What started as a small Dutch start-up is now one of the world’s leading digital travel companies, booking over 1.5 million room nights daily in over 150,000 destinations around the world. As part of travel giant Booking Holdings Inc., Booking.com offers a multitude of accommodation listings, flight options, attractions, and car rentals to make global travel easier.

For a clearer picture of the biggest player in Booking Holdings’ portfolio, we’ve compiled all the latest figures and statistics related to Booking.com. Here, you’ll find over 70 Booking.com statistics related to its revenue, products, and more. Keep reading to discover everything you need to know about Booking.com in 2025.

Booking.com Statistics Highlights

Booking.com Company Statistics

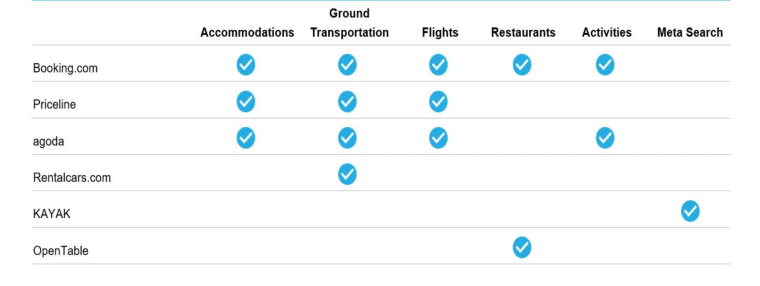

Booking.com is owned by Booking Holdings Inc., whose mission is to make it easier for everyone to experience the world. Under Booking Holdings, Booking.com works alongside five other consumer-facing brands: Priceline, Agoda, Rentalcars.com, KAYAK, and OpenTable. However, Booking.com remains the company’s largest profit driver, accounting for over 80% of its revenue.

Booking Holdings Brand

Description

Booking.com

Rentalcars.com

Priceline

Agoda

KAYAK

OpenTable

Booking.com is based in Amsterdam in the Netherlands.

Booking.com is supported by 198 offices in over 70 countries around the world and its headquarters is Booking Holdings’ largest leased office space. Booking Holdings also leases office space facilities for its corporate headquarters in Connecticut, US, as well as office space and data center facilities in various locations around the world. The systems infrastructure and web and database servers needed to support Booking.com and other Booking Holdings brands are mainly located in the:

- United Kingdom

- Switzerland

- Netherlands

- Germany

- Singapore

- Hong Kong

- United States

These data centers provide network connectivity, networking infrastructure, 24-hour monitoring, and engineering support.

Glenn Fogel is Booking.com’s CEO.

Glenn Fogel is also President and CEO of Booking Holdings and has served in these positions since January 2017 and June 2019, respectively. Previously, he served as Booking Holdings’ Head of Worldwide Strategy and Planning from November 2010 to December 2016 and as its Executive Vice President, Corporate Development, from March 2009 to December 2016.

As of December 31, 2022, Booking Holdings employed around 21,600 employees.

3,100 were based in the US, and 18,500 were based outside the United States. Approximately 99% were full-time employees. The company also works with independent contractors to support its customer service, website content translation, and system support functions.

As of December 31, 2022, approximately 47% of Booking Holdings employees were women.

25% of the company’s technology positions and 31% of leadership roles were occupied by women. Booking Holdings is also committed to pay equity, regardless of gender, race, or ethnicity.

Booking.com embraces diversity and inclusion throughout its global operations.

As of 2023, Booking.com has 150 nationalities represented in 140 of its global offices and plans to continue promoting a more diverse work culture.

Booking Holdings’ global average daily rates (ADRs) increased by 25% in 2022 as compared to 2019.

This was driven primarily by higher ADRs for accommodations located in Europe and growth in ADRs across all other regions in 2022.

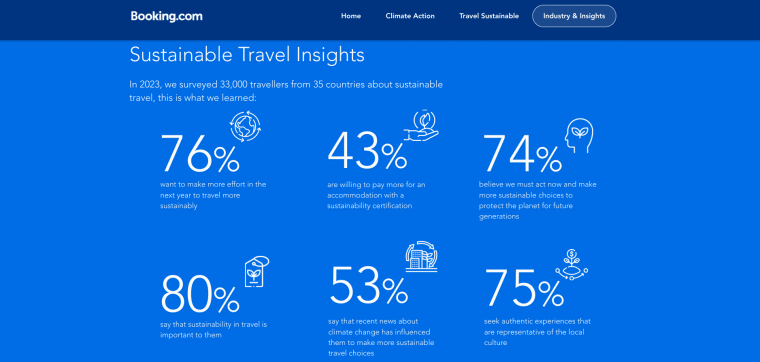

As of 2023, more than 500,000 accommodations have been recognized by Booking.com’s Travel Sustainable program.

This is up from 400,000 accommodations in 2022. Booking.com introduced its Travel Sustainable program in 2021 and since then, more than 500,000 accommodations on Booking.com have been certified with a badge.

Booking.com is committed to exceptional customer service, with 65% of complaints being handled within 24 hours.

Booking handles complaints as soon as possible, treating the most urgent ones as the highest priority. Additionally, the company strives to resolve 85% of all complaints within 14 business days.

Booking.com has over 240 million verified reviews from real travelers.

These reviews help customers choose the best travel options. They also contribute to Booking.com’s Traveller Review Awards, which have awarded over 1.36 million winners since 2012.

Booking Holdings’ total marketing expenses were up 58% in 2022.

Booking Holdings’ performance and brand marketing expenses were up $6 million in 2022, due to the company’s increased investment into promotional efforts for Booking.com and its other brands. Performance marketing expenses are related to the use of online search engines (primarily Google), meta-search and travel research services, and affiliate marketing to generate traffic primarily to Booking.com and its other platforms. Brand marketing expenses are primarily related to costs associated with producing and airing television advertising, online video, and display advertising.

Booking.com Investment Data

Booking Holdings had its initial public offering on March 29, 1999.

Booking Holdings (then Priceline) had its initial public offering (IPO) on March 29, 1999. The company went public at $16 per share on the NASDAQ stock exchange under the ticker symbol “BKNG”.

A month after its IPO, Booking Holdings stock closed at an impressive $162.37.

At that price, Booking Holdings’ stock was over 914% of its IPO value.

By the end of 2000, the company’s stock had tanked to $6.37 a share.

Following the bursting of the dot com bubble, Booking Holdings lost 99% of its peak market cap of $23 billion. The company’s shares also fell to around $6.37 per share.

Booking Holdings had a one-for-six reverse stock split in 2003.

Despite turning over its first profit in 2001, Booking Holdings’ share price stayed stuck in the single digits for several years. To get its stock price back above the $20 mark, the company had a reverse stock split.

By March 2004, Booking Holdings shares were up 25%.

After launching its retail service in 2003, Booking Holdings’ shares made a steady climb to around $22.60 a share in the first quarter of 2004.

Booking.com was acquired by Booking Holdings in 2005.

Booking Holdings acquired Booking.com to strengthen its reach in the European market.

In 2007, Booking Holdings acquired Agoda.com

To strengthen its presence in the Asia Pacific region, Booking Holdings acquired Agoda in November 2007.

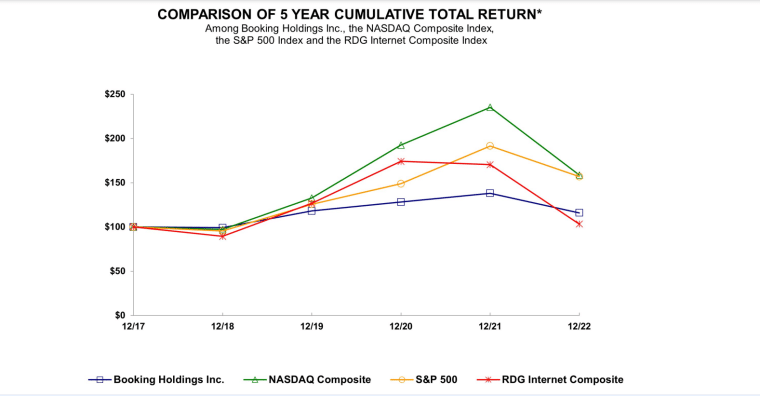

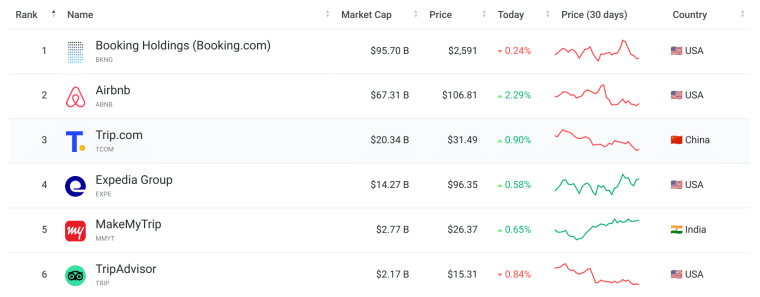

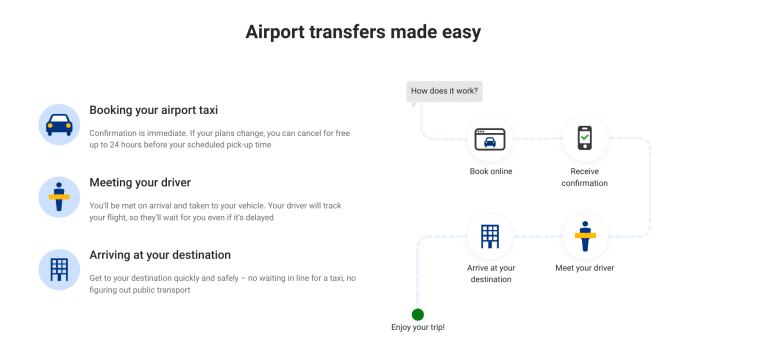

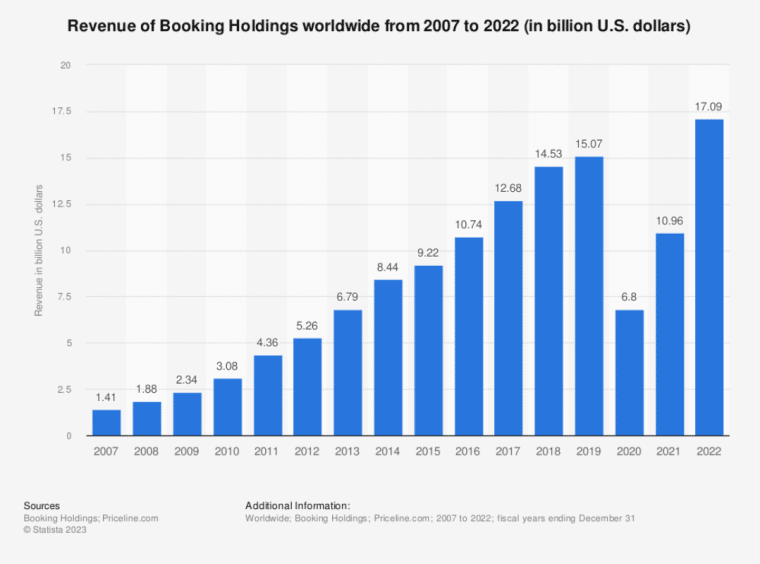

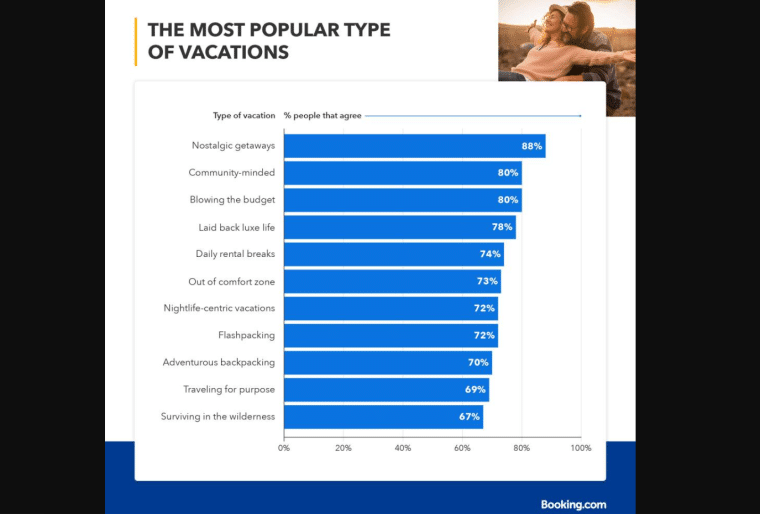

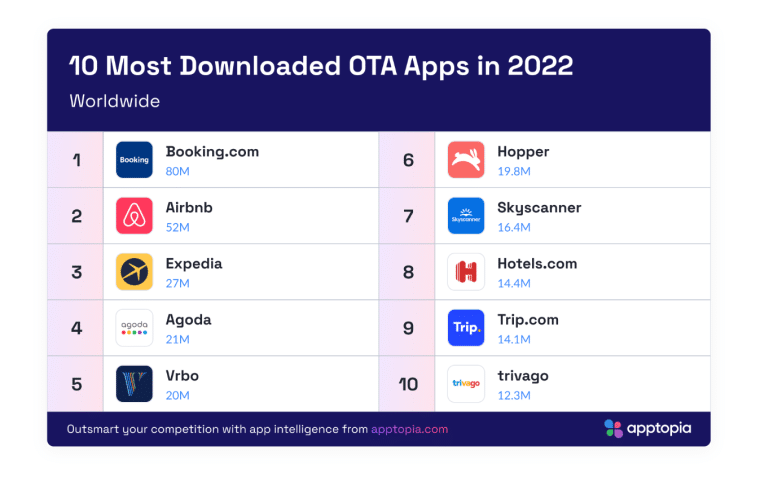

By the end of 2009, Booking Holdings’ share price was up nearly 200% from 2008 lows of around $54 a share. Booking Holdings pulled in record profits in 2009 and steadily raised its share price above the $200 mark. In 2010, Booking Holdings’ acquired Rentalcars.com. By acquiring the car rental comparison website, Booking.com expanded its suite of travel service offerings to include car hire. Booking Holdings had net margins of 24% in 2011. This was more than its rival Expedia, which at the time had net margins of less than 10%. In addition, Booking Holdings’ share price was at around $483.87 in December, further proving the company’s growing success in a highly competitive industry. Kayak was acquired by Booking Holdings in 2013. Booking Holdings acquired Kayak, a travel search engine for $1.8 billion to enhance its metasearch capabilities. Booking Holdings acquired OpenTable, a leading online restaurant reservation platform in 2014. The $2.6 billion deal, which came at a premium of 46%, sought to broaden Booking Holdings’ operations in a new market. In December 2015, Booking Holdings’ share price surpassed the $1,200 mark. Due to significant year-over-year growth in both revenue and bookings, Booking Holdings’ shares were up 18% from January 2015 and over 150% from December 2011. In August 2017, Booking Holdings’ share price rallied as much as 41% to hit an all-time high of $2,067 per share. Fueled by a positive outlook and increasing profitability, Booking Holdings’ share price breached the $2,000 mark. 2018 proved to be a great year for the company, with its annual revenue increasing by 15% to $3.2 billion. In addition to higher revenue, the company’s share price remained stable at an average stock price of $1,969. In April 2020, Booking Holdings’ share price dropped to $1,293 as the impact of COVID-19 shook the travel industry. While the company managed to maintain an average share price of $1,742, total revenues for the year plunged by over 50%. By the end of 2021, Booking Holdings’ average stock price had increased to $2,293. Driven by recovery across its major business (Booking.com) Booking Holdings also experienced a 116% increase in gross bookings and a 61% increase in total revenues. On May 26, 2023, Booking Holdings’ stock was $2,591 per share. According to data from Yahoo Finance, this share price represented a 15.5% increase over 52 weeks. The company’s market cap was also $95.7 billion, making it the 144th most valuable company by market cap and the most valuable travel company in the world. From its humble roots as a Dutch travel start-up, Booking.com is now the world’s leading online travel platform and the main profit driver of its parent company, Booking Holdings. Booking.com has contributed greatly to the growth and success of Booking Holdings, catapulting it from a valuation of $12.9 billion in 1999 to over $95.7 billion in 2023. Below, we explore Booking.com and Booking Holdings’ journey to market dominance. Booking.com is the world’s largest travel booking website with localized content, 185 million+ verified guest reviews, and round-the-clock customer service in 40+ different languages and dialects. Through its core service offerings, Booking.com makes travel easier and allows global travelers to: Booking.com’s ‘Stays’ offering allows travelers across the globe to find, compare and make online accommodation bookings from hotels, property owners, and other service providers. As of May 2023, Booking.com has more than 29 million total reported listings worldwide. This is up from 28 million in 2022 and includes more than 6.6 million options in homes, apartments, and other unique places to stay. As of December 2022, Booking.com offered accommodation reservation services for over 2.7 million properties in over 220 countries and territories. This represents an increase from 2.4 million properties from December 31, 2021, and was driven primarily by an increase in alternative accommodation properties. 2.3 million of these properties were alternative accommodation properties (homes, apartments, and other unique places to stay) while over 500,000 were hotels, motels, and resorts. 30% of Booking.com’s room nights booked were for alternative accommodation properties in 2022. This is up slightly from 2019 and 2021, with Booking Holdings reporting a longer-term trend of an increasing mix of room nights booked for alternative accommodation properties. To keep up with growing demand, the company continues to increase the number and variety of alternative accommodation properties available to travelers on Booking.com. Room nights booked increased by 51.6% from 591 million in 2021 to 896 million in 2022. Higher 2022 figures were due to eased travel restrictions and an increase in travel demand trends following the COVID-19 pandemic. Room nights booked on mobile devices increased between 2019 and 2022. Booking Holdings reported an increase in the mix of room nights booked on a mobile device in 2022 compared to 2019. In 2022, global room nights were 52% higher than in 2021 and 6% higher than in 2019. The year-over-year growth in room nights in 2022 was driven primarily by continued recovery in Europe, Asia, and the Rest of the World, as well as continued growth in North America. Booking.com’s ‘Flights’ offering helps travelers find and book flights from service providers and third-party aggregators. In 2022, Booking.com expanded its flight offering into over 50 countries. To better serve customers and meet pent-up travel demand, Booking.com added more flight options and destinations. Airline tickets reserved increased by 50% from 15 million in 2021 to 23 million in 2022. The increase came as more customers took advantage of eased travel restrictions. Through Rentalcars.com and Booking.com’s ‘Car Rentals’, travelers can compare bookings from various car rental companies in over 60,000 locations. Rental car days booked increased by 30.7 % from 47 million in 2021 to 62 million in 2022. The increase in car rentals is due to eased travel restrictions and an increase in travel demand following the COVID-19 pandemic. As of 2023, Booking.com has rental car search filters to quickly find fully electric and hybrid cars across 111 countries. As part of its initiative to give customers more sustainable travel options, it is now easier to locate sustainable vehicles on the platform. Booking.com’s ‘Attractions’ offering helps travelers find and book destination tours and experiences through various service providers. In 2022, Booking.com significantly expanded its attractions offering to 54 markets and in-destination tours and activities to more than 1,200 cities around the world. As part of its mission to give travelers more options, Booking.com expanded not only its flight options but attraction offerings, too. Through Booking.com’s ‘Airport Taxi’ offering, travelers can compare bookings from over 1,000 public and private ground transportation providers in over 800 locations. There are 95 cities worldwide where travelers can now find and book greener taxi options by looking for the 100% Electric tagging in the search results. This comes as Booking.com’s 2023 sustainable travel report reveals 80% of its customers consider sustainability more important to them in 2023. Booking.com now has 47 cities worldwide where public transport ticketing options are available after making an accommodation booking. As part of its promise to make travel easier, Booking.com has added even more travel options for customers to explore. Booking.com has added tagging to indicate when a certain route or carrier is offering relatively lower emissions. Customers also have the option to view the impact of flights and compare CO2 emissions for different options. Booking.com for Business is a free business travel platform that gives businesses the ability to book and manage complete business trips. Booking.com boasts the widest range of accommodations, flights, and car rentals from around the world with no fees or subscription costs, ever. Businesses using Booking.com can save up to 20% on travel. Booking.com allows businesses to unlock unlimited discounts and travel rewards for their teams across thousands of properties. On May 4, 2023, Booking Holdings reported the following key highlights related to its performance in the first quarter of the year: Between 2020 and 2022, an average of 88% of Booking Holdings’ revenue was generated through online accommodation reservation services. Booking Holdings Inc. derives almost all of its revenue from providing online travel reservation services through Booking.com. The travel giant also earns revenues through: Revenue from all other online travel reservation services and advertising, as well as other revenue sources, accounted for less than 10% of the company’s total revenues between 2020 and 2022. Booking Holdings reports its revenue under three key categories: The company also measures its performance through the operational metric, Gross Bookings. Gross bookings capture the total dollar value, inclusive of taxes and fees, of all travel services booked through Booking Holdings brands by customers, excluding cancellations. This includes mainly agency and merchant bookings from Booking.com. The company’s non-online travel company brands (KAYAK and OpenTable) do not contribute to gross bookings. For the year ended December 31, 2022, Booking Holdings had total revenues of $17.1 billion compared to $10.9 billion in 2021. As the impact of the COVID-19 pandemic eased up in 2022, Booking Holdings saw a rise in gross bookings and a 56% increase in total revenue. For the year ended December 31, 2022, Booking Holdings had total gross bookings of $121.3 billion compared to $76.6 billion in 2021. Gross bookings increased by 58.3% in 2022 because of higher travel demand trends. Additionally, merchant gross bookings increased more than agency gross bookings due to the expansion of merchant accommodation reservation services at Booking.com. Agency revenues are generated through travel-related transactions where Booking Holdings does not facilitate customer payments. They consist almost entirely of travel reservation commissions from accommodations, rental cars, and airline reservation services. Agency revenues accounted for approximately 53% of Booking Holdings’ total revenue in 2022 and 61% in 2021. According to Booking Holdings SEC filings, substantially all of its agency revenue is from Booking.com’s accommodation reservations. Agency revenues increased by 35.1% in 2022. Booking Holdings collected $9 billion in agency revenue, predominantly through Booking.com in 2022. This represents a 35.1% increase from $6,6 billion in 2021. Agency gross bookings are derived from travel-related transactions where Booking Holdings does not facilitate payments from travelers. Agency gross bookings increased by 32.8% in 2022. Agency gross bookings went up from $50.7 billion in 2021 to $67.9 billion in 2022. Merchant revenues are generated through travel-related transactions facilitated by Booking Holdings at the time of booking. Merchant revenues include: Merchant revenues accounted for approximately 43% of Booking Holdings’ total revenue in 2022 and 34% in 2021. Booking Holdings confirms that most of its merchant revenue is earned through Booking.com’s accommodation reservations. Merchant revenues increased by 94.6 % in 2022. Booking Holdings generated merchant revenues of $7.2 billion, primarily through Booking.com, in 2022. This is a 94.6% increase from $3.7 billion in 2021. Merchant revenues increased more than agency revenues in 2022 due to the growth of merchant accommodation reservation services at Booking.com. Merchant gross bookings are derived from services where Booking Holdings facilitates travelers’ payments. Merchant gross bookings increased by 108.4 % in 2022. Merchant gross bookings went up from $25.8 billion in 2021 to $53.9 billion in 2022. Advertising and Other revenues consist of revenue generated by: Advertising and Other revenues accounted for approximately 5% of Booking Holdings’ total revenue in 2022 and 2021. Booking.com’s audience is predominantly male. Similarweb’s gender distribution analysis shows Booking.com’s website users on both desktop and mobile devices are 50.08% male and 49.92% female. In April 2023, The US accounted for most of Booking.com’s traffic. Web visits from the US accounted for over 10% of Booking.com’s overall traffic. Bringing in 7.76% of all traffic, Germany ranked second. The United Kingdom, which accounted for 7.5%, ranked third. Booking.com gets most of its social media traffic from Facebook. In April 2023, Facebook accounted for 39.9% of all social media traffic to Booking.com. In second place was YouTube, which accounted for 26.87% of all traffic. In third place was the Whatsapp Web App which sent 11.52% to Booking.com. 73% of Booking.com users are more optimistic about travel than they were in 2022. Booking.com conducted a study of over 24,000 customers across 32 countries and territories across the globe to uncover key travel trends for 2023. Even amid global economic and political uncertainty, over three-quarters of travelers surveyed by Booking.com consider traveling worth it in 2023. Additionally, 33% of travelers in 2023 will be traveling with friends. 55% of Booking.com users want to spend their vacations off-grid. As most travel restrictions have been lifted, travelers are keen to disconnect and vacation off the grid. Booking.com’s research also shows that: 62% of Booking.com’s Millennial users consider traveling off-grid as a way to escape from reality. This is followed by In 2023, 88% of travelers favor nostalgic getaways. Booking.com’s internal data reveals the most popular types of vacations for 2023 are nostalgic getaways followed by community-minded vacations (80%). Other popular types of travel include: 47% of Booking.com users selected eccentric eating as the most popular type of niche travel. This is followed by spiritual stays (44%) and health retreats (42%). Other niche travel experiences include: 50% of Booking.com users want to experience a culture shock in 2023. As more travelers seek a break from their routines, they’re mixing things up with novel experiences in exotic locations. In fact, 38% of travelers surveyed want an out-of-this-world culture shock or to go on the hunt for UFOs. 73% of travelers want to experience travel out of their comfort zone. A majority of Booking.com users surveyed want to embrace the unfamiliar, with 30% keen to explore lesser-known cities to find some hidden gems. Budget-savvy traveling is becoming increasingly important, with 68% of Booking.com users paying close attention to how much they’re spending. Due to ongoing economic uncertainty, Booking.com users say investing in a vacation is still a top priority. Millennials are the most budget savvy, with 69% of them using the platform to hunt down travel deals. According to research by Booking.com, top destinations for 2023 based on global booking trends include: Booking.com competes globally against both online and traditional travel and restaurant reservation and related services. According to insights provided by Booking Holdings, Booking.com competes with a variety of companies, including: In 2022, Booking.com’s mobile app was the most downloaded online travel agency (OTA) app globally, and in the US. Booking.com had over 80 million downloads in 2022. In second place was Airbnb with 52 million downloads. Expedia, with 27 million downloads, took third place. In 2022, Booking.com was the third most downloaded travel app worldwide. Booking.com also made it onto the list of the most downloaded travel apps in 2022. But this time at number three. In first place was the Google Maps mobile, app downloaded 113 million times, and in second place, Uber with 107 million downloads. In March 2023, Booking.com was the most visited travel and tourism website worldwide. Booking.com had 555 million visits in March 2023 and 557 million in April 2023. This is followed by Tripadvisor and Airbnb, which had around 165 million and 98 million visits, respectively. In 2022, Booking.com was the most popular for hotel and private accommodation online bookings in the US. This was followed by Expedia and Hotels.com. Expedia was the most popular option when it came to making online flight reservations in December 2022. With a 39.2% market share, Booking.com was the global leader in hotel reviews in 2022. Booking.com’s market share reached 39.2% of total reviews, surpassing Tripadvisor (10.1%) Expedia (7.3%), and all other review sources. Google also emerged as a review powerhouse in 2022 with a market share of 29.6%. As of May 2023, Booking Holdings is the largest online travel company by market cap. Driven by Booking.com’s long-standing dominance in the travel industry, Booking Holdings is the most valuable travel company in the world with a market cap of $95.7 billion. With a market cap of $67.31 billion, Airbnb takes second place. In third place is Trip.com, with a market cap of $20.34 billion In 2022, Booking.com dominated online travel market sales across regions. While competitors such as Expedia Group and Airbnb experienced growth in various markets post-pandemic, Booking.com was the highest revenue maker globally within the online travel agencies market.

Year

Booking Holdings Acquisitions

1997

Priceline.com

2004

Travelweb and Active Hotels

2005

Booking.com

2007

Agoda.com

2010

TravelJigsaw / Rentalcars.com

2013

Kayak.com

2014

OpenTable, Buuteeq, and Hotel Ninjas

2015

Rocketmiles

2017

Momondo, CheapFlights, Mundi

2018

FareHarbor, DiDi, HotelsCombined

2019

Venga

2021

Flyinn, Getaroom

2023 (pending approval)

Etraveli

Booking.com Timeline and History

Booking.com Product Stats

Booking.com Core Service

Description

Key features

Stays/Accommodations

Find, compare, and make bookings from hotels, property owners, and other service providers.

Attractions

Find and book attraction services such as tours and experiences through various service providers.

Car Rentals

Compare Bookings from many different car rental companies.

Flights

Find and book flights from service providers and third-party aggregators.

Airport/Ground Transportation

Compare Bookings from over 1,000 public and private ground transportation providers in over 800 locations.

Business

Free and easy business travel platform to book and manage complete business trips.

Stays Data

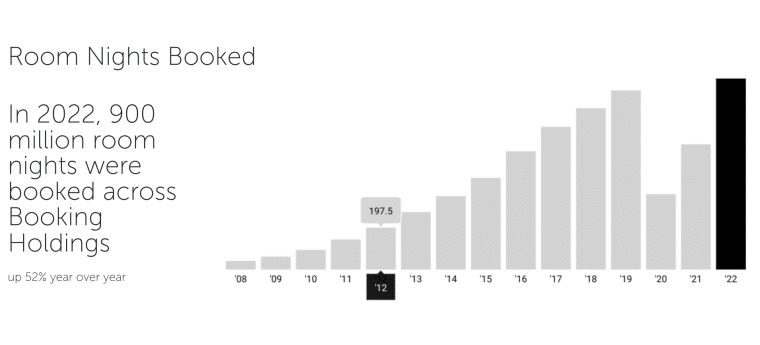

Year

Nights booked in millions

Year-on-Year Growth

2016

556

–

2017

674

21%

2018

760

13%

2019

844

11%

2020

355

-58%

2021

590

66%

2022

895

52%

Flights Data

Year

Airline Tickets (Millions)

Year-on-Year Growth

2016

7.3

–

2017

7.6

4%

2018

8.1

7%

2019

8.6

6%

2020

7.1

-17%

2021

15.3

115%

2022

23.0

50%

Car Rentals Data

Year

Rental car days booked in millions

Year-on-Year Growth

2016

66.2

–

2017

73.3

10%

2018

74.3

1%

2019

76.9

4%

2020

31.1

-60%

2021

47

51%

2022

48

2%

Attractions Data

On-Ground Transportation Data

Business Program Data

Booking.com Revenue Statistics

Q1 2023 Booking.com Revenue Statistics

FY 2022 Booking.com Statistics

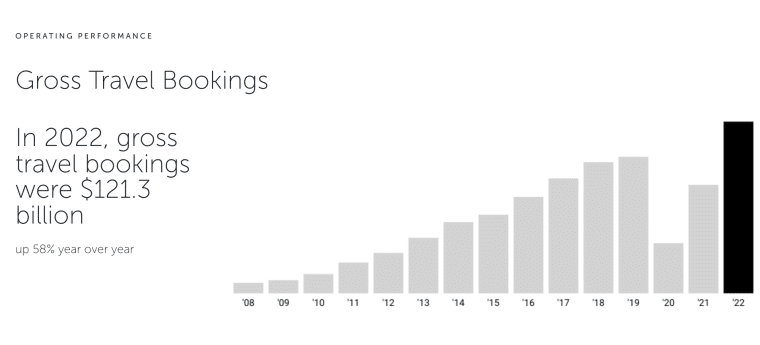

Year

Gross Bookings in billions of dollars

Year-on-Year Growth

2016

60.08

–

2017

81.22

35.%

2018

92.75

14%

2019

96.44

4%

2020

35.39

-63%

2021

76.58

11%

2022

121.3

58%

Agency Revenues

Agency Gross Bookings

Merchant Revenues

Merchant Gross Bookings

Advertising and Other Revenues

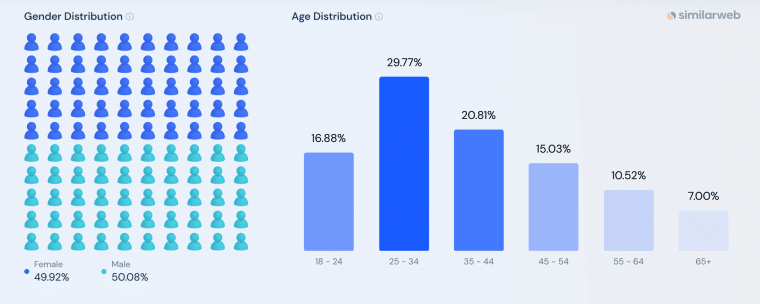

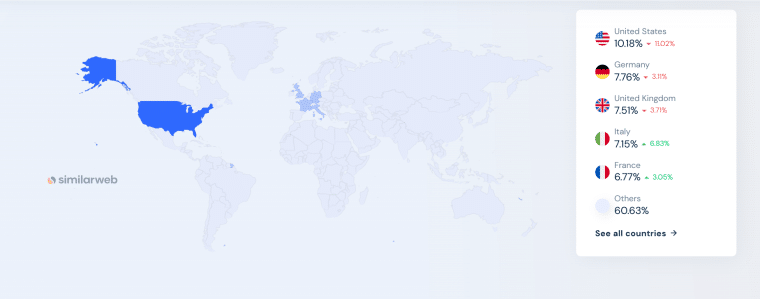

Booking.com Demographics Data

Booking.com Usage Statistics

Booking.com vs Competitor Stats

Booking.com Offering

List of Competitors

Stays

Car rentals

Flights

Attractions

Airport taxis

Business

References