For businesses looking to thrive in an increasingly uncertain environment, decision analysis is an invaluable tool for empowering sound decision-making and improving performance. If you’re a business owner, professional, or investor involved in any form of decision-making, decision analysis is the edge you need to guide your strategic efforts.

To help you leverage decision analysis and drive success in your operations, our experts at Business2Community will guide you through everything you need to know in a simple step-by-step process, with relevant examples to demonstrate its value in a business context.

Decision Analysis – Key Takeaways

- Decision analysis is a valuable business tool that aids decision-makers in making important business decisions.

- By quantifying uncertainties and potential outcomes, it helps determine the opportunities, risks, and trade-offs associated with complex decisions.

- It’s an indispensable addition to the decision-making process and can be integrated with other analysis tools to enhance decision-making.

What is Decision Analysis?

Created by management science professor Ronald A. Howard in 1964, decision analysis is a systematic and numerical method for assessing decision options through different models and tools. It examines possible results in uncertain situations and takes into account various decision factors like costs, benefits, and risks to find the option that offers the best result.

Types of Decision Analysis

There are three main types of decision analysis:

- Predictive decision analysis: Uses historical data, statistical decision theory, and forecasting techniques to predict future events and understand the potential consequences of different decision alternatives.

- Normative decision analysis: Uses decision theory, a decision-maker’s preferences, risk tolerance, and a set of criteria or values to identify the best alternative out of multiple decision alternatives.

- Prescriptive decision analysis: Identifies the best decision out of possible outcomes, providing specific guidance, feedback, and insights from previous decisions.

Decision Analysis Tools

The tools outlined below can be adapted for predictive, normative, and prescriptive decision analysis modeling, depending on your decision problem, available data, and your decision analysts’ preferences. You can also combine them to guide more effective decision-making.

- Decision matrix: A grid for evaluating alternative solutions based on a predefined set of criteria.

- Decision trees: Structured visual representations of decisions and their possible outcomes to enable the analysis of sequential decisions.

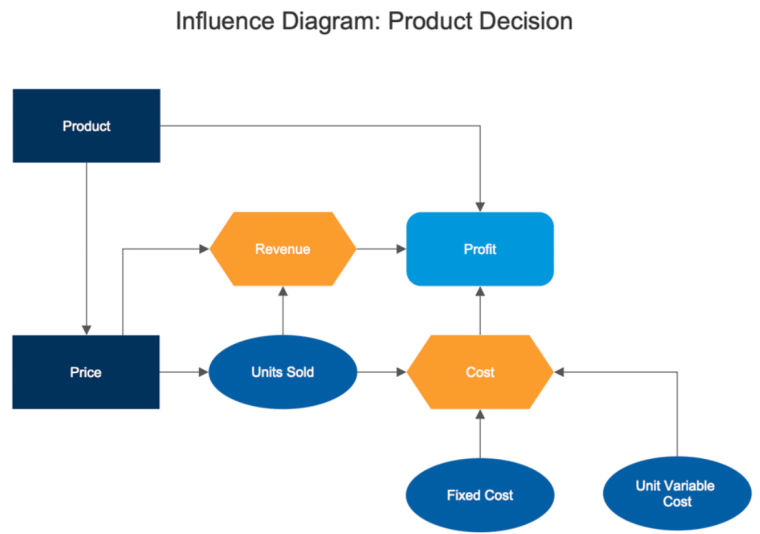

- Influence diagrams: Visual representations showing the relationship between factors, decisions, and uncertainties in complex decision scenarios.

- Expected value analysis: Determines the expected value of decision alternatives based on probabilities and payoffs.

- Utility theory: Quantifies a decision-maker’s attitude toward risk as well as their values and preferences through a utility function to guide choices that minimize trade-offs and maximize expected utility.

- Analytic Hierarchy Process (AHP): A technique that breaks down complex decisions into a hierarchy of criteria and alternatives, enabling systematic evaluation.

- Cost-benefit analysis (CBA): Compares the costs of different decisions with their corresponding benefits.

- Multi-attribute decision making (MADM): Incorporates value judgments and methods such as Multi-attribute Utility Theory and Multi-attribute Utility Analysis to assess and rank alternative solutions based on relevant factors.

- Bayesian analysis: Uses a Bayesian approach to help decision-makers while continuously updating their beliefs as new information becomes available.

- Cost-effectiveness analysis (CEA): Cost-effectiveness analyses evaluate the costs and outcomes of different alternatives to identify the options that yield the best value for money.

- Risk analysis: Evaluates uncertainties to inform a recommended course of action, ensuring a decision process where potential outcomes are weighed against their likelihood and impact.

- Sensitivity analysis: Assesses how changes in input variables affect the expected outcomes of a decision model to pinpoint the most influential factors on a decision.

Who Needs to Do a Decision Analysis?

Decision analysis informs difficult decisions involving various stakeholders, multiple (possibly conflicting) objectives, complex alternatives, notable uncertainties, and significant consequences. As such, business owners, managers, and investors tasked with making strategic decisions need to do decision analysis. Using this detailed analysis process, these key decision-makers can:

- Make high-level strategic decisions related to potential mergers and acquisitions, entering new markets, or launching major product lines.

- Optimize strategies, resource allocation, and performance in business departments such as marketing, sales, and finance.

- Weigh the risks, opportunities, and trade-offs associated with complex decisions.

How to Perform a Decision Analysis

Now let’s dive into a simple 7-step process to help you perform a decision analysis.

Step 1: Define Your Decision Problem

In the first step, clearly define the decision that needs to be made. In addition:

- Understand the nature of the decision, its alternatives, and key constraints.

- Identify relevant stakeholders and their interests.

- Formulate a problem statement.

This will provide a clear understanding of the decision context and ensure that your decision analysis process aligns with key business goals and stakeholder expectations.

Step 2: Generate Solutions

Once you’ve defined your decision problem:

- Generate possible solutions, alternatives, or various courses of action to address your decision problem.

- Use tools like mind mapping, or SWOT analysis to help you with realistic alternatives.

- Gather relevant data, both quantitative and qualitative, from various sources such as historical records, market research, experts, surveys, or online databases.

Key factors to consider include the costs, benefits, risks, uncertainties, and probabilities associated with each option as this will help you develop a comprehensive framework for evaluating your decision.

Step 3: Create an Evaluation Framework

To systematically evaluate the options, it’s essential to create an evaluation framework. This involves establishing specific decision criteria or key performance indicators (KPIs) that you can use to measure and compare potential outcomes.

- Assign weights to each of your KPIs to reflect their relative importance.

- Assign a numerical value to represent your risk preference.

- Assign probabilities and monetary values to potential outcomes.

Step 4: Weigh Your Options

This next step involves comparing and evaluating the alternatives based on your evaluation framework. Use decision models such as decision trees, influence diagrams, or expected value calculations to help you visualize and quantify potential decision outcomes.

A decision tree is a model with ‘branches’ that represent potential outcomes, alternatives, and probabilities of various decisions.

An influence diagram is a model that visually depicts the relationships and influences among various factors, decisions, and outcomes in a decision-making process.

Expected value represents the weighted average of potential outcomes, factoring in the probabilities of each outcome. This helps quantify the potential value of each option and aids in comparing and ranking them based on their expected outcomes.

To calculate the expected value, multiply the probability of each outcome by its associated value (benefit or cost), and then sum the values for each decision option.

Step 6: Select the Best Decision

Once the expected values have been calculated, it’s time to make the decision. The option with the highest expected value is generally considered the best choice. However, other factors such as risk tolerance, time constraints, and resource availability may also play a role in the final decision.

To arrive at the best decision, consult other stakeholders for their feedback and expertise, or conduct additional analysis such as:

- Sensitivity analysis to identify how changes in probabilities or payoffs affect the overall decision.

- Risk analysis to evaluate the potential risks associated with each option.

Step 7: Implement and Iterate

After making a decision, move into the implementation phase. Here, you’ll need to:

- Develop a detailed plan, allocate resources, and establish a timeline.

- Monitor and evaluate the decision’s progress.

- Compare actual outcomes with expected ones, spot deviations, and make necessary adjustments for success.

- Prioritize continuous improvement and apply new insights to improve future decision-making.

Decision Analysis Examples

Let’s dive into some real-world examples of decision analysis:

Example 1: Launching a New Product

Scenario: A company wants to launch a new product.

Decision options:

Option 1: Launch the product

Option 2: Don’t launch the product

After visualizing the key variables, factors, and outcomes in an influence diagram, the analyst assigns quantitative values to each option.

Based on market research, there is a 75% chance of high sales or demand for the product with a payoff of $500,000 and a 25% chance of low demand with a net loss of $300,000.

The analyst uses the expected value formula to determine the best option.

EV = (Probability 1 x expected payoff 1) + (Probability 2 x expected payoff 2)

For Option 1:

(Probability x expected payoff ) = EV

($500,000x 75%) = $375,000

For Option 2:

(Probability x expected payoff) = EV

($300,000x 25%) = $75, 000

Option 1 yields a higher payoff, suggesting that the company should proceed with the product launch.

Example 2: Acquiring a Company

Scenario: A CEO would like to acquire a company.

Decision options:

Considering all the available data, the CEO visualizes the outcomes in a tree diagram and assigns a probability and utility metric to each option as shown in the table below.

The CEO uses the expected value formula to determine the best option.

EV = (Probability A x expected payoff A) + (Probability B x expected payoff B)

Expected Utility of Option A:

(0.7 x 200)+(0.3 x −100) = 140−30 = 110

Expected Utility of Option B:

(0.5 x 300)+(0.5 x−200)= 150−100 = 50

Of the two alternatives, Option A has a higher expected utility, suggesting that it is the better choice for the CEO in our example.

When to Use Decision Analysis

Whatever the size of your business, you can use decision analysis to stay ahead of the competition. A case in point is the billion-dollar corporation Chevron, which was awarded the Decision Analysis Society Practice Award in 2010 for its use of decision analysis in all major business decisions. Here are key examples of how decision analysis can be used to aid sound decision-making:

Introducing a New Product Line

When you’re launching a new product line, decision analysis is a vital tool for evaluating potential outcomes, market dynamics, and financial implications. For example, a tech company considering the launch of a new software product can evaluate market demand, development costs, and potential profitability using decision analysis and decide whether to proceed with the new product or explore alternative strategies.

Investing in New Assets

Decision analysis is crucial when considering significant investments in new assets such as infrastructure or technology and can aid in determining expected returns, associated risks, and financial implications.

For instance, a company deciding whether to invest in renewable energy can use decision analysis to assess the expected payoffs, environmental impacts, and regulatory implications of investing in sustainability.

Entering New Markets

For businesses wanting to expand into new markets, decision analysis should be a critical step enabling the assessment of factors such as market size, growth potential, and compatibility with existing business capabilities.

For example, an ecommerce firm exploring entry into a new international market can use decision analysis to evaluate the expected value of the move based on the target location’s cultural fit, logistical infrastructure, and market potential.

How to Adjust a Decision Analysis

To adjust your decision analysis and ensure it remains relevant and insightful even as circumstances or your business priorities change, do the following:

- Consider “what-if” scenarios: If you’re evaluating a product launch, explore “what-if” scenarios by adjusting marketing budgets and launch timelines to see how these changes influence projected sales and market penetration.

- Develop contingency plans: If you’re making a project management decision, conduct operations research to develop alternative project timelines and address potential delays or constraints.

- Incorporate new information: If you’re deciding on marketing strategies, regularly update your decision analysis with the latest market research data as new consumer trends and competitor actions can significantly impact the feasibility of your strategies.

- Realign with priorities: If you’re managing a portfolio, align your decision analysis with shifting investment priorities and adjust weightings for different investment criteria or to reflect changes in your goals or market conditions.

- Adjust your risk tolerance: If you’re considering financial investments, adjust your risk tolerance based on market volatility and economic conditions.

- Seek balance: If you’re selecting a supplier for a critical project, seek balance by weighing not only cost factors but also supplier reliability and reputation.

Ultimately, the key to influencing your decision analysis positively lies in flexibility, continuous learning, and the willingness to refine your approach.

Limitations of Decision Analysis

While decision analysis provides you with a structured framework for evaluating complex decisions, it’s crucial to recognize its limitations and consider complementary approaches for a more effective decision-making process.

Decision Analysis Problems

Decision analysis may not accurately represent complex decision scenarios and may cause you to oversimplify or overlook critical factors. As such, it is important to carefully consider the context of your decision problem and supplement your quantitative analysis with qualitative analysis and other frameworks like PESTEL to avoid oversights.

Analysis Paralysis

When faced with a large number of factors or scenarios to analyze, decision analysis can lead to analysis paralysis (the state of being so overwhelmed with information that you can’t make a decision). As this can hinder effective decision-making, it’s important to strike a balance between comprehensiveness and practicality.

Reliance on Management Judgment

In business settings, decision analysis can rely heavily on management judgment, leading to subjectivity and potential biases. As a decision-maker, your perspectives can significantly impact the outcome, so prioritize diverse input from external sources and multiple stakeholders.

The Value of Decision Analysis

The value of decision analysis lies in its ability to ensure that your decisions are made after careful consideration of a range of factors, risks, and potential outcomes. Whether you’re exploring market entry strategies, allocating resources across projects, or evaluating potential investments, decision analysis provides a systematic and data-driven approach to assessing options and their potential outcomes.

Its adaptability allows your business to fine-tune analyses based on evolving circumstances or shifting priorities and despite its limitations, decision analysis remains crucial in strategic decision-making. To enhance its effectiveness and address issues that decision analysis alone may not capture, you can complement it with other analyses and methodologies.

Ultimately, by ensuring that your decisions are grounded in a robust analytical process, decision analysis fosters efficiency, informed growth, and overall success. Integrate it into your business operations to not only achieve your goals but drive long-term success and resilience. For an even greater edge in the marketplace, combine decision analysis with strategic analysis tools like PESTEL.