Invoice payment terms could arguably be the most important part of invoicing. That’s because your payment terms define when and how you’ll be compensated. So, if you choose the wrong terms, you could be doing some serious harm to your cash flow.

As you know, when you experience payment delays in your cash flow, you’re putting your business in jeopardy. That’s because you don’t have the money to satisfy your expenses, which can ultimately result in penalties like late fees.

Simply put, having clear invoice payment terms ensures that you get paid in a timely manner. But, which terms should you go with? Definitely start with these five payment terms.

1. The Shorter, the Better

Invoice terms vary across industries. For example, manufacturers expect a payment to be made within 30 days, aka NET 30. In the fashion or construction industries, the norm is NET 30 or NET 60. With freelancers, this could be anywhere from 30 to 60 days.

Unless there’s a strict industry standard, you have some flexibility in selecting your billing terms. And, in most cases, this means that they should be listed or said in a way that’s as short as possible.

After we studied over 250,000 invoices, we found that 63 percent of invoices are paid on time within 30 days. We also discovered that 18 percent of all invoices are paid within 24 hours of being sent. However, if an invoice hasn’t been paid within 90 days, then only 18 percent of those invoices get paid.

Research from Xero shows that between 70 percent and 80 percent of businesses give two weeks or less to be paid. Over half, however, request payment within seven days.

In other words, not only is it common to request shorter payment terms, but it’s also in your best interest. After all, the sooner you get paid, the sooner you get cash flowing back into your business. And, it also encourages the other party to pay your invoice faster.

Bonus Tip: When writing your payment terms, use “days” instead of “net” so that it’s crystal clear when you expect to be paid.

2. Payments Should Be Upfront or Immediate

Due co-founder John Rampton writes that payment in advance, or PIA for short, is simply a payment that’s made ahead of schedule. He then goes on to say:

If a client doesn’t agree on an advance payment, then you should request an immediate payment.

Often associated with “Cash on Delivery” (COD) or “Payable on Receipt,” an immediate payment is one that’s “due at the same time as a product or service is delivered.”

Rampton adds,

He also gives insight into some of the benefits of this:

3. Mind Your Manners

Take the advice of your mom; always say “please” and “thank you.”

It’s been found that a simple ‘please pay your invoice within’ or ‘thank you for your business’ can increase the percentage of invoices that are paid by over 5 percent!

The reason? Good manners can help establish and strengthen relationships. And, if you have a strong relationship with a client, they’re more inclined to pay you quickly.

4. Discounts and Overdue Fees

As noted in a previous Due article, offering an incentive is one of the best ways to secure a better payment term for your small business.

For example, you could offer an incentive like free shipping, discounts on future work, or a 2/10 Net 30. This is where there’s a two percent discount if you’re paid within 10 days.

This is usually a win-win. Since you’re getting paid sooner, and you’re reducing any gaps in your cash flow. This also keeps the customer satisfied since it saves them a couple of bucks.

However, you should also implement overdue fees. “This is the interest rate that you’re going to charge a client if they miss the due date.”

When the client “is aware that there will be a penalty if the invoice is not paid by the due date, it should be enough to motive them to accept your terms.”

When using overdue fees, make sure that they’re reasonable. Charging an excessively high late fee may backfire and influence the client not to pay the bill. In most cases, it’s customary to charge 1.5 to two percent of the invoice amount as a late fee for past-due invoices.

5. Multiple Payment Options

We live in an era of digital banking and electronic payments. So, why not use this to your advantage? For example, platforms like Due allow you to accept payments via PayPal, credit card, ACH, transfer, and even cryptocurrencies like bitcoin.

By accepting a wide range of payments, you’re allowing your customers to use a payment method that they’re comfortable with. When a customer is familiar with and trusting of a payment method, they’ll be more inclined to pay the invoice on time.

The Bottom Line With Invoice Payment Terms

Don’t overthink your payment terms. Keep them as simple as possible. This means keeping them short, requesting advanced/immediate payments, being polite, offering incentives/penalties, and accepting multiple types of payments.

When you communicate these terms with your clients or customers in advance, you’ll increase the speed at which your invoices will be paid.

The Best Invoicing Software for 2025 — Bonsai

Now that you know the importance of keeping your invoice terms clear and polite, you may be interested in learning about the perfect invoicing software.

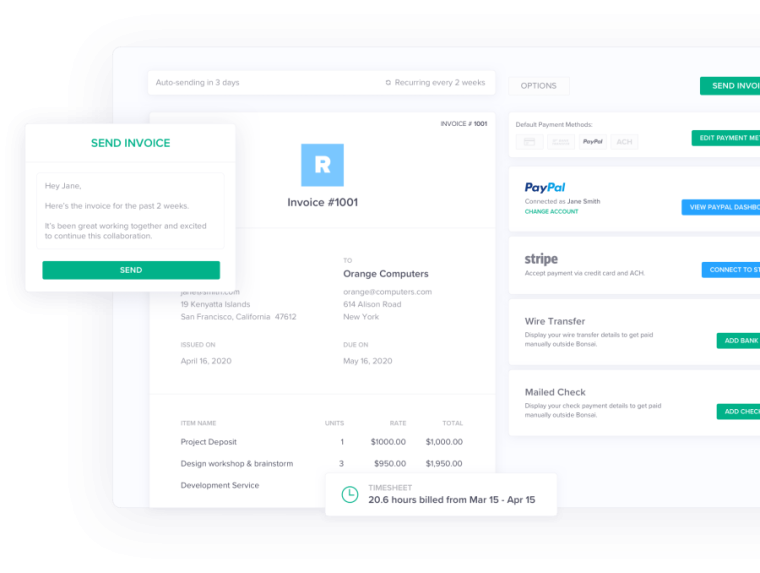

Bonsai is a popular all-in-one solution for small businesses and freelancers looking to streamline their processes and get a handle on their business processes.

With Bonsai, you have ample pre-made invoice templates covering various industries — plus, the invoices are highly customizable and include integrated payment to simplify your invoice creation process.

On top of this, Bonsai also offers global payment options, including credit card, ACH, and PayPal, and the tool will automatically send payment reminders to your clients and help with accruing late fees.

Partial payments, attachment locking, and more are also on offer. Check them out, their invoice templates are all completely free.