When developing a business idea, creating a break-even analysis is an important step. It considers all the fixed and variable costs related to production to find the break-even point and explore ways to cut costs. A break-even analysis provides helpful financial forecasts for setting prices and gives your investors clear numbers to use.

Here at Business2Community, we’re experts in helping entrepreneurs and ambitious traders to curate the best business model. In this detailed guide, we will walk you through everything you need to know about break-even analyses and how they can aid your business growth.

Break-Even Analysis – Key Takeaways

- A break-even analysis gives businesses a detailed breakdown of the total costs involved in the production.

- By knowing the break-even point, companies better arrange resources and organize the production flow.

- Vital business elements like the market demand and break-even timeframe are absent from the analysis.

What Is a Break-Even Analysis?

A break-even analysis tells you the number of units you need to sell to cover all monetary costs, meaning you will neither suffer a loss nor make a profit at that point. Your initial investment is returned once you have reached the break-even point.

This financial calculation takes into account the total costs involved in production to identify how many units you need to sell.

After your company’s break-even point, every unit sold will only need to cover its variable costs. The remaining sales dollars are profits for the business.

TR = Total revenue

TC = Total costs

FC = Fixed costs

TVC = Total variable costs

Conducting a break-even analysis helps investors understand how your new business idea looks. It is a basic step in evaluating the profitability of an operation. You can also perform several break-even analyses by inputting various values to see which business proposal works best.

Who Needs to Do a Break-Even Analysis

Every business needs to do a break-even analysis when it starts to operate or when there are cost-related changes in the production line.

This financial calculation can:

- Estimate the startup capital/expansion costs.

- Offers insights about your pricing strategy.

- Compare the effect of different price changes to choose an optimal production process.

- Lower fixed costs or variable costs by comparing different options.

If you want to borrow money to start a new business, you will very likely need to present a break-even analysis to your investors or bank to show them your vision of success.

A detailed breakdown of the production costs makes it easier for you as a business owner to price your products and manage the total expenses. It scans the structure of your operation so you can catch missing expenses you may not have thought of.

Existing businesses can also benefit from a break-even analysis when they expand or adjust their pricing strategies. From the results, companies can decide if the minimum sales volume is attainable.

Whether you are a business owner or a trader, knowing how to interpret and conduct a break-even analysis provides a more all-rounded view of the operation.

How to Calculate Your Break-Even Point

Fixed costs refer to costs that will remain the same, regardless of the production level. Rent, full-time salaries, equipment setups, and property taxes are typical fixed costs for businesses.

Even if your production level is zero, i.e. you have shut down the operation or paused it, you will still pay for your fixed costs.

Variable costs are costs directly related to the units produced, such as costs of raw ingredients, machine hours, hourly-paid wages, and sales commissions. Variable costs tell you how much more money you need to produce an extra unit.

When there is no production activity, there is no variable cost. In this analysis, the total variable cost is assumed to remain the same for every unit.

Contribution Margin

The contribution margin measures the differences between the selling price and the total variable costs. It identifies how many sales dollars contribute towards covering the total fixed costs in each unit sold.

For example, if the selling price is $50 and the total variable costs are $20 per unit, the contribution margin is $30 ($50 – $20) per unit. For every unit you sell, $30 goes into offsetting the total fixed costs.

With the above information, you can also calculate the contribution margin ratio:

Contribution margin ratio (%) = (Selling price per unit – Variable cost per unit) / Selling price per unit

= $(50 – 20) / 50 = 60%

The percentage represents the value of an individual sales unit minus the variable cost. For each additional unit sold, 60% of the sales revenue contributes to compensating the fixed cost.

The higher the contribution margin, the lower the break-even point.

Break-Even Analysis Formula

The break-even point analysis formula is:

Break-Even Sales Units = Fixed Costs / (Sales Price Per Unit – Variable Cost Per Unit)

Using the same numbers from the last section and assuming the fixed costs to be $1,000, the break-even point is:

1,000 / (50 – 20) = 33.3 units

When we are working with non-integers, it is often best to round them up. Your total costs will still be greater than the sales volume if you round the number down, so you are not at the break-even point yet.

In this case, you have to sell 34 units to break even. The total revenue is ($50 x 34) = $1,700.

Alternatively, you can calculate the break-even point in sales revenue.

Break-Even Sales Dollars = Fixed Costs / Contribution Margin

The total revenue needed is $(1,000) / 60% = $1666.6. When you sell 33 units, you will get $1,650. Therefore, you will need to sell 34 units to get back your startup capital.

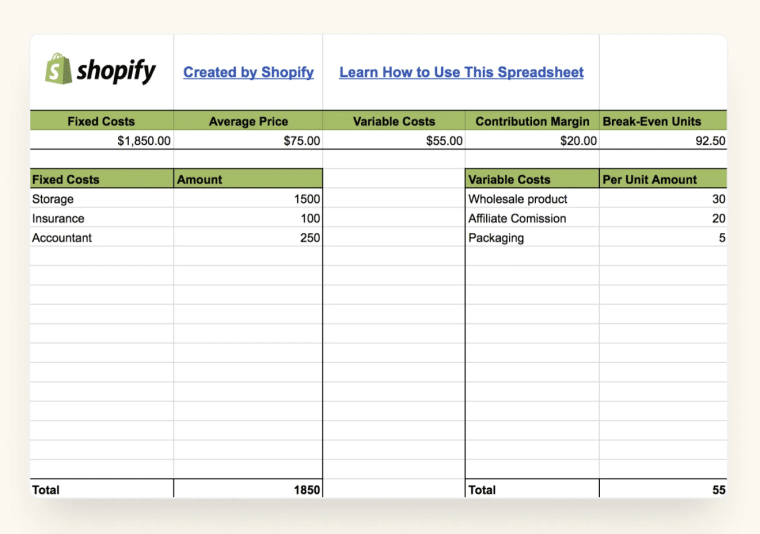

Leading ecommerce platform Shopify created a break-even analysis template for users to easily plug in respective numbers. Depending on your company’s styles and needs, you can create similar templates for your accounting and investment teams.

Examples of Break-Even Analysis

After learning about the break-even analysis formula, it is time to dive into its real-life applications and how this financial analysis can help prevent your business from losing money and estimate the production or sales volume.

Here are a few break-even analysis examples for you to better understand its usefulness.

Opening Up a Physical Branch

Let’s say you are starting a massage business and want to borrow money from financial institutions to open up a physical branch. To convince your investors, you need to do a break-even analysis and lay out the total costs in detail.

Fixed costs:

- Rent ($1,000)

- Full-time staff ($5,000)

- Equipment rental/credit payments like massage chairs, spa pools, and hairdryers ($10,000)

- Property and business taxes ($2,000)

- Interest paid to investors ($1,000)

Total fixed monthly costs = $19,000

Variable costs:

- Massage oil ($5 per sales unit)

- Towels/beddings ($10 per sales unit)

- Refreshments ($10 per sales unit)

- Miscellaneous ($50 per sales unit)

Total variable costs = $75

If each massage session is worth $200, your break-even quantity is 19,000 / (200 – 75) = 152. You need to sell at least 152 sessions before you see a net profit.

Adding a New Sales Channel Online

When you introduce a new product or add a new sales channel online, doing another break-even analysis is an imperative step. Each analysis should only target one product/channel as mixing costs will lead to unreliable results.

With an online channel, fixed costs include hosting service fees, domain fees, and website setups. As for variable costs, you need to consider shipping fees, storage fees, and processing fees.

Closing Down an Existing Business

A break-even analysis is not only helpful in expanding your operation, but it is also an incredible tool when deciding the right time to close down a business.

For example, due to rising ingredient costs at a sandwich store, your variable costs are now significantly greater than your unit price. Regardless of the units sold, you will suffer a loss.

To avoid a bad financial toll, you can shut down the operation completely and only pay for your contractual fixed costs. It is important to note that most businesses cannot avoid paying the total fixed costs because of financial commitments like loans or interest owed.

How to Adjust a Break-Even Point Analysis

The business world can be full of surprises. Whether you are running a business or starting one, the related costs incurred may not always be the same as previously estimated.

The break-even analysis assumes the fixed costs and variable costs to be constant, which rarely reflects reality. In real life, costs are ever-changing so you will have to continuously tweak your break-even analysis.

If you raise prices, a lower break-even point will follow. A change in salaries will also affect the break-even point formula. These changes must be included in the latest analysis so you can make the most informed business decisions.

Some common unpredictable variables that may impact your break-even point analysis include:

- Change in the minimum wage/rent/raw material costs

- Inflation

- Unexpected replacements of outdated/broken technologies/fixtures

- New government taxes

Amending your break-even analysis in the business plan is vital to getting the most accurate numbers.

Limitations of Break-Even Analysis

Although the break-even analysis is useful in limiting financial strain by offering tangible numbers, it is a very basic financial calculation with several limitations.

It Does Not Tell You About the Break-Even Period

A break-even analysis is useful for showing how many units you need to sell, but it doesn’t provide any information about the time it will take to reach those results. If you’re operating a pop-up store or aiming for a quick entry and exit in a market, you’ll want to know how quickly you can start earning money.

The formula does not consider the market demand either so make sure to use other forms of analysis to ensure your product or service is popular enough. A break-even analysis neglects the effectiveness of your pricing strategy too. If your product is priced higher than the average selling price, you may not meet the target sales even with a low break-even point.

It Does Not Consider Positive Non-Monetary Benefits

This method does not consider the value of non-monetary benefits like building up company goodwill or brand value. The break-even analysis strictly calculates monetary costs and revenues. Business proposals with unfavorable production costs can bring a positive effect on the company image, which generates profits in the long run. This analysis doesn’t help aid business decisions that are not money-centric.

It Does Not Give Comprehensive Business Predictions

When you can calculate your break-even point without using additional tools, the result doesn’t offer a comprehensive look into the venture. It doesn’t make predictions nor does it summarize past trends based on data points observed.

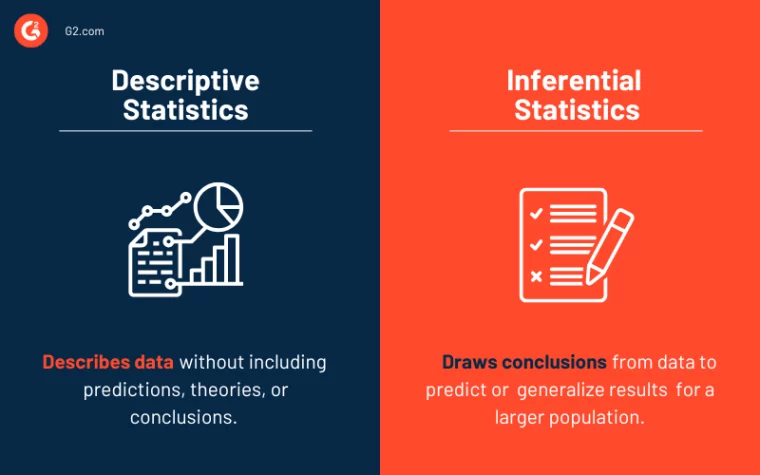

To get a better look, you can study your business together with descriptive statistics and inferential statistics. The former summarizes key characteristics of past performances while the latter makes estimations about the future with existing data.

The Value of Break-Even Analysis

From planning your operations to presenting your business proposals, a break-even analysis contributes massively to your success. It also serves as a stepping stone to other more complicated analyses. While it isn’t a perfect tool and it doesn’t consider a myriad of vital metrics and variables, it can still be vital for success in many industries.

Whether you are preparing for your next investment meeting or budget plan, having a break-even analysis allows you to methodically organize and present your business outlook.