Managing a property is not restricted to finding the most cooperative tenants who agree to pay the best rates. You have to shoulder multiple responsibilities that tag along with rental property ownership.

From managing your tenant details and drawing up contract terms to timely collecting rent, there’s a lot to do that would be impossible to accomplish without an accountant.

But it makes little sense to hire an accountant when you can get a more comprehensive, skilled, and most importantly, error-free accounting software that does all the work for you much more efficiently, quickly, and at a much lower price.

Today, we will share the best landlord accounting software for managing property rents and revenue like a pro. We have picked these tools based on their features, pricing, advantages, customer support, etc., so make sure you read this article until the end.

Our Top Pick for the Best Landlord Accounting Software: FreshBooks

It’s hard to look past FreshBooks as far as the best landlord accounting software is concerned.

Here are the standout features of FreshBooks:

The Best Landlord Accounting Software 2025

Here is a list of the best accounting software for landlords with their most notable features:

- FreshBooks: The best landlord accounting software product overall, with a huge range of features, including automating recurring payments and expense tracking.

- Zoho: Popular pick that can handle bank reconciliation, core accounting, and invoice management and that has a vast capacity for integrations.

- Sage Accounting: Award-winning cloud accounting software that’s easy to use and is ideal for landlords, small business owners, and solopreneurs.

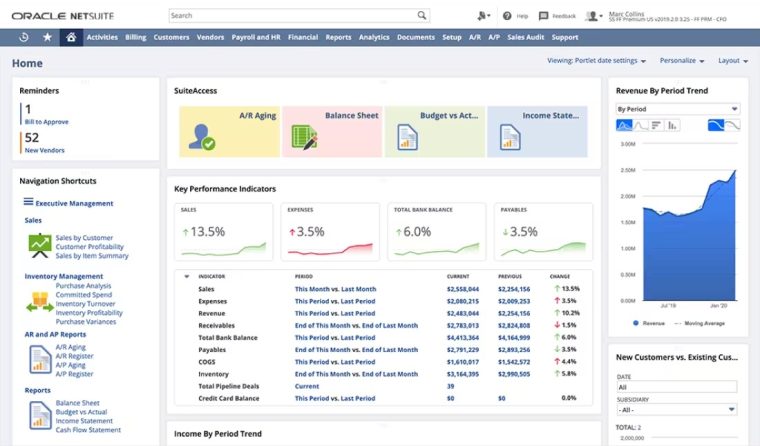

- Oracle Netsuite – First-rate accounting package that comes with huge potential for extension and powerful automation tools. Great option for landlords with large numbers of properties.

- Xero: An option that provides all the tools landlords, independent accountants, and bookkeepers would need, with automatic bank feeds removing the need for manual data entry.

- Free Agent: Affordable accounting product for small business users that’s great for financial reporting, tracking expenses, and generating invoices.

- Tax Slayer: Intuitive software to help individuals put together tax returns for themselves, with a useful mobile app and a free version available.

- Turbo Tax: Exceptional tax software that comes with the option of having rental experts assist you with your tax return or for the Turbo Tax team to complete your return on your behalf.

- Hemlane: Property management tool with great rent and finance management features, which automates tedious tasks like late fee collection, bank verification, and expense tracking.

- Tenant Cloud: Comprehensive rental management software tool, with an excellent automated invoicing feature, that helps you to get rent in on time and maximize your revenue.

- Rent Manager: Property management software product with extensive accounting features, including finance reporting, electronic reconciliation, and expense recording.

Best Landlord Accounting Software Reviews

This is where we take a closer look at each of our top picks and pen down their best features, pricing, advantages, and even their limitations to help you gauge their suitability for your needs.

1. FreshBooks: Best Landlord Accounting Software Overall

FreshBooks has long been a well-liked accounting software for businesses of every size and type. But did you know they offer a special version just for landlords to manage their rental properties? With FreshBooks handling all the key financial tasks, you can focus more on growing your business and keeping your tenants satisfied.

As a property manager, there’s probably too much you have to look after, with your tenants calling you for every small problem. In this case, having a tool like Freshbooks that automates tedious processes can be just what your business needs. Moreover, FreshBooks is also the best small business accounting software.

Best Features

Here is what we love about Freshbooks:

- Automated Expense Tracking: Once you connect your bank account with Freshbooks, it will automatically track all your property expenses at the end of each day.

- Mobile Receipt Scanning: Keep all your receipts in one place by quickly scanning them with Freshbooks’ mobile receipt scanning feature.

- Automated Recurring Payments: Have the permission to auto-charge your tenants’ credit card each month? You can automate the payments with Freshbooks.

- Upfront Deposit: Quickly create a professional invoice for the upfront deposit and send it over to your tenants for worry-free payments.

More information about FreshBooks:

| Best For | Top Benefits | Pricing | Free Trial | Mobile App |

| Automating recurring tasks | 1. Automated expense tracking

2. Upfront deposits 3. Mobile receipt scanning |

Starting at $4.50/month | 30-day free trial | iOS & Android |

Pricing

Here are the plans offered by Freshbooks:

- Lite: $4.50/month

- Plus: $7.50/month

- Premium: $15/month

- Select: Custom pricing

Pros

- All-in-one accounting software

- Comes with a mobile app

- Automated invoicing & tracking

- Perfect for auto-charging credit cards

Cons

- Foreign language barrier in customer support

2. Zoho: Popular Product with Vast Capacity for Integrations

Zoho is a group of SaaS applications catering to various aspects of managing a business online. Its accounting software is loaded with features like bank reconciliation, core accounting, and invoice management, helping you get rents on time without lifting a finger.

The best thing about Zoho is that once you sign up for their accounting software, you can automatically access all the other 50+ Zoho apps. Along with that, its vast integration capacity helps you integrate other business apps, allowing you to centralize your workflow in one platform.

Best Features

Here is what we love about Zoho:

- Estimates: Win more tenants with professional quotes that can be converted to invoices in a click.

- Client Portal: Want to maintain 100% transparency with your tenants? Use the client portal to give them an overview of their rents and dues.

- Bank Connection: Zoho books seamlessly connects with your banks and helps you tally transactions and keep a record of all your expenses automatically.

- Online Payments: Simplify online payments by offering multiple safe and secure options to your customers through PayPal, RazorPay, 2Checkout, etc

More information about Zoho:

| Best For | Top Benefits | Pricing | Free Trial | Mobile App |

| Integration capacity | 1. Estimate-to-invoice conversion

2. Automated bank reconciliation 3. Secure online payments |

Starting at $15/month | 14-day free trial | iOS & Android |

Pricing

Here are the plans offered by Zoho:

- Standard: $15/month

- Professional: $25/month

- Premium: $35/month

Pros

- User-friendly interface

- Estimate-to-invoice converter

- Integration with 50+ Zoho Apps

- Swift & secure online payment options

Cons

- Mobile app could be more efficient for receipt processing

3. Sage Accounting: Award-Winning Cloud Accounting Software for Small Business Owners

Sage Accounting is an award-winning cloud accounting software designed for both solopreneurs and small business owners, including landlords. The best thing about Sage is its user-centric approach. Every feature and element here is designed keeping your convenience in mind.

To help new businesses get started, Sage also offers the first two months of service free of cost, after which you can continue to use its services for a very reasonable amount. It also finds a place on the list of the

.

Best Features

Here is what we love about Sage:

- Customizable Invoices: Want branded invoices? Sage’s invoice templates are 100% customizable, allowing you to create professional designs without working from scratch.

- Currency Exchange: If you are managing international properties, Sage’s currency converter will give you accurate exchange rates and adjustments, so you spend less time in calculations and more time renting properties.

- Recurring Invoices: Get rid of the burden of creating the same invoices every month when you can set up automated recurring invoices for long-term tenants.

- Direct Payments: Allow your tenants to pay directly from the invoice with a click; use Invoice Payments powered by Stripe.

More information about Sage Accounting:

| Best For | Top Benefits | Pricing | Free Trial | Mobile App |

| Recurring invoices | 1. Customizable invoices

2. Currency exchange 3. Direct payments |

Starting at £12/month | 30-day free trial | iOS & Android |

Pricing

Here are the plans offered by Sage:

- Start: £12/month

- Accounting: £26/month

- Plus: £33/month

Pros

- First 2 months free

- Award-winning service

- Professional invoices

- Easier payments from tenants

Cons

- Too complicated to set up

4. Oracle NetSuite: Great Option for Landlords with Lots of Properties to Manage

Oracle NetSuite is a leading business package that provides a comprehensive set of tools for accounting and finance. The product comes with an easy-to-use dashboard, which allows you to get a real-time overview of your accounts with all the detail you need just a click away.

The software makes it effortless to track financial information, reconcile statements, file taxes, and manage your payables and receivables – so you can ensure you’re compliant in every respect. There’s also a great planning and budgeting feature, which is ideal for landlords.

NetSuite also has a capable mobile app, meaning you can check in on your accounts and payments from the office or from your properties.

Best Features

Here is what we love about Oracle NetSuite:

- Automating data entry: NetSuite makes it easy to automatically enter bank transactions into the system, getting things done faster and without errors. There are also automation features on hand for managing transactions and bank reconciliations.

- Detailed reports: The platform provides detailed reports on every aspect of your accounts, so it’s easy to go from an overview to individual line items.

- Integrations: NetSuite’s accounting package is part of a modular business suite with tools for CRM, eCommerce, and much, much more. If you want to scale up your subscription, you hence have immediate access to a huge range of business software tools.

More information about Oracle NetSuite:

| Best For | Top Benefits | Pricing | Free Trial | Mobile App |

| Large-scale rental management | 1. Automating data entry

2. Detailed reports 3. Integrations |

Quote on request | Demo tour only | iOS & Android |

Pricing

Oracle doesn’t publicly share pricing information but instead offers custom quotes for every customer. Costs apparently start at $99 for the core service, with additional charges being added on the basis of the NetSuite modules selected and the number of users on the system (on top of a one-time setup fee).

Pros

- Detailed reporting features

- Robust payroll tools

- Automated data input capabilities

- Lots of templates for invoices

Cons

- Relatively expensive

- Lots to learn

5. Xero: Everything Independent Accountants and Bookkeepers Need

Xero offers a diverse range of accounting features that cater to both small businesses as well as independent accountants and bookkeepers. It also has mobile apps for both Android and iOS to let landlords manage their rents and profits on the go.

With more than 3 million users, Xero is most famous for its safe and secure transactions. Moreover, it provides every user with 24×7 live chat support regardless of the plan they have subscribed to. Its simple interface, feature diversity, and ceaseless assistance from the Xero team make it perfect for your rental business.

Not only landlords, Xero serves farmers too, making it one of the best farm accounting software in the world.

Best Features

Here is what we love about Xero:

- Automatic Bank Feeds: No more manually uploading your bank transactions. Xero will draw your bank feed automatically and keep track of your finances.

- Direct Payments from Invoice: Add a “Pay Now” button to your invoices for faster payments. Easy payments will undoubtedly make your tenants happier.

- Multiple Payment Options: Don’t limit your tenant’s payment options if you want to get your rent on time. From debit and credit cards to Stripe & GoCardless, Xero accepts multiple payment options.

- Paperless Expense Tracking: Want to keep all your receipts for the tax season? Don’t let piles of bills take up space. Switch to digitally scanned copies of your receipts instead.

More information about Xero:

| Best For | Top Benefits | Pricing | Free Trial | Mobile App |

| Automatic bank feeds | 1. Multiple payment options

2. Direct payments from invoice 3. Paperless expense tracking |

Starting at $22/month | 30-day free trial | iOS & Android |

Pricing

Here are the plans offered by Xero:

- Starter: $22/month

- Standard: $35/month

- Premium: $47/month

Pros

- Multiple payment options

- Secure bank connections

- Digital receipt scanning

- Expense tracking on the go

Cons

- Multiple currencies are only supported in expensive plans

6. Free Agent: Affordable Accounting Product for Small Business Users

If you are looking for the cheapest accounting software for your new rental property business, try Free Agent. The plans are affordable and yet provide all the accounting features you could possibly want from a landlord accounting software.

Free Agent has been developed keeping in mind the needs of accountants, freelancers, and even small business owners and currently has more than 100,000 active users.

Best Features

Here is what we love about Free Agent:

- Cash Flow Dashboard: Free Agent offers an informative dashboard highlighting all your transactions in one place.

- Comprehensive View: With a comprehensive view of your transactions, expenses, and revenue, Free Agent helps you design better rental strategies.

- Estimate Template: Don’t waste your time creating estimates for individual clients from scratch. With professional estimate templates, send over your quote in a minute.

- Secure Connection: Free Agent is extremely sincere about its users’ data privacy. Distributed data centers ensure protection from localized failures. On top of that, premium encryptions and automated vulnerability detection keep your digital data secure.

More information about Free Agent:

| Best For | Top Benefits | Pricing | Free Trial | Mobile App |

| Affordable plans | 1. Cash flow dashboard

2. Comprehensive finance view 3. Secure connections |

Starting at $10/month | 30-day free trial | iOS & Android |

Pricing

Free Agent has universal pricing of $10/month for the first 6 months, which increases to $20/month from the 7th month.

Pros

- Instant bank connection

- Informative dashboard

- Uncompromisable data security

- Professional templates for invoices & estimates

Cons

- Buggy mobile apps

7. Tax Slayer: Great for Filing Accurate Tax Returns

Rental accounting is more than just managing your rents and tracking expenses. Like any other business, the most challenging part of the rental business comes during the tax season. Without a skilled accountant, your business might run into several tax-related issues, but you don’t need to worry about that with Tax Slayer.

Best known for its unparalleled customer support, Tax Slayer helps you file your taxes on time and get the best return. Everything you need to sail through the tax seasons is available at TaxSlayer.

Best Features

Here is what we love about Tax Slayer:

- Accuracy: Tax Slayer guarantees 100% accurate numbers. In case you get a penalty, they will cover it.

- Fastest Refunds: Tax Slayer is one of the few apps that guarantees the fastest tax refunds.

- Guaranteed Returns: With their expertise, you are sure to get the maximum refund on your tax. If not, they will refund you the remaining amount from their pocket.

- No Upfront Payment: Don’t have the funds for upfront payment? No problem. You can choose to have their fees deducted from your refund instead, thanks to TaxSlayer.

More information about TaxSlayer:

| Best For | Top Benefits | Pricing | Free Trial | Mobile App |

| Fastest refunds | 1. Fastest refunds

2. Guaranteed returns 3. No upfront payment |

Starting at $29.95 | Free demo | iOS & Android |

Pricing

Here are the plans offered by Tax Slayer:

- A free forever plan

- Classic: $29.95

- Premium: $49.95

- Self-employed: $59.95

Pros

- Generous free plan

- No upfront payment

- Incredible customer support

- Maximum refund guaranteed

Cons

- Services limited to taxing alone/li>

8. Turbo Tax: Exceptional Tax Software with Experts On-Hand

Turbo Tax is an exceptional tax software with features difficult to match for any other tax software. It offers three types of plans — you can do your own taxes, have an expert help you file the tax, or simply let the Turbo Tax team handle it all.

Turbo Tax has a massive team of tax experts with skills in multiple industries. Once you communicate your needs, they will get you a taxing expert with a specialization in rental properties.

Best Features

Here is what we love about Turbo Tax:

- Accurate Calculations: Turbo Tax guarantees 100% accurate tax calculations. In case anything goes wrong, they will pay your IRS penalty.

- Best Tax Deductions: Reviewing over 350 tax deductions options, Turbo Tax helps you get the best rates.

- Guided Audit: In case your tax filing requires an audit, their trained professionals will guide you through every step.

- Tax Refund: Get the best tax refunds on your rental properties in record time only with TurboTax and their vast network of tax specialists.

More information about TurboTax:

| Best For | Top Benefits | Pricing | Free Trial | Mobile App |

| Tax deductions | 1. Guided audit

2. Fast tax refund 3. Accurate calculations |

On request | NA | iOS & Android |

Pricing

All the plans are free to begin with. Share your needs to get a custom quote from the TurboTax team.

Pros

- Customizable pricing

- Guided tax audit

- 100% accurate calculations

- Instant access to tax experts

Cons

- A tad steep learning curve

9. Hemlane: Property Management Tool That’s Ideal for Automated Recurring Rent

Hemlane is a property management tool with a stellar rent and finance management feature. The best thing about Hemlane is that it automates most tedious rent management tasks like late fee collection, bank verification, and expense tracking, allowing you to focus on expanding your business.

Hemlane connects instantly with most US banks and simplifies payments for both you and your tenants with its diverse payment options.

Best Features

Here is what we love about Hemlane:

- Split Payments: With Hemlane, you can choose whether you want to take full payments or split them in half.

- Recurring Rent: Getting recurring payments is a breeze with Hemlane’s automated request for recurring rent.

- Reminders: Help your tenants pay their rent on time by sending automated reminders before their due date.

- Automated Late Fees: Send automated notice for late fees, which must be compulsorily paid before paying the rent.

More information about Hemlane:

| Best For | Top Benefits | Pricing | Free Trial | Mobile App |

| Recurring rent | 1. Split payments

2. Automated reminders 3. Automated late fees |

Starting at $30/month | 30-day free trial | iOS & Android |

Pricing

Here are the plans offered by Hemlane:

- Basic: $30/month

- Essential: $40/month

- Complete: $60/month

Pros

- Automated rent management

- Compatible with most US banks

- Comprehensive property management

- Reminders for tenants for upcoming payments

Cons

- The UX for rental payments lacks clarity

10. Tenant Cloud: Comprehensive Rental Tool, Recommended for Automated Invoicing

Tenant Cloud is another comprehensive rental management software tool to boost your property business. From listing your properties in the hottest markets to helping you get rents on time and maximize your revenue, Tenant Cloud does it all.

Along with regular rent and finance management, it also helps your taxes and property lease statements. If you want to grow your business worry-free, Tenant Cloud is the way to go.

Best Features

Here is what we love about Tenant Cloud, the best free landlord accounting software:

- Automated Invoicing: Ditch the burden of sending invoices every month to long-term tenants with Tenant Cloud’s automated invoicing feature.

- Partial Payments: Want to help your tenants pay rent? Tenant Cloud will allow them to split their rent and send partial payments at fixed intervals.

- Online Payments: Get paid 2x faster with Tenant Cloud’s swift and secure online payment options.

- Late Fees Request: Automatically request late fees and make it compulsory for your tenants to clear them before they can pay the rent.

More information about Tenant Cloud:

| Best For | Top Benefits | Pricing | Free Trial | Mobile App |

| Automated invoicing | 1. Automated invoicing

2. Partial payments 3. Late fees request |

Starting at $12/month | Free plan | iOS & Android |

Pricing

Here are the plans offered by Tenant Cloud:

- A free forever plan

- Starter: $12/month

- Growth: $40/month

- Business: Custom pricing

Pros

- Free plan for beginners

- Tax file preparation

- Secure online payment options

- Automated invoicing for recurring payments

Cons

- Limited integration opportunity

11. Rent Manager: Property Management Software That’s Great for Finance Reporting

Rent Manager is one of the few property management software product that offers extensive accounting features. Along with faster payments and seamless bank reconciliation, it helps you nail your taxes and keep better track of your own expenses.

You can also deposit funds within Rent Manager and link them to the right property and bank account in a jiffy.

Best Features

Here is what we love about Rent Manager:

- Finance Reporting: Get an overview of all your transactions and see how well your properties are performing with a comprehensive finance report every month.

- Electronic Reconciliation: Automatically draw all your bank transaction data to your Rent Manager account and verify the payments through electronic reconciliation.

- Transaction Ledger for Receivables: Rent Manager lets you record all your expenses on your contact’s transaction ledger for accurate income reporting.

- Charge Types: Create multiple charge types to track the revenue generated on each of your properties or service types.

More information about Rent Manager:

| Best For | Top Benefits | Pricing | Free Trial | Mobile App |

| Finance reporting | 1. Finance reporting

2. Charge types 3. Electronic reconciliation |

Starting at $1/user/unit/month | Free demo | iOS & Android |

Pricing

Here are the plans offered by Rent Manager:

- Basic: $1/user/unit/month (Implementation package is 2x monthly fee)

- Plus: $1.50/user/unit/month (Implementation package is 2x monthly fee)

Pros

- Highly affordable plans

- Reliable finance reporting

- Charge types for categorized transactions

- Perfect for expense tracking and budgeting

Cons

- Could offer better training for beginners

Best Landlord Accounting Software: Comparison Table

A comparison table like the following is often the best way to draw out the most crucial differences between a bunch of tools speedily and without compromising the quality of research.

We have compared our top picks for the best landlord accounting software side-by-side across parameters like USP, pricing, the availability or non-availability of a free trial and mobile app, etc.

2. Upfront deposits 3. Mobile receipt scanning 2. Automated bank reconciliation 3. Secure online payments 2. Currency exchange 3. Direct payments 2. Detailed reports 3. Integrations 2. Direct payments from invoice 3. Paperless expense tracking 2. Comprehensive finance view 3. Secure connections 2. Guaranteed returns 3. No upfront payment 2. Fast tax refund 3. Accurate calculations 2. Automated reminders 3. Automated late fees 2. Partial payments 3. Late fees request 2. Charge types 3. Electronic reconciliation

Software

Best For

Top Benefits

Pricing

Free Trial

Mobile App

FreshBooks

Automating recurring tasks

1. Automated expense tracking

Starting at $4.50/month

30-day free trial

iOS & Android

Zoho

Integration capacity

1. Estimate-to-invoice conversion

Starting at $15/month

14-day free trial

iOS & Android

Sage

Recurring invoices

1. Customizable invoices

Starting at £12/month

30-day free trial

iOS & Android

Oracle NetSuite

Large-scale rental management

1. Automating data entry

Quote on request

Demo tour only

iOS & Android

Xero

Automatic bank feeds

1. Multiple payment options

Starting at $22/month

30-day free trial

iOS & Android

Free Agent

Affordable plans

1. Cash flow dashboard

Starting at $10/month

30-day free trial

iOS & Android

Tax Slayer

Fastest refunds

1. Fastest refunds

Starting at $29.95

Free demo

iOS & Android

Turbo Tax

Tax deductions

1. Guided audit

On request

NA

iOS & Android

Hemlane

Recurring rent

1. Split payments

Starting at $30/month

30-day free trial

iOS & Android

Tenant Cloud

Automated invoicing

1. Automated invoicing

Starting at $12/month

Free plan

iOS & Android

Rent Manager

Finance reporting

1. Finance reporting

Starting at $1/user/unit/month

Free demo

iOS & Android

Best Landlord Accounting Software Free

If you are looking for the best, all-around landlord accounting software for free, try Tenant Cloud. The biggest benefit of using Tenant Cloud is that it’s specially designed for rental properties. This means that along with rent management, you will also get access to other features like rental listings, marketing and estimate generation, etc.

Tenant Cloud has a pretty generous free plan where you get access to the following services:

- Listings

- Scheduling

- Appointments

- Screening

- Rent Payments Maintenance

Moreover, there are no time restrictions on the free plan, meaning it’s a free forever plan and not a free trial. You can use it for as long as you need.

The tool also has a commendable customer support wing that is always on its toes to help you out with any problem you might be facing.

Best Landlord Accounting Software for Mac

Want the perfect landlord accounting software for your Mac? Try Zoho. A standout feature of Zoho is that it’s a part of a group of business tools that cater to almost every aspect of managing a business.

Starting from CRM, marketing, project management, and of course, accounting, Zoho covers it all. This means you not only get access to Zoho’s accounting software but also to the other 50+ tools powered by Zoho.

Speaking of its accounting tool, it’s perfect for rental businesses of all sizes. It seamlessly connects with your bank, giving you the choice of automated bank reconciliation, meaning you don’t have to upload your transactions manually.

Along with that, it also simplifies payments for your tenants by offering multiple payment options, including cards, Stripe, GoCardless, etc. Get it on your Mac or even download it on your iPhone to work on the go.

What are the Benefits of Using Accounting Software as a Landlord?

Using property management software can make you a more effective and successful landlord.

Here are seven prominent reasons why it’s a wise investment:

Creates Perfect Financial Statements

When parties start asking for your financial statements, it’s critical to show formal rather than amateur documentation. The financial statements you share must be accurate, appropriately formatted, and delivered on time, especially when dealing with potential investors.

If they aren’t, it gives the wrong picture about your financial situation, and you risk missing out on opportunities. Accounting software generates financial statements in standardized forms available for download and sharing as requests come in.

Regularly Evaluate Your Performance

Do you wait for the end of the year to review yearly performance as a growth gauge for your rental business? If so, it’s time to modify your method of performance evaluation. Regularly checking your landlord accounting software’s dashboard will keep you up to date with your financial situation.

You must analyze your balance sheets and income statements regularly to see how well your investments are performing. It will help you find out which investments are profitable and which ones can be considered dumping.

Accounting software for real estate investors has the advantage of allowing users to quickly go over their data whenever and wherever they need to. This eliminates confusion and makes procedures simpler.

Regular Rent Payment

Late rent payments might hurt your company’s cash flow and put you under unnecessary stress. You have enough to think about managing a rental property company, so it’s an efficient approach to have your chosen accounting software lay penalties to encourage tenants to pay every dollar owed on time.

Such software automatically triggers late fines according to your particular policy. To avoid unpleasant surprises for tenants, provide information about your late fee policy in your invoice payment terms.

Accessible at Any Time and From Any Place

Most accounting programs for property management offer cloud-based storage so you can manage your finances at any time and from any location. Thanks to mobile compatibility, you may access your financial information from a desktop computer, tablet, or even a smartphone.

Since there is a chance the data could be lost or distorted, many landlords are reluctant to move to online accounting software. However, rest assured as your financial documents will be secure, courtesy of cloud storage.

Data backup and recovery are also streamlined, so you no longer need to call a professional to recover your files from a damaged device.

Streamlined Accounting

The least enjoyable aspect of being a landlord or property owner is accounting. There are many moving parts in property management, and each one needs to be considered.

Property management accounting software streamlines the accounting process. It automates recurring, mundane tasks, giving you more time to focus on the more important things.

You also get perpetual access to your records and information for your properties. This includes taxes, payments, income, debts, and more. With everything available in a centralized spot, you’ll have all the records at your fingertips.

Make Long-term Financial Savings

Property management accounting software are no longer as costly as they once were. Thanks to technological advances, top-of-the-line software like Freshbooks and Zoho are now within the arm’s reach of even small businesses and solopreneurs.

Accounting software, for instance, can assist you with daily activities that previously required hours to complete. All you have to do is enter the numbers, and the software program will organize everything. Since accounting activities are more straightforward, you won’t need to employ a bookkeeper for simple data entry activities, allowing you to make even more savings.

Expense Tracking Made Easier

Expense categories essential to rental property investments are already set up in a property accounting platform. As a result, it’s simple to arrange your income and expense data for tax preparation in a logical manner.

The specific expense categories that landlords are permitted to deduct from their rental income by the IRS are provided by the majority of property management software with accounting tools.

You can choose one of the standard categories for each transaction, making it simple to arrange your transactions. That said, you also have the liberty to create your own expense categories as per your requirements.

Effective Rental Billing and Payment Processing

A landlord accounting software enables you to manage all of your predetermined payment schedules and achieve them. Additionally, these programs send payment notifications to the tenants, ensuring prompt payments and strengthening existing business ties.

The software will also manage repetitive tasks like check writing, collections and receivables, bank reconciliations, and much more. All of this will give you a rock-solid foundation for making informed and data-driven economic decisions. You will be able to resolve issues with back-end accounting, payment processing, offshore accounting, holder tracking, financial management, and work orders much more quickly and often without any manual interference at all.

Convenience

Receiving rent payments digitally makes it straightforward for both you and your tenants. Allowing tenants to pay online will eliminate some of the need for face-to-face interactions and daily schedules, reducing the time necessary to process, accept, or deposit the payment.

Tenants may also choose direct debits, which automatically deduct money from their bank accounts when a payment is due. Although many people would object to an automatic deduction, they would nonetheless be pleased with the opportunity to make a payment without having to interact with anyone personally.

To help tenants and landlords handle any disputes over rent payments, landlord accounting software also provides payment reports and easily accessible records for all parties.

How We Evaluated the Best Landlord Accounting Software

Selecting the best landlord software is indeed challenging. In fact, the only recommended way to know if the software will serve you how you want it to is to use it on a trial basis, preferably a free demo or a free plan.

If you make the wrong choice, you can be left with a thinner pocket and a product that is ineffective for both your business and you.

The process we followed to handpick the best landlord accounting software took the guesswork out of the picture. We assessed each product on the following criteria:

Platform (Local or Cloud)

Traditionally, all landlord accounting systems are administered by a single application on your computer (PC or Mac). This means you cannot use the software on a device other than the one in which it is installed. This isn’t recommended, even if you are an individual landlord with little to no team members.

Go for a cloud-based software like the ones on our list that will allow you to access your data via mobile apps from any part of the world. All you will need is an active internet connection.

Cloud-based software comes in extremely handy if you need to update or handle administrative tasks while on the property.

Costs & Fees

When scouring for an adept landlord accounting management solution, pricing is one of the most crucial aspects to consider. It could be a fixed upfront fee or recurring monthly payments; it all depends on how many users or units you want to support. Before deciding on a property solution, you must research all hidden fees to make a well-informed purchase and to ensure you don’t exceed your predetermined budget for the software.

Technical Assistance

It’s crucial to have quick and easy access to an expert who can explain how to fix or work your way around a problem when you start using a new product. This makes it critical to ascertain whether the software package has technical support.

Also, zero in on the price of the customer service and its deliverables. While some businesses charge over $110 per hour, others are cost-free and unlimited. To save time and money, make sure your chosen landlord accounting software has a responsive customer support team that’s quick to first register and then solve your problems.

Simple to Use

An accounting system’s primary purpose is to save you time. You can manage your properties seamlessly and hassle-freely by using software that automates time-consuming and challenging tasks.

If the software is difficult to use, you will get frustrated — sooner or later — and unable to use the program to its full potential. The ideal accounting software will be easy to navigate and have an aesthetic interface.

Features

Rental accounting software can often be confusing because it’s not always clear what features it has or doesn’t have. The one that’s geared towards your line of business, meaning it’s not generic, is the one you want.

Indispensable features for a landlord include bookkeeping tools like mobile apps, online payments, and receipt capture. To track both assets and liabilities as well as revenue and expenses, the software must be a double-entry system.

Conclusion: What is the Best Landlord Accounting Software?

All the ten accounting software for landlords mentioned above are competent enough to look after and streamline your rental business. That said, you only need one!

Having carefully reviewed all the tools, we conclude that FreshBooks is the best landlord accounting software.

FreshBooks offers automated expense tracking and recurring payments, speedy invoice creation and upfront deposits, mobile receipt scanning, etc. The cherry on top is its pricing; its Lite plan starts from as low as $4.50/month, not to mention that it also offers a 30-day free trial to all new users.