Making up nearly a quarter of the global economy, the finance sector includes important areas like banking, lending, insurance, real estate, and investment. Additionally, this sector supports the whole world economy by providing essential liquidity, banking services, and more. By using artificial intelligence (AI) in finance, companies in these fields are changing their business models, improving efficiency, and making informed decisions in a fast-changing financial environment.

Considering the vast amounts of information scattered across various sources, understanding the impact of AI in finance can be difficult. That’s why at Business2Community we’ve pulled together all the latest data on how AI is used in the industry, its key benefits, challenges, and more.

AI in Finance – Key Highlights

- Natural language processing (NLP) and large language models (LLMs) are the top AI use cases for financial services institutions in 2023.

- AI spending in 2023 will be driven by customer service functions, program advisors, and recommendation systems.

- By 2030, the use of AI could reduce operating costs in the financial services industry by 22%.

- 93% of financial services leaders are confident about AI’s ability to detect fraud.

- Finding AI talent is becoming more difficult for businesses in finance and the workforce shortage is higher in North America than anywhere else.

How Is AI Used in Finance?

Powered by the availability of large data sets and increasing computing capacity, the use of AI in finance continues to accelerate. AI technologies are successfully being deployed across broad use cases such as process automation, product enhancement, decision-making, compliance, risk management, and more.

Nvidia’s State of AI in Financial Services 2023 survey, featuring over 500 global financial services professionals, analyzed 21 different AI use cases. It found that 10 types of AI were used by over 15% of respondents’ companies. These include:

- Natural language processing (NLP)/large language models (LLMs) – 26%

- Recommender systems/next-best action – 23%

- Portfolio optimization – 23%

- Fraud detection: transactions/payments – 22%

- Fraud detection: anti-money laundering/know your customer (KYC) – 22%

- Algorithmic trading – 21%

- Conversational AI – 20%

- Marketing optimization – 20%

- Creating synthetic data for model creation/optimization – 20%

- Synthetic data generation – 18%

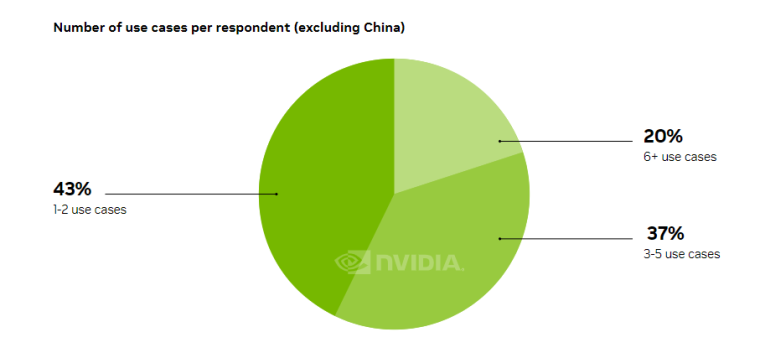

The same survey found that in over half of the respondents’ companies, AI was already being deployed across three or more use cases. 20% of respondents cited having six or more use cases in the market. The results echo a 2022 McKinsey survey where almost 60% of financial services respondents reported they had adopted at least one AI capability in 2022.

According to Statista, in 2023 the financial sector spent $35 billion on AI. With a CAGR of 29%, that number is expected to hit $97 million by 2027. Spending will be concentrated across three main use cases, namely customer service functions, program advisors, and recommendation systems. The other use cases that will see the largest spending support a more diverse set of tasks such as:

- IT optimization

- Augmented threat intelligence

- Prevention systems

- Fraud analysis and investigation

| AI Technology | Description | Finance Use Cases |

| Machine Learning | An application of AI that trains computers to learn from experience without being programmed to do so. |

|

| Computer Vision | AI technology that trains machines to capture and interpret information from videos and images, understand the context, and take appropriate actions. |

|

| Deep Learning | A subset of machine learning that simulates how the human brain learns based on training from large amounts of data. |

|

| Natural Language Generation | A subset of NLP, that allows computers to transform data into natural language text responses. |

|

| Natural Language Processing | A branch of AI that helps computers understand how humans write and speak. |

|

| Robotic Process Automation | AI applications that can be programmed to do repetitive tasks. |

|

Research by Gartner revealed that global banking and investment services IT spending was projected to hit $685.7 billion in 2023. With an expected CAGR of 8.5%, we’re looking at spending reaching $957.6 billion by 2027. Banking and investment services executives plan to spend the largest amount of new or additional funding in 2023 on cybersecurity, data and analytics, integration technologies, and cloud.

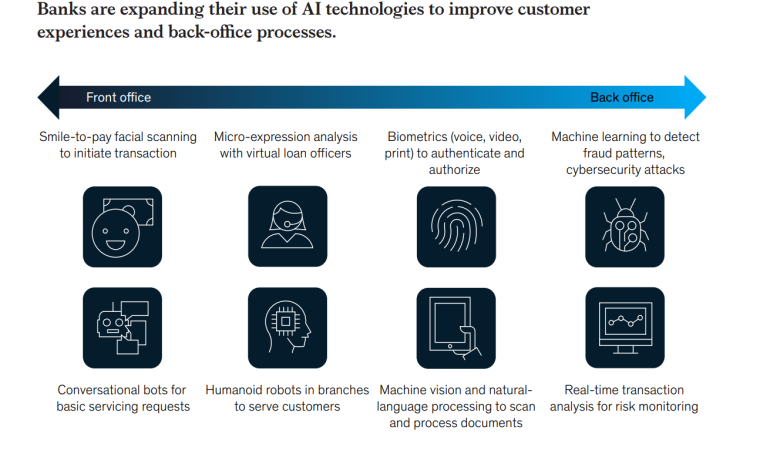

AI in Banking

Since the start of the global financial crisis in 2008, the average return on equity (ROE) of banks globally has declined and continues to contract. AI technologies give banks the power to increase their profitability and compete with non-traditional players in the industry. In fact, 80% of banks are highly aware of the potential benefits presented by AI, noted an OpenText survey in 2018.

Key AI use cases in banking include:

- Tailored products and personalized solutions

- Chatbots for customer service

- Credit scoring, underwriting, and decision-making

- Credit loss forecasting

- Anti-money laundering (AML)

- Fraud monitoring and detection

- Sentiment analysis using natural language processing (NLP)

AI in Real Estate

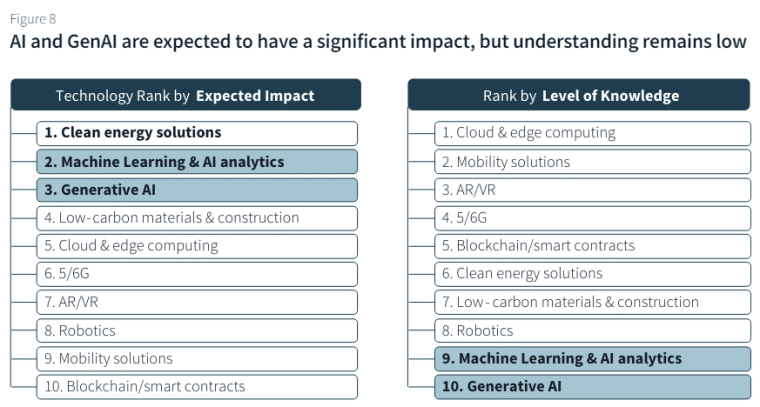

AI and its various technologies have the potential to transform the real estate sector. In JLL’s 2023 Global Real Estate Technology Survey, AI and generative AI were ranked among the top 3 technologies projected to have the greatest impact on real estate over the next three years by investors, developers, and corporate occupiers. However, how much industry players understand the technology lags significantly.

In fact, over 80% of these real estate occupiers, investors, and developers plan to increase their real estate technology budget over the next three years.

Key examples of AI use cases in real estate include:

- Predictive analytics: AI’s primary real estate application is predictive analytics, and as such, property valuation estimates can be AI-driven. Leading platforms offer personalized recommendations to clients, enhancing buying decisions.

- 3D modeling: Real estate leverages AI-driven 3D modeling, allowing for immersive property tours. This attracts more potential buyers and investors while saving time and money on in-person visits.

- Lead generation: AI helps realtors identify potential qualified leads from a variety of sources and invest their efforts into quality leads that are more likely to convert into sales.

- Smart home devices: Proptech is a growing field that relies on AI-powered smart devices for remote property monitoring. Smart locks, thermostats, and cameras increase tenant satisfaction and utility savings while minimizing major repairs and improving property maintenance.

- Property management: AI helps property managers screen tenants, collect rent, and schedule maintenance. Chatbots assist with inquiries, while automation streamlines payment processing, workflow management, and reporting for better operational efficiency.

- Mortgages: AI evaluates borrower data for risk, offers competitive rates, detects fraud, and automates loan servicing.

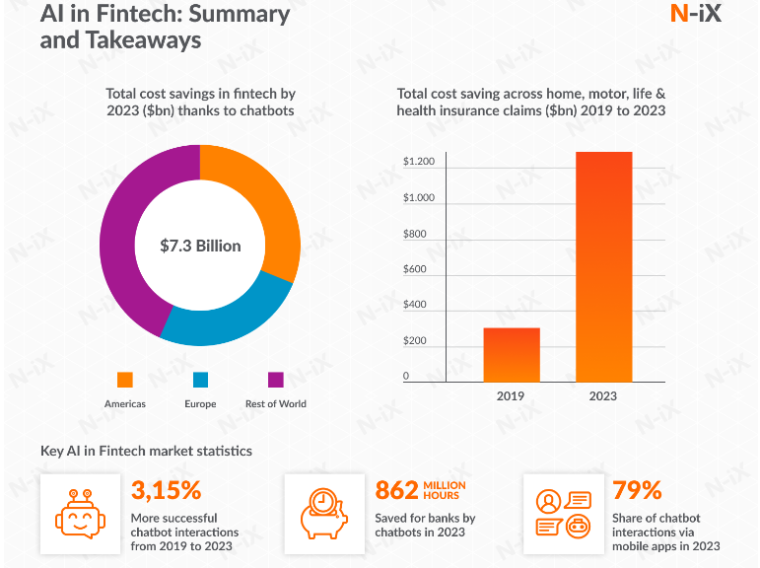

AI in Fintech

In 2022, AI in fintech saw the third highest in-flows of private investment, at $5.5 billion. This is just behind data management, processing, and cloud ($5.9 billion) and healthcare ($6.1 billion), as noted by the Stanford Artificial Intelligence Index. Close to 70% of fintech companies identify AI as the technology that will most profoundly shape the sector over the next decade.

AI is leveraged by fintech firms to automate processes, improve customer service, enhance security, and provide hyper-personalized financial solutions. Key use cases include:

- Automation: AI can automate financial processes such as loan underwriting, account opening, and risk assessment, saving time, and improving efficiency.

- Fraud detection: AI helps companies detect and prevent fraud by analyzing patterns, anomalies, and suspicious activities in real time.

- Customer service: AI-powered chatbots and virtual assistants provide personalized and instant customer support, answering queries, and assisting with transactions.

- Risk management: AI algorithms analyze vast amounts of data to assess risk, predict market trends, and optimize investment strategies to hedge against losses.

- Personalized financial advice: AI algorithms analyze customer data to provide tailored financial recommendations, investment plans, and budgeting advice based on customer risk profiles and past behaviors.

- Data analysis: AI can analyze large volumes of structured and unstructured data to identify patterns, predict customer behavior, and improve decision-making for managers, leaders, and marketers.

- Regulatory compliance: AI helps fintech companies comply with regulations by automating compliance checks such as KYC processes, monitoring transactions, and detecting suspicious activities.

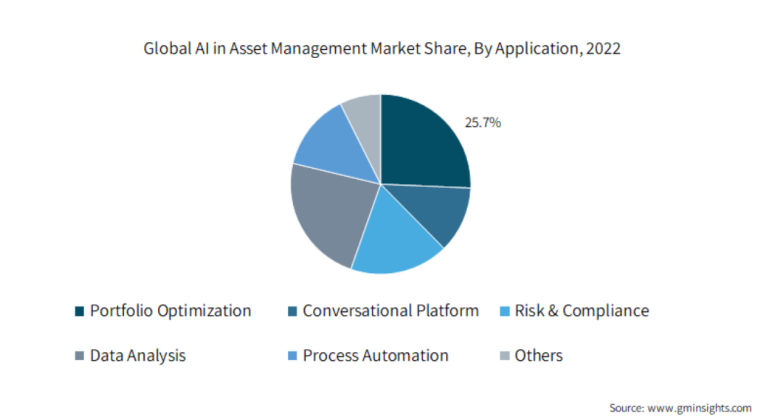

AI in Asset Management

The AI in asset management market was valued at $2.61 billion in 2022 and is expected to grow at a CAGR of 24.5% between 2023 and 2030. Growth is expected to be driven primarily by growing data volumes tight regulations, and low interest rates which are forcing asset managers to rethink their traditional business strategies.

Since 2005, the average asset-weighted equity index ETF expense ratio has dropped from 30 basis points to 15. Mutual fund expense ratios have also fallen from 1% to 0.40%. Additionally, players in the industry face tougher competition and the constant threat of new entrants. Margins are lower and the industry needs to find ways to streamline processes.

According to McKinsey, 2022 was a challenging year for asset managers, with a sharp decline in total assets under management (AUM) dropping from $121 trillion to $109 trillion in 12 months.

Given increasingly volatile market conditions, AI presents fresh opportunities for asset managers to improve their operations and margins. For example, vast amounts of data combined with the predictive capabilities of machine learning can give investors the power to unlock valuable insights, inform their strategies, and allocate resources optimally.

According to another McKinsey report, asset managers who invested in AI-enabled distribution analytics experienced a notable 20% growth in subscriptions and reduced redemptions by between 5% and 8% in 2022. In addition to facilitating more efficient decision-making, machine learning allows asset managers to monitor risk indicators and simulate portfolio performance under various market or economic scenarios.

AI in Trading

Driven primarily by AI, online trading will exceed a market value of $15.34 billion by 2030. AI is increasingly being used to automate decision-making processes and improve trading strategies. In fact, algorithmic trading accounts for up to 73% of US equity trading.

AI algorithms analyze real-time market data, identify patterns, and predict price movements. They also execute trades based on predefined criteria, optimizing entry and exit points. Furthermore, machine learning models adapt to dynamic market conditions, enhancing trading accuracy and potentially yielding higher returns.

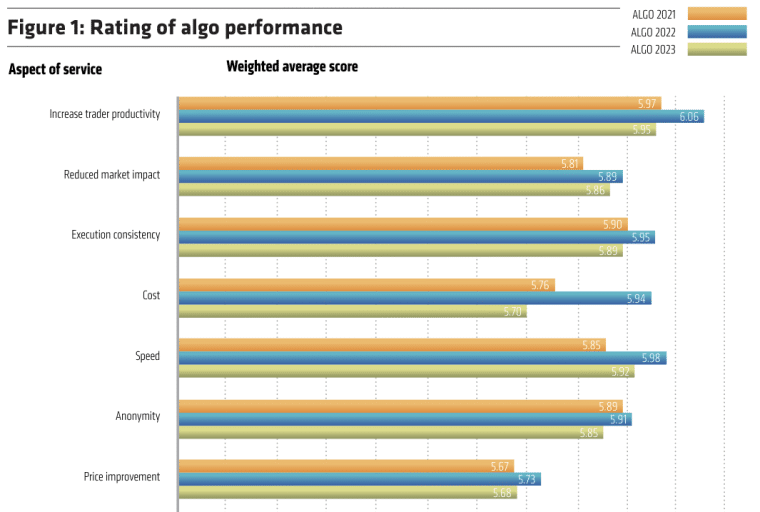

In The Trade News’ 2023 Algorithmic Trader Survey, the most impactful features of algorithms identified were:

- Customer support,

- Increased trader productivity

- Breadth of dark pools

- Speed

Respondents also saw the largest improvements in the categories of cost, speed, and customization features.

AI in Insurance

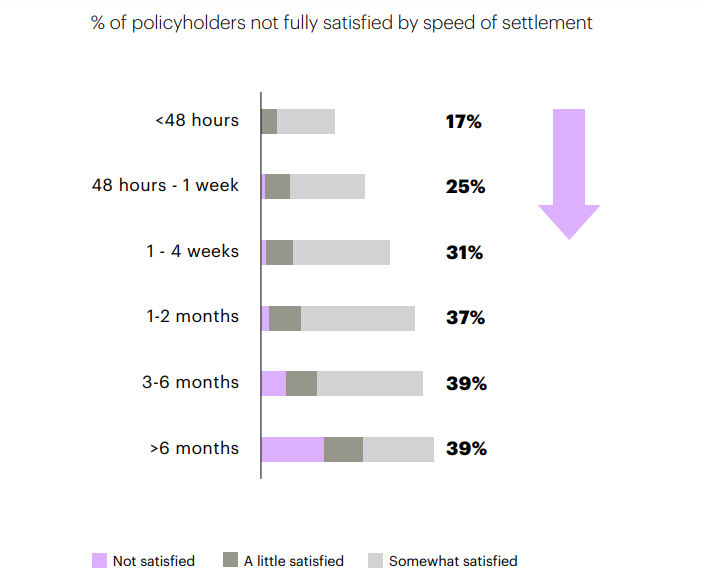

According to a report by Accenture, $170 billion worth of premiums are at risk over the next 5 years as consumers switch carriers due to dissatisfaction with the claims process. Additionally, underwriters are spending 40% of their time on non-core activities, representing an efficiency loss of $85-$160 billion over the next 5 years.

Globally, insurers are increasingly making use of AI for underwriting, claims processing, and customer service. AI and ML algorithms automate risk assessment by analyzing large datasets, improving accuracy in determining policy pricing and coverage.

AI streamlines claims processing and expedites payouts through image analysis and data validation. Chatbots and virtual assistants powered by NLP provide efficient and personalized support, enhancing overall efficiency and customer satisfaction. Industry-wide, AI has the potential to transform the industry by improving customer service, increasing efficiency, and reducing costs.

AI in Lending

Lenders use AI to automate document processing, improve risk assessment, streamline the loan approval process, and personalize micro-lending solutions. AI, along with ML and NLP helps financial institutions understand borrowing patterns and reduce the risk of non-repayment. Examples of key use cases include:

- Process automation: AI-led lending can lower operational expenses for lenders by automating processes, reducing manual effort, and improving overall efficiency.

- Risk assessment: AI algorithms analyze vast amounts of customer data to better assess credit risk, leading to better lending decisions, with the potential to strip out human biases.

- Loan approvals: By automating tasks such as credit checks, income verification, and document verification, loan approvals are faster.

- Personalized offers: AI allows lenders to target the right consumers by sifting through large amounts of data and sending tailored offers that match their credit criteria.

- Customer experience: AI-powered chatbots and virtual assistants provide personalized customer support, answering queries, and assisting with loan applications.

AI in Corporate Finance and Accounting

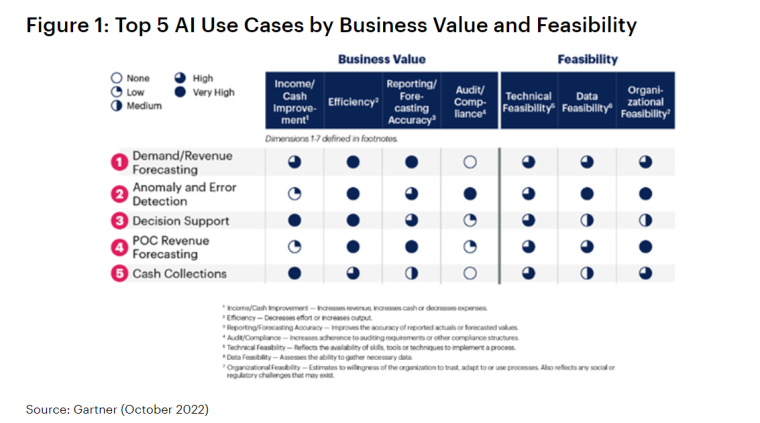

As company investors, accountants, treasurers, and analysts work to ensure long-term growth, AI plays a crucial role in predicting and assessing risk, improving processes, and tackling financial crime. Gartner analyzed over 23 use AI use cases in corporate finance and accounting and identified the top five key use cases that lead to notable business performance gains.

- Demand and revenue forecasting: Using data and AI models to predict demand and associated revenue across a variety of dimensions including business unit, product line, customer type, and region.

- Anomaly and error detection: Using ML models and real-time analysis to detect transactions that violate accounting principles or policies, preventing data entry errors from entering the workflow, and avoiding costly downstream corrections.

- Decision support: ML prediction algorithms are used to predict outcomes when alternative data values are used.

- POC revenue forecasting: ML models forecast the percentage-of-completion metrics (e.g., hours, cost, units, weight, etc.) to predict POC revenue and other factors.

- Cash collections: ML models are used to forecast cash flow and customer payments and inform proactive collection efforts.

Who Is Using AI in Finance?

Banks, insurance companies, and asset managers now make up 65% of the finance industry as opposed to 90% ten years ago. Big tech, fintech, FITs (financial infrastructure and technology firms), and other merchants in financial services account for 35% of the industry.

Almost one-third of the world’s largest financial institutions are now FIT firms, up from only two a decade ago. Advances within the sector have been driven by digitization and the growing role of tech and AI across various subsectors.

While automated systems and algorithms help determine credit ratings, loan terms, bank account fees, and other aspects of financial lives, they have the potential to perpetuate unlawful bias, automate discrimination, and produce other harmful outcomes. In April 2023:

- Rohit Chopra, Director of the Consumer Financial Protection Bureau

- Kristen Clarke, Assistant Attorney General for the Justice Department’s Civil Rights Division

- Charlotte A. Burrows, Chair of the Equal Employment Opportunity Commission

- Lina M. Khan, Chair of the Federal Trade Commission

…issued a joint statement about enforcement efforts to protect the public from bias in automated systems and artificial intelligence.

Today, our agencies reiterate our resolve to monitor the development and use of automated systems and promote responsible innovation. We also pledge to vigorously use our collective authorities to protect individuals’ rights regardless of whether legal violations occur through traditional means or advanced technologies.

Lemonade

By harnessing the power of AI and ML, Lemonade, a blossoming insuretech company founded in 2015, has streamlined its operations and demonstrated the transformative capabilities of AI within the insurance industry. Through automation, the company is able to offer convenient online-only solutions and policies at very low prices.

Lemonade uses AI in finance to assess risks, underwrite policies, process claims, and mitigate fraud. The company’s AI chatbot, Jim, handles sign-ups and claims. It also checks policy conditions and performs anti-fraud algorithms for claims resolution in a record-breaking two seconds. Lemonade also uses AI to analyze video submissions for signs of fraud.

| Company | Lemonade |

| Location | New York, US |

| Industry | Insurance |

| Types of AI Used |

|

PayPal

Since 1999, PayPal has been at the forefront of online payments. Notably, the payments giant uses ML models to improve the authorization rates of valid transactions on its platform. It also uses a combination of ML and graph technologies to combat fraud.

PayPal also relies on AI in finance to automate document processing and improve efficiency. Through the use of AI-powered chatbots, the company provides personalized customer support. Due to its effective use of AI to manage costs, PayPal’s profits increased in Q2 2023.

| Company | PayPal |

| Location | California, US |

| Industry | Fintech – Digital Payments |

| Types of AI Used |

|

Goldman Sachs

Goldman Sachs Asset Management’s recent success also exemplifies the power of AI in finance, as it uses it to support investment activities. Goldman Sachs Electronic Trading (GSET) is powered by a full suite of algorithms, including liquidity-seeking, benchmark-matching, and dynamic volume participation.

The investment giant is actively researching and experimenting with generative AI tools to help its developers automatically generate and test code.

In May 2023, Goldman Sachs released a new AI-powered social media platform focused on competing with networking platforms like LinkedIn. The program – named Louisa – uses artificial intelligence to inspect a company’s employee database and recommend professional connections to those who are likely to benefit from working together

| Company | Goldman Sachs |

| Location | New York, US |

| Industry | Investments and Asset Management |

| Types of AI Used |

|

JLL

Jones Lang LaSalle Incorporated (JLL), a global real estate services company, views AI as a valuable human enhancement rather than a replacement for human expertise. The company believes that AI in finance can augment the capabilities of real estate professionals while providing them with the tools to make informed decisions.

JLL uses AI and new occupancy management methods to optimize the utilization of workplaces and create more efficient environments. In 2023, the company launched Carbon Pathfinder, an AI-driven sustainability software planning tool.

The real estate giant also leverages AI to gain powerful insights into global real estate trends. JLL Technologies, the technology division of JLL, develops bespoke generative AI models designed for commercial real estate use.

| Company | Jones Lang LaSalle Incorporated (JLL) |

| Location | Chicago, Illinois US |

| Industry | Real Estate |

| Types of AI Used |

|

JP Morgan Chase

JP Morgan Chase uses AI to drive cost savings and innovation across its operations. The bank is developing a “ChatGPT-like” service called IndexGPT that will use AI to help customers select investments. Using cloud computing software, the service will analyze and select securities tailored to customers’ needs.

The world’s most valuable bank invests heavily in AI in finance to enhance customer personalization and client insights. It even has a Focused Analytics Solutions Team (FAST) that partners across Chase businesses to develop analytics and prototype solutions. It also applies the latest data science techniques to its own unique data assets while collaborating across teams to drive data-led transformation.

| Company | JP Morgan Chase |

| Location | New York, US |

| Industry | Banking |

| Types of AI Used |

|

Benefits of AI in Finance

With myriad applications of artificial intelligence across the industry, it’s important to understand where the gain can be made. When choosing the type of AI a company is going to invest in, it’s crucial to know what the end goal is.

Improved Products and Services

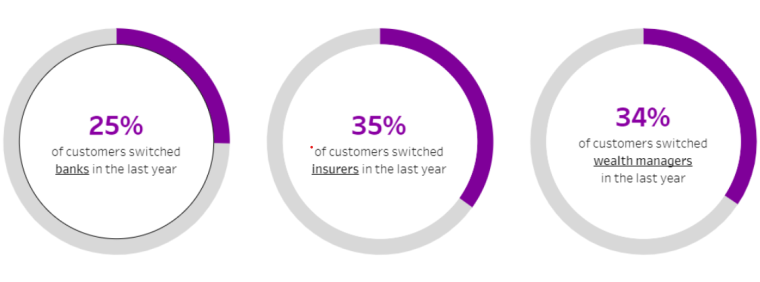

According to Salesforce, between 2022 and 2023:

- 35% of customers switched insurers.

- 25% of customers switched banks.

- 34% of customers switched wealth managers.

73% of customers expect financial institutions to understand their unique needs and expectations, up from 66% in 2020. Considering that 53% of financial customers would switch providers for better digital experiences, there has never been a better time for financial institutions to leverage AI.

AI gives financial institutions the power to enhance their product offerings to keep up with the changing demands of consumers. In fact, Stanford’s AI Index places improving products and services in the top four of AI’s most significant benefits. By moving toward more complete and tailored solutions, players in the industry can transform customer experience and drive up falling loyalty levels.

Lower Costs

AI-enabled cost savings for financial institutions stand at $447 billion in 2023, with front- and middle-office operations accounting for $416 billion of the total. By 2030, the use of AI could reduce operating costs in the financial services industry by 22%.

The 2022 Stanford AI Index noted that the most significant benefit of AI is lower costs. AI achieves this through:

- Process automation: AI automates various processes, improving efficiency, increasing productivity, and reducing costly errors.

- Risk management: AI improves risk assessment by analyzing historical data and identifying patterns. This enhances the accuracy of risk models, reducing potential losses from poor investment decisions.

- Customer service: AI-powered chatbots and virtual assistants handle customer inquiries and issues 24/7, reducing the need for large and costly customer service teams.

- Portfolio management: AI-powered Robo-advisors manage investment portfolios more cost-effectively than traditional human advisors. This reduces management fees and makes investment management more accessible to a wider range of investors.

- Regulatory compliance: By monitoring transactions and automating compliance tasks, AI helps financial institutions avoid regulatory fines and the costs associated with manual compliance efforts.

- Personalization: AI enables personalized financial services which can increase customer satisfaction, improve retention rates, and potentially lead to lower marketing costs.

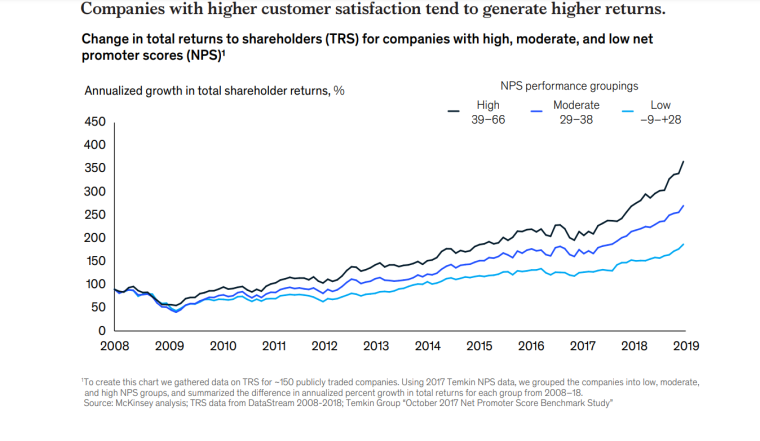

Higher Revenue and Profits

77% of all financial institutions anticipate that AI will be of significant importance to their operations within two years. As financial institutions contend with fierce competition and tighter margins, they must transform their business models to thrive.

Stanford’s AI index places increased revenue in the top five of AI’s most significant benefits. In the banking industry alone, the potential value of AI is expected to reach $1 trillion. Overall, AI technologies help financial institutions boost revenues through:

- Increased personalization of product offerings

- Lower costs enabled by automation

- Reduced error rates

- Enhanced fraud and risk management

- Optimal resource utilization

AI also makes emerging financial firms more investable. For example, firms that leverage AI, ML, computer vision, NLP, and virtual assistants or chatbots as their primary technology solution raise 20% more investment each year.

Improved Fraud and Risk Management

With global online payment fraud losses expected to hit $48 billion per year by 2023 according to Mastercard, consumers are looking to financial services providers for more secure solutions. As operational risks across the finance industry evolve, AI’s vast capabilities in real-time fraud detection and management continue to garner interest from players of all sizes.

According to IBM, the average cost of a data breach in financial services was $5.97 million in 2022. Additionally, 78% of customers would switch financial service providers if they felt their data was mishandled or compromised. With so much at stake, fraud and risk management are imperative for financial institutions.

AI can spot anomalies and deal with fraud in record time, saving institutions and customers billions. Plus, when augmented with shared data across institutions, AI models help bolster the entire industry’s defense systems, detecting criminal patterns before they become viral.

Better Data Management

AI can be used to organize, analyze, and extract insights from massive datasets more efficiently than traditional methods. It’s no wonder that 71% of financial institutions now structure their operations around data-driven insights.

Empowered by AI, businesses across all areas of finance can make informed decisions and allocate their resources optimally. Stanford’s AI index places valuable insights in the top three of AI’s most significant benefits and improved decision-making in the top six.

In Nvidia’s 2023 State of AI in Finance report, financial services professionals revealed the key challenges they faced while adopting AI, with insufficient data sizes and low data quality ranking among the top three at 26%. By leveraging AI, banks can generate synthetic data to enhance existing datasets. This, in turn, improves the performance and precision of AI, enabling financial institutions to harness its vast capabilities.

Challenges of AI in Finance

According to a Forrester survey, 98% of financial institutions believe that AI and ML can improve their operations business and give them a competitive edge. However, around 80% to 85% of ML or AI projects don’t launch due to various challenges.

Based on KPMG data, 93% of financial services leaders are confident in AI’s ability to detect fraud – an increase of 8% from 2022. However, cybersecurity breaches (50%) and privacy violations (44%) are the top potential risks financial services business leaders face when implementing AI.

In fact, 50% of business leaders consider managing AI-related risks the top barrier to scaling existing AI initiatives. This is closely followed by the need for quality data to train models (44%) and the difficulty of implementing AI technologies (42%).

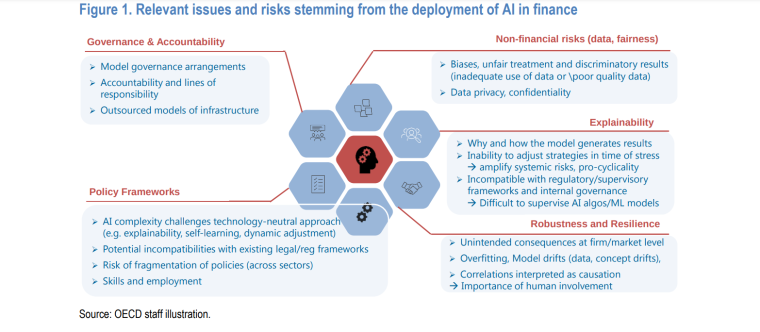

Explainability Challenges

In the finance sector, new risks arise due to the lack of explainability of AI models. Many automated systems are “black boxes” whose internal workings are not clear even to developers. This lack of transparency often makes it difficult to anticipate their outcomes and gauge whether they are responsible or fair.

Since 2022, the Consumer Finance Protection Bureau has fined banks over mismanaged automated systems. These systems resulted in wrongful home foreclosures, car repossessions, and lost benefit payments after the institutions relied on new technology and faulty algorithms.

Data Challenges

As AI adoption increases, financial institutions must plan for the potential overreach and unintended consequences of its technologies. AI outcomes can be affected by low-quality or imbalanced datasets, datasets that incorporate historical bias, or datasets that contain other types of errors. Automated systems sometimes link data with categories that should be protected, resulting in unfair and biased results.

55% of customers are satisfied with how financial institutions use their data to provide relevant services. This is up from 45% in 2022, noted The Business Journals. Customers, however, still want to understand how their data is being used and want to maintain a general sense of control over what is shared, how financial institutions will use it, and who has access to it.

AI and ML systems raise several privacy concerns that must be addressed by players in the highly regulated financial sector. Key challenges include:

- The potential to unmask anonymized data through inferences.

- Data leakages or outputs leaking sensitive data directly or by inference.

- AI “remembering” information about individuals in a training data set after the data is discarded.

Regulatory and Ethical Challenges

A rapidly changing regulatory climate presents new challenges for the finance sector. Financial institutions, which have long faced heavy regulation, will need to establish a set of ethical standards to govern their operations and guide a highly skilled workforce in the collaborative use of AI.

In May 2023, Sam Altman, the head of OpenAI and creator of ChatGPT, said government intervention would be “critical to mitigate the risks of increasingly powerful AI systems,” suggesting the formation of a US or global agency to license and regulate the technology.

A Stanford AI Index analysis of the legislative records of 127 countries shows that the number of bills containing “artificial intelligence” that were passed into law increased from just 1 in 2016 to 37 in 2022. Additionally, parliamentary records on AI in 81 countries show that mentions of AI in global legislative proceedings have increased nearly 6.5 times since 2016.

In 2022 alone, 10% of all federal AI bills in the US were passed into law. This is up from 2% in 2021. The growing adoption of AI has prompted intergovernmental, national, and regional organizations to craft strategies around AI governance.

According to the AIAAIC database, which tracks incidents related to the ethical misuse of AI, the number of AI incidents and controversies has increased 26 times since 2012. Interest in AI ethics continues to grow. In fact, the number of accepted submissions to FAccT, a leading AI ethics conference has more than doubled since 2021 and increased by a factor of 10 since 2018. 2022 also saw more submissions than ever from industry actors.

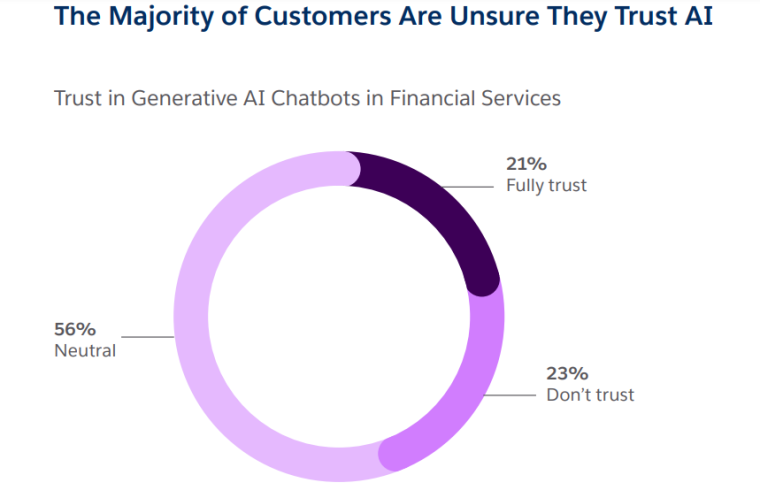

A 2023 Salesforce report revealed that 23% of customers don’t trust AI and 56% are neutral. This trust deficit can swing either way based on how financial institutions deliver AI-powered solutions. As the number of incidents concerning the misuse of AI rapidly increases, players in the finance industry will need to invest heavily in strategies to ensure the ethical use of AI in their operations.

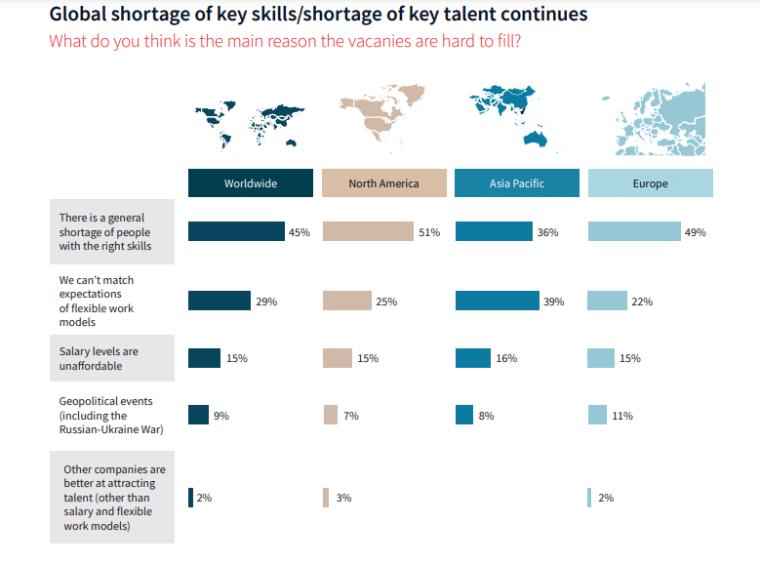

Talent and Workforce Challenges

Software developers are now one of the most in-demand roles in the finance industry, and since 2018, the largest institutions have increased hiring for software developers and data scientists by 90%. To keep up with the rapid pace of AI advancements, financial institutions require talent in cloud computing, AI, ML, and programming.

Cybersecurity and risk management talent is also in high demand as industry players face increasing regulatory pressure to improve their risk infrastructure and internal governance.

In a 2023 Nvidia survey of over 500 global financial services professionals, over a third of respondents (36%) cited challenges in recruiting and retaining AI talent as the top barrier to achieving their AI in finance goals. This represents an increase of 80% from 2022 and the first time in the survey’s three-year history that recruiting and retaining AI talent emerged as the top challenge.

A 2023 JLL report also confirmed that finding AI talent is becoming more difficult for businesses in the finance sector. The global shortage of key talent is higher in North America (51%) than in other regions. It’s also higher than the global average of 45%. In terms of employment levels across US states, New York City remains the center of the financial services industry.

Dallas has seen the highest increase in financial services employment jobs (14%) since 2019 outside of New York, followed by Miami (12.5%) and Detroit (7.6%). To take advantage of the benefits of AI, finance firms will need to come up with attractive hiring and retention strategies. They will also need to prioritize expanding in markets that offer scalability and affordability of diverse tech talent.

The Future of AI in Finance

The use of AI in finance is expected to grow over the next three years, with almost 50% of executives in the sector anticipating widescale adoption and critical implementation by 2025. Growth will be driven mainly by advances in automation technologies, smarter fraud prevention, more effective risk management, better customer support, and improved compliance with finance industry regulations.

85% of financial services leaders surveyed by KPMG in 2023 wished their businesses would adopt AI technology more aggressively, while 55% believed AI adoption is moving at the right speed. Meanwhile, 37% believe AI is moving faster than it should.

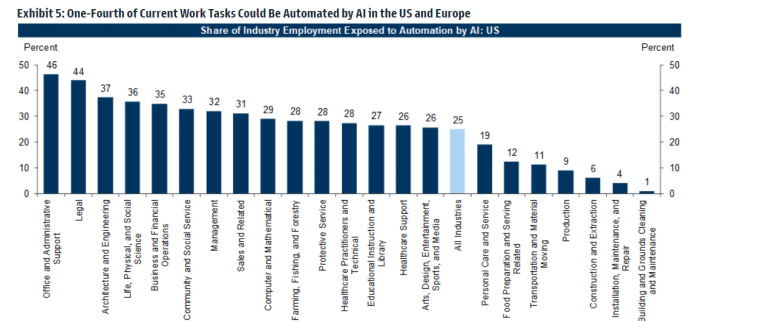

In the finance sector, 35% of current work tasks could be automated by AI in the US and Europe. Goldman Sachs maintains that if generative AI delivers on its promised capabilities, the labor market could face significant disruption. Across all sectors, the workforce in the US and Europe faces disruption, and a total of 300 million jobs could be lost or degraded by AI.

By 2030, McKinsey predicts that underwriting across life, property, and casualty insurance as we know it will cease to exist. For most personal and small-business insurance products, the process of underwriting will be reduced to a few seconds by automation. It will also be supported by a combination of machine and deep learning models built within the technology stack.

IoT sensors and an array of data-capture technologies will replace traditional, manual methods of first notice of loss. Claims will be automated and advanced algorithms will handle the entire process with record efficiency and accuracy.

Looking ahead, the costs of implementing AI will continue to fall, making it more viable to adopt at scale. For example, the cost to train an image classifier like ResNet-50 on a public cloud platform fell from approximately $1,000 to $10 between 2017 and 2019. Spending on AI-centric systems is therefore expected to increase by a CAGR of 27% to hit $300 billion by 2026.