As the third-largest bank in the US by assets, Citigroup has dominated the banking industry through innovation and diversification.

In November 2024, Citigroup’s net worth stands at $132.86 billion.

Here at Business2Community, our team of experts delivers the most reliable data about public companies. We’ve documented all the important dates in Citigroup’s net worth trajectory over the years so you can learn from its success.

Citigroup Key Company Data

Citigroup Net Worth: $132.86 billion

Date Founded: 1812

Founded By: Colonel Samuel Osgood

Current CEO: Jane Fraser

Industries: Financial services

Citigroup Stock Ticker: NYSE: C

Dividend Yield: 3.21%

What is Citigroup’s Net Worth?

As of November 2024, Citigroup has a net worth, alternatively known as market cap, of $132.86 billion, based on a stock price of $70.61 per share and 1.89 billion shares outstanding. Citigroup is traded on the New York Stock Exchange (NYSE) under the ticker symbol C.

The company first went public in 1968 through its predecessor First National City Corporation. Over the next two decades, the company underwent a series of mergers and acquisitions which eventually led to the record-breaking $70 billion merger between Citicorp and Travelers in April 1998 that gave birth to the present-day Citigroup.

Following the merger, Citigroup’s net worth reached $77.38 billion in that July.

In the late 1990s and early 2000s, the US housing market experienced a drastic boom. Due to this, Citigroup’s services such as mortgage loans and asset management expanded quickly, pushing its market cap to $350 billion by August 2000.

That same year, to curb the fast-growing lending and borrowing market, the federal government stepped in and raised the interest rate to 6.5%, the highest of the decade. It pushed Citigroup’s net worth down to $256.45 billion at the end of 2000.

Before the Great Recession ravaged the US economy, the New York-based bank had a net worth of $270 billion in mid-2007. As Lehman Brothers and other financial institutions began crumbling, Citigroup’s stock also took a deep plunge.

In March 2009, its per-share price dropped to $0.97, its lowest point since its creation in 1998. The drop in stock price caused nearly 98% of its market value to disappear, leaving it with a net worth of just $6 billion.

With the help of the federal government’s investments, Citigroup’s financial situation began to improve. In March 2011, it announced a 1-to-10 reverse stock split, which successfully boosted its per-share price to $40 with a market cap of $130 billion. However, the positive outlook didn’t last as the 2011 Eurozone debt crisis affected global markets. Citigroup’s net worth dropped to $74.89 billion in September.

COVID-19 was another challenge for the leading investment bank due to the decline in investment activities. Citigroup saw a 46% year-to-year decline in its 2020 Q1 profits, corresponding to its market cap decline from $168.90 billion at the end of 2019 to $87.69 billion in April 2020.

To alleviate the situation, the company invested $5 billion to deal with COVID-19 losses and resumed job cuts on around 26,000 positions to save costs.

Citigroup’s financial year ends on December 31 with a full-year report published on its website within the next quarter.

Citigroup’s Revenue

With the fall of Lehman Brothers and the subprime mortgage crisis in 2008, Citigroup was on the brink of collapse. In Q1 alone, the bank reported a $10 billion loss, the worst-ever quarter recorded. Its 2008 total deficit was $27.6 billion on $51.83 billion in revenue.

To prevent one of the biggest US banks from damaging the economy further, the US Treasury stepped in and bought a 36% stake in Citigroup in early 2009 with a total value of $25 billion. During the financial crisis, the US government invested a total of $45 billion to bail out the failing bank. The tactic worked – the mortgage loan provider’s 2009 annual losses fell to $1.60 billion on $81 billion in revenue.

The government exited Citigroup with a profit of $12 billion by the end of 2010 with the investment bank reporting the first profitable year since the crisis at $10.60 billion on $85.42 billion in revenue.

Soon after the Great Recession, the Eurozone debt crisis started. Together with the ongoing uncertainty in trading, Citigroup’s revenue fell to $69.67 billion in 2012.

Since then, the investment firm’s annual net revenue has been fluctuating between $70-78 billion. Its 2023 full-year net income was $78.43 billion.

| Year | Revenue ($ billions) |

| 2014 | 77.13 |

| 2015 | 76.35 |

| 2016 | 69.88 |

| 2017 | 72.31 |

| 2018 | 72.85 |

| 2019 | 74.29 |

| 2020 | 74.57 |

| 2021 | 72.12 |

| 2022 | 74.64 |

| 2023 | 78.43 |

Citigroup Dividend History

Citigroup’s dividend history began when it paid its first dividend in 1986 at $0.05 per share. Since then, it has been paying dividends quarterly and annually even through various economic crises. In the months leading to the housing bubble burst in 2007, Citigroup paid dividends at $5.70 per share.

After the 2008 financial crisis, its dividend payout fell to $0.01 per share in 2011 before gradually increasing in the years that followed. In November 2024, Citigroup paid a dividend of $0.56 per share with a dividend yield of 3.21%.

Throughout the years, Citigroup recorded 10 stock splits in total with the first one taking place in 1987.

The last stock split, which was a 1-to-10 reverse stock split, was carried out in 2010 in an attempt to stabilize the crashing stock during the financial turmoil. If you bought one share in Citigroup’s IPO in 1968, it would’ve increased to 24 shares in 2010 after the 9 previous stock splits. Then, the reverse stock spilt would’ve put your number of shares down to 2.4 shares.

| Date | Stock Price ($) | Dividend Payout ($) | Dividend Yield (%) |

| 01/31/2020 | 61.83 | 1.26 | 2.04 |

| 05/01/2020 | 38.25 | 1.69 | 4.24 |

| 07/31/2020 | 42.25 | 1.71 | 4.02 |

| 10/30/2020 | 35.59 | 1.72 | 4.84 |

| 01/29/2021 | 50.27 | 1.74 | 3.46 |

| 04/30/2021 | 62.20 | 1.76 | 2.83 |

| 07/30/2021 | 59.48 | 1.77 | 2.98 |

| 10/29/2021 | 61.29 | 1.97 | 2.92 |

| 02/04/2022 | 59.01 | 1.80 | 3.05 |

| 04/29/2022 | 43.51 | 1.82 | 4.17 |

| 07/29/2022 | 47.30 | 1.83 | 3.87 |

| 11/04/2022 | 41.59 | 1.85 | 4.45 |

| 02/03/2023 | 47.43 | 1.87 | 3.94 |

| 04/28/2023 | 44.29 | 1.89 | 4.27 |

| 08/04/2023 | 43.51 | 1.93 | 4.43 |

| 11/03/2023 | 40.73 | 1.97 | 4.84 |

| 02/02/2024 | 54.04 | 2.01 | 3.72 |

| 05/03/2024 | 60.37 | 2.05 | 3.40 |

| 08/05/2024 | 55.71 | 2.10 | 3.77 |

| 11/04/2024 | 62.35 | 2.15 | 3.45 |

Who Owns Citigroup?

Citigroup Inc. is a public company. Its largest shareholders are institutional investors, such as Vanguard Inc. (8.86% ownership), BlackRock Inc. (8.63%), State Street Corporation (4.32%), and Berkshire Hathaway Inc. (2.92%), which hold around 71% of Citigroup stock collectively. Approximately 3% of shares are owned by Citigroup insiders.

Citigroup Inc. was formed by the 1998 merger of Citicorp and Travelers Group Inc. Citicorp was the holding company for Citibank and a global leader in credit cards, foreign exchange, and consumer financial services. Travelers Group was a franchise-based giant in financial services, insurance, and investment banking.

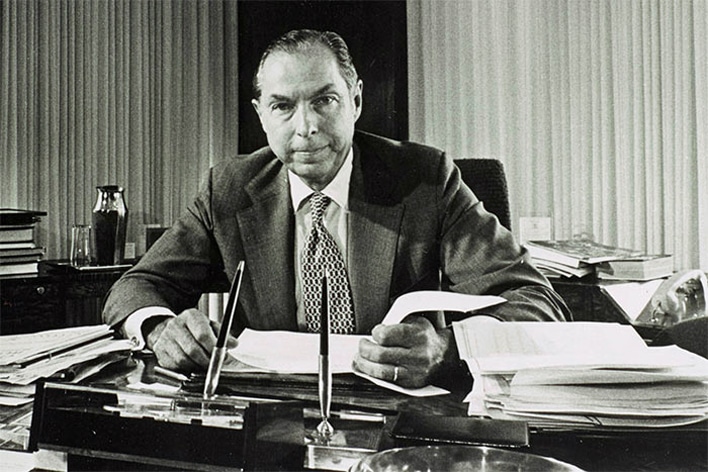

Speaking about the merger, Sanford Weill, the Travelers CEO said:

Citicorp stuck out like a strategic home run

Who is the Citigroup CEO?

Jane Fraser was appointed Citigroup CEO in 2021. She is the first woman to be named CEO of a Wall Street bank.

Fraser joined Citigroup in 2004 and has held leadership roles across Citi’s consumer and institutional businesses. Before joining Citi, Jane was a partner at McKinsey & Company.

Below is a list of all previous Citigroup CEOs since its creation in 1998:

| CEO | Tenure |

| Sandy Weill | 1998-2003 |

| Charles Prince | 2003-2007 |

| Vikram Pandit | 2007-2012 |

| Michael Corbat | 2012-2021 |

| Jane Fraser | 2021-present day |

Growth and Development of Citigroup

By looking at the decisions of Citigroup senior management over the centuries, we can learn a lot about its innovative breakthroughs and truly international approach.

A History of Citigroup – Key Dates

- Citicorp was Citibank’s holding company, set up in 1968 as First National City Corporation.

- In 1974, Citicorp established a consumer division, led by John Reed.

- Citigroup Inc. was formed by the 1998 merger of Citicorp and Travelers Group Inc.

- During the 2008 global financial crisis, Citigroup received $45 billion from the US government.

- In 2021, Jane Fraser was appointed Citigroup CEO – the first woman to lead a major US bank.

1791-1929: City Bank Evolves to Become the Largest Bank in the USA

Citicorp, which merged with Travelers in 1998 to form Citigroup, can be traced back to the First Bank of the United States. Founded in 1791, the First Bank was designed to stabilize and improve the country’s post-revolution economy. In 1812, Colonel Samuel Osgood took over the First Bank’s New York branch and renamed it the City Bank of New York.

City Bank was almost toppled during the financial panic of 1837, after which it was taken over by John Jacob Astor and led by Moses Taylor. Under Moses Taylor’s leadership, City Bank built a strong financial approach. In 1856, the bank changed its name to the National City Bank of New York.

Taylor was also a director of the company which laid the first transatlantic cable between New York and London. This was when the National City Bank first adopted the wire code address Citibank.

James Stillman took over in 1891. He had believed that businesses deserved a bank that could offer specialist services. Following the 1893 financial panic, the National City Bank became the largest bank in the United States thanks to its meticulous and low-risk banking practices. As the company’s reputation for safety spread, it drew in business from the country’s biggest corporations.

Towards the end of the 1800s, agricultural projects in South and Central America had become popular investment targets for US businesses. Government regulations at the time meant that the National City Bank was unable to do business from foreign branches. City Bank President Vanderlip lobbied to change the policy, winning in 1913 with the passing of the Federal Reserve Act.

Previously, national banks had catered almost entirely to big businesses. Recognizing an untapped opportunity to grow into personal banking, the National City Bank became the first bank to offer interest on savings and personal loans. By the end of the 1920s, the National City Bank had become the largest bank in the USA.

1929-1967: National City Bank is Saved by the Negotiable Certificate of Deposit

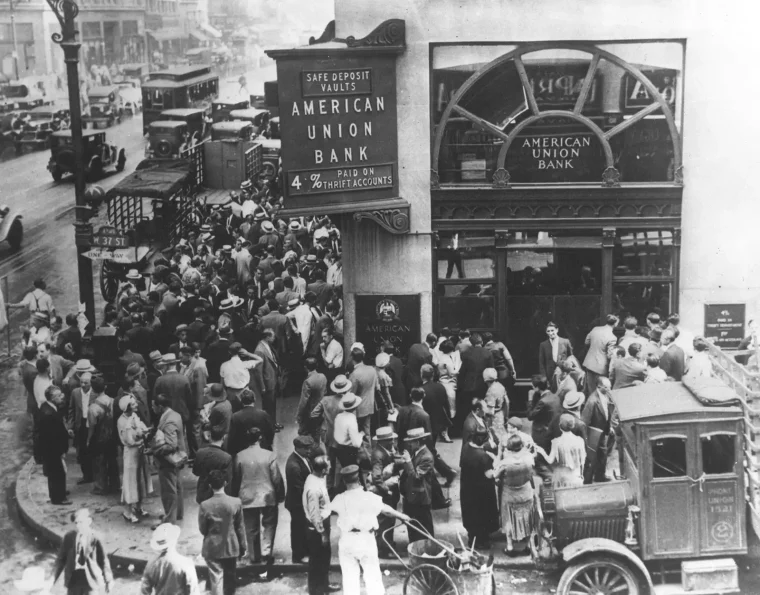

In 1929, the stock market crash that kicked off the Great Depression caused a crisis in the banking industry. While thousands of banks were forced to close, the National City Bank managed to stay in business.

However, the Glass-Steagall Act, passed by Congress in 1933, restricted the activities of banks by forcing them to separate investment and commercial banking to protect depositors’ money. The National City Bank had to shut down its securities affiliate and limit its financial product offering.

The National City Bank had implemented a defensive strategy which it continued throughout the Second World War and emerged from the war in a strong position. This enabled it to quickly regain its leading position.

The National City Bank changed direction in 1948, moving more aggressively into corporate loans. In 1955, it acquired the First National Bank of New York and subsequently changed its name to become the First National City Bank of New York, often referred to as Citibank.

Citibank relied heavily on its bond portfolio to finance this move into corporate lending, but by 1957, Citi had more or less used up its reserves. After several years of difficulties, in 1961, Citibank launched an innovative new product known as the negotiable certificate of deposit or CD.

The CD offered corporate depositors higher returns on their savings in exchange for limited liquidity. This innovation marked a change for the entire banking industry, and the launch was an enormous success, with the value of outstanding CDs reaching $15 billion by 1965.

In 1962, the bank changed its official name to First National City Bank. Intending to get around federal government regulations that controlled banking activities, in 1968 Citibank set up a holding company. The holding company was called First National City Corporation and, while it owned the bank, it was free to engage in all areas of business. Many other large US banks also followed suit.

In 1970, the federal government announced a change to the Bank Holding Company Act of 1956 to put a stop to this workaround and ensure these holding companies couldn’t move into non-financial activities.

1967-1998: John Reed Steers Citicorp Through Troubled Times

Walter Wriston became president in 1967 and campaigned heavily for the relaxation of banking laws. In 1974, the holding company changed its name to Citicorp, and, in 1976, First National City Bank officially became Citibank, N.A.

Having been heavily focused on corporate banking, in 1974 Citicorp established a consumer division led by John Reed. Reed’s vision was to build a global retail banking business based on the evolving needs of individual customers. He wanted to find a way to keep customers loyal to Citi throughout their lifetimes. Reed is quoted as saying:

I proposed three questions for the consumer business: Who is your customer? What role do you play in their life? What makes them choose you?

Reed also led Citibank’s entry into the credit card market. He was behind an offer of Visa and MasterCharge cards to millions of Americans. This move brought many customers to Citibank but many of these later defaulted, costing the corporation hundreds of millions.

In the late 70s, Citicorp hit hard times. Declining economic conditions in developing countries and political unrest elsewhere in the global markets led to poor returns on Citicorp’s international loans. Back at home, Citicorp was also suffering from higher-than-expected interest rates.

Citicorp continued to invest in its retail banking services despite these challenges, with millions spent on a new network of automated teller machines (ATMs). Placed across its Citibank branches by 1978, the innovation was a double win for Citi as it helped to reduce labor costs and drew in many new customers.

Citicorp announced in 1987 that its loans to developing nations could pose a significant risk and that it was setting aside a $3 billion reserve fund. It was the first major bank to admit to this and reveal its mitigation plans, many others followed suit.

The early 1990s saw Citicorp enter what many consider the most challenging period in its history. The weak US economy and unprofitable corporate lending led to financial difficulties that were so extreme they threatened the very existence of America’s biggest bank.

From 1990 to 1995, the US GDP grew at just 2.4% each year, down from 4.3% between 1983 and 1989. In December 1990, against a quarterly loss of $300 million, Citicorp launched several urgent initiatives to reorganize and cut its overheads. The company aimed to save $500 million in operating costs by 1992 by cutting 8,000 jobs and halving the annual common stock dividend.

In 1991, Citi’s third quarter financial statements demonstrated the huge financial impact of the restructure, write-downs of assets, and increased reserves with the holding company reporting an $885 million loss. What’s more, for the first time in its history, Citicorp’s shareholders lost their annual dividend.

However, Citicorp didn’t escape further scandal. In 1996, a Citibank employee was accused of illegal activity in connection to Raul Salinas, the Mexican President’s brother. Mexico delivered more scandal in 1998 when Citicorp’s purchase of Banco Confia was linked to the laundering of drug money.

1998-2007: Mega-merger Leads to the Birth of Citigroup

In 1998, Citicorp famously merged with Travelers to create Citigroup, the biggest financial services company in the world. John Reed and Sanford Weill, chairman of Travelers, agreed to run Citigroup together.

Weill said at the time that they were creating a “model of the financial services company of the future”. Dubbed a global financial supermarket, the company would benefit from Citicorp’s power in banking, consumer finance, and credit cards, alongside insurance and brokerage services from Travelers’ franchisees.

The merger was approved by the Federal Reserve, despite the Glass-Steagall Act of 1933 banning banks from owning insurers and visa versa. The company lobbied Congress to change the law which eventually led to the Financial Services Modernization Act in 1999. Under the new regulations, Citigroup became one of the first companies to qualify as a financial holding company.

John Reed resigned in 2000, leaving Sanford Weill as CEO. The same year, Citigroup acquired Associates First Capital Corporation, a consumer finance firm that specialized in higher-risk customers. Just months later, the Federal Trade Commission charged Citigroup with predatory lending through the new business. In 2002, Citigroup settled the lawsuit with a reported $240 million payout to affected customers.

Citigroup embarked on a drive to enter more mid-range banking and finance markets internationally, with several acquisitions across global markets. In 2001, Citigroup completed its biggest-ever international acquisition with the purchase of Grupo Financiero Banamex-Accival, one of Mexico’s largest banks. Citigroup’s existing Mexican operations were incorporated to create the biggest bank and brokerage firm in the country.

In 2002, Citigroup spun off around 20% of the Travelers unit, and the remaining stake was distributed to shareholders later that year. Also in 2002, Citigroup reorganized the company’s operations, launched retail banking operations in China and Russia, and entered a partnership with the Shanghai Pudong Development Bank to join the Chinese credit card market.

It was also a tricky time for Citigroup, which was drawn into several state and federal investigations into the practices of its Salomon Smith Barney investment bank. Analyst Jack Grubman was accused of overplaying the stock of several firms in return for hundreds of millions of dollars in fees. Citigroup CEO Weill was also embroiled in the scandal. In 2003, Citigroup agreed to pay $400 million and Grubman was fined $15 million.

Citigroup also was involved in the huge Enron Corporation scandal. Citigroup and JPMorgan Chase were both linked to funding ventures that played a central role in the alleged fraud. In 2003, Citigroup and J.P. Morgan reached an agreement with the SEC to pay a $305 million settlement between them. Citigroup also faced private lawsuits from investors and bondholders and the corporation had to set aside $1.5 billion as a litigation reserve in December 2002.

In 2003, Weill announced that he would step down to be succeeded by Charles Prince.

2007-2024: Citigroup Survives the Financial Crisis to Hit New Scandals

The early 00s saw low interest rates and an inflow of investment funds into the USA from emerging economies and oil-rich nations. This led to the easy availability of low-cost private debt and in particular, cheap but large mortgages. In 2007, house prices started to decline sharply and more and more people began to default on their mortgages.

Like many other banks and financial firms, Citigroup felt the impact. In 2008, the economic environment worsened, leading to the infamous collapse of Lehman Brothers. The US government was forced to act and launched the Troubled Asset Relief Program. Under this program, Citigroup received $45 billion from the government in 2008. Citigroup also gave $7 billion in preferred stock to government regulators to take part in a loss-sharing agreement.

Following widespread criticism of the enormous pay packages of Wall Street executives, the new Citigroup CEO, Vikram Pandit, pledged to take just $1 a year in salary until the company got back into the black. By the end of 2009, Citigroup had raised $20.5 billion to repay the preferred shares owned by the government and end its loss-sharing agreement.

“We will always be grateful to the American people for their crucial support during the crisis,” Pandit said.

In 2012, Citi celebrated its 200th anniversary. Since then, the company has seen further scandals. In 2019, it was fined by the Bank of England for failures in its governance of regulatory reporting. Citigroup was ordered to pay £43.9 million – the biggest fine the Bank of England had ever issued.

In 2020, the company was fined a further $400 million over its money-laundering controls. Another well-publicized scandal was the 2023 lawsuit brought by a managing director who claimed she had been sexually harassed and abused by a former banker. She also made claims about the company’s misogynistic culture.

In 2021, Jane Fraser became the first woman to lead a major US bank when she was appointed as Citigroup CEO. Her vision for Citigroup is said to focus on modernization, excellence, and empathy.

Fraser said, “Together, we’re charting a new course for the world’s most global bank – a bank that is systemically important to the world – a bank that is iconic – a bank that champions excellence.”

Citigroup Stock Split and Dividend History

Citigroup has made several stock splits which are listed below:

- 09 May 2011 – 1 for 10

- 25 Aug 2000 – 4 for 3

- 28 May 1999 – 3 for 2

- 19 Nov 1997 – 3 for 2

- 22 Nov 1996 – 4 for 3

- 24 May 1996 – 3 for 2

- 27 Aug 1993 – 4 for 3

- 26 Feb 1993 – 3 for 2

Citigroup’s dividends have been reliable since it came into being in 1998, reaching as high as $5.40 a share in 2007. During the 2008 financial crisis, however, Citi drastically reduced its quarterly dividend to almost nothing by May 2011. It has slowly increased since, reaching $0.53 per share in February 2024.

History of the Citigroup Logo

- Citicorp (1976-1998) had a simple back-and-white logo comprised of its name and an icon with a white star. It went through a slight rebrand in 1980 where the lettering was slanted slightly.

- Travelers Group (1993-1998) had a colorful and featuring a red umbrella which was meant to symbolize protection.

- Citigroup was created in the 1998 merger and the new logo combined both companies’ existing logos.

- In 1999, the Citigroup logo was updated with a new font and color scheme.

- In 2007, the logo was changed to read simply Citi and has a simpler curve in place of the umbrella.

- In 2011, the colors were changed slightly but the logo design remained the same.

The Future of Citigroup

When Jane Fraser took over in 2021, she began to overhaul Citigroup’s strategy. This includes selling most of its international retail banking units. In 2023, Citigroup announced significant changes to align its management structure with its strategy and simplify operations. The company hopes that this will speed up decision-making, improve accountability, and increase its focus on clients.

Citi’s long and rich history tells a tale of resilience. As a large, powerful bank it has been able to lobby for laws to be changed and made in the US. It was also one of the organizations that was “too big to fail” during the Great Recession, meaning it had to work with the government to preserve the business.

“I am determined that our bank will deliver to our full potential, and we’re making bold decisions to meet our commitments to all our stakeholders,” said Jane Fraser.

It seems that Citi is committed to transforming itself into a bank that is fit for the future, however, revenues for the first quarter of 2024 were down 2% year on year. While there is work being done to restore the bank to its former glory, there appears to be much left to do.