In 2022, most payroll services offer an all-in-one service with complete HR services, tax services, and more. Because of this, there aren’t many that solely focus on payroll. However, Square Payroll is a dedicated payroll service with fair pricing, making it a fantastic option for a small business.

Read our review for information on all of Square Payroll’s features and more to see if it’s right for your business!

The Low-down

What Is The Software? Square Payroll

How much does it cost? Starts at $29/month

Cons

Would We Recommend It? We recommend it for small businesses and businesses that only add contractors to a payroll service.

How does Square Payroll Score?

| Category | Our score |

| Features | ⭐⭐⭐⭐⭐ |

| User Experience | ⭐⭐⭐⭐⭐ |

| Customer Service | ⭐⭐⭐⭐ |

| Pricing | ⭐⭐⭐⭐ |

| Overall | ⭐⭐⭐⭐ |

What Is Square Payroll?

Square Inc. (now Block. Inc) is a substantial financial services company that offers many different financial products to businesses and individuals. Despite starting in 2009, it has already grown hugely with a current revenue of $9.49 billion (as of 2020), which is very impressive. It also has almost 5500 employees as of 2020.

Square offers many products to its customers. There’s Cash App, devices like the Square Reader, and many financial services like Square POS, Square Market, Square Capital, Square Team App, and Square Payroll.

Beginning in 2015, Square Payroll manages a business’s payroll, taxes, and other handlings. It is currently available in all 50 U.S. states and Washington DC.

Square Payroll Summary

Our Square Payroll review covers all of the features it can provide, the user experience, customer service options, pricing options, and who should get it!

The primary features include:

- Integrations with other software, including other Square products and different software like Quickbooks

- Tax filing services

- Time tracking services

- Team management services

- Workers comp insurance

- Multiple payment methods, including direct deposit and Cash App

- Benefits packages like health and retirement

- You can access all of the features on the mobile app and the online software

- It has a flat pricing structure, so you pay one subscription fee per month, plus a set price per employee/ contractor per month

Square Payroll features ⭐⭐⭐⭐⭐

To cover all of the available features, we have split the features between the Pay Employees and Contractors tier and the Pay Contractors Only tier. We’ll also cover all of the features available on the mobile app.

Pay Employees And Contractors Features

This is the main payment tier and includes all of Square Payroll’s major features. These features include:

- It has a full-service payroll system that includes payroll processing, tax filing, check printing, and direct deposits.

- The main pricing tier covers both employees and contractors. The price is $35 per month, plus $5 per employee or contractor per month.

- There are many automated payroll services in the Square Payroll software, including payroll tax calculations.

- Multiple payment options include Cash App (another Square product), checks, and direct deposits to a credit or debit card. All of these payment options are free of extra charges.

- A live chat support assistant is available when you first create an account.

- The software allows users to import timecards from other apps and software like Square POS or the Square Team app. These timecards update automatically. You can also upload timecard data from third-party software.

- The software also lets you track commissions and import them.

- The software can complete W-2, W-4, and 1099-NEC forms.

- A U.S. customer support system is in place, with a customer support phone number and email. These options are available Monday to Friday, between 6 am and 6 pm PT.

- There is no cap on the number of pay runs a business can conduct.

- If you run a seasonal business (e.g., Christmas products), you don’t have to pay for the service during inactivity in certain seasons.

There are also no additional fees to pay for the software; the base price of $35 is all you need to pay (plus the $5 per user per month). Also, because this is a monthly subscription, you can cancel at any time with no charges or penalties.

Pay Contractors Only Features

There’s also a pricing tier where you only pay the fee per contractor and avoid paying the full monthly subscription. A few features are missing in this tier, such as the inability to process W-4 forms, but most of the features are still available.

The main features of this tier include:

- All of the main payroll features are included, such as payroll processing, tax filing, etc.

- The software can complete W-2 and 1099-NEC forms for contractors. However, the tier won’t accept W-4 forms.

- There is a U.S. customer support system for contractors or employers, with a customer support phone number and email. These options are available Monday to Friday, between 6 am and 6 pm PT.

- Multiple payment options include Cash App (another Square product), checks, and direct deposits to a credit or debit card. All of these payment options are free of extra charges.

- If you run a seasonal business (e.g., Christmas products), you don’t have to pay for the service during inactivity in certain seasons because you only pay the fee per contractor per month. So if the contractor isn’t working because of the season, they don’t need the service.

Additionally, there are no additional fees to pay for the Contractor Only tier; the price of $5 per contractor per month is all you need to pay. Also, businesses can cancel the contractor tier payments with no charges or penalties.

Square Payroll Mobile App

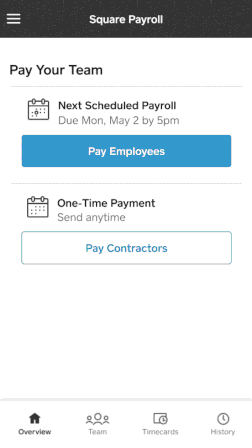

A prominent feature that both pricing tiers offer is the mobile app. The app is available on up-to-date Apple and Android devices.

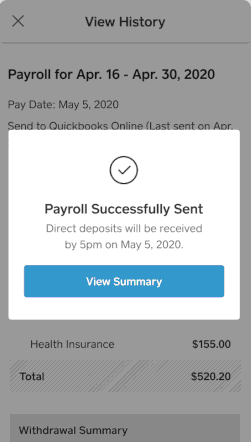

The app will offer you similar features to the main software, with payroll, time cards, reports, and more available to view. However, because of the drastic change in hardware, a couple of features are missing, such as a page linking to previous payrolls and the graph displaying labor costs.

The app also enables employers to pay employees and contractors on the same page.

Other features available on the app include clocking in and out on a timecard, filing taxes, viewing pay stubs, and more.

The app also integrates with other Square apps like the Square scheduling app and third-party apps like the Galileo health insurance app. You can also directly integrate Square Payroll with Cash App so that you can send your payroll funds straight into your Cash App account.

Square Payroll user experience ⭐⭐⭐⭐⭐

The user interface for this software is more cluttered and less professional-looking than some of its competitors, but it does display all of the information you need to see on the home page. It takes a function over flair approach.

On the main employer home page, you will find various information boxes, including deposits, gross sales, payment methods, customer visits, invoices, and top items by sales.

On the left-hand side of the Square software screen will be all of the available tabs, such as Home, Sales, Items, Employees, Customers, Appointments, Capital, Invoices, Virtual Terminal, Loyalty, Marketing, Online Store, Payroll, Timecards, and Apps.

Square could streamline the main software layout, but it’s simple enough for users to access everything they need.

The mobile app streamlines and simplifies the online payroll software. It includes every primary employee self-service function you could want from the online software, including payroll features, payroll tax services, time card viewing, and more.

There are, unfortunately, a couple of features missing, such as linking to previous payrolls and the labor cost graph.

Square Payroll customer service ⭐⭐⭐⭐

While some customer support options are available for this software, there are significantly fewer than some competitors.

If you need help setting up your account, a live chat support assistant is available when you first create it. The live chat function can help with registration, setup, and installation process questions.

There is a U.S. customer support system for contractors or employers, with a customer support phone number and an email address. These options are available Monday to Friday, between 6 am and 6 pm PT.

There are also various customer support pages on the website, covering fees and pricing, transfers, tax forms, and more.

Square Payroll pricing ⭐⭐⭐⭐

Unlike many other popular services, Square Payroll’s pricing structure is straightforward. It consists of two tiers, with only one having a fixed monthly subscription.

The two pricing tiers on offer are:

- Pay Employees And Contractors tier: If you have both employees and contractors who you need to pay, you need to get this tier. There is a flat $35 monthly fee, plus $5 per employee or contractor per month. There are no extra fees for this tier, and you can cancel at any time.

- Pay Contractors Only tier: Square Payroll gives you that option if you only need to pay contractors. You don’t need to pay the $35 monthly subscription fee for this tier; you only need to pay the $5 per contractor per month. Many other competitors simply don’t offer this service; it is a standout feature.

Square aims both of these tiers at smaller businesses. The main difference between the two pricing tiers is that one will allow employees and contractors to access the software, and one will only allow contractors.

The main subscription tier can process W-4 forms, but the Contractor Only tier can’t, so you should get the main subscription if you need to process these tax forms.

Who Should Get Square Payroll?

Square Payroll is primarily for small business payroll needs; its pricing and features aim mainly at smaller companies with simple payroll needs. It doesn’t offer further pricing tiers for scaling, so larger companies should look elsewhere. Square Payroll is also perfect for businesses that only need to pay contractors, as there’s a pricing tier for contractors only without the monthly subscription fee.

The Wrap-up

What Is The Software? Square Payroll

How much does it cost? Starts at $29/month

Pros

Cons

Would We Recommend It? We recommend it for small businesses and businesses that only add contractors to a payroll service.