Cost-volume-profit (CVP) analysis is a valuable cost-accounting technique that identifies the costs involved in your production and the sales volume needed to break even. Mastering this analytical tool can enhance business performance, facilitate short-term business decisions, and highlight profitable strategies.

Our team at Business2Community has meticulously prepared this beginner’s guide to conquering CVP analysis. We will provide a detailed guide on conducting the analysis, real-life examples, as well as its limitations so you can put this tool to work in your business.

CVP Analysis – Key Takeaways

- CVP analysis calculates the fixed costs, variable costs, and contribution margin to identify the break-even point.

- With this simple method, you can adjust the numbers to see how changes in prices and costs can affect the firm’s profitability.

- Due to its limitations, you should always perform further analyses to produce the most reliable results.

What is a CVP Analysis?

Cost volume profit analysis is a cost-accounting tool used to investigate the effect of changes in fixed costs and variable costs on a firm’s profit. It informs you about the sales volume you must attain in order to break even.

In accounting, fixed costs, such as rent, installation fees, and license fees, refer to costs that remain the same regardless of the units produced. Variable costs, such as part-time salaries, raw ingredients, and electricity, are costs that will increase proportionally with the units sold.

The break-even point indicates the output level where the sales revenue can cover the total costs, i.e. you will neither make a profit nor a loss at this point.

CVP analysis is an essential tool for assessing your company’s profitability before you engage in any production activities. It also helps you identify hidden expenses associated with operations that you might not have been aware of or considered yet.

Who Needs to Do a CVP Analysis?

CVP analysis penetrates every aspect of the business spectrum. Regardless of your role, this technique will come in handy at some point.

Here are a few examples of using this analytical method to demonstrate its value in the business world:

- Business owners: Before you start your entrepreneurship, you need to calculate the variable and fixed costs involved in the production to better set your product’s selling price. This analysis breaks down the cost structures in the production line so you can determine a suitable output level.

- Stock traders: As a stock trader, CVP analysis reveals the price movements needed to fully cover your trading costs. It gives you an idea about the market risk, how fast you can make a profit, and the total costs involved.

- Production managers: Production managers need to closely monitor fluctuations in costs like price changes in rent and raw materials to formulate short-term strategies. This technique identifies the corresponding break-even point at each contribution margin.

- Investors: Being able to interpret a CVP graph is crucial for investors as it tells you about how many units the company needs to sell to cover the fixed costs and start making a profit. The break-even point determines if a company is worth investing in.

How to Perform a CVP Analysis

Before we walk you through a step-by-step guide to performing a CVP analysis, let’s take a look at the assumptions within it, first:

- The unit sales price, fixed costs, and, variable costs per unit will remain constant at all production levels.

- All units produced are sold.

- Changes in expenses are strictly due to changes in the output level/sales volume.

With these assumptions in mind, we can conduct the cost volume profit analysis.

Step 1: Find Out Your Fixed Costs

Investigate the total fixed costs you’ll face in the operations. By definition, a fixed cost will remain payable even if you decide to close the production or set the output level at zero.

Examples of fixed costs include rent, insurance, equipment purchases, full-time salaries, registration fees, and administration fees. These fees are vital to the operations and will remain constant, regardless of the production output.

Step 2: Calculate the Variable Costs and the Per Unit Sales Price

A variable cost per unit refers to the extra cost needed to produce an additional unit. Sales commissions, piece-rate staff salaries, raw material costs, delivery fees, and packaging supplies are typical examples of variable costs. Gather information about the total variable costs and determine the per-unit sales price of the production.

Step 3: Identify the Contribution Margin

A contribution margin is the money left from sales after covering the total variable costs. The leftover money can contribute towards paying for the fixed costs.

The contribution margin formula is:

Alternatively, you can use the contribution margin ratio (CM ratio), which measures the amount of sales dollars covering the fixed costs in percentage.

The CM ratio formula is:

Step 4: Conduct a Cost Volume Profit Analysis

Now that you have the contribution margin ratio, fixed and variable costs, and the sales price, you can conduct the cost volume profit analysis to find out the sales volume required to cover the total expenses.

You can calculate the break-even point in terms of sales dollars or on a per-unit basis.

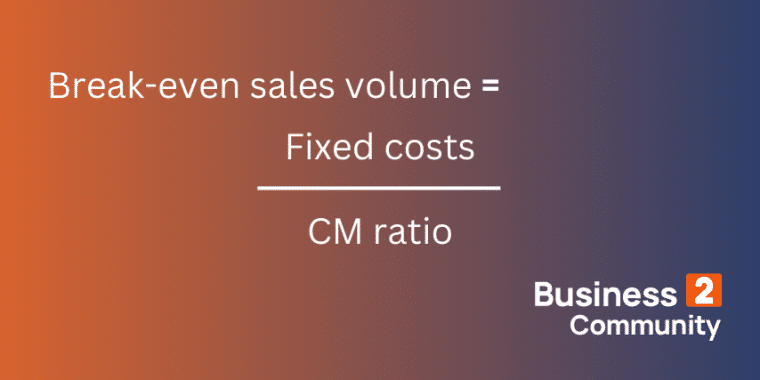

For the break-even sales volume, the formula is:

For calculating the break-even sales units, use the following formula:

When you’re calculating the break-even point, it’s important to always round up the final answer to make sure your net income is greater than the total costs.

With the CVP analysis results, you can discuss possible expansion plans, production timelines, and resource allocation strategies with your team to achieve the target sales units more effectively.

CVP Analysis Examples

CVP analysis is a quick and simple way to assess the profitability of a business. The contribution margin and the break-even net income determine the difficulty in achieving desirable results for your company.

We’ve created two in-depth examples of utilizing the CVP analysis so you can make smarter and more profitable decisions.

Example 1: Determining the Right Time to Sell Stocks

You are a stock trader interested in finding out the break-even point of a stock you just bought. Suppose you bought $150 worth of stock in a tech firm. The stock you bought is considered the variable cost.

To calculate the break-even point, you need to measure the fixed costs as well, which are:

- License fee: $100

- Registration fee: $50

Using the formula above, your total costs are:

$150 + $100 + $50 = $300

In order to break even, the market price of the stock needs to reach $300. If you sell it after the break-even point, you will make a profit.

Example 2: Starting a New Business

You want to open up a coffee shop and before you do that, you need to conduct a CVP analysis to understand the profitability and feasibility of this business idea.

Here are the fixed costs involved:

- Unit rent: $1,000 per month

- Full-time salaries: $2,000 per month

- Rental of equipment: $800 per month

- Insurance: $500 per month

Total fixed costs: $1,000 + $2,000 + $800 + $500 = $4,300

As for your variable costs:

- Raw materials: $1 per cup

- Piece-rate direct labor: $2 per cup

- Electricity: $4 per cup

Total variable costs: $1 + $2 + $4 = $7

Assuming you are selling each cup of coffee at $10, the contribution margin ratio is:

($10 – $7)/10 = 0.3

Using the break-even formula, the break-even sales volume is:

$4,300/0.3 = $14,333.33

You need to make $14,334 (1,434 cups of coffee at $10 each) to break even.

If your company sells more than that, you will start seeing a positive net income.

How to Adjust a CVP Analysis

Sometimes, CVP analysis may not generate the results you want. You can review the contribution margin, selling prices, and the cost of goods sold to produce satisfactory results.

To positively adjust your CVP analysis, i.e. a lower sales revenue is needed to break even, here are a few things you can do:

- Increase the selling price or decrease the total variable costs to raise the unit contribution margin, which increases the amount of total dollars contributing to cover the fixed costs. Hence, you will need fewer sales before you start making a profit.

- Lower the fixed costs by renting a cheaper place or reviewing the number of full-time staff needed. It speeds up the time needed to achieve the target sales volume so you can reach the target profit level quicker.

- Update your equipment or production process to produce a product at a lower cost.

Limitations of CVP Analysis

Despite being an insightful tool for measuring the contribution margin and net income of a business, this analysis technique comes with several limitations. You should always incorporate other statistical tools like regression analysis and PEST analysis for the best results.

Costs Are Not Always Constant

The cost-volume-profit analysis assumes a constant contribution margin and variable costs throughout all output levels. The only variable is the total revenue. However, in reality, it is often not the case. The total costs usually decrease proportionally when the output levels increase.

Since this technique doesn’t provide a relevant range that considers the changes in costs, you need to utilize other statistical regression tools to better understand the relationships among variables.

It Doesn’t Tell You When You Can Break Even

Although the various calculations give you an idea about the costs and contribution margin of your operations, it fails to analyze the time frame needed to break even. It doesn’t predict sales or fluctuations in demand.

It Doesn’t Help With Long-Term Strategies

The CVP analysis technique is only concerned with short-term planning. It doesn’t look at your long-term business goals and analyze your strengths and weaknesses. To better understand the competitiveness of your company, you can adopt qualitative analytical tools to identify any challenges and opportunities ahead.

The Value of CVP Analysis

CVP analysis is an important tool that determines the break-even point for various cost structures so you can make more informed expansion decisions. By breaking down your production costs, you can also gain a deeper understanding of your operations and strategize to reduce costs.

In the business world, this kind of break-even analysis is one of the first things professionals conduct to analyze a company’s profitability. This simple technique can be used as your blueprint when you start a new business and should be updated regularly to keep track of its profitability.

That said, this versatile tool has a few limitations. You should always adopt further analyses to cross-examine your results to make sure you make the right decisions.