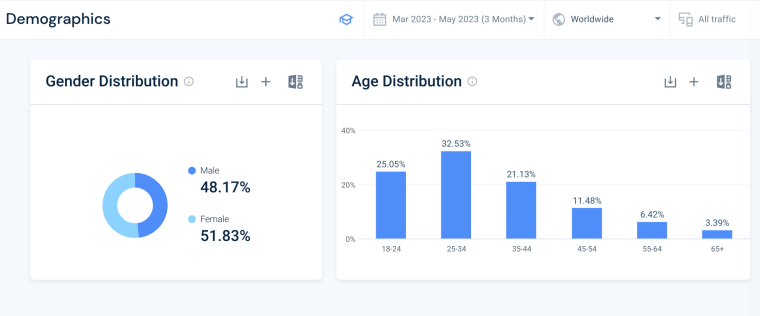

DoorDash’s audience is predominantly female.

The gender split is

- 51.83% Female

- 48.17% Male

DoorDash’s audience is predominantly 25 to 34-year-olds.

The age distribution is as follows:

- 18 to 24 – 25.0%

- 25 to 34 – 32.5%

- 35 to 44 – 21.1%

- 45 to 54 – 11.5%

- 55 to 64 – 6.42%

- Over 65 – 3.4%

Year

DoorDash MUAs (in millions)

Year-on-Year (%)Change

2018

4

–

2019

10

6

2020

20

10

2021

25

5

2022

32

7

As of December 31, 2022, DoorDash had over 15 million DashPass and Wolt+ members.

This is up from 10 million subscribers in 2021 and 1.5 million subscribers in 2020. DashPass and Wolt+ improve affordability and lower transactional friction by reducing the delivery and service fees charged to consumers.

Year

DoorDash Pass Subscribers (in millions )

Year-on-Year (%) Change

2019

0.8

–

2020

1.5

0.7

2021

10

8.5

2022

15

5

DoorDash Dashers Demographics Data

If they weren’t delivering with DoorDash, over a third of Dashers say they would not choose an alternative way to replace their income from dashing. This increases to 47% among stay-at-home parents and 43% of veterans.

More than 2% of the US adult population chose to dash during 2022, earning well over $10 billion.

According to the company’s SEC filings, over 6 million people dashed in 2022, earning a total of over $13 billion. This is compared to 1 million dashers in 2020.

According to DoorDash’s internal data, 60% of Dashers are women.

Most women prefer Dashing over rideshare as they believe it’s safer and/or because they don’t want to share their car with strangers.

47% of Dashers identified as people of color in 2022.

Dashers in communities of color earned over $6.6 billion and Dashers in rural communities earned more than $3.7 billion.

Additionally, the company’s 2022 Economic Impact Report reported the following Dasher demographics:

- 50% were aged 18 to 34.

- 38% were parents to children under 18.

- 34% were caretakers.

- 18% had a disability or chronic illness.

- 84% had other income or responsibilities.

DoorDash Competitor Stats

Globally, DoorDash competes with

- Local food delivery logistics platforms such as Uber Eats, Just Eat Takeaway, Grubhub, and Delivery Hero.

- Merchants that have their own online ordering platforms.

- Online ordering systems.

- Merchants that own and operate their own delivery fleets.

- Grocers and grocery delivery services.

- Convenience and convenience store delivery services, and companies that provide point-of-sale solutions.

- Merchant delivery services.

- Offline ordering channels, such as take-out offerings, telephone, and paper menus that merchants distribute to consumers.

- Advertising that merchants place in local publications to attract consumers.

In 2022, DoorDash was the most visited online food delivery website worldwide.

Out of all the leading online food delivery platforms worldwide, DoorDash had the most web traffic, with an estimated 68 million visits in December 2022. In second place was Uber Eats, which was visited more than 50 million times, followed by Instacart.com, with over 34 million visits. Together, DoorDash and Uber Eats accounted for more than 8% of total traffic to restaurant and delivery sites worldwide.

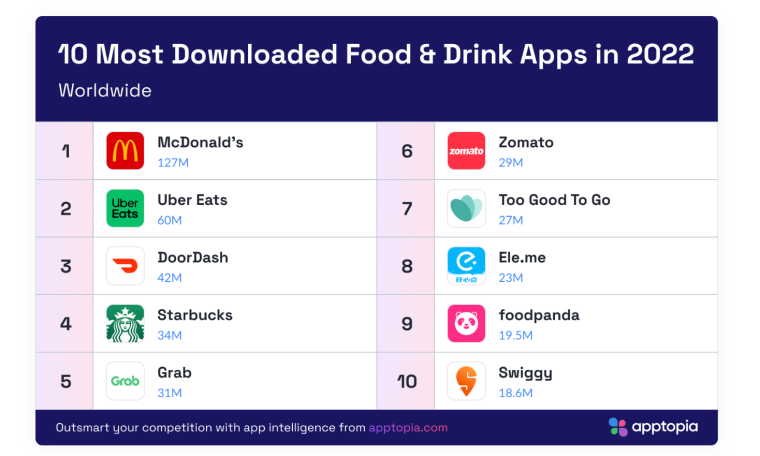

DoorDash was the fourth most downloaded food delivery app globally, with more than 27 million downloads in 2022.

Zomato topped the charts in 2022 with over 55 million downloads. Uber Eats ranked second, with nearly 47 million downloads.

According to Apptopia, DoorDash was the third most downloaded food and drink app worldwide in 2022.

In first place was the McDonald’s app with 127 million downloads. The Uber Eats app came in second with 60 million downloads. In the US, DoorDash had over 34 million downloads, putting it just behind the McDonald’s app on Apptopia’s top 10 most-downloaded food and drink apps in the US.

According to Statista, DoorDash had a 65% market share of the online food delivery market in the US, as of 2023.

In 2019, the company’s market share surpassed that of key rivals such as Grubhub, and Uber Eats. As of February 2023, DoorDash had a market share of 65% in the US. With 23%, Uber Eats held the second-highest share.

With a valuation of over $28 billion, DoorDash is the largest food delivery company by market cap.

This puts the company ahead of Grab Holdings, valued at $13 billion, Delivery Hero valued at $10 billion, and Zomato valued at $7 billion.

References

- Statista

- DoorDash Medium Blog

- Crunchbase

- Finsmes

- Reuters

- PRNewswire

- Tech Crunch

- Tech Crunch

- Finsmes

- Tech Crunch

- Business Insider

- Bloomberg

- Axios

- New York Times

- MarketWatch

- Nasdaq

- Statista

- Yahoo Finance

- Companies Market Cap

- DoorDash 2022 Annual Report/ SEC filing

- DoorDash ESG 2022 Update

- Statista

- DoorDash 2022 EIR

- DoorDash News

- Tech Crunch

- Business Insider

- PR Newswire

- Australia Finance Review

- DoorDash News

- Tech Crunch

- DoorDash News

- DoorDash News

- DoorDash 2020 Prospectus

- DoorDash Shareholder letter Q1 2023

- DoorDash Restuarant 2023 Trends

- DoorDash News

- DoorDash News

- DoorDash News

- DoorDash 2023 Q1 Quarterly Release

- Statista

- Start.io

- Statista

- McKinsey&Company

- SimilarWeb

- DoorDash News

- Statista

- Statista

- Apptopia

- Statista

- Companies Market Cap