Every business, big or small, needs a handle on its finances, especially when tax time comes around. Thankfully, with the best accounting and payroll software by your side, you can say goodbye to the days of spreadsheets and painful manual data entry!

But with no shortage of options, choosing the best can be tricky. In this post, we’ve rounded up (and reviewed) 13 of the best for 2025 to help you find the right fit for your needs.

The Best Accounting and Payroll Software: Our Top 13 List

Considering factors like value for money, functionality, ease of use, integration support, plus genuine customer reviews, we’re confident that these 13 are the best on the market — for various needs and budgets:

- FreshBooks — Overall, the best for various-sized businesses as its affordable and scalable plans, plus it offers effortless compliance, powerful automation, and time tracking.

- Zoho Books — The best free accounting and payroll solution for small businesses with 5 affordable, scalable plans that include timesheets, project management tools, and tax automation.

- Sage Accounting — A popular choice for small and mid-sized companies looking for incredible value for money for tools like multi-currency support, tax and audit compliance, and financial automation.

- Oracle Netsuite — The best all-in-one solution for enterprises looking for a highly flexible solution to manage their entire business — from the financials to orders, compliance, and everything in between.

- Gusto — A payroll and HR powerhouse best for businesses looking for multi-state payroll, hiring and onboarding tools, and time tracking for easy invoicing.

- Rippling — Integrated payroll, HR, and IT for companies with big ambitions, particularly to easily hire globally, manage benefits and talent, automate training, and have payroll handled in seconds.

- Crunch — A popular option for mid-sized businesses looking for dedicated expert assistance with finances, regulations, and compliance: plus, there’s a free plan for basic accounting needs.

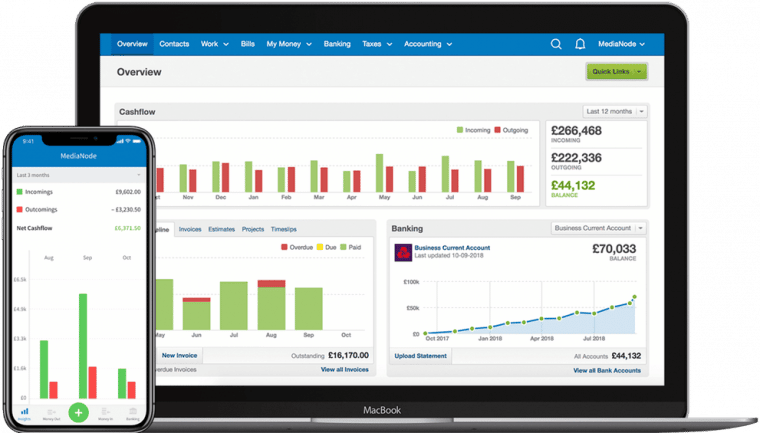

- Xero — Top choice for small firms and non-profits thanks to the 25% discount, integrated payroll, 1,000+ integrations, and tax compliance — all for just £12/month.

- QuickBooks — Premium solution with a budget price tag considering the value on offer with features like bank reconciliations, project and time tracking, and employee management.

- FreeAgent — Inexpensive project, accounting, and payroll solution that’s one of the easiest to use and offers multi-language and currency support, plus automated transactions and invoices.

- BrightPay — Desktop-specific option for accounting and payroll and a great solution for managing employee leave, payslips, and documents, but it does come at a steep price.

- ClearBooks — One of the cheapest solutions, costing just £6, especially when you consider that this includes accounting tools, plus budget and time management capabilities.

- Kashflow — Affordable tool for submitting VAT returns and managing travel expenses, orders, and invoices with support for multiple currencies. Unfortunately, payroll is a paid add-on.

Best Accounting and Payroll Software Programs: Reviewed

In the following sections, we’ve reviewed each of our top 13 picks to help you get a better understanding of how they could help your business. We’ll explain why they’ve secured a spot on our list and explore their unique features, pricing, and pros and cons.

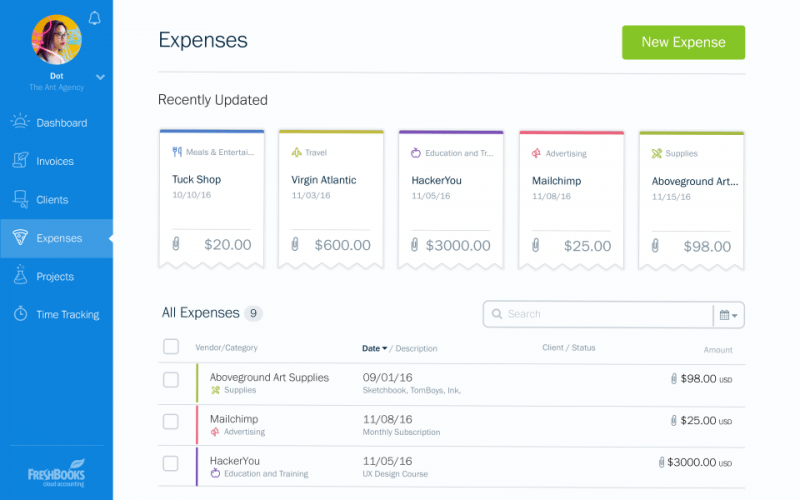

1. FreshBooks — Feature-Rich Solution and the Best Overall for Various Sized Businesses

From automatic expense and time tracking to powerful automation, inventory tracking, and practically everything else you’d be looking for in the best accounting software UK businesses could use — FreshBooks has it all.

|

Best For |

Monthly Pricing from | Annual Pricing from | Users for Starting Price | Device Support | Free Trial/Plan |

| Any-sized business | £3.30 | £95.70 | 1 | Windows, Mac, Android, iOS |

30-day free trial |

Its ease of use and superb functionality means it’s easy to see why over 30 million businesses use FreshBooks to manage their accounts and expenses.

You can even run double-entry accounting checks to ensure accuracy and compliance, plus you get over 132 apps (including Zapier) that you can seamlessly integrate with. There’s no doubt that it’s an accounting powerhouse capable of meeting even the most demanding business needs.

Special Features:

- Create professional-looking invoices

- Accept all leading payment methods and currencies

- Create expense and profit and loss reports

- View detailed invoice histories and sales tax summaries

- Receive updates on client payments

- Set up automatic receipts, late payment fees, and follow-up reminders

- Integrates seamlessly with BrightPay for payroll

Pricing:

FreshBooks offers these plans:

The Lite starter plan limits you to 5 clients, but you get automated, recurring invoices, plus unlimited time and expense tracking, making it an affordable option for small businesses.

For added client limits and functionality, you’ll want to opt for the Plus or Premium plan for 50 or unlimited clients, respectively.

Get started now — it’s free for a full 30 days — and if you opt for a paid plan, there’s a solid 30-day money-back guarantee if you find that it’s not right for you (although that’s pretty unlikely).

Pros:

- Offers incredible value for money

- Fantastic automation and security

- The platform is intuitive and user-friendly

Cons:

- Invoice templates could be more customizable

- Client limits on lower-tier plans

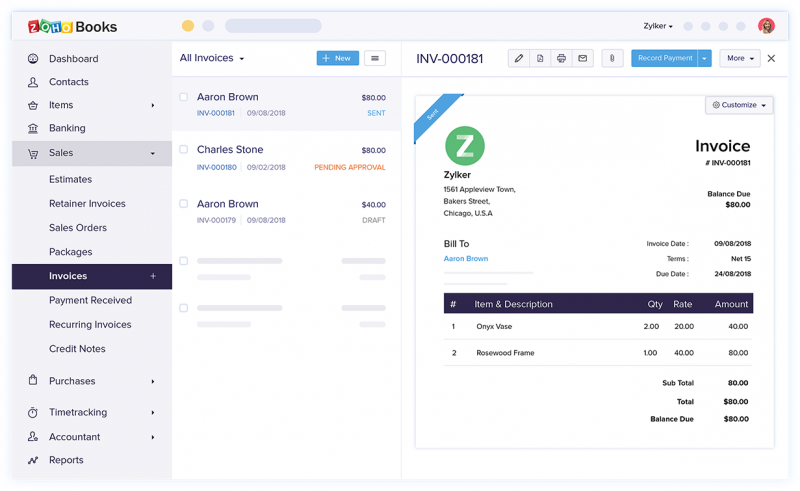

2. Zoho Books — Best Small Business Accounting and Payroll Software

While it also offers one of the best free solutions for small businesses or self-employed individuals, Zoho Books’ incredibly affordable paid plans have secured it a high spot on our list.

|

Best For |

Monthly Pricing from | Annual Pricing from | Users for Starting Price | Device Support | Free Trial/Plan |

| Small businesses | £12 | £120 | 3 | Windows, Mac, Android, iOS |

Free plan + 14-day free trial |

From offering a complete payroll management solution to double-entry accounting, team collaboration, project tracking tools, and automation capabilities, there’s no doubt that Zoho Books offers small UK businesses superb value for money.

You can automatically calculate salaries, taxes, deductions, and more, plus set up payment reminders, recurring payments, and schedule reports.

Not only do you get a client portal to improve collaboration, but you have a full suite of features to stay compliant, improve efficiency, and more.

Special Features:

- Create quotes, invoices, and purchase orders

- Manage your customer and supplier contacts

- Collaborate with clients on the portal

- Send scheduled, customized reports via email

- Upload your receipts and monitor your expenses

- Time tracking for tasks and projects

Pricing:

Besides Zoho Books’ free plan, there are a staggering 5 other paid options to choose from:

The starter plan allows for 3 users, 5,000 invoices, and features like recurring expenses, custom fields, timesheets, and billing capabilities.

You’ll want to opt for a higher-tier plan for additional users and some nifty features like recurring bills, workflow rules for powerful automation, and custom reports.

Additional users cost just £2/user/month, plus there’s a 14-day free trial on offer if you want to test Zoho Books in all its glory, completely risk-free.

Pros:

- Seamlessly integrate with other Zoho apps

- Great for contact management, invoicing, and billing

- Incredible value for money

- Affordable and user-friendly solution

Cons:

- You can’t make payments through the mobile app

- Not the most suitable for larger businesses

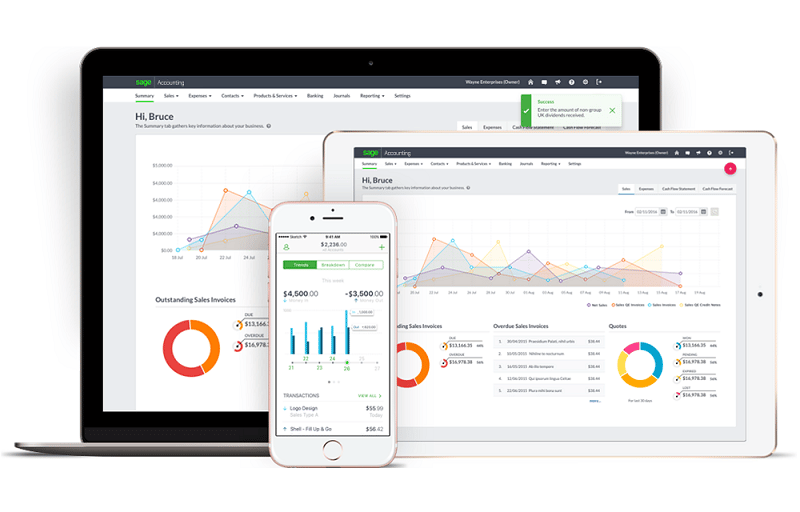

3. Sage Accounting — Popular, Robust Solution for Small and Medium-Sized Businesses

Sage Accounting for UK businesses and sole traders is a hugely popular solution and for good reason. With built-in payroll capabilities, real-time syncing with your bank accounts, multi-currency support, and even stock management — Sage delivers incredible value for money to its users.

|

Best For |

Monthly Pricing from | Annual Pricing from | Users for Starting Price | Device Support | Free Trial/Plan |

| Small and medium-sized businesses | £12 | N/A | 1 | Windows, Mac, iOS, Android |

30-day trial |

Besides the impressive suite of features covering every accounting and payroll need, HMRC also endorses Sage to help ensure you stay compliant with your tax returns and audits.

You can automatically record every transaction and even use auto-entry to capture your receipts and other documents from the mobile app. Plus, you can set different permission settings to seamlessly collaborate with your bookkeepers and accountants.

Special Features:

- Create custom invoices, quotes, and estimates

- Automate your payments, invoices, and payment reminders

- Monitor your balance sheets, profit and loss reports, cash flow forecasts, and more.

- Track time spent on clients/projects (additional add-on option)

- Integrate with 20+ external apps

- Handle recurring bills and refunds

- In-app budgeting and project tracker tools

Pricing:

Sage Accounting starts at £12/month, but at the time of writing, you can try any of the plans free for a full 30 days:

The starter plan includes core features like invoicing and bank reconciliation, but it’s limited to 1 user. The Standard plan, on the other hand, allows for unlimited users, plus you get some handy extra features.

Unfortunately, the payroll capabilities come at an additional cost, but you can test them for free in the trial.

Pros:

- Fully functional mobile apps

- Incredibly feature-rich

- Quality customer support

- A breeze to use

Cons:

- Time tracking and payroll come at an additional cost

- The web interface is a bit outdated

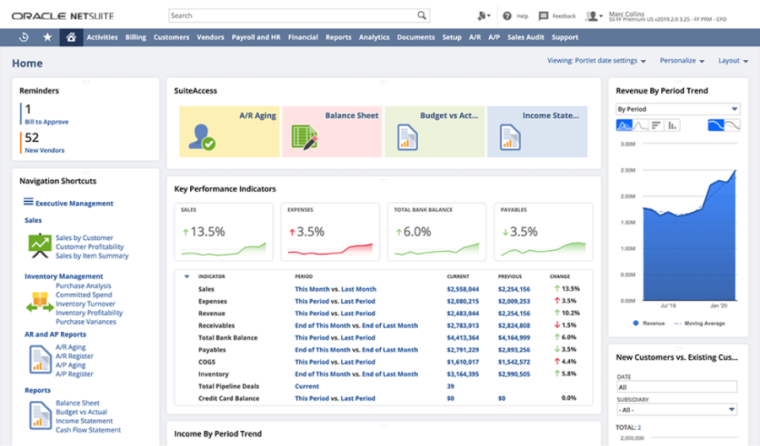

4. Oracle Netsuite — The Best All-in-One Solution for Enterprises

When it comes to accounting and payroll, Oracle Netsuite is a top choice for thousands of companies as it boasts everything you’d need, plus it includes ERP, CRM, and e-commerce capabilities – all under one roof.

As an all-in-one business management tool, this means that you can do everything from managing contracts to automating your payroll, managing your materials and orders, down to budgeting and distribution.

|

Best For |

Monthly Pricing from | Annual Pricing from | Users for Starting Price | Device Support | Free Trial/Plan |

| Large Businesses | Custom Quote | N/A | N/A | Android, iOS, Windows, Mac, Unix, Linux |

Demo + 30-day guarantee |

Beyond this, it offers powerful automation and custom processes to streamline your business, plus, as a cloud-based tool, you’ll have updated information and the means to access it all from anywhere and on any device.

And to top it off, Oracle Netsuite understands that business needs vary considerably, and as such, you’ll need a custom quote based on your specific needs.

Although this is a rarity and has its own pros and cons, however, considering the overall benefits of the product, many don’t mind this — especially as there’s a free demo on offer to give you a test drive of the tool.

Special Features:

- Real-time analytics and custom reporting

- Handle multiple legal entities and currencies

- Manage all your projects, including resources, allocation, and cost

- Cost estimation, retentions, and order management

- Stay compliant with exchange rates, currencies, and subsidiaries

Pricing:

Unlike most, Oracle Netsuite doesn’t offer pricing on its website. Instead, you’ll need to get a custom quote based on your particular needs.

This includes things such as the length of the subscription, the number of users, any add-ons, etc. That said, we’d strongly recommend exploring Netsuite by taking advantage of the free demo.

Pros:

- Oracle experts are phenomenal

- Effortless payroll, invoicing, and billing

- Clients love how it organizes data

- It’s very customizable and scalable

Cons:

- Has a learning curve

- Support can be expensive

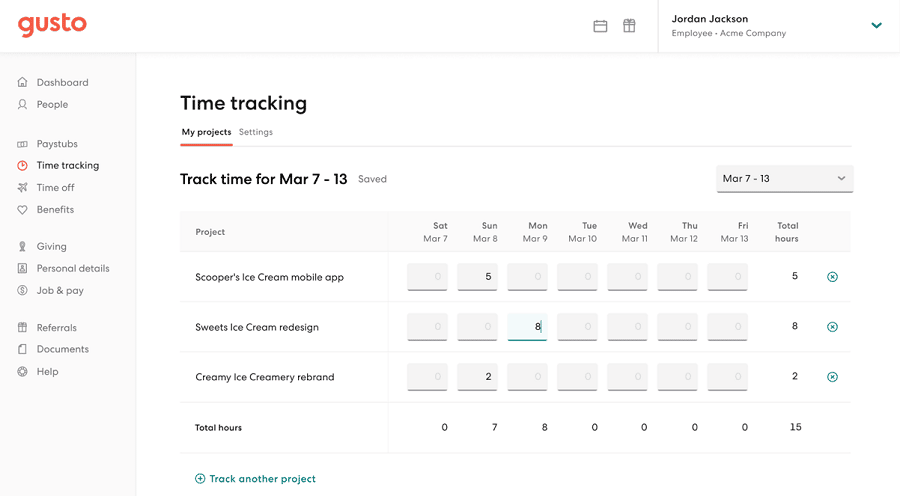

5. Gusto — A comprehensive payroll solution for US businesses

Gusto helps US businesses with payroll, time tracking, onboarding, hiring, health insurance and more, and this one-stop shop payroll and HR powerhouse can transform your business.

Gusto automatically files your taxes in all 50 US states and identifies tax credits you might have never known you qualified for — which could mean big savings for US SMEs.

These smart payroll systems are linked to easy-to-use time tracking tools, with Gusto making sure that every hour worked is properly paid. Payroll, though, is just the start.

Gusto can help you hire top talent, offer a range of health and financial benefits, set clear growth plans with regular feedback structures, and even give you access to HR experts so you can make important business decisions with confidence.

In short, Gusto helps you run a smarter, better business — and could cost you as little as $46 per month. Check out its free public demo today!

Special Features:

- Automatically files your taxes in all 50 states

- Identifies tax credits that can save your business money

- Easy-to-use time-tracking tools

- Hiring support

- Employee benefit systems

- Access to HR experts

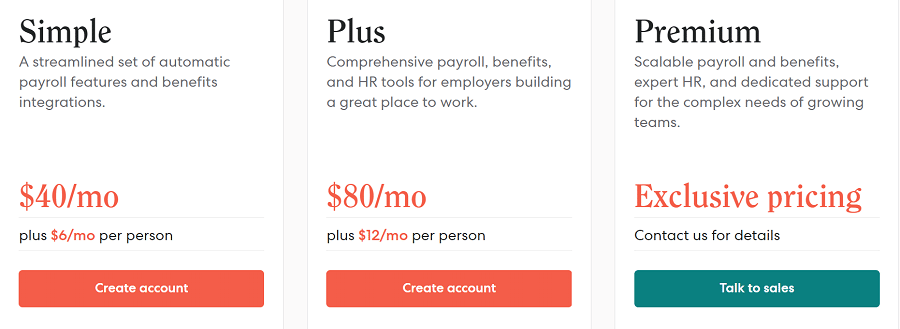

Pricing:

The Simple plan is designed for small US businesses — you get unlimited single-state payroll, automatic tax filing, basic hiring and onboarding tools, Gusto-brokered health insurance administration, and employee financial benefits.

The Plus plan adds full-service multi-state payroll, next-day direct deposit, advanced hiring and onboarding tools, time tracking and extended live support hours. Finally, the Premium plan offers a comprehensive range of tools and bespoke pricing to suit your business.

Pros:

- A huge range of services

- Automatically files your taxes in all 50 US states

- Help with health insurance and employee benefits

- Finds tax credit savings

Cons:

- Expensive for smaller businesses

- Time tracking isn’t included on the basic plan

|

Best For |

Monthly Pricing from | Annual Pricing from | Users for Starting Price | Device Support | Free Trial/Plan |

| Comprehensive US business payroll | $46 | N/A | 1 | Windows, Mac, iOS, Android |

Free demo |

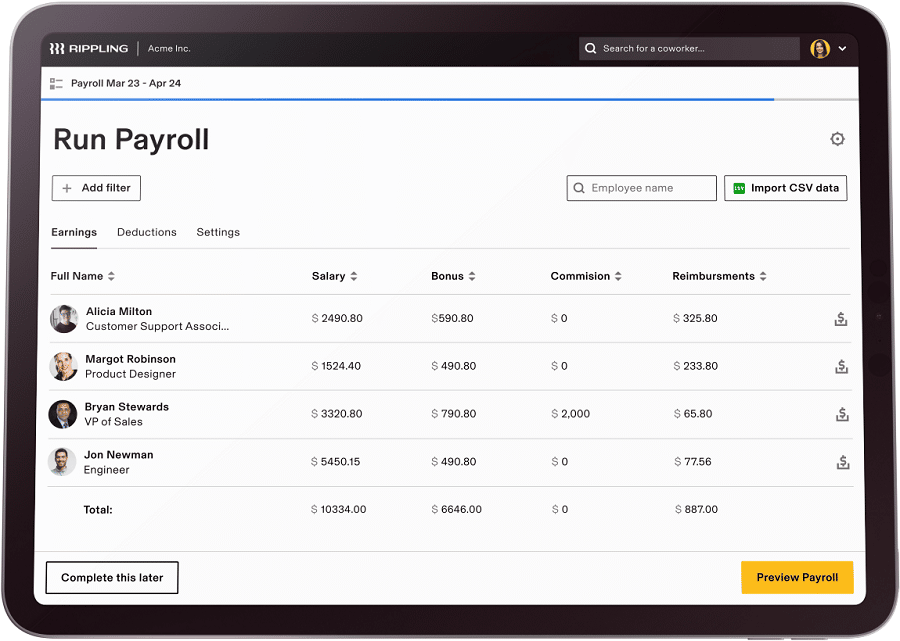

6. Rippling — Integrated payroll, HR and IT for US businesses with big ambitions

Rippling is slick, smart, and seriously powerful — this finance/HR/IT platform can effortlessly handle your payroll and a whole lot more besides.

You can actually run payroll in just 90 seconds because the platform tracks how many hours each employee worked and what deductions to apply. All you have to do is click through and confirm. It’s also easy to pay employees and contractors anywhere in the world.

|

Best For |

Monthly Pricing from | Annual Pricing from | Users for Starting Price | Device Support | Free Trial/Plan |

| US businesses with big ambitions | $8 | N/A | 1 | Windows, Mac, iOS, Android |

Free demo |

Rippling takes care of the whole process. Plus, it also covers all the standard features but then goes deeper with its Pulse tool that lets you easily send out employee surveys and learning management that automatically organizes key sessions such as sexual harassment training.

Other services include benefits and talent management, plus smart analytics tools that help you grow your business. All this means Rippling is the perfect springboard to take your business to the next level. Check out the free demo now to see exactly what it can do for you!

Special Features:

- Run payroll in 90 seconds

- Effortlessly pay employees and contractors worldwide

- Automatically organize workplace training

- Track employee satisfaction with Pulse surveys

Pricing:

Rippling offers custom pricing depending on which services your business requires.

Pros:

- A slick, smart platform

- Integrated HR and finance makes payroll a breeze

- Can scale with your business

- Smart analytics tools

Cons:

- No public pricing

- Might be overwhelming for small businesses

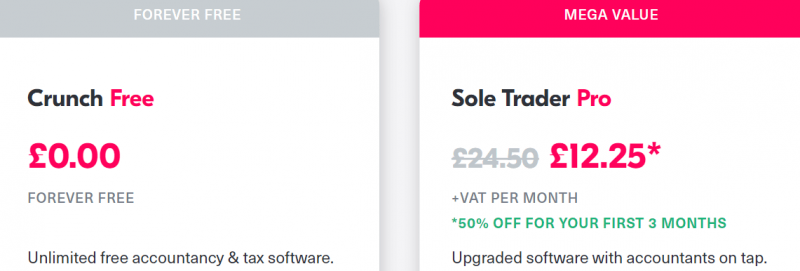

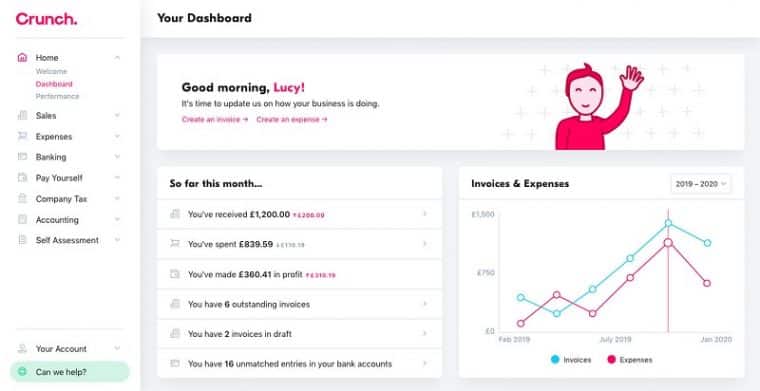

7. Crunch — Best Payroll and Accounting Software for Small Businesses Who Need Expert Assistance

Crunch is a bit different from every other provider on this list — although you still get all the accounting and payroll features you need, you also get something most don’t offer — dedicated, specialised assistance.

|

Best For |

Monthly Pricing from | Annual Pricing from | Users for Starting Price | Device Support | Free Trial/Plan |

| Expert assistance for small businesses | £24.50 | N/A | N/A | Windows, Mac, iOS, Android |

Free plan |

Running a business is undoubtedly complex, especially when it comes to finances. With Crunch, you get an expert accounting assistant that can give you personalized support with any queries you may have, whether that’s understanding regulations or dealing with HMRC, payroll, and VAT.

Expert assistance and a boatload of features come at a price, but most small businesses find it well worth the investment. From bookkeeping and payroll to every accounting need — Crunch certainly doesn’t disappoint.

Special Features:

- Create invoices and manage your expenses

- Connect your bank account for seamless transaction syncing

- Snap your receipts for auto-entry

- VAT and Self-Assessment filing

- Tax dashboard for real-time insight into what you owe

Pricing:

Crunch has packages for sole traders and LTD companies. These are the sole trader options:

The free version includes essentials like invoicing, bank reconciliation, and expense tracking. Still, you’ll need the Pro plan to get the dedicated accountancy tools and client management support that make Crunch so attractive to small businesses.

You also don’t get VAT and Self Assessment filing. For companies earning over £35k, there are 3 plans to choose from:

These plans include additional features great for growing business, such as managing tax-efficient dividends and in-app chat with Crunch’s client managers.

Pros:

- Free accounting solution

- Includes expert support on the Pro plan

- Fantastic customer and service support

- Incredibly easy to use

Cons:

- Pricey compared to other leading options

- Payroll is only included in some of the plans

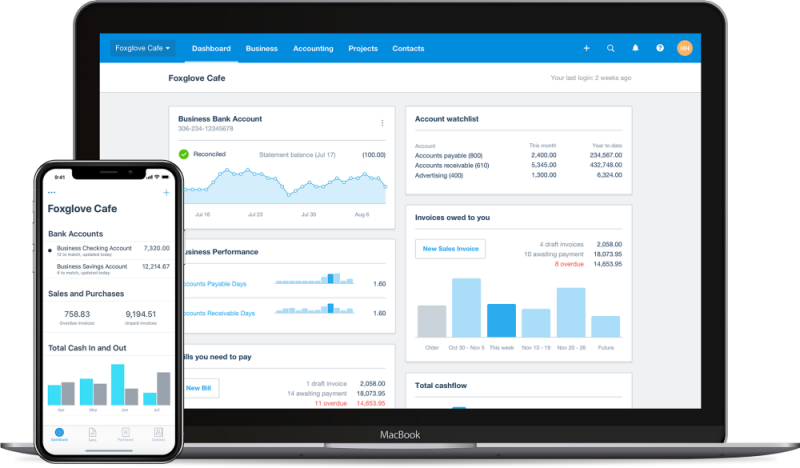

8. Xero — Fantastic Accounting Tool for Small Businesses and Non-Profits in the UK

Xero is undoubtedly one of the best charity accounting software solutions for UK non-profits, but it also offers excellent value for money for small and growing businesses.

|

Best For |

Monthly Pricing from | Annual Pricing | Users for Starting Price | Device Support | Free Trial/Plan |

| UK non-profits and small businesses | £12 | N/A | Unlimited | Windows, Mac, Android, iOS |

30-day trial |

As a non-profit organization, you can get 25% off your Xero subscription, manage your cash flow, calculate your taxes and wages, and share reporting insights with stakeholders.

Xero is also HMRC compliant and calculates everything to make filing a breeze. Plus, you can manage your employee expense refunds, sync Xero with your bank accounts, schedule payments, and so much more.

Special Features:

- Project budget and time management tools

- Create and send customized invoices

- In-app payroll + integration options

- Capture and share files, bills, receipts, and more

- Support for 160 currencies and 1,000+ integrations

Pricing:

Xero has these 3 plans:

What’s nice is that all the plans support an unlimited number of users, but the starter plan does limit you to 5 bills and 20 invoices a month.

You’ll want to go for the Standard or Premium plan for unlimited billing and invoicing, plus features like bulk reconcile transactions, multi-currency support, and the ability to track projects.

Overall, there’s no doubt that Xero is one of the best cloud-based accounting software UK businesses and non-profits can use.

Pros:

- The interface is intuitive

- Affordable, scalable accounting solution

- All plans support unlimited users

Cons:

- The mobile apps lack functionality

- The starter plan is limited to 5 bills and 20 invoices a month

- Payroll comes as an add-on extra after 3 months

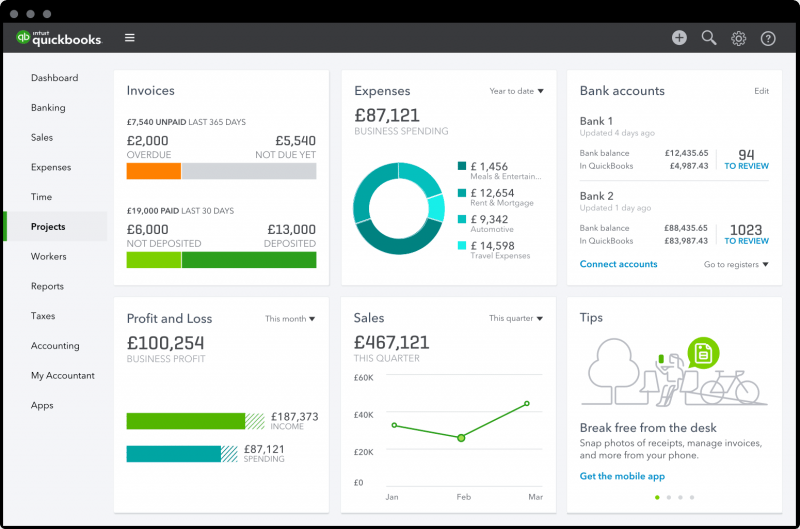

9. QuickBooks — One of the Best Accounting and Payroll Software Programs for Functionality

Our list of the best wouldn’t be complete without QuickBooks — it’s one of the best cloud-based accounting tools and is hugely popular with small businesses.

|

Best For |

Monthly Pricing from | Annual Pricing | Users for Starting Price | Device Support | Free Trial/Plan |

| Small and growing UK businesses | £8 | N/A | 2 | Windows, Mac, Android, iOS |

30-day trial |

You get all the essential features plus loads of nice-to-have extras. Payroll and stock management are available as paid add-ons — making QuickBooks a one-stop choice to manage your taxes, payroll, invoicing, and cash flow.

It’s easy to see why it’s a premium online accounting and payroll software solution for UK businesses.

Special Features:

- Manage employee leave, expenses, timesheets, and wages

- Easily submit your Self Assessment and VAT returns to HMRC

- Connect your bank accounts for automatic capturing and categorizing

- Accept and make payments in 145+ currencies

- Manage access permissions to collaborate with your team

- Send invoices to clients via email or WhatsApp and set up reminders

- Project and time-tracking features

Pricing:

QuickBooks has the following 4 plans:

Considering what’s on offer, £8/month for 2 users on the Self Employed plan is a bargain. However, you can’t send “pay-enabled” invoices, create and send quotes and estimates, or use the time tracking and other handy features on this plan.

The £12 Simple Start plan offers the best value for money, and if you want to add payroll to the mix, this costs an extra £4 a month plus £1 per paid employee per month.

Pros:

- Quality around-the-clock support

- The software is a pleasure to use

- Fantastic reporting and bank reconciliation capabilities

- Competitive pricing plans

Cons:

- There’s a higher learning curve

- The platform can be buggy

- Mixed customer reviews

10. FreeAgent — Best Accounting and Payroll Software for Built-in Payroll and Project Management Capabilities

FreeAgent isn’t as well known as others on this list, but it’s one of the best project management tools and has some nifty accounting features too!

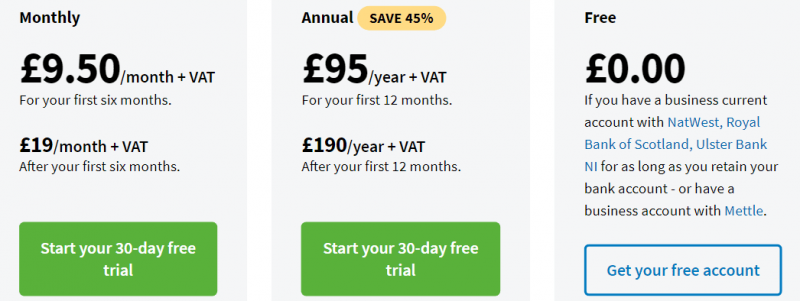

|

Best For |

Monthly Pricing from | Annual Pricing | Users for Starting Price | Device Support | Free Trial/Plan |

| Accounting and project management | £19 | N/A | N/A | Windows, Mac, Android, iOS |

Free option + 30-day trial |

You’ll genuinely struggle to find much to complain about with this software — it’s incredibly intuitive, easy to use (even for the least tech-savvy among us), offers next-level customer support, and has fantastic built-in capabilities, including payroll!

You can send invoices, proposals, and estimates and track your expenses, tasks, and the time spent on projects — overall, FreeAgent is a very impressive project and accounting management tool.

Special Features:

- Monitor the time spent on projects on mobile and desktop

- Create timesheets and reports on logged time

- Connect your bank account for automatic transaction syncing

- Send automated, recurring invoices

- Multi-language and currency support

- Set your sales taxes rates and create tax reports

Pricing:

FreeAgent has various plans for an array of needs, budgets, and business sizes — the cheapest of the bunch are the sole trader plans:

Unlike most, the payroll capabilities come at no extra cost on all of the plans, making it one of the best accounting and payroll software for small business needs.

Pros:

- Intuitive and easy to use

- Superb customer service

- Offers numerous pricing packages

- One of the best PM apps with integrated accounting

Cons:

- Print on mobile is small, so it requires a lot of zooming

- It can be expensive to grow your business with this tool

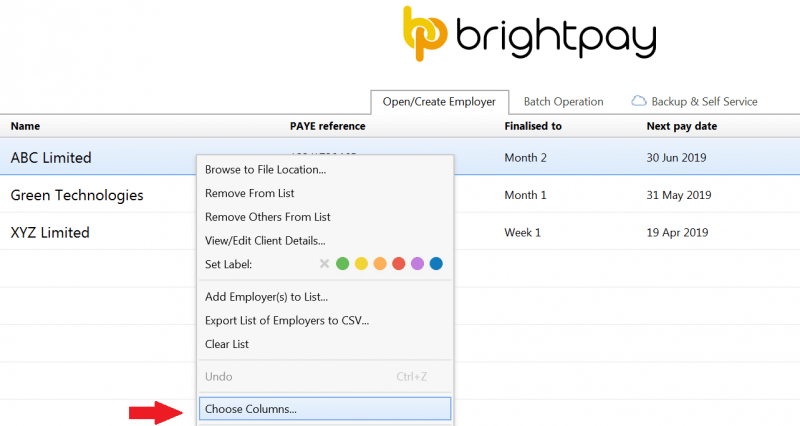

11. BrightPay — Best UK Payroll Software for Mac and Windows

BrightPay is an award-winning platform specializing in payroll and HR software. Plus, it allows you to integrate with some of the best accounting tools, such as Sage Accounting, Xero, QuickBooks, and countless others.

|

Best For |

Monthly Pricing | Annual Pricing | Users for Starting Price | Device Support | Free Trial/Plan |

| Payroll on desktop | N/A | £59 | 4 | Windows, Mac |

60-day trial |

We’ve chosen it as our best pick for Mac devices, and it’s also a great choice for Windows — but, sadly, there’s no support for mobile. Still, this straightforward solution offers a lot for UK businesses; in fact, it’s considered a leading client management software solution.

Special Features:

- View payslips, run payroll reports, and manage your employees’ leave

- Set up multiple employer bank accounts

- Review your cash and cheque payment summaries

- Employee calendar to set working and non-working days

- Manage absences, paid and unpaid leave, and more

- Record all personal data, expenses, and benefits for each employee

- Organize client documents and information

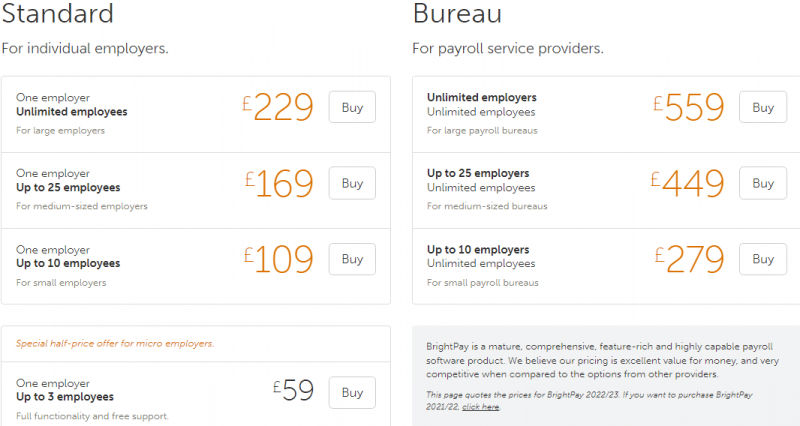

Pricing:

Below are your options with BrightPay:

The above pricing is on a per-tax year basis, and all licenses can be used on up to 10 computers. BrightPay Connect is an optional add-on for automatic payroll data backups and a web-based self-service dashboard for your employees and clients.

This starts at £0.54/month for 1 employee. There’s also a whopping 60-day trial if you want to try BrightPay out before committing.

Pros:

- Loaded with features

- Customer support is great

- One of the best payroll software UK tools

- User-friendly interface and affordable pricing plans

Cons:

- Importing can be a bit glitchy

- No mobile support

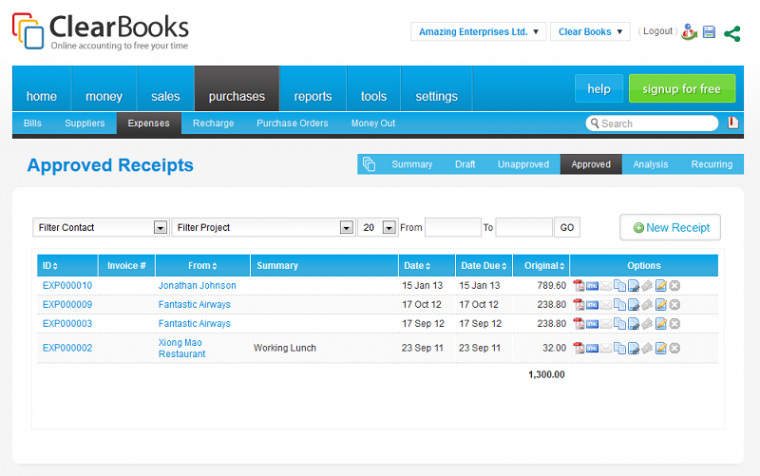

12. ClearBooks — Affordable Accounting and Payroll Software for Small Businesses

ClearBooks aims to clear all accounting confusion and noise and help you get things done easier.

From creating and sending invoices to tracking bills and employee expenses, the ability to collate bills and receipts by customer or supplier, and more — Clear Books certainly does its job well.

|

Best For |

Monthly Pricing from | Annual Pricing from | Users for Starting Price | Device Support | Free Trial/Plan |

| Small and growing UK businesses | £12 | £129.60 | Unlimited | Android, iOS, Windows, Mac |

30-day trial |

Plus, it has an impressive suite of offerings to ensure you’re on the ball with your bills and remain compliant. The platform supports over 170 currencies and has project budget and time management tools too!

Special Features:

- Create reports and submit your tax returns

- Manage user permissions levels for collaboration

- Set automatic payment reminders

- Import your transactions by connecting your bank accounts

- Create dividends and track fixed assets

- Calculate pay and produce payslips

Pricing:

Clear Books has just these 2 accounting plans:

You have the option of monthly, annual, or a 2-year subscription — the cheapest being the 2-year option which renews at £4.80/month after your initial 3-month discount.

In terms of adding payroll and HR features, you’re looking at an extra £2.70/month for 2 employees (this renews at £5.40 after the discount period), but you can also get a custom quote to fit your needs.

Pros:

- Outstanding customer support

- Affordable and superb value for money

- Very easy to use

- Loaded with impressive features

Cons:

- Implementation can be tricky

- Payroll comes at an additional price

13. Kashflow — An Integrated Payroll and Accounting Software Tool for Growing UK Businesses

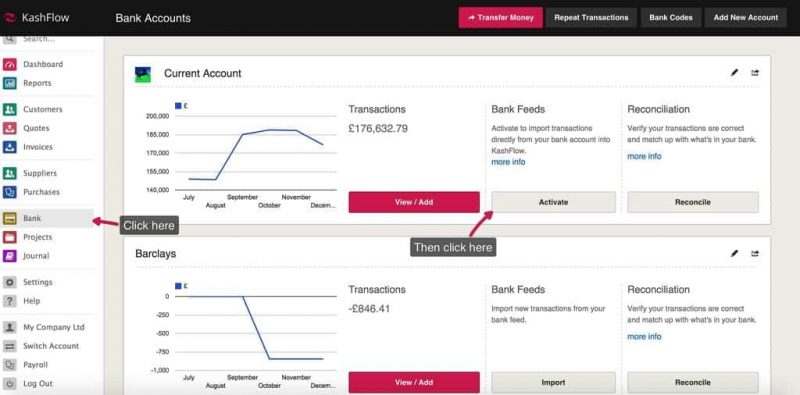

Although payroll is an optional add-on on the standard plans, Kashflow gives UK businesses what they need to simplify their accountancy tasks. From customizable invoice templates to automatic payment reminders and auto-entry for receipts, Kashflow has all the core features you’d be looking for.

|

Best For |

Monthly Pricing from | Annual Pricing from | Users for Starting Price | Device Support | Free Trial/Plan |

| Growing businesses | £9 | £62 | 1 | Windows, Mac, Android, iOS |

14-day free trial |

In terms of payroll, you get features like automated payroll approval, employee self-service to access their data and payslips, plus synced payslip updates.

Special Features:

- Create and email purchase orders, and set up recurring purchases

- Manage your expenses and add receipts

- Calculate, log, track, and export your business travel mileage

- File your VAT returns directly to HMRC

- Create quotes and estimates

- Bank feed for real-time insight into your cash flow

Pricing:

Kashflow has the following 3 plans:

As with Xero, Kashflow limits you to 10 invoices a month on the starter plan, but you can also send unlimited quotes, reconcile up to 25 bank transactions, manage and submit your VAT returns, and more on this plan.

You’ll need to opt for one of the other 2 plans for no limits and additional functionality like managing purchases and expenses, multi-currency support, and repeat invoices.

You can add payroll to your plan for an extra £7.32/month or opt for the highest tier plan, which includes the payroll features.

Pros:

- It has a good range of features

- Affordable pricing plans

- Great mobile functionality

Cons:

- Payroll is an extra add-on

- Limited reporting functionality

- Poor customer support

Best Payroll and Accounting Software — Comparison Table

When it comes to comparing software, the easiest way to work out which option is best suited to your needs is with a handy table like the one below that includes all the key criteria:

|

Payroll and Accounting Software |

Best For | Monthly Pricing from | Annual Pricing from | Users for Starting Price | Device Support |

Free Trial/Plan |

| Any-sized business | £3.30 | £95.70 | 1 | Web, Android, iOS | 30-day free trial | |

| Zoho Books | Small businesses | £12 | £10 | 3 | Web, Android, iOS |

Free plan +14-day trial |

| Small and medium-sized businesses | £12 | N/A | 1 | Windows, Mac, iOS, Android | 30-day trial | |

| Large businesses | Custom | N/A | N/A | Windows, Mac, iOS, Android, Linux, Unix | Demo + 30-day guarantee | |

| Medium and large-sized businesses | $46 | N/A | 1 | Windows, Mac, iOS, Android | Free demo | |

| Small and medium-sized businesses | $8 | N/A | 1 | Windows, Mac, iOS, Android | Free demo | |

| Crunch | Expert assistance for small businesses | £24.50 | N/A | N/A | Windows, Mac, iOS, Android |

Free plan |

| UK non-profits and small businesses | £12 | N/A | Unlimited | Windows, Mac, Android, iOS | 30-day trial | |

| QuickBooks | Small and growing UK businesses | £8 | N/A | 2 | Windows, Mac, Android, iOS |

30-day trial |

| Accounting and project management | £19 | N/A | N/A | Windows, Mac, Android, iOS | Free option + 30-day trial | |

| BrightPay | Payroll on desktop | N/A | £59 | 4 | Windows, Mac |

60-day trial |

| Small and growing UK businesses | £12 | £10.80 | Unlimited | Android, iOS, Windows, Mac | 30-day trial | |

| Kashflow | Growing businesses | £9 | £62 | 1 | Windows, Mac, Android, iOS |

14-day free trial |

The Best Free Payroll and Accounting Software

As with most things in life, you get what you pay for when it comes to accounting software. So unless you’re after the bare minimum, we’d recommend opting for a paid version regardless of the size of your business.

The support and functionality you get far outweigh that of even the best free accounting software tools — nevertheless, these are the top options from our list:

|

Free Payroll and Accounting Software |

Users | Expense Tracking & Invoicing | Other Top Features |

| Zoho Books | 2 | Yes + 1,000 invoices/year |

Client portal, payment reminders, recurring invoices, taxes, bank reconciliation |

|

Crunch |

N/A | Unlimited | Bank reconciliation, capture expenses |

| FreeAgent | N/A | Unlimited |

Bank feed for auto transaction syncing, cashflow overview, create invoices and estimates |

The best accounting and payroll software programs are available at a wide range of price points, offering even those on tight budgets an affordable solution without costing you in terms of functionality.

Free trials are also better than free plans as they can give you deeper insight into the platform’s full capabilities.

What is Accounting and Payroll Software?

With cloud-based accounting software, businesses have the tools they need at their disposal to reduce human error with things like manual data entry, improve bookkeeping accuracy, and save time with features like automatic bank reconciliation.

From invoicing to managing your payments, cash flow, balance sheets, employee payroll, and your tax filings — the best payroll and accounting software solutions are built to make your life easier.

You also get in-depth, real-time financial reports with visual dashboards for an overview of your profits and losses, your expenses, and more to make crucial decisions with greater accuracy.

Some, like FreeAgent, even come with the best project tracking tools, such as time and task management capabilities.

Why Does My Business Need Payroll and Accounting Software?

We could undoubtedly write an entire article dedicated to the benefits of payroll and accounting software for businesses of all sizes — but here’s 5 key ways such tools can improve your business:

1. Invaluable Savings

By automating tasks that don’t require human intervention, you can save time and reduce the implication of human error in tasks like data entry while improving efficiency and ensuring the accuracy of your financial data records.

With automation, your accountant can also focus on work requiring human input — improving your firm’s productivity and saving you time and money.

It’s a win, win, win!

2. Easy Tax Returns

Preparation for tax season can be incredibly tedious, not to mention stressful. It requires accuracy in your data records that can be hard to attain and maintain without software built to make things far more straightforward.

With the best accounting software, you have what you need to ensure your books are always in order and that you stay compliant — with many, you can even file your Self Assessments and returns to HMRC from within the platform.

3. Accessibility and Scalability

Unlike traditional on-premise accounting solutions or spreadsheets, modern software is accessible from practically every device. In fact, our list includes the best payroll and accounting software for Mac UK, plus for Windows and mobile devices.

Having a cloud accounting solution with this much flexibility also makes it incredibly easy and affordable to scale your business with one of these tools — as your business grows, you can add the functionality your business needs.

4. Additional Features

As we’ve seen, the best accounting solutions include some nifty features to make managing your finances and day-to-day business operations easier.

Besides the ability to collaborate with others and share reports via email, other great features include:

- Time tracking — Allowing your employees to track the time spent on tasks and projects for accurate timesheets for payroll time

- Automation — Receive updates on client payments, set up automatic receipts, late payment fees, and follow-up reminders

- Project management — With time and project tracking tools, and budget management capabilities, you can get a handle on all your projects like never before

- Auto data entry — Snap photos of receipts and other documents from the mobile app and have the data accurately inputted into your records

- Bank reconciliation — Connect your bank accounts for automatic information syncing

And, of course, you get real-time insights into the health of your business, which brings us to our final point.

5. Valuable Insights

Of course, one of the most crucial benefits of having software like this for your business is that it gives you invaluable real-time insight into the state of your cash flow, expenses, and more.

With this data, you’ll have complete transparency about your business’s health and the financial data on hand to make crucial decisions for your business.

Although we’ve explored just 5 benefits, there’s no doubt that accounting and payroll software is a must-have for your businesses if you’re looking to simplify the handling of your books and improve your accuracy without letting anything slip through the cracks.

Factors to Consider When Choosing Online Accounting and Payroll Software

Choosing the right solution for you and your business is hard work, even when we’ve picked out the best of the bunch.

Here are some of the most critical factors you’ll want to take into consideration when making your decision:

1. Cost and Scalability

Because pricing plays a huge role in our decisions, especially as business owners, it’s essential to consider how many users you want to onboard.

Because most of these accounting tools are priced on a per-user basis, you’ll want to take this into account.

Make sure you also bear in mind the future needs of your business in terms of both user limitations and functionality to ensure that the software you choose offers the means to scale without costing you an arm and a leg.

As we’ve seen in this guide, some features crucial to your business might only be available on a higher plan or as an extra add-on.

2. Accessibility

Of course, our list includes the best accounting software for Windows, Mac, and even mobile devices — but some offer more functionality than others for mobile.

If mobile functionality is crucial to your business, you’ll want to double-check how good the support is with your chosen payroll and accounting software.

3. Features

As mentioned in the cost section, considering what you need now is key when choosing accounting software, as some features are only available on higher-tier plans depending on the solution.

For example, although platforms like FreeAgent are one of the best payroll software tools, most accounting programs require integration or charge extra to add payroll to your plan.

Plus, you may also have tools that your company or accountants already uses, such as one of the best HR software, CRM tools, or anything else — so make sure you double-check the integration support options.

4. Customer Support and Ease of Use

Although each platform offers similar features, that’s not to say that the same applies to their support and interface — and unfortunately, this is also the case with payroll and accounting software.

Some have better customer support and online documentation than others, and some have higher learning curves.

It’s best to check the support out yourself, review customer feedback on sites like TrustPilot, and test the free trial before your commit to a paid plan.

Conclusion: What is the Best Payroll and Accounting Software?

From simplifying your finances, invoicing, payroll process, expense tracking, and everything in between — there’s no doubt that UK businesses of all sizes could do with one of the best payroll and accounting software solutions.

Having reviewed the best of the bunch, choosing FreshBooks as our top pick was easy — it offers superb value, and it’s packed to the brim with impressive functionality to tackle even the most demanding business needs.

Whether it’s right for your business will depend on your needs, of course, and there’s no doubt that each of our top 10 is worthy of serious consideration. Overall though, FreshBooks is our top pick.