In the past decade, sports betting statistics have shown that the worldwide landscape has transformed from a niche hobby to a major component of the online gambling industry, showcasing impressive growth in global market share and gross revenue. This evolution is notably reflected in the expanding sports betting market size, with key regions like North America driving this surge.

However, finding meaningful insights from sports betting often feels like navigating a labyrinth. That’s why our experts at Business2Community collected all of the most important sports betting statistics for 2025 from around the internet. Our aim is to provide clear insights into trends, total amounts wagered, and the potential for future expansion in this vibrant industry.

Sports Betting Statistics Highlights

- Americans wagered $119.84 billion in 2023, generating a total revenue of $10.92 billion.

- In 2023, 75% of sports bettors expressed a preference for placing their wagers online or through mobile apps.

- Draft Kings emerged as the top choice for online sports bets, with 57% of respondents favoring it in 2023.

- 85% of Americans supported the 2018 Supreme Court decision to end the federal ban on sports betting.

- Nevada sportsbooks took in a record-breaking $185.6 million in bets for Super Bowl LVIII.

Overall Sports Betting Stats & Trends

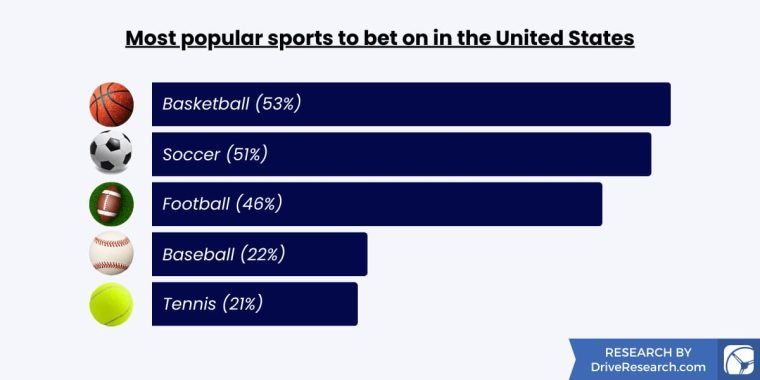

Basketball (53%), soccer (51%), and football (46%) ranked as the top three sports Americans bet on, per 2023 Sports Betting statistics from Drive Research. Other sports that also enjoyed popularity among bettors include baseball (22%), tennis (21%), horse racing (20%), golf (17%), motorsports (12%), hockey (11%), and mixed martial arts (8%).

According to the same study, nearly half (46%) of American adults engaged in at least one sports wager in 2023. The increase in sports wagering was due to a combination of factors, such as the proliferation of online betting platforms, enhanced marketing and media focus on sports betting, and the legal approval of sports gambling across various states.

Weekly sports betting was reported as a habit for 31% of American bettors. Daily betting was practiced by 10% of individuals, while 16% partake a few times weekly. Less frequent betting intervals include several times a month (6%) and once every few months (4%).

63% of individuals considered team/player performance statistics crucial in making sports betting decisions. Over half of bettors also paid attention to betting odds and market trends (58%) when placing bets. Additional considerations included advice from influencers, insiders, and experts (48%); tips from friends and family (48%); historical head-to-head matchups (47%); and injury reports along with team news.

In 2023, 75% of sports bettors expressed a preference for placing their wagers online or through mobile apps. This inclination towards digital platforms underscores a transformative shift in the gambling sector, with three-quarters of bettors opting for the convenience and accessibility of online or app betting.

Convenience (78%) and ease of deposits (75%) were the main reasons for the preference towards online/mobile sports betting. These leading motivations demonstrate the critical role of user-friendly interfaces and streamlined financial transactions in attracting and retaining bettors. Other reasons for the preference included the allure of rewards/promotions (63%), the availability of more betting options (63%), and the absence of in-person betting facilities nearby (21%).

Draft Kings emerged as the top choice for online sports betting. Statistics showed that 57% of respondents favored it in 2023. This preference signals Draft Kings’ effective brand positioning, appealing user experience, and possibly lucrative bonuses or promotions. Drive Research’s data indicated that other preferred online sports betting platforms include FOX Bet (50%), FanDuel (45%), BetMGM Sportsbook (41%), PointsBet (41%), BetRivers (35%), WynnBET (31%), Caesars Sportsbook (29%), and Barstool Sportsbook (23%).

FanDuel is notably favored by bettors from households earning $50K or less, with a 50% preference rate. This insight highlights FanDuel’s strategic penetration into a market segment characterized by lower-income households, catering to the needs and limitations of this particular demographic.

25% of sports bettors preferred making wagers in person. This preference was due to the value placed on social interaction, the ambiance of a physical sportsbook or casino, and direct dealings with staff and other bettors amidst the rise of digital betting options.

The primary reasons for this preference were the social experience (58%) and more manageable finances (51%). The Drive Research study showed the social aspect of betting and the perception that handling cash directly helped maintain spending discipline, contrasting with the abstract nature of the online betting market. Other reasons included the transactional experience (46%), the absence of mobile betting in their state (31%), and distrust towards online/mobile platforms (27%).

Men were more than twice as likely to prefer in-person betting for the transactional experience, with 59% stating this reason compared to 26% of women. The act of physically placing bets and cashing out was almost as appealing for men as the social aspect of betting.

Individuals with a household income of $150,000 or more were particularly drawn to in-person betting for the transactional experience, at a rate of 73%. This preference was likely due to the luxury and personalized service associated with higher-stakes betting, fitting the lifestyle and expectations of higher-income earners.

Bettors must win 52.4% of bets to break even. While most sports bettors might think winning 50% of the time will break them even, that’s not the case. That’s because the top sportsbooks take a small fee to take your bet. By covering the spread and winning bets at least 52.4% of the time, bettors can grow their capital over time.

Sports Betting Revenue & Handle

The regulated US sports betting market generated a total revenue of $10.92 billion in 2023, up 44.5% from 2022. Americans legally gambled $119.84 billion in 2023, an additional $27.8 billion from the previous year. The slower increase in total wagers compared to the growth in revenue can be attributed to the national hold percentage rising to 9.1% last year, an increase from 8.1% in 2022.

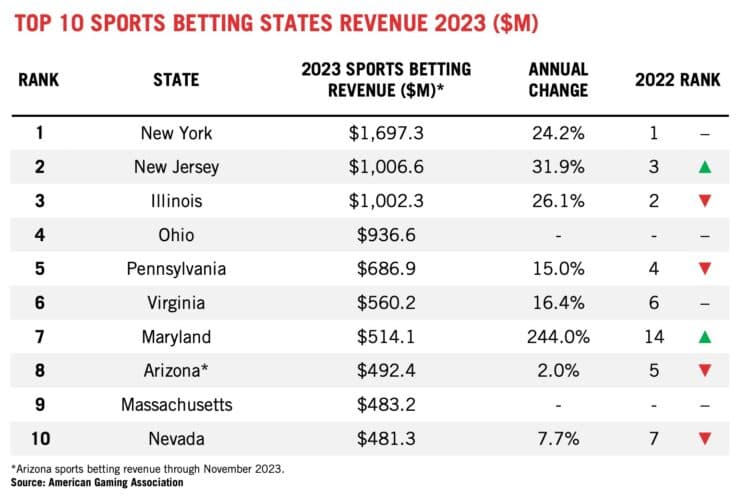

In 2023, the sports betting industry welcomed five new markets: Kentucky, Maine, Massachusetts, Nebraska, and Ohio, collectively generating $1.49 billion in revenue. Massachusetts and Ohio contributed to this total, with revenues of $483.2 million and $936.6 million respectively, positioning them among the top ten sports betting states by the year’s end.

In a milestone, New Jersey and Illinois each surpassed the $1 billion threshold in annual sports betting revenue for the first time in 2023, with New Jersey generating $1.0066 billion and Illinois close behind at $1.0023 billion. New Jersey regained its status as the second-ranked state in sports betting revenue, while Maryland saw an ascent in the rankings during its first complete year of online betting operations.

The latter part of 2023 saw legal sportsbooks achieving their highest-earning quarter to date, with revenues soaring to $3.41 billion. This represented a 30.8% increase from the fourth quarter of 2022 and was 19.6% above the prior record set in the first quarter of 2023.

A record-breaking $40.02 billion was wagered on sports during the fourth quarter of 2023, up 34.4% from the year before.

New York was the first online sportsbook to surpass $25 billion in sports betting handle. Following the legalization of sports betting in New York in January 2022, the state witnessed a surge in activity. Within an 18-month span, New York crossed the $25 billion threshold, achieving this milestone faster than any other state.

In June of 2023, DraftKings processed 42% of all mobile sports betting ($488.5 million), surpassing FanDuel as the number one sportsbook in New York. Following several weeks as the top choice, DraftKings Sportsbook experienced an 81% rise in its betting handle compared to June 2022, when it was $270.2 million.

Canadian iGaming and online sports betting contributed CA$1.58 billion to Canada’s GDP in its first year. The industry also created 12,072 full-time jobs and supported CA$523 million in provincial and municipal government revenues, according to a report by Deloitte. In year 1, $906 million was contributed to labor income.

A record-breaking $185.6 million was wagered on 2024’s Super Bowl LVIII at the state’s sportsbooks. This surpassed the prior record for Super Bowl betting in 2022 by nearly $6 million. The state’s 182 sportsbooks managed a modest victory, securing a $6.8 million win from the event, demonstrating that bettors held their ground for the second consecutive Super Bowl, the first hosted in Las Vegas.

Americans bet approximately $15.5 billion on March Madness 2023. Approximately 68 million American adults planned to wager on March Madness 2024, according to the American Gaming Association. That’s about a quarter of American adults that bet on March Madness in 2023.

A total of $35 billion was wagered on the soccer World Cup 2022, representing a 65% increase from the previous tournament. Only $1.7 billion of bets came from the US. There was around $1 billion wagered on each knockout game and up to $2.5 billion on the final.

The sports betting industry set a quarterly record by generating $3.41 billion in revenue during the fourth quarter of 2023. This represents a 30.8% rise from the fourth quarter of 2022 and a 19.6% improvement over the previous record established in the first quarter of 2023.

Sports Betting Statistics – Legalization

Delaware was the first state to legalize sports betting in 2018 after the repeal of the Professional and Amateur Sports Protection Act of 1992 (PASPA). It was the first state to take advantage of the US Supreme Court decision and legalize sports betting in June 2018. The state’s Governor, John Carney, was the first in line to lay money down on a single game bet.

Prior to the repeal, sports betting was largely restricted to Nevada due to exemptions under PASPA. The repeal of PASPA allows states to legalize sports betting if they choose, leading to a rapid expansion of legal sports betting across the US. The decision by the Supreme Court to declare PASPA unconstitutional opened the door for states to set their own sports betting regulations, leading to a diverse and rapidly growing market.

In less than six years since the repeal of PASPA, regulated sportsbooks have taken in over $300 billion from sports betting. This activity has contributed over $2 billion to local and state governments, marking an impact on the economy and indicating the widespread adoption and acceptance of sports betting across the country.

38 total states (plus Washington DC) have a form of regulated sports betting options in 2024, up from 37 in 2023. 26 states permit online sports betting through either smartphone applications or websites.

Since 2018, almost every state legislature in the US has considered a sports betting bill at one time or another. It’s anticipated that more states will either reintroduce or propose new sports betting legislation in 2024.

New York had the largest sports betting market share in the US after legalizing mobile sports betting in January 2022. Within the first month, the state generated over $1.6 billion in wagers, setting a new record for the largest amount of money wagered in a single state in its first month.

California remains the most populous state without legal sports betting. Despite multiple attempts to legalize it through legislative measures and ballot propositions, efforts have been unsuccessful due to opposition from tribal gaming interests and complex regulatory challenges.

California’s legal standstill contrasts sharply with the national trend in the US toward legalization. As neighboring states and the broader country embrace sports betting, California’s lack of legal frameworks leaves a large portion of its population navigating a gray market. The absence of regulated betting options not only limits consumer protection but also foregoes potential tax revenues for the state.

Illinois ranks as one of the top states for sports betting volume in the US. Following its legalization of sports betting in March 2020, Illinois quickly emerged as a major player, consistently ranking in the top 5 states for monthly sports betting handle.

Nevada, once the only state with legal sports betting, has seen drastically increased competition. Despite this, it remains a key player in the sports betting market, with billions of dollars wagered annually. The state has adapted by enhancing its mobile betting options and integrating sports betting more deeply with its casino operations.

Ontario was the first province in Canada to introduce regulated sportsbooks. By April 2022, Ontario launched its first legalized sports market, resulting in access to multiple operators with online sportsbooks and casinos.

Projected Sports Betting Market Growth

Revenue from online sports betting is forecasted to see a 10% compounded annual growth rate (CAGR) over the next five years. This growth follows the sector’s expansion after the 2018 Supreme Court decision to legalize sports betting, with states like Kansas, Ohio, and Maryland recently adopting online/mobile betting.

The global sports betting market value will be $182.12 billion by 2030. Factors fueling the demand for sports betting include changes in the worldwide gambling sector’s regulatory environment, the widespread use of connected devices, and advancements in digital infrastructure.

North America is expected to dominate global sports betting. Statistics show the US is expected to lead this growth, with a potential market value of $42.3 billion by 2028, driven by the increasing number of states legalizing sports betting, technological advancements, and the widespread use of mobile devices.

Mobile betting is expected to account for the majority of sports betting revenue in the coming years. With the convenience and accessibility of smartphones, mobile platforms are becoming the preferred method for sports betting, driving innovation and competition among operators in the market.

iGaming and regulated sports betting are expected to grow 3x in Ontario by 2023, contributing approximately CA$4.73 billion to GDP. The projections also account for a total contribution of 22,132 jobs, per Deloitte.

Sports Betting Advertising

In 2022, nearly half of Canadians (48%) believed the volume of gambling advertising was excessive. 63% of the population supported limiting the amount and placement of these ads. Negative posts about sports betting advertising on social media also surged by 820% between July 2022 and October 2022, according to an Ipsos survey.

Sports fans are exposed to gambling advertisements about 20% of the time during sports broadcasts in the US and Canada. A study by CBC’s Marketplace and the University of Bristol found an average of 2.8 gambling messages per minute across seven NHL and NBA games. The study counted 3,537 gambling messages across all broadcasts, with FanDuel accounting for over a quarter of them.

The NFL limited sports betting ads during the Super Bowl LVIII broadcast to three, aiming to curb the saturation of gambling advertisements. This decision was part of broader efforts to address concerns over the impact of such ads, including those from recovering compulsive gamblers and lawmakers. The league’s actions reflect a commitment to maintaining the integrity of the game amidst the growing legalization and popularity of sports betting.

The UK has implemented strict regulations on sports betting ads, particularly during live sports broadcasts. In April 2019, a “whistle-to-whistle” ban prohibited gambling ads from airing from five minutes before a live sports event starts until five minutes after it ends, before the 9 PM watershed. This measure aims to reduce the exposure of children and vulnerable people in the UK to gambling content.

Australia has also taken measures to regulate sports betting advertising. Since March 2018, bans restrict gambling advertising during live sports broadcasts between 5 AM and 8:30 PM. The policy is also designed to protect minors and vulnerable groups from gambling harm, reflecting growing concerns about the impact of such advertising.

In Spain, a crackdown on gambling advertising was announced in 2020. The new regulations, which came into effect in 2021, include a ban on sports teams’ sponsorship by gambling companies and restrictions on advertising gambling services on all media platforms, except between 1 AM and 5 AM. These measures were introduced to combat problem gambling and reduce the visibility of gambling ads to minors.

How Do People Feel About Legal Sports Betting?

85% of Americans supported the Supreme Court’s 2018 decision to end the federal ban on sports betting, per statistics from the American Gaming Association in 2023. In 2019, only 63% of Americans agreed with the Supreme Court’s decision.

In 2023, 77% of American adults supported legalization in their state of residence. There are 38 states that have legalized sports betting since the PASPA decision, with growing support from every state each year.

77% of online sports bets were placed through regulated operators in 2023, compared to just 44% in 2019. With more operators available in every legalized state, sports betting fans have options about where to place their bets. That has taken 33% of the total market share away from offshore sportsbooks, which remain a highly viable option for many residents of the USA.

In 2023, 9 out of 10 bettors who placed most of their bets legally intended to stay within the legal market in the following year. 46% of bettors using unregulated operators planned to transition to regulated operators within the following 12 months.

Key factors driving bettors to prefer legal operators over illegal ones include:

- Assurance of payout (71%)

- Confidence in account security and the convenience of payment methods (68%)

- Access to responsible gaming tools (58%).

Nearly half of sports bettors (45%) were aged between 23 to 34 years, highlighting a younger demographic’s engagement in sports betting. Additionally, 69% of bettors were male, indicating a gender disparity in the activity.

Over half of the bettors (53%) possessed at least a BA degree, and two-thirds had an income of $50k or more. This suggests that sports bettors are generally well-educated and affluent.

Women showed a distinct preference for single-game wagers (34%) and were more likely than men (32% vs. 22%) to bet in person. Despite this, 72% of women had not placed any sports bets in the previous year, compared to 33% of men, demonstrating a gender difference in betting participation.

Preferences in sports betting varied significantly across income levels. Individuals earning over $100K predominantly bet on soccer, those with incomes between $50K and $99K favored basketball, and bettors earning less than $50K mainly chose American football.

Generational differences also shape sports betting preferences. The Silent Generation showed a preference for FanDuel, whereas other generations leaned towards DraftKings. Millennials mostly bet on soccer, Gen Z focused on basketball, and Baby Boomers, along with Gen X, prefer American Football.

15% of Americans reported knowing someone with online sports betting issues, according to a survey conducted in 2024 by the Siena College Research Institute and St. Bonaventure University.

As per the same survey, 37% of online sports bettors felt bad or ashamed after losing. 38% of bettors indicated they bet more than they should have.

65-23% of Americans believed online sports betting will create compulsive gamblers, causing family pain.

AI is expected to significantly alter the sports betting landscape. Artificial intelligence in sports betting, particularly the use of blockchain technology for recording data on digitized ledgers, is set to automate data processing, speed up transactions, and enhance security, including for cryptocurrency dealings.

Virtual reality sports betting platforms are on the horizon. With the introduction of the VR22 sports betting platform in October 2023, virtual reality betting has advanced, offering users a 360-degree live experience. This platform enables real-time interaction with games, including specific play wagers and the option to buy merchandise or NFTs.

FAQ

What is the success rate of sports betting?

What percent of people are successful at sports betting?

Is the sports betting industry growing?

What percent of sports gamblers win money?