Using one of the top insurance agency CRM software tools, you can track customer information, interactions, and communications, among other features. Additionally, along with automating many of your customer management tasks, your insurance brokers will be able to turn leads into clients and maintain existing relationships.

With that said, finding the best insurance agency CRM software for your agency isn’t easy. We’ve scoured the market to source, rank, and review the market’s leading customer relationship management software to help you find one that ticks all the right boxes. From the almighty HubSpot to Zoho and Freshsales, read on to learn more.

Insurance Agency CRM Software: Top 10 for 2025

Looking for a list of top-tier CRM software options to boost your insurance agency? We’ve got you covered. Here is our list of the ten best CRM software for insurance agencies as of 2025.

- HubSpot CRM – Overall, the Best Insurance CRM

- Zoho CRM – Best for Lead Communication Testing

- Freshsales – Best for Customization

- Insureio – Best for Operations Management

- Less Annoying CRM – Best for Ease Of Use

- Radiusbob – Best for Call Centers

- Velocify – Best for Streamlining Sales Process

- Salesforce – Best for Generating Leads

- Pipedrive – Best for Account Management

- AgencyBloc – Best for Commissions

Best Insurance Agency CRM Software – Compared

To help you choose the very best CRM software for your agency, our experts have compared and contrasted the top 10 products on the market. These are the very best in the game, and they all offer a range of features to make your agency run smoother and more efficiently.

1. HubSpot CRM — Overall, the Best Insurance CRM

HubSpot CRM is a well-known sales management platform that offers free plans and solutions for businesses of all sizes. The system allows for customization and features an easy-to-use interface.

There are so many insurance companies to pick from in this sector that it can be tough to stand out.

Many agencies, however, employ content marketing to engage prospects on complicated insurance issues, advertise their brand, and create leads. Although not specifically designed for insurance, HubSpot CRM is a superb tool for managing all parts of marketing.

Users may use CRM to manage their blog, SEO, social media profiles, and adverts. Users may also utilize segmentation to send tailored campaigns to specific audiences.

Despite being a high-quality CRM, HubSpot is not industry-specific to insurance companies and hence cannot manage certain tasks in an agency’s operations, such as handling policy renewals, distributing policies, and submitting applications.

We chose Hubspot CRM as the overall best CRM because it offers a great mix of functionality and ease of use, which is perfect for small businesses that are just starting out. The software is also suitable for larger businesses with more complex sales and marketing needs.

Key Features:

- Metrics Tracking – HubSpot CRM tracks all of your website and marketing data in one place so you can see how well your campaigns are performing.

- Profile Segmentation – You can target specific leads with tailored content using HubSpot’s powerful segmentation features.

- Lead Capture and Management – Leads captured through your website or marketing campaigns can be easily added to HubSpot CRM and managed through the system.

Pricing:

Paid plans start at $45 per month

Pros:

- Offers free plan

- End-to-end workflow

- Ease-of-use

Cons:

- Needs to upgrade for more features

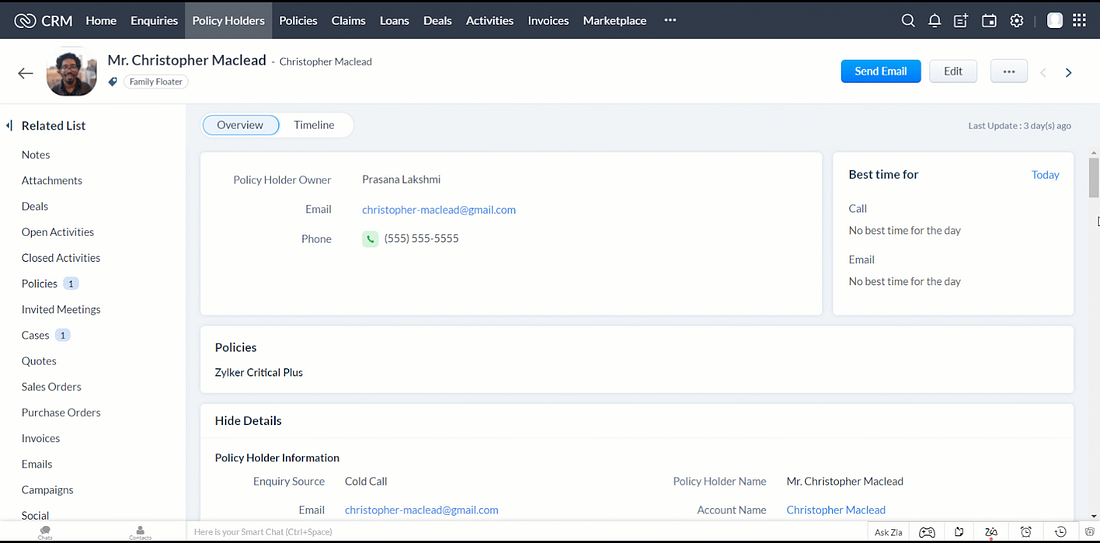

2. Zoho CRM — Best for Lead Communication Testing

Zoho CRM has a lot of modification possibilities for turning it into an insurance CRM system. Based on an employee’s position and how the process is built, there are additional automation options to auto-assign, finish, and alert team members about tasks.

The built-in AI Zia function also keeps data up to date with enrichment tools and informs customers about the jobs they may automate using Zia’s suggestions.

The platform’s most notable feature is its omnichannel communication capabilities, which allow you to communicate with your insureds across different platforms.

Native and integrated VoIP systems, bulk and direct email, and chat support capabilities are all available as telephonic solutions. You can also integrate Zoho with different social media platforms to get an idea about customer sentiment and preferences.

Another important feature is the ability to measure sales performance and track opportunities at each stage of the sales funnel. You can also create custom reports to help you understand how your team is performing.

Key Features:

- Custom Fields – You can add custom fields to your account and insurance policies to capture additional data.

- Task Automation – You can automate tasks based on the position of an employee in the process or the stage of the sales funnel.

- Assignment Rules – You can set up rules to automatically assign tasks to team members.

Pricing:

Standard Plan costs $14 per month

Pros:

- Affordable

- User-friendly

- AI-Based (Automation)

Cons:

- You need to pay extra for more customization

3. Freshsales — Best for Customization

Freshsales is a wonderful CRM choice that offers a free version, low-cost subscription options, and a simple UI. Freshsales users appreciate the built-in phone, which may be used to place, receive, and track phone conversations with policyholders or new leads.

Its AI features are also available to assist in spotting hot possibilities and forecasting sales. Additionally, the ability to handle team deals is beneficial to businesses that involve collaboration among vendors. brokers, and sales teams.

Because Freshsales has comprehensive sales tools but isn’t created primarily for insurance companies, users like the extensive system flexibility it provides.

Insurance companies have certain sales processes, such as underwriting or sending applications to carriers, that necessitate the collection of particular pipeline stages and contact information.

This CRM system allows you to modify modules, data fields, funnels, and sales activities, even on the most basic subscriptions.

Key Features:

- Freddy AI – Freddy AI is an artificial intelligence assistant that helps you identify hot opportunities and forecast sales.

- Team Deals – The ability to handle team deals is beneficial to businesses that involve collaboration among vendors, brokers, and sales teams.

- Phone -The built-in phone may be used to place, receive, and track phone conversations with policyholders or new leads.

Pricing:

$15 per user per month

Pros:

- Very customizable

- Comes with the phone system

- AI-powered

Cons:

- Limited project management tools

4. Insureio — Best for Operations Management

Insureio is a CRM system for insurance firms that helps them sell their brand, handle prospects, and assist their present customers. The numerous modules may be used to handle everything related to sales, from handling leads to issuing policies and managing the claims process.

Insureio is our recommendation for the finest CRM for insurance agents to manage operations because of its client service features that are specifically designed to meet insurance demands.

Users may maintain policies, arrange key documents, and respond to case ticket requests. Through interfaces with over 30 different carrier quote systems, you can even apply for and distribute new insurance online from inside the CRM.

Key Features:

- Recruitment – Insureio’s powerful best recruitment CRM software tool automates the process of finding and hiring new insurance agents. It includes a customizable online application form, automatic email notifications to potential candidates, and an easy-to-use interface for reviewing applications.

- Policy Management – Insureio makes it easy to manage your policies with a variety of tools, including electronic signatures, policy tracking, and automatic renewal reminders.

- Customer Relationship Management – Insureio’s CRM module helps you keep track of your customers’ contact information, insurance policies, and claims history. You can also use the CRM module to send out automated marketing campaigns.

Pricing:

$25 per month

Pros:

- Industry-specific

- Ease of Use

- Best for agencies

Cons:

- No mobile app

5. Less Annoying CRM — Best for Ease Of Use

Less Annoying CRM was created to be a basic, user-friendly software that gives a hassle-free experience.

It is inexpensive and simple to use. Task, event, contact, and lead management, as well as basic collaboration functions for working with other users, are all included in this package.

Insurance companies are frequently content with their current software solutions for managing insureds, policies, and assessment procedures, and all they need is a simple mechanism to track sales.

Less Annoying CRM is the perfect platform for quickly modifying data fields and modules, as well as tracking sales prospects. Everything in this CRM is straightforward, even the approach to single-subscription options.

Key Features:

- Contact and Lead Management: Keep track of all your leads in one place and easily convert them into contacts.

- Pipeline Task Management: Easily create and manage tasks for yourself or your team.

- Event Management: Create and manage events, invite attendees, and track who’s coming.

Pricing:

$15 per user per month

Pros:

- Easy to navigate UI

- Straightforward pricing

- Very customizable

Cons:

- No AI capabilities

6. Radiusbob — Best for Call Centers

Radius is designed primarily for insurance agencies, and it integrates with insurance productivity systems such as AgentMethods, Applied Systems, and Vertafore.

One of the benefits of using Radius is that it can help agencies manage their customer relationships more effectively. It enables them to keep track of all customer interactions, whether these are phone calls, emails, or chats.

There’s also a wide range of marketing options for sending out email, SMS, and direct mail campaigns automatically.

Radius users can add a native voice-over-internet-protocol (VoIP) solution to their regular CRM package.

They may place and receive calls, log or record their chats, and create interactive voice response (IVR) that employs a bot to give menu navigation choices with this premium package. Calls can also be made straight from a lead or customer record using click-to-call.

Key Features:

- VOIP Native Software – Agency owners can make and receive calls, log or record chats, and create IVRs with a bot to give menu navigation choices. Calls can also be made straight from a lead or customer record using click-to-call.

- Insurance Productivity Systems Integration – Radius integrates with insurance productivity systems such as AgentMethods, Applied Systems, and Vertafore.

- Marketing Automation – Radius offers a wide range of marketing options for sending out email, SMS, and direct mail campaigns automatically.

Pricing:

$34 per user per month

Pros:

- License tracking

- Agent scoring

- Customer 360 view

- Fraud detection

Cons:

- Pricey

7. Velocify — Best for Streamlining Sales Process

For streamlining the sales process and maximizing insurance sales, CRM Velocify is the numero uno choice. It automates activities and provides opportunities for agents to sell more products.

Velocify integrates with other software to make it more efficient and improve customer service. The system also offers a customizable interface, so you can work the way you want to.

The insurance CRM offered by Velocify is definitely worth taking a closer look at. It is packed with features that are designed to help you optimize your sales process and increase your sales productivity.

First of all, the Velocify insurance CRM can help you quickly and easily identify your most promising leads. It also enables you to effectively manage your sales pipeline, so you can track your progress and ensure that all of your leads are being properly followed up on.

Additionally, the Velocify insurance CRM makes it easy to create custom workflows that will help you accelerate the sales process.

Key Features:

- Contact management – The Velocify insurance CRM enables you to easily manage your contacts, including important contact information and past interactions. This makes it easy to track your progress with each lead and ensures that you are providing the best possible service.

- Lead scoring – The Velocify insurance CRM also includes a powerful lead scoring system that can help you quickly identify your most promising leads. This makes it easy to focus your efforts on the leads that are most likely to convert into sales.

- Pipeline management – The Velocify insurance CRM also enables you to effectively manage your sales pipeline, so you can track your progress and ensure that all of your leads are being properly followed up on.

Pricing:

$60 per user per month

Pros:

- Intuitive interface

- Great for agencies

- A powerful lead-scoring system

Cons:

- Can be expensive

8. Salesforce — Best for Generating Leads

Another popular CRM that would be ideal for an insurance firm or a single insurance agent is Salesforce. This platform has a lot of valuable capabilities, but some of them can be a little tough to use, especially if you’ve never used software like this before.

Salesforce is a comprehensive CRM that covers everything from sales and marketing to customer service and support. It’s a cloud-based platform that can be accessed from any device with an internet connection, making it perfect for busy insurance professionals on the go.

One of Salesforce’s best features is its ability to track customer interactions across all channels, including email, social media, and phone calls. This gives agents a complete view of each customer’s history and allows them to provide better service by anticipating needs and addressing any concerns.

Salesforce also offers a wide range of templates and tools that can be used to create custom workflows, track leads, and create reports. And because it’s such a popular CRM, there are plenty of online resources and support forums available to help you get the most out of the platform.

Key Features:

- Pipeline Management – Keep track of opportunities and deals at all stages of the sales process.

- Sales Automation – Trigger actions based on predefined conditions and increase your sales efficiency.

- Customer Service and Support – Provide world-class customer service with a 360-degree view of each customer.

Pricing:

Essential Plans start at $25 per month

Pros:

- Robust features

- Lead management tools

- Social media integration

Cons:

- Steep learning curve

9. Pipedrive — Best for Account Management

Pipedrive is a CRM that your insurance firm may use. Pipedrive is a CRM application that also serves as an account management tool. It will help you with the entire sales process as well as marketing campaigns. It is also very customizable, so it can be tailored to your specific needs.

It is stated on its website that it will increase by 38% of your insurance sales. It is also a very affordable CRM, with different pricing options for small and large businesses.

The Pipedrive CRM has many features that can be helpful to your insurance firm. One of these features is the lead management tool. This tool will help you keep track of all of your leads, from the moment they are generated to the moment they become customers.

You can also track how much progress you are making with each lead, and decide which leads are worth pursuing further.

Key Features:

- Progress Tracker – Keep track of your leads and see at a glance which ones are closest to becoming customers

- Precision Forecasting – Know how much business you can expect in the future and plan your campaigns accordingly

- Activity-Based Planner – Plan your workday by the hour and see how much you can achieve in a day

Pricing:

$12.50 per user per month

Pros:

- Productivity booster

- Offers mobile app

- Very affordable

- Can set up alerts and reminders

Cons:

- No campaign planner

10. AgencyBloc — Best for Commissions

AgencyBloc was created with the needs of life and health insurance agencies in mind. It’s the most popular insurance agency administration system, and it includes a CRM. AgencyBloc is jam-packed with insurance-specific features, including a commissions calculator.

Aside from the calculator, this CRM is great for commissions because it offers a variety of ways to view and filter information. You can view it by agent, product, state, or company. This makes it easy to find the right information and make accurate payments.

This CRM also helps with customer service. You can track interactions with customers and even see a timeline of all the interactions. This makes it easy to find information and resolve any customer service issues.

Overall, AgencyBloc is a great CRM for insurance agencies. It includes all the features you need to manage your agency and provide great customer service.

Key Features:

- Contact Management – AgencyBloc’s CRM allows you to keep track of all your customer interactions. You can see a timeline of all the interactions, making it easy to find information and resolve any customer service issues.

- Filtering Options – With AgencyBloc’s CRM, you can filter information by agent, product, state, and company. This makes it easy to find the right information and make accurate payments.

- Commission Calculator – AgencyBloc’s CRM includes a commission calculator that helps you calculate commissions accurately.

Pricing:

$65 per user per month

Pros:

- Jam-packed with insurance-specific features

- Excellent reporting and analytics

- Helps with customer service

Cons:

- Pricey

What Does an Insurance Agency CRM Software Do?

CRM software for insurance agencies isn’t just ornamental; in fact, it’s one of the most important tools an insurance agency can use to increase productivity and efficiency.

These tools help agencies keep track of customer interactions, including potential leads and current customers, as well as past interactions. This enables agencies to provide better customer service by quickly locating and referencing relevant information about customers or prospects.

Furthermore, CRM software can also automate many of the processes an insurance agency uses to interact with customers, such as sending email campaigns or processing payments. Automation saves time and allows employees to focus on more important tasks.

While customer relationships can be managed manually — and indeed, they were managed this way for many years before CRM software was invented — this process is often time-consuming, difficult to scale, and error-prone. By contrast, a good CRM system can make managing customer relationships much easier and more efficient.

What Are the Advantages of Using An Insurance Agency CRM Software?

As mentioned in the previous section, there are many advantages to using CRM software for your insurance agency. Let’s take a closer look at some of the top benefits:

Increased Productivity and Efficiency

When your agency is using CRM software, all of your customer data is stored in one place. An arrangement like this makes it easy for agents to quickly find the information they need, whether it’s contact details, policy information, or claims history.

With everything at their fingertips, agents can spend less time searching for data and more time serving customers. This increased efficiency can result in a better customer experience and, ultimately, more sales.

Better Customer Insights

A good CRM software should offer features that give you a better understanding of your customers. For example, you may be able to see a customer’s complete purchase history, as well as their interactions with your agency.

Such information can help you identify opportunities for upselling and cross-selling, as well as identify potential problem areas. Armed with this knowledge, you can take steps to improve your customer relationships and increase your agency’s profitability.

Improved Customer Service

Good customer service is key to retaining customers and building long-term relationships. A good CRM software can help you deliver excellent customer service by providing features such as:

All of these features can help you automate tasks and processes, making it easier to provide fast and efficient service. This, in turn, can help you build a loyal customer base. Finally, another advantage of using CRM software is that it can help you reduce costs. This is because good CRM software will automate many tasks, such as customer service and lead tracking. This automation can help your agency to run more efficiently, saving you time and money in the process. You’ll also be able to reduce your reliance on external contractors, which can save you even more money. If you are running an insurance agency, the last thing you want is to miss out on converting leads due to a lack of organization. CRM software can help you manage your leads and customer data, so you can focus on closing more sales. From the ten top CRM software for insurance agencies listed above, we’ve picked HubSpot CRM as the best overall CRM software for insurance agencies in 2025. It’s easy to use, affordable, and packed with features that will help you manage your leads and customers more effectively.

Salesforce - World's #1 CRM Software

Reduced Costs

Conclusion — What’s the Best Insurance Agency CRM Software?