As the leading company in the e-signature market, DocuSign makes it possible to sign documents remotely, using any device. Its paperless process means less back-and-forth, a more efficient workflow, and cost savings. DocuSign statistics highlight what problems the software company solves, both with signatures and its newer smart agreement products.

Our experts at Business 2 Community scoured the internet, gathering DocuSign statistics on the company’s revenue, products, users, employees, and management so you can better understand the success of the tech company.

DocuSign Statistics Highlights

- Tom Gonser, Court Lorenzini, and Eric Ranft founded DocuSign in 2003.

- In 2018, DocuSign launched its initial public offering, announcing its stock pricing at $29 per share.

- The company’s all-time high stock price was $310.05 in 2021, which would plummet to around $60 the following year.

- After using DocuSign’s signature product, e-signature, 70% of users saw an ROI in less than three months.

- In the 2023 financial year, DocuSign generated $2.5 billion revenue and had over one billion users worldwide.

Who Owns DocuSign?

DocuSign is owned by various institutions and insiders, with institutions possessing more than 75% of the company’s shares. Vanguard Group Inc. is the biggest shareholder, owning over 10% of DocuSign shares.

The company was founded by Court Lorenzini, Tom Gonser, and Eric Ranft in 2003. Although they focused on e-signatures when they first started, over the years the platform has expanded its services to transaction management, offering more products related to digital signatures and contracts. Between 2003 and 2014, DocuSign had 20 funding rounds, raising $536.4 million.

On April 26th, 2018, DocuSign announced the pricing of its initial public offering of 21,7 million shares at $29 per share. The next day, shares opened at $38 on the Nasdaq and DocuSign raised $629.3 million by selling the stock.

Similar to companies like Netflix and Zoom, DocuSign stocks surged in 2020 and 2021 due to the COVID-19 pandemic, as people leaned on remote work. On September 3, 2021, the company’s year-high stock price was $310.05, representing an all-time high. By June 2022, the stocks had plummeted, fluctuating between $50 and $60.

News outlets including Bloomberg, Yahoo, and Reuters, labeled DocuSign a “pandemic darling”. In December 2023, the Wall Street Journal reported that DocuSign was exploring a possible sale.

Who is the CEO of DocuSign?

Allan Thygesen has been DocuSign’s CEO since 2022. Previously, he was the President of Advertising at Google North and South America. To help recover DocuSign post-pandemic, Thygesen made some leadership changes and shifted the focus from sales to product innovation.

There have been five other DocuSign CEOs before Thygesen. While DocuSign founder Tom Gonser served as the Chief Strategy Officer, Court Lorenzini, the other co-founder, was the CEO between 2003 and 2007.

After Lorenzini, the next CEOs were Matthew Schiltz until 2010 and Steven King until 2011. When King resigned, Keith Krach became the company’s CEO for the six following years.

In 2017, Krach announced Dan Springer as the new DocuSign CEO. Under Springer, DocuSign launched an initial public offering in 2018, increasing the company’s worth to nearly $6 billion.

Dan Springer stepped down from his role in 2022 after DocuSign’s stocks plummeted and the “pandemic darling” lost 60% of its value year to date. Chairman of the Board Maggie Wilderotter served as the interim CEO until Alan Thygesen took over at the end of the year.

What Does DocuSign Own?

As of 2024, DocuSign owns eight companies in the industries of smart agreements, contracts, document preparation, and digital asset management.

- Cartavi (2013): As its first acquisition, DocuSign bought Cartavi, a real estate transaction collaboration company, to provide an all-in-one experience to real estate brokers, agents, buyers, and sellers.

- Comprova (2014): DocuSign acquired Comprova, a leading digital signature platform in Brazil, and invested in Brazil’s emerging tech market.

- ARX (2015): By acquiring Arx, DocuSign brought together CoSign digital signature and Digital Transaction Management (DTM) platform.

- Estate Assist (2015): Estate Assist is a company focusing on securing customers’ account information, logins, and documents, acquired by DocuSign in 2015.

- SpringCM (2018): The cloud-based contract and document management company SpringCM joined DocuSign in 2018.

- Seal Software (2020): DocuSign made advancements in AI by acquiring the AI-driven contract analytics company Seal Software.

- Liveoak Technologies (2020): As the demand for remote notary services for legal documents increased, DocuSign added Liveoak Technologies’ agreement-collaboration platform to its e-signature services.

- Clause (2021): DocuSign’s recent acquisition is Clause, a smart agreement provider. With this acquisition, the company has strengthened its Agreement Cloud platform.

DocuSign Earnings and Revenue

In the 2023 financial year, DocuSign’s revenue was $2.5 billion in total, representing a 19% increase year-over-year. CEO Allan Thygesen said these numbers represented progress in product innovation, go-to-market effectiveness, and operational efficiency.

The same year, DocuSign’s GAAP gross margin was 79%, slightly increasing from the previous year’s 78%. Non-GAAP gross margin remained the same in 2022 and 2023, with 82% in both years.

In 2022, the total DocuSign revenue was $2.1 billion, a 45% year-over-year increase compared to 2021 when the revenue was $1.5 billion.

As of the end of 2023, DocuSign had a market cap of over $11 billion. It does not pay dividends.

DocuSign Product Stats

Besides e-signature technology, DocuSign has also developed DocuSign Agreement Cloud, combining electronic signature, document generation, contract lifecycle management, and digital notary services.

DocuSign e-Signature

E-signature was DocuSign’s first product, allowing users to sign documents electronically. Digital signatures are legal in all US states and many countries around the world.

DocuSign has found that e-signatures help companies cut hard costs by 56%, as no printing, scanning, or postage expenses are involved. This accounts for a saving of $4-10 per document, depending on the company. $4 may not seem like a lot but across an entire company it could easily save millions of dollars.

Besides costs, e-signatures help save time. 79% of agreements that use e-signature are signed within 24 hours. With automation and standardized procedures in place, employees save over 300 work hours per month as DocuSign creates, updates, and secures documents.

Setting up an e-signature can be as quick as 15 minutes, and 20% of DocuSign clients reported that they were able to implement it immediately.

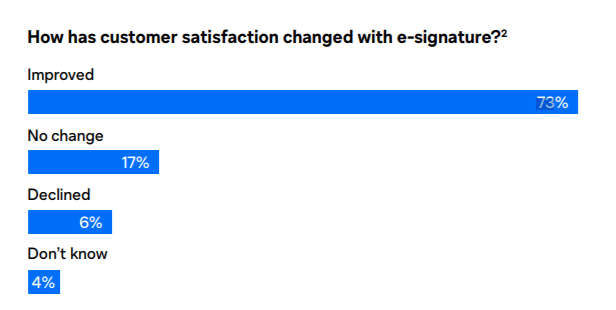

According to DocuSign statistics, over 70% of e-signature users see an ROI in less than three months, and 90% in six months. Companies also seem to enjoy DocuSign’s speed and effectiveness. 75% of users said it increased employee productivity in their organization, and 73% found their customer satisfaction improved after implementing e-signature.

Contract Lifecycle Management (CLM)

As DocuSign grew, its founder, Tom Gonser, realized that electronic signatures were only a part of the problem they were trying to solve.

The problem is, we have this workflow that we didn’t automate because we needed signatures

Enter contract lifecycle management. With this service, companies can store contracts in one place, benefit from the platform’s security, and automate workflows, depending on the agreements.

Organizations using CLM experience an 83% reduction in contract process time and a 50% reduction in contract completion time, according to company data. Without CLM, the average company spends 45 minutes locating a contract and 1 hour and 24 minutes finding a specific section in digital documents.

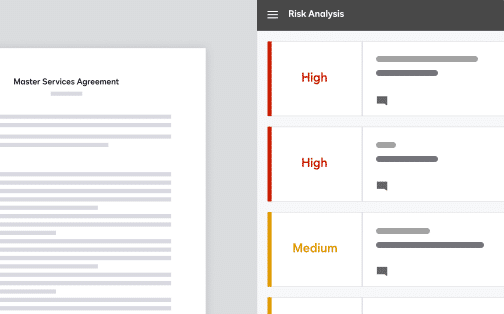

DocuSign Insights

A Forrester research commissioned by DocuSign found that 61% of businesses were not able to search agreements’ full text effectively. Nearly half of the businesses surveyed risked the inability to detect problematic language.

DocuSign Insights uses AI technology to extract key terms, show a risk score, and compare the legal language of two different contracts.

Document Generation

DocuSign users can generate documents within the Salesforce interface, so sales reps can get updated content with a few clicks. According to DocuSign, an automated contract process reduces the average time of deal closure by 41%.

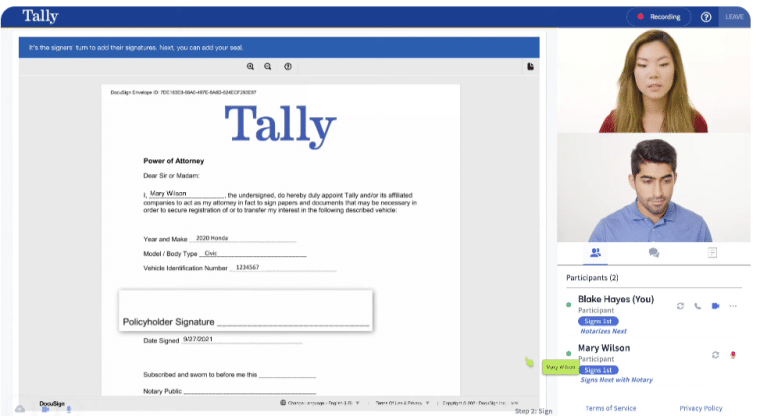

DocuSign Notary

In 2021, DocuSign launched Remote Online Notarization (RON), allowing users to notarize documents remotely through secure audio-visual sessions. By 2023, 38 US states had established permanent RON laws, as demand for remote notarization grows.

The image below shows how Remote Online Notarization with DocuSign takes place, using recorded video calls, e-signature, and screen sharing.

Application Programming Interface (API)

In 2021, DocuSign won an award for the Best Business Software API by API World. Nearly 60% of DocuSign transactions use the e-signature API with over 400 endpoints.

The DocuSign API has:

- 550 million API transactions

- 500,000 companies

- 100,000 developers

- 6 programming languages

- 44 signing languages

DocuSign Integrations

DocuSign offers over 400 integrations with CRM and business productivity apps, such as Microsoft, Salesforce, and Zoom. This way, users don’t have to leave these apps to use DocuSign.

DocuSign Business Data

DocuSign operates in more than 180 countries, supporting 44 languages for the signing part, and 14 languages for the sending part. In 2022, Fast Company put DocuSign on its list of the top 10 most innovative enterprise companies for its new products besides digital signatures, such as AI in contract lifecycle management, smart agreements, and digital notary services.

Here are more statistics related to DocuSign employees, clients, and market share.

DocuSign Market Share

DocuSign is the leader in the electronic signature market, with a market share of over 67%. The global e-signature market value was around $3.9 billion in 2022, and is predicted to increase to $43.14 billion by 2030.

DocuSign Headquarters

DocuSign’s headquarters are in San Francisco, California, USA. It also has offices in 18 different cities across six continents.

DocuSign Careers

DocuSign has nearly 8,000 employees, 94% of which work flexibly or remotely. According to Glassdoor, the average salary in the company ranges from $83,691 to $566,396 per year.

63% of employees who reviewed the company on Glassdoor were satisfied, saying they would recommend it to a friend.

On average, employees get over 35 paid days off, including company holidays, volunteer days, and earned days off.

DocuSign Clients

Paying DocuSign users can send, sign, and collaborate on agreements. Users on the receiving end can sign documents for free.

As of 2024, DocuSign has more than 1.4 million paying customers and over a billion users worldwide. There are also 3,000 federal, state, and local government agencies using DocuSign’s services.

The company offers three paid plans for individuals, small teams, and businesses with advanced e-signature needs. Realtors and software developers can benefit from tailored plans.

With the free account, DocuSign allows users to send three signature requests. Prices of the paid plans start from $10 for individuals and go up to $40 for businesses.

| Plan Name | Who is it for? | Price |

| Personal | Individuals with basic needs | $10/month |

| Standard | Small teams that need to collaborate on digital documents | $25/month per user |

| Business Pro | Businesses that need advanced automating features | $40/month per user |

DocuSign Reviews

DocuSign has over 2,000 reviews on G2, and an average rating of 4.5 out of 5 stars. Overall, the positive experiences included its user-friendliness, customer experience, template creation, and efficiency.

As for negative comments, users mentioned the expensive price, customer support issues, and sending issues.

DocuSign Competitor Statistics

DocuSign’s main competitors are Adobe Sign, Xink, Nitro, signNow, HelloSign, and others. Here are some key statistics about DocuSign competitors.

DocuSign vs. Adobe Sign

Both DocuSign and Adobe Sign are popular e-signature software. Adobe Sign has over 500,000 organizations using its services, and DocuSign is trusted by the vast majority of the top 15 Fortune 500 companies. Adobe Sign offers around 100 integrations, especially for Microsoft since the two companies are partners. DocuSign has 400 integrations and other signature-related products such as document generation.

Adobe Sign’s cheapest plan starts from $18 while DocuSign starts from $10.

DocuSign vs. Xink

According to LinkedIn, the Danish startup Xink has 11-50 employees. It focuses on email signature branding, with integrations with Outlook and Gmail. Its pricing can be as cheap as $1 per user per month.

DocuSign vs. signNow

signNow has 700 employees, 40+ integrations, and 20 million users worldwide. It’s a smaller company than DocuSign, and its paid tiers are slightly cheaper than DocuSign, with Business accounts starting at $8.

DocuSign vs. Nitro

Nitro is a PDF editor and e-signature software. While it has fewer products than DocuSign, it has flexibly-priced plans, offering unlimited signature requests to all tiers. Also a smaller company, Nitro has less than 500 employees.

DocuSign vs. Dropbox Sign (HelloSign)

Dropbox acquired HelloSign in 2019, changing its name to Dropbox Sign three years afterward. Dropbox Sign has signing, API, forms, and fax features that enable users to integrate with other productivity apps. Pricing for individuals starts at $15, similar to DocuSign, but its small team and premium tiers are cheaper than DocuSign.

The Future of DocuSign

While DocuSign has fallen from the heights it experienced during the COVID-19 pandemic, it still has a strong business outlook.

The company is dominant in the e-signature market, holding two-thirds of the sector, and it doesn’t seem to be losing its foothold anytime soon. It hasn’t become complacent with it’s leading position and it actively introducing new products and services. Harnessing AI within the contracts space shows a clear drive towards innovation.