Since Disney was founded over a century ago, the name has become synonymous with animated films, amusement parks, and all the characters the studio has produced. Now, Disney’s net worth of $168.65 billion places it within the 100 largest companies in the world and makes it the 29th most valuable global brand.

At Business2Community, we’ve researched a wide range of sources to compile this detailed guide to The Walt Disney Company’s history. Get ready to learn about the successes, failures, leadership challenges, and economic factors that have brought the business to its current market value.

Disney Key Company Data

Disney Net Worth: $168.65 billion

Date Founded: October 1923

Founded By: Walt Disney and Roy Disney

Current CEO: Robert (Bob) Alan Iger

Industries: Entertainment, travel and tourism, consumer goods

The Walt Disney Company Stock Ticker: NYSE: DIS

Dividend Yield: 0.95%

What is Disney’s Net Worth?

Disney’s net worth, also known as market cap, is $168.65 billion as of October 2024. This is based on Disney’s stock price of $95.20.

Disney’s IPO, co-led by Goldman Sachs, took place in November 1957, two years after its iconic Disneyland California park opened. Shares were initially priced at $13.88.

The company was worth $1 billion by the mid-1960s and Walt Disney’s net worth upon his death in 1966 was an estimated $100-150 million which, adjusted for inflation, would be between $750 million and $1.1 billion today.

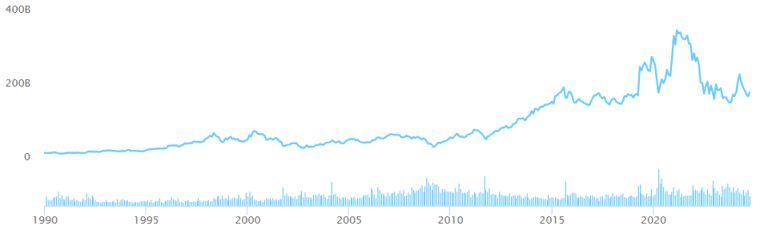

The Walt Disney Company had reached a market cap of $10 billion by 1990, but growth was slow over the next couple of decades.

It was only in the 2010s, through a combination of factors including its investment in Marvel Entertainment, the success of the Frozen franchise, and international theme park expansion, that Disney’s market cap soared past $100 billion.

The Walt Disney Company reached a peak market cap of $366.87 billion on March 8, 2021. On the same day, stock prices peaked at $203.02. The pandemic-driven success was relatively short-lived, though, with shares dropping back below $100 in June 2022 and reaching an 8-year low by September 2023.

Disney releases its end-of-year financial results for the fiscal year in January or February of the following year, providing investors with detailed insights into the company’s performance and financial position.

Disney Revenue

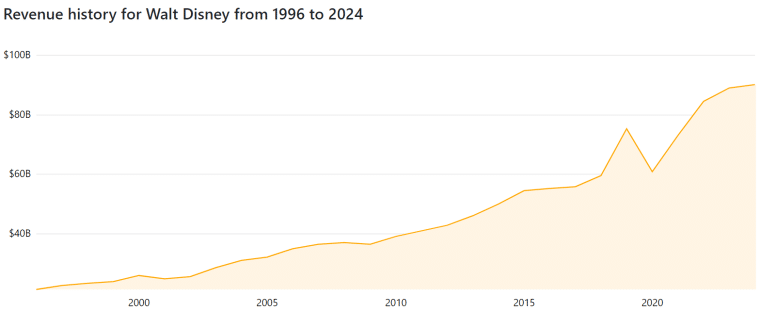

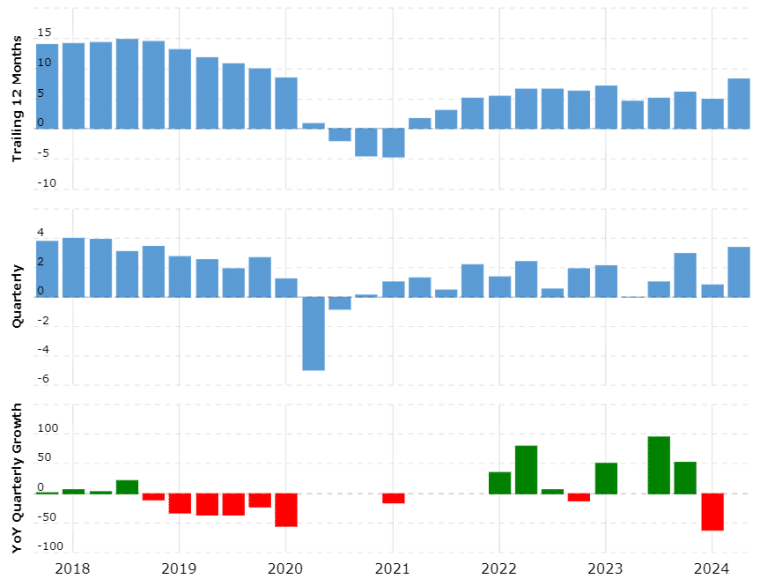

The Walt Disney Company achieved a record-high revenue of $88.9 billion in FY2023; up 5.35% from the previous year.

Its revenue growth has been positive every year this century, with the exception of 2001 (-4.14%), 2009 (-1.9%), and 2020 (-19.16%).

However, this revenue growth has been offset by increasing costs and the company’s net income of $2.35 billion in 2023 was less than a fifth of the levels achieved five years before.

| Year | Disney Revenue ($ billions) | Disney Net Income ($ billions) |

| 2014 | 48.813 | 7.501 |

| 2015 | 52.465 | 8.382 |

| 2016 | 55.632 | 9.391 |

| 2017 | 55.137 | 8.980 |

| 2018 | 59.434 | 12.598 |

| 2019 | 69.607 | 11.054 |

| 2020 | 65.388 | -2.864 |

| 2022 | 82.722 | 3.145 |

| 2021 | 67.418 | 1.995 |

| 2023 | 88.898 | 2.354 |

Looking at a breakdown of Disney’s business segments, we see that Experiences (theme parks, consumer products, other travel and tourism) is delivering a much stronger profit than its Entertainment (TV and film) or Sports segments.

Here are the revenue and operating income for each segment in fiscal year 2023:

- Experiences: $32.549 billion/$8.954 billion

- Entertainment: $40.635 billion/$1.444 billion

- Sports: $17.111 billion/$2.465 billion

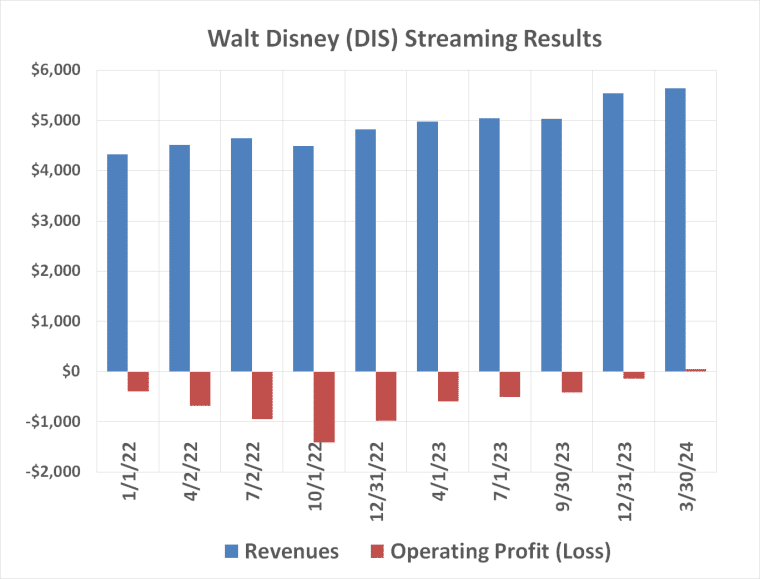

In Q3 of 2024, Disney reported that its combined streaming businesses were profitable for the first time. The company expects to build on this performance in Q4.

Disney Dividend History

Disney was paying regular six-monthly dividends until 2020, when disruption from the pandemic put payments on hold for four years.

After paying $0.88 in January 2020, the next dividend paid was $0.30 in January 2024, followed by $0.45 in July 2024.

| Dividend | Payment Date |

| 0.45 | Jul 25, 2024 |

| 0.30 | Jan 10, 2024 |

| 0.88 | Jan 16, 2020 |

| 0.88 | Jul 25, 2019 |

| 0.88 | Jan 10, 2019 |

| 0.84 | Jul 26, 2018 |

| 0.84 | Jan 11, 2018 |

| 0.78 | Jul 27, 2017 |

| 0.78 | Jan 11, 2017 |

| 0.71 | Jul 28, 2016 |

| 0.71 | Jan 11, 2016 |

| 0.66 | Jul 29, 2015 |

| 1.15 | Jan 08, 2015 |

There have been seven stock splits in the history of The Walt Disney Company, but the most recent was in 1998:

- July 9, 1998: 3-for-1

- May 15, 1992: 4-for-1

- March 5, 1986: 4-for-1

- January 15, 1973: 2-for-1

- March 1, 1971: 2-for-1

- November 15, 1967: 2-for-1

- August 20, 1956: 2-for-1

In February 2024, Disney announced a $3 billion share buyback along with a 50% dividend increase and other measures intended to appeal to shareholders. To date, the company has completed $2.5 billion of these buybacks; $1 billion in March 2024 and a further $1.5 billion in June 2024.

For several years up to 2018, the company had been conducting quarterly share buybacks, often exceeding $1 billion.

Who Owns Disney?

As a publicly traded company, Disney is owned by individual and institutional shareholders. Approximately 70% of its shares are held by institutions such as Vanguard (8.54%), BlackRock (6.74%), and State Street (4.25%). CEO Bob Iger and former CFO Christine McCarthy own over 200,000 shares each, according to Disney’s 2024 Proxy Statement.

There may be other private investors who own a similar stake in the business, but since no individual owns more than 5% of the company’s outstanding shares, they are not required to publicly declare their interests.

As of September 2023, there were approximately 768,000 common shareholders of Disney stock.

One of Disney’s earlier investors was Warren Buffett. In 1966, he invested $4 million for a 5% share of the company which he sold the following year for around $6 million. Although an impressive short-term gain, the billionaire says it was a mistake to sell so soon – these shares would be worth over $8 billion today.

Through his holding company Berkshire Hathaway, Buffett currently owns a modest 316,000 Disney shares worth around $30 million.

Who is the Disney CEO?

Robert (Bob) Alan Iger is the current CEO of Disney, having returned to the role in November 2022 just 11 months after retiring. He previously held the position of CEO and Chairman from 2005 to 2020, and Executive Chairman and Chairman of the Board during 2021.

Bob Iger began his career in television, working his way up to the position of president and COO at ABC before it was purchased by Disney in 1996. Iger continued to run the company’s media division until 1999 when he was named president of Walt Disney International, overseeing the company’s presence outside the US.

A year later, Iger was promoted to COO, working directly below then-CEO Michael Eisner. He served in this position for four years before beginning his tenure as CEO when Eisner resigned following following criticism from Walt’s nephew, Roy Disney.

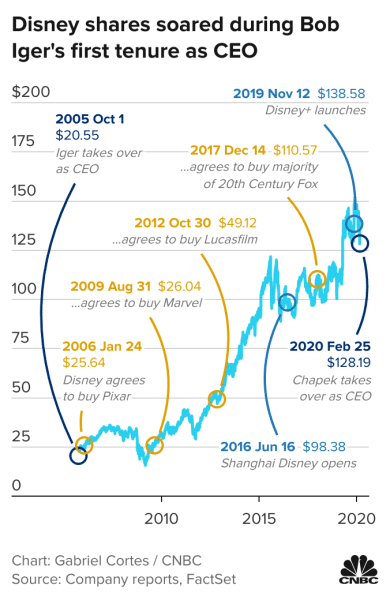

Iger’s first tenure as CEO was characterized by a series of high-profile acquisitions including Pixar, Marvel, and Lucasfilm, as well as a 420% increase in share prices.

When Bob Chapek succeeded Bob Iger in February 2020, Iger took the role of executive chairman to oversee the transition. However, he ended up staying until the end of 2021 to help the company recover from the effects of the COVID-19 pandemic.

Some reports say that Iger never fully relinquished the role of CEO, referring to himself as “Big Bob” and Chapek as “Little Bob”. Iger thought it was only natural that he should step back up during the COVID crisis, whereas Chapek felt that he “didn’t need a savior”.

In November 2022, Disney fired Chapek and reinstated Iger as CEO. An initial two-year term has since been extended to the end of 2026.

Iger earned a pay package worth over $31 million in 2023 and has an estimated net worth of over $700 million.

The table below shows a full history of Disney CEOs:

| Name | Tenure |

| Roy O. Disney | 1967–1971 |

| Donn Tatum | 1971–1976 |

| E. Cardon Walker | 1976-1983 |

| Ron W. Miller | 1983-1984 |

| Michael Eisner | 1984-2005 |

| Bob Chapek | 2020-2022 |

| Bob Iger | 2005-2020 |

| Bob Iger | 2022-present |

It wasn’t until after Walt Disney’s death in 1966 that the company’s first CEO, Walt’s brother Roy, was instated.

The Walt Disney Company’s History

Disney’s 100+ year history shows how it’s possible for a company to evolve successfully; from animated film and television production to theme parks and online streaming.

It wasn’t all plain sailing for Walt Disney and those who followed in his footsteps, so let’s take a look at the ups and downs in the timeline of The Walt Disney Company and how the company’s net worth developed.

1921-1927: Founding and Early Animated Films

In 1921, Walt Disney and fellow animator Ub Iwerks founded Laugh-O-Gram Studio in Kansas City, Missouri. They produced a series of short animated films but didn’t end up getting paid for them, and the studio went bankrupt in 1923.

One of the last projects Walt worked on was a series called Alice’s Wonderland, which starred four-year-old Virginia Davis interacting with cartoon figures.

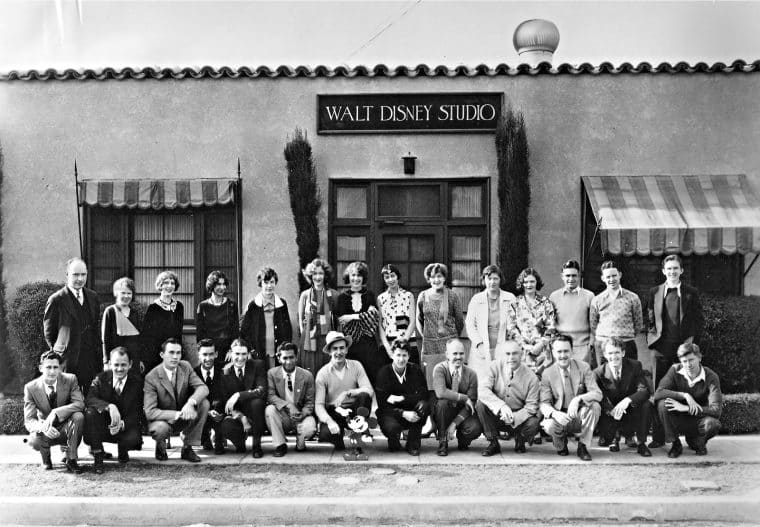

Aged 21, Walt moved to Los Angeles, California, to join his brother Roy. It was here that the Alice Comedies were picked up by a film distributor. The brothers founded Disney Brothers Cartoon Studio on October 16, 1923, to produce the films which continued for four years until Walt decided to focus on fully animated shorts.

In 1926 they changed the name to The Walt Disney Studio at Roy’s suggestion.

The studio’s first animated character was Oswald the Lucky Rabbit. While trying to negotiate terms for a second series of the short cartoons, Walt realized that the distribution contract had handed intellectual property for Oswald to Universal Pictures, who cut Walt out of the picture. It was a difficult lesson to learn, but from then on, Walt was careful to always retain the rights to his characters.

Needing a new idea, Walt Disney turned to a character inspired by a mouse he had kept on his desk at Laugh-O-Gram, and Mickey Mouse was brought to life.

1928-1941: The Golden Age of Animation

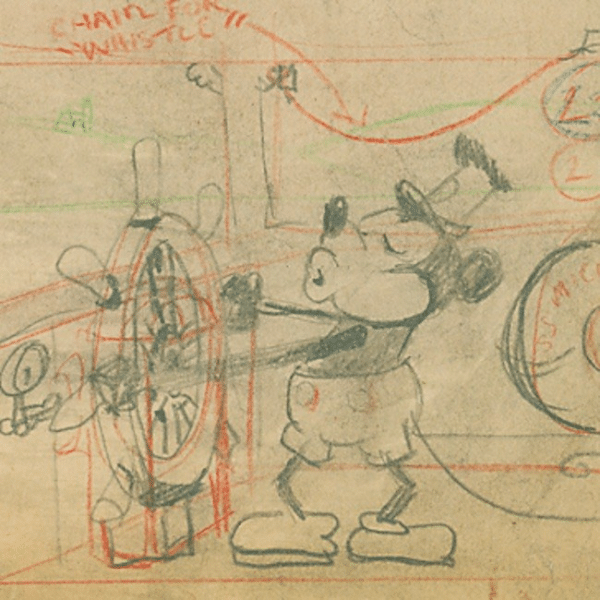

In 1928, the short film Steamboat Willie was released as one of the first animated films with synchronized sound and a fully post-produced soundtrack. It was an instant hit and launched Mickey Mouse as a global icon, starring in a long series of short cartoons that also introduced characters like Minnie Mouse and Donald Duck.

Around this time, Walt Disney saw the potential for merchandising his characters as an additional source of revenue. For $300, he sold the rights to use Mickey Mouse on some pencil tablets. It was estimated in 2018 that the Mickey Mouse brand had earned $226.7 million at the box office and another $323 million through video and DVD sales.

Mickey Mouse Writing Tablet

First Licensed Piece of Disney Character Merchandise

1930#DisneyArchives50 pic.twitter.com/Ijy2w3eOGB— Disney D23 (@DisneyD23) June 11, 2020

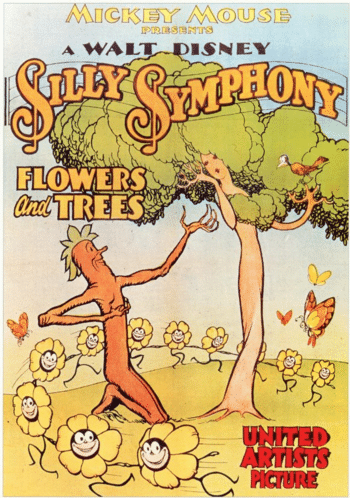

Another milestone in this period was the 1932 release of Disney’s first color animation: A Silly Symphonies cartoon named Flowers and Trees. It won the Academy Award for Best Cartoon – the first year an Oscar was awarded in this category. A Disney cartoon took the award every year for the rest of the decade, proving that the company was truly at the top of the animated film industry.

In 1934, Walt decided to move into animated features; a risky move because of the investment required, but one that he believed in. The risk paid off, as Snow White and the Seven Dwarfs was released in 1937 and became the highest-grossing film of its time.

Adjusting for inflation, Snow White is the highest-grossing animated film of all time with ticket sales equivalent to almost $2 billion. Needless to say, its success was a huge boost to Disney’s financial position. In fact, it helped fund the company’s new headquarters in Burbank, California, featuring a 51-acre studio complex.

However, the outbreak of World War II meant that later feature films such as Pinocchio and Fantasia underperformed internationally, once again straining the company’s finances.

In 1940 Walt Disney reluctantly went public to raise funds, with stocks traded over-the-counter.

A Disney animators’ strike in 1941 lasted for five weeks and resulted in hundreds of staff leaving or being fired. Walt was criticized for disorganized pay structures and forcing staff to work long hours without recognition.

1942-1966: Disney Diversifies

Walt Disney Productions struggled to regain its footing in the film industry following the war.

The company started to diversify into live-action films, which led to its next big success, Treasure Island, in 1950. Cinderella was another big hit the same year.

Walt also branched out into television production with Davy Crockett (1954) and The Mickey Mouse Club (1955).

Perhaps the most significant diversification, which would pave the way for the company’s success well into the next century, was its theme parks. In 1952, Walt formed a separate company, Walt Disney Inc. (renamed WED Enterprises the following year) to build Disneyland.

Walt’s inspiration for Disneyland was simple: He enjoyed taking his two daughters to the fair but imagined an amusement park that could entertain both adults and children.

Disneyland opened in Anaheim, California, on July 17, 1955, having cost $17 million ($200 million adjusted for inflation) to build.

The opening day was a PR disaster with dry water fountains, malfunctioning rides, and a gas leak. Walt invited the press back after addressing the problems, managing to restore faith in the park and attract 1.2 million visitors by the end of the year.

Disney’s IPO took place in November 1957, with shares trading on the New York Stock Exchange for $13.88.

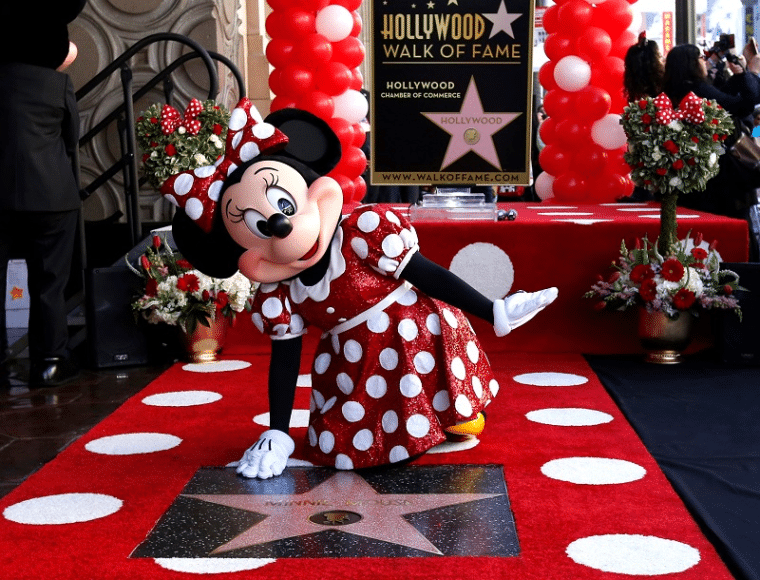

In 1960, Walt Disney was inducted into the Hollywood Walk of Fame with two stars; one for television and one for motion pictures. Several Disney characters were later awarded their own stars, including:

- Mickey Mouse

- Minnie Mouse

- Donald Duck

- Tinker Bell

- Snow White

Over the next decade, Disneyland expanded with new rides and Disney’s film division started to recover. Its 1964 live-action release Mary Poppins became the top-grossing film at the time and won five Academy Awards.

Walt Disney passed away on December 15, 1966, aged 65. He left behind a huge legacy, plans for future parks, and a proven model for integrating the company’s film, TV, and theme park divisions through cross-promotion.

1967-1983: The Post-Walt Transition

After Walt Disney’s death, the company released the last of his animated films, The Jungle Book. Walt’s brother, Roy, stepped in as CEO and chairman, but he lacked Walt’s creative flair and the company’s animation output began to falter with a drastically downsized team.

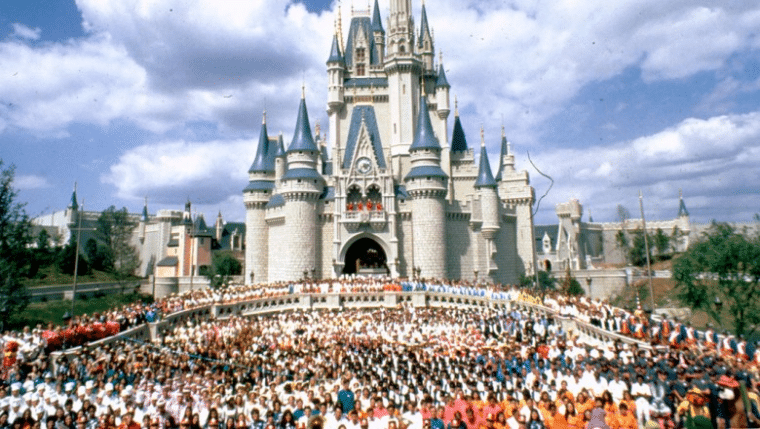

Meanwhile, work had begun on Disney’s second theme park: Walt Disney World in Orlando, Florida. The Magic Kingdom opened in October 1971, just two months before Roy O. Disney died. Disney World introduced the resort concept to theme parks, with hotels and golf courses complementing its amusement attractions.

In July 1981, Disney continued venturing into the entertainment industry with its first showing of Walt Disney’s World on Ice, which ran for two years and showcased famous characters.

However, the company was still heavily dependent on its theme park income, which accounted for 69% of its total revenue in 1981.

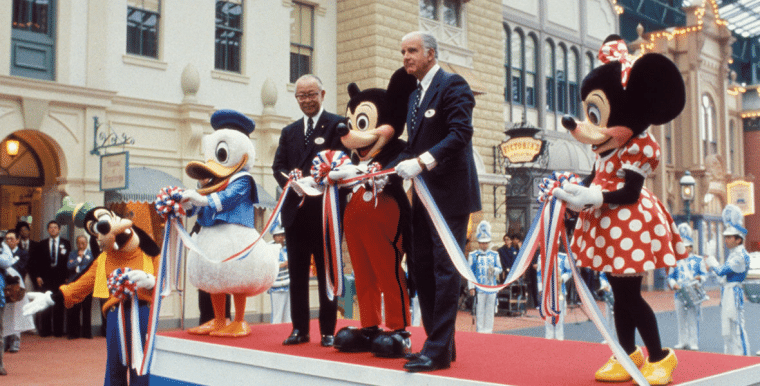

The following year saw the opening of EPCOT (Experimental Prototype Community of Tomorrow), the second park in Disney World and one of the last ideas Walt Disney had spoken about before his death. Tokyo Disneyland, Disney’s first foreign theme park, opened in Japan the following year.

The company’s faltering film and TV revenue had caused its stocks to become undervalued on Wall Street, making it an attractive target for corporate raiders who saw the value of Disney’s assets.

Under threat from financier Saul Steinberg, who had amassed a 12.2% share of Disney and intended to more than double this amount, the parties agreed to a greenmail deal which saw Steinberg sell his shares back to Disney for $325 million, a profit of $32 million. Uproar from investors who had lost out over this led to a class-action lawsuit with a $45 million cash settlement in 1989.

1984–2005: The Eisner-Wells Era & Disney Renaissance

Disney’s near miss with the hostile takeover was a wake-up call that prompted a change in management. Michael Eisner became the first CEO with no personal ties to the Disney family and Frank Wells was appointed president.

Under this fresh leadership, Walt Disney Productions found a new lease of life, ramping up its animation output and venturing further into short cartoons for TV.

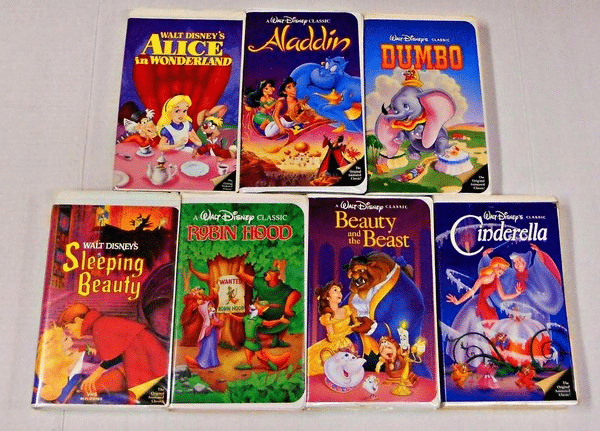

With financing from Silver Screen Partners, Disney produced hits including The Little Mermaid, Beauty and the Beast, Aladdin, and The Lion King in the decade that followed. It also started to release some of its older animated films on VHS. 7 out of 10 of the top-selling VHS tapes of all time are Disney films, with The Lion King having sold 32 million copies.

Euro Disney Resort, later renamed Disneyland Paris, opened in April 1992. However, it struggled financially due to lower-than-expected attendance and has been bailed out by Disney multiple times.

In 1996, Disney acquired Capital Cities/ABC (including ESPN) in a $19 billion deal that was the second-largest corporate takeover in history at the time. Bob Iger, who was president before the acquisition, would go on to become one of Disney’s most influential CEOs.

The company continued to develop new revenue streams with Broadway shows, cruise liners, and a large network of Disney Stores.

However, Disney returned to financial difficulty in the early 2000s, with ABC viewership declining and park attendance falling after the 9/11 attacks. Over 4,000 jobs were cut in an attempt to stabilize costs.

Soon after, Eisner faced calls to step down from leading The Walt Disney Company. Roy O. Disney and board member Stanley Gold both resigned in December 2003, stating that they believed Eisner was no longer the right person to be running the company. He remained for almost two more years though, eventually resigning in September 2005 and waiving his right to stay on as a consultant.

2005-2020: The Iger Expansion

Bob Iger was appointed CEO in October 2005. He announced in his first earnings call that the company would be “selective and strategic” in its approach to acquisitions under his leadership.

The first major acquisition, and the one that Iger later said he was most proud of, was the $7.4 billion purchase of animation studio Pixar. The two companies had been working together since Disney distributed Pixar’s Toy Story in 1995, but had more recently had disagreements over their partnership.

Disney shares were priced at $25.52 when the acquisition was announced in January 2006 and had risen to $29.09 by the time the deal was completed in May.

It also saw Pixar Chief Executive – and Apple leader – Steve Jobs take a place on Disney’s board. His 49.65% interest in Pixar was converted to 7% shares in Disney, worth $3.9 billion, making him the company’s largest individual shareholder. After Jobs’ death, his shares were inherited by Laurene Powell Jobs which amounted to around 4% of the company at the time.

Meanwhile, new Disney releases were breaking records; Pirates of the Caribbean: Dead Man’s Chest became its highest-grossing feature after its release in July 2006, raking in over $1 billion to become the highest-grossing movie that year. The sequel At World’s End took the same prize the following year with a total of $961 million.

The next significant acquisitions masterminded by Iger were Marvel Entertainment, purchased for $4.4 million in December 2009, and Lucasfilm from George Lucas, for $4.05 billion in December 2012. Both would bring billions of new revenue to the company through blockbuster films and merchandising of Avengers and Star Wars characters.

Shanghai Disneyland opened in 2016, marking a major push into the lucrative Chinese market and exceeding business expectations in its first year of operation.

By far the largest acquisition in the company’s history came in 2019 when The Walt Disney Company purchased 21st Century Fox for $71.3 billion. Not only did the deal bring characters such as The Simpsons and Deadpool into the Disney fold, strengthening the position of its soon-to-be-launched streaming service; but the transfer of Fox’s 30% share of Hulu gave Disney a controlling stake of 60%.

This podcast from Reid Hoffman gives a deeper analysis of how Iger managed to expand The Walt Disney Company so significantly without losing its magic:

2020–Present: The Streaming Era and Iger Returns

Disney’s online streaming service, Disney+, launched on November 12, 2019, and gained over 10 million users on its first day. The success of the launch pushed Disney’s market cap to a record high of $273 billion on November 25 that year.

Bob Iger resigned as CEO in February 2020, with Bob Chapek named as his successor. Iger took the role of executive chairman to oversee the transition but ended up staying until the end of 2021 to help the company navigate the pandemic as it faced extended park closures and disruption to its cruises. Iger’s prolonged involvement in the company was viewed by some as undermining Chapek’s authority as CEO.

Disney posted an operating loss of almost $5 billion in Q3 of fiscal year 2020. Shortly after, the company announced it was cutting 28,000 jobs – a number that later increased to 32,000, with an additional 37,000 staff placed on furlough.

These measures were not enough to keep Disney profitable; it recorded an operating loss of $2.86 billion compared to a profit of $11 billion in 2019.

Despite its struggles, Disney’s share prices soared close to $200 and the company reached a peak market cap of $366.87 billion on March 8, 2021.

2021 marked the end of an era for Disney Stores. With sales suffering from the pandemic and consumers increasingly shifting to online shopping, Disney closed more than 300 of its stores over the year, leaving just 25 standalone stores in the US.

Unimpressed by Chapek’s performance and his handling of several PR matters, the board ousted him in November 2022 and brought back Iger. In July 2023, Iger’s contract was extended until the end of 2026.

Disney’s streaming business (Disney+ and Hulu; ESPN reported separately) is just starting to become profitable, having been operating at a loss for several years.

However, part of this turnaround comes from cost-cutting which may have knock-on effects in years to come.

For a deeper look at the future of Disney’s streaming business, especially in comparison to Netflix, take a look at this analysis from Travis Hoium. He predicts that Disney may come out on top by 2026 thanks to its broader range of programs.

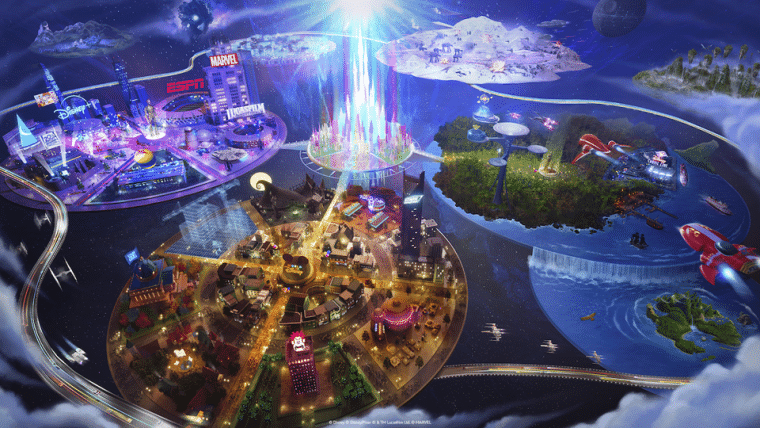

As The Walt Disney Company pushes through 2024 into 2025, it continues to look for opportunities in new markets. Most recently, it expanded further into the gaming world by purchasing a 9% stake in Epic Games for $1.5 billion. The collaboration will allow players to play and interact with their favorite Disney, Marvel, Star Wars, Pixar, and Avatar characters in the online game Fortnite.

Disney also announced plans to invest $60 billion in its Experiences over the next decade. Around half of this will go towards developing and updating its theme parks, including a fifth park at Wald Disney World in Florida. These announcements did little to revive its stock prices, which have remained below $100 for much of 2024.

What Does Disney Own?

The Walt Disney Company is broken down into three main business units following a restructure in 2023: Entertainment, Sports, and Experiences.

Prior to this, Entertainment and Sports were known as Media and Entertainment Distribution, and Experiences was known as the Parks, Experiences and Products segment. The restructure moved some of its Consumer Products revenue to Entertainment to account for the income generated on merchandise that uses IP created by the Entertainment segment.

Notable properties owned and licensed by Disney include:

- Mickey and Friends

- Frozen

- Star Wars

- Spider-Man

- Avengers

- Disney Princess

- Toy Story

- Winnie the Pooh

- Lilo & Stitch

Here is an overview of what Disney owns within each of its business units:

Entertainment

Non-sports focused film, TV, and direct-to-consumer (DTC) content production and distribution:

- Linear networks

- Domestic: ABC, Disney channels, Freeform, FX, National Geographic (73% ownership), A+E Networks (50% ownership)

- International: Disney channels, FX, Star, National Geographic (73% ownership)

- Direct-to-consumer

- Disney+: Global DTC general and family entertainment with over 150 million subscribers

- Disney+ Hotstar: Primarily Indian DTC service with general entertainment and sports

- Hulu (67% ownership): US network with general and family programming plus digital over-the-top (OTT) cable network streaming

- Content sales and licensing

- Sales and licensing of film & TV content to third-party services

- Theatrical distribution

- Home entertainment

- Live event staging and licensing

- Royalties from product sales

- Music distribution

- Post-production services

- National Geographic Magazine and online business (73% ownership)

Sports

Sports-focused global TV and DTC streaming content production and distribution:

- ESPN (80% ownership): Domestic and international channels; programs and streaming

- Star: Indian sports channels

Experiences

Theme parks, vacations, and other experiences in the US and worldwide:

- Domestic theme parks and resorts

- Walt Disney World Resort in Florida

- Disneyland Resort in California

- International theme parks and resorts

- Disneyland Paris

- Hong Kong Disneyland Resort (48% ownership)

- Shanghai Disney Resort (43% ownership)

- Third-party IP licensing for Tokyo Disney Resort

- Domestic experiences

- Disney Cruise Line

- Disney Vacation Club

- National Geographic Expeditions (73% ownership)

- Adventures by Disney

- Aulani Resort & Spa in Hawaii

- Consumer products

- Merchandise licensing of Disney-owned characters

- Disney Stores and online sales

Disney Controversies

It’s no surprise that a company with a 100-year history has faced some scandals in its time. Here are some of the most notable Disney controversies that have occurred in recent years:

- Wrongful death lawsuit: In 2023, Jeffrey Piccolo’s wife tragically died of an allergic reaction to food served at a restaurant in Disney Springs, despite his best attempts to ensure the meal was allergen-free. He later filed a wrongful death lawsuit, but Disney’s outrageous reaction was to point to an arbitration clause in terms and conditions Piccolo had signed in 2019 when signing up for a 1-month free trial of Disney+. This, predictably, sparked a huge public backlash and in August 2024 Disney dropped its attempt to stop the lawsuit.

- LBGTQ+ representation: Trying to walk the fine line between supporting the LBGTQ+ community and keeping its films suitable for more conservative markets, Disney has come under criticism for its lack of response to Florida’s “Don’t Say Gay” bill and its attempt to censor a same-sex kiss in the 2022 Pixar film Lightyear.

- Backlash over price increases: The introduction of the unpopular Lightning Lane system in 2021 required guests to pay for priority ride queues and since then, the park’s price increases seem to have been under greater scrutiny than usual. Ticket price hikes of up to 10% for the 2025 season had fans dubbing the park “The Most Expensive Place on Earth”, while one visitor calculated that the price of Mickey Premium Ice Cream Bars had risen at almost double the rate of inflation since they were introduced in 2009.

- Problematic older content: Some of Disney’s older animated films have been brought to light in recent years for their characters and storylines that are, by today’s standards, problematic or even racist. An offensive portrayal of Native Americans in Peter Pan and Lady and the Tramp’s “The Siamese Cat Song” have been given sensitivity warnings on Disney+, while the live-action release of Snow White came under fire from actor Peter Dinklage for being allowed to happen at all, despite a Latina actress having been cast as Snow White.

What Can We Learn From The Walt Disney Company?

One of the recurring themes in The Walt Disney Company’s history is diversification into new markets: From an animation studio to theme parks, cruises, TV networks, and streaming platforms.

Walt Disney was an entrepreneur who was always on the lookout for new opportunities, and the company has prospered from maintaining this ethos, taking chances on new ventures that may not have seemed a natural fit from the outside.

There are also lessons to learn about the importance of public image. Good PR is what Walt Disney used to turn Disneyland’s disastrous launch day into a huge success, while bad PR has marred the company’s public perception recently because of situations that could have been handled much better.

Disney’s board made a bold decision to bring Iger back in 2022, and it remains to be seen whether his leadership is enough to steer the company back to its former glory – especially in an era of more frugal consumers. He was able to fight off activist shareholders attempting to remove him from his position, showing his position of strength and internal support for the direction he’s taking the company.