Freelancers and self-employed individuals have it tougher than everybody else. They are the boss and the employee of the same business. From meeting with prospective clients to finishing the project and looking after post-delivery client needs, freelancers and self-employed individuals have to do it all alone.

They operate in high-pressure situations, so the last thing they would want on their plate is the additional responsibility of accounting. If you want to supercharge your business as a self-employed or freelacer, we highly recommend getting an accounting software to look after your finances.

And since we don’t want to disrupt your busy schedule and send you off to scour for competent accounting software for your needs, we have researched and curated this list of the top 10 accounting software for self-employed, so make sure you read this article until the end.

Best Accounting Software for Self Employed: Our Top Pick

We find Quickbooks to be the best accounting software for self-employed. Read on to find out why.

Here are the standout features of Quickbooks Self-employed:

The Best Accounting Software for Self Employed Individuals

- Quickbooks: Best Accounting Software For Self Employed Overall

- Wave: Best Free Accounting Software For Self Employed

- Xero: Best Accounting Software For Self Employed For Easy Payments

- Freshbooks: Best Self-Employed Accounting Software For Creating Professional Invoices

- Sunrise: Best Self-Employed Accounting Software For Expert Assistance

- Harpoon: Best Accounting Software For Self Employed For Revenue Forecasting

- FreeAgent: Best Self-Employed Accounting Software For Taxes

- Bonsai: Best Self-Employed Accounting Software For Expense Tracking

- OneUp: Best Accounting Software For Self Employed For Automated Payment Processing

- Shoeboxed: Best Self-Employed Accounting Software For Receipt Management

Best Accounting Software for Self Employed Individuals: Compared

Surely, you want to know about the details of each of the accounting software mentioned above. Continue reading to find out the best features, pricing structure, advantages, and disadvantages of the top 10 software for self-employed accounting:

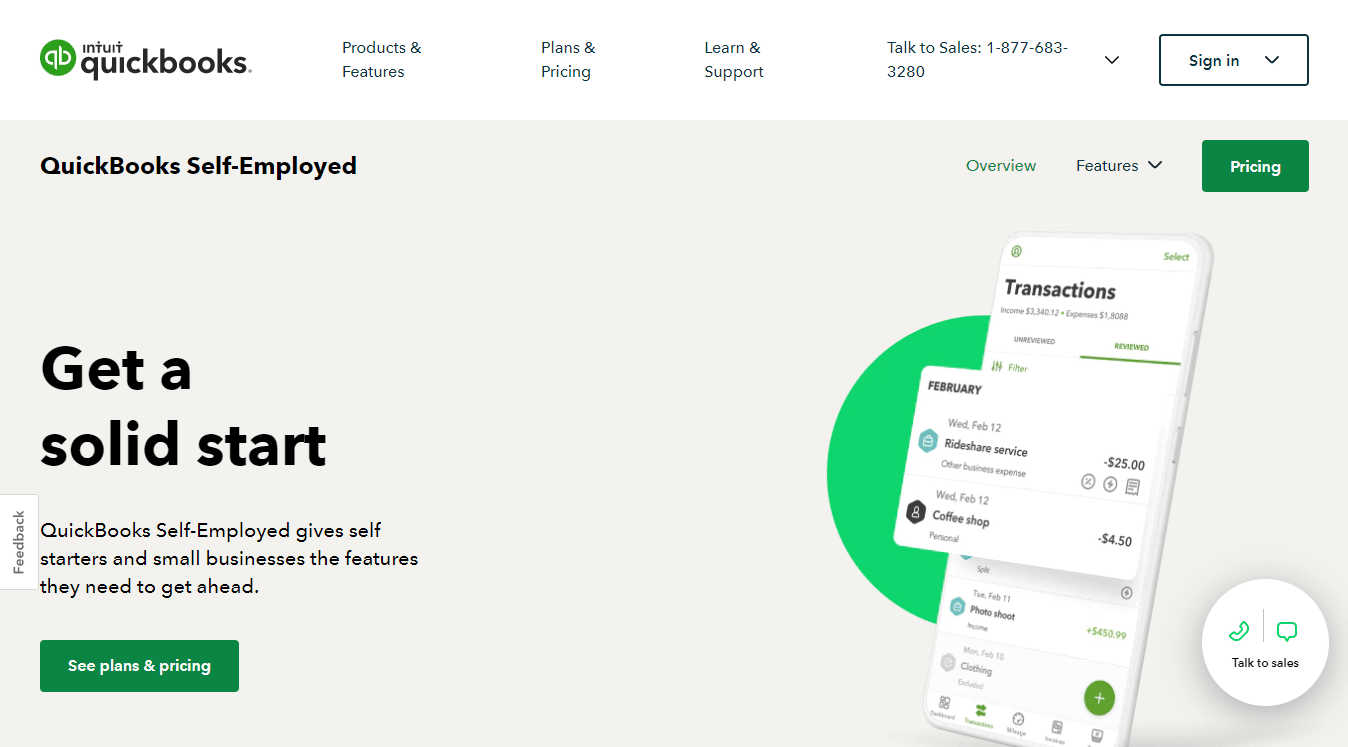

1. Quickbooks Self-employed: Best Self Employed Accounting Software

Quickbooks has always been a popular accounting software among startups and small businesses. But did you know that it has a special version just for freelancers and self-employed individuals? Yes, Quickbooks Self-employed is a dedicated accounting tool designed to meet the financing needs of self-employed users.

Quickbooks not only helps you with regular financing and day-to-day budgeting, but it also extends its support to help you with taxes through an expert or TurboTax.

Best Features

Here is what we love about Quickbooks self employed accounting software:

- Mileage Tracking: Connect your phone’s GPS with the Quickbooks app and watch it automatically calculate the money you spend on travel each month.

- Receipt Tracking: Quickbooks allows you to take a quick picture of your paper receipts and automatically categorize the expense.

- Tax Calculation: Want to know when your taxes are due and what you are liable to pay? Quickbooks will do all the math for you, meaning all you would have to do is clear the tax due.

- Expense Categorization: One of the best ways to organize your expenses is to sort them into categories. Quickbooks helps you track all your bank transactions and automatically categorizes them based on your custom settings.

Pricing

Here are the plans offered by Quickbooks Self-employed:

- Self-employed: $15/month

- Self-employed + Tax: $25/month

- Self-employed + Live Tax: $35/month

Pros

Cons

2. Wave: Best Free Self Employed Accounting Software

If you are looking for a completely free accounting software for your business or service, we recommend Wave. First things first, Wave is free forever. Also, Wave has a group of tools and apps that come together in a bundle to help you with the financial aspects of your work, including payments and invoicing.

The tool also provides adequate customer support and offers a stellar resource database to help you get started.

Best Features

Here is what we love about Wave:

- Double Entry Accounting: Wave is one of the few apps that truly understand the nitty-gritty of accounting. That’s why it offers double-entry accounting to reduce errors.

- Data Security: If data security is your top priority, Wave will be a good pick for you. It keeps your bank data in read-only mode and provides 256-bit encryption to all your data.

- Professional Invoices: Want to get paid faster? Use Wave to create professional-looking invoices in seconds for your personal brand.

- Recurring Billing: Wave allows you to switch between manual and automatic billing as and when needed. You can set up recurring billing from your client’s credit cards or simply automate monthly invoices for regular customers.

Pricing

Wave is a free accounting software. There are no hidden charges.

Pros

Cons

3. Xero: Best Accounting Software For Self Employed For Easy Payments

Xero offers a flexible accounting service. This means that all your needs will be taken care of by Xero, irrespective of whether you are self-employed, a small business owner, or a bookkeeper for a company.

Xero is trusted by 3 million users all over the world. Being feature-rich and helmed by a stellar customer support team, users trust Xero to take care of their finances while they direct their focus toward their business.

Best Features

Here is what we love about Xero:

- Bank Connections: Xero will easily connect to your bank account, making it easy for you to keep a record of all your bank transactions in one place.

- Bill Payment: Stay on top of all your bills, track your payables and clear your dues on time with Xero’s assistance.

- Project Tracking: What’s the point of working hard on your projects if you are not getting paid enough or on time? Xero calculates the profitability of all your projects and reminds you of invoices yet to be cleared. Get paid your worth with Xero.

- Accept Payment: Want to get 2x faster payments? Try Xero. Accept online payments with Stripe or GoCardless to keep both your customers and your pocket happier.

Pricing

Here are the plans offered by Xero:

- Starter: $22/user/month

- Standard: $35/user/month

- Premium: $47/user/month

Pros

Cons

4. Freshbooks: Best Self-Employed Accounting Software For Creating Professional Invoices

Freshbooks is another competent accounting software that works wonders for small businesses, freelancers, and accountants. What we love about Freshbooks is its vast array of accounting features. Whatever your accounting needs may be, no matter how big or small, rest assured that Freshbooks has a solution for that.

Another benefit of using Freshbooks is its easy-to-use mobile application. As a self-employed individual, it’s essential not to waste your time glued to your screen all day but instead work at your own pace with Freshbooks’s mobile application.

Best Features

Here is what we love about Freshbooks:

- Professional Invoices: Don’t let your customers believe you are new in the business (even if you are!) Design professional invoices with Freshbooks in seconds and build authority.

- Payment Reminders: Too shy to remind clients of late payments? Freshbooks will send automated late payment reminders if the clients don’t follow up with your invoices on time.

- Time Tracking: For the ones getting paid hourly, Freshbooks’s time tracking feature is a blessing. Each minute worked will be each minute paid.

- Reporting: Freshbooks’s detailed accounting reports will allow you to check all your expenses, payments, and profitability in a glimpse.

Pricing

Here are the plans offered by Freshbooks:

- Lite: $15/month

- Plus: $25/month

- Premium: $50/month

- Select: Custom pricing

Pros

Cons

5. Sunrise: Best Self-Employed Accounting Software For Expert Assistance

Sunrise is designed for small businesses, but its features and tools are equally adept for freelancers and self-employed individuals. One of our favorite things about Sunrise is that it’s extremely easy to get started with. All you have to do is create your account and connect it to your bank account; you will have complete control of your finances in under five minutes.

Whatever you need for your business, be it expense tracking or tax filing, you can get it all with Sunrise. And considering it’s free to sign up, there is no reason you shouldn’t give it a try.

Best Features

Here is what we love about Sunrise:

- Multiple Payment Methods: Sunrise enables you to accept multiple payment methods, including cards and bank transfers, making it easier for your clients to pay you.

- Branded Invoices: Want to add a hint of your personal brand on your invoices? Use Sunrise’s branding elements to create pro-level invoices for your brand.

- Profit Statement: Sunrise creates detailed profit-loss statements and balance sheets for your business to help you make informed decisions.

- Expert Assistance: As a self-employed individual, you have a plethora of things to look after. We recommend you hand over your bookkeeping responsibilities to Sunrise’s experts.

Pricing

Here are the plans offered by Sunrise:

- Self-service: Free forever

- Sunrise Plus: $19.99/month

Pros

Cons

6. Harpoon: Best Accounting Software For Self Employed For Revenue Forecasting

Harpoon’s diverse services and features work for large companies, freelancers as well as small businesses. What makes Harpoon different from all accounting software is that it helps you record not only financial history but also create a profitable future for your company or yourself with its smart financial forecasting.

Harpoon starts by setting yearly revenue goals for your services. Hitting this goal will automatically ensure that all your bills, payables, and other expenses are taken care of and that you make a profit.

Best Features

Here is what we love about Harpoon:

- Revenue Forecasting: Harpoon will automatically estimate the revenue you will make from a particular client or project, allowing you to choose the most profitable work.

- Project Budgeting: Afraid of quoting too less for your services? Let Harpoon take care of your project budget and help you quote a competitive price.

- Scheduling Project: Schedule all your projects in advance to keep your calendar for the year updated and to check how much you will make in revenue each month.

- Revenue Roll-over: Determined to meet your financial goal? Harpoon will roll over parts of your revenue that couldn’t be met in a month to the next month so that your yearly revenue goal remains intact.

Pricing

Here are the plans offered by Harpoon:

- Agency: $99/month

- Studio: $39/month

- Freelancer: $19/month

- Starter: $9/month

Pros

Cons

7. FreeAgent: Best Self-Employed Accounting Software For Taxes

FreeAgent is the perfect accounting tool for beginners and self-employed individuals. One of the best things about FreeAgent is that all new users get a flat 50% off on their first 6 months with FreeAgent.

After that, if you have a bank account in NatWest, Royal Bank of Scotland, Ulster Bank NI, or a business account with Mettle, you get a free FreeAgent account for as long as you do business with those banks.

Voted one of the best accounting software in the UK, the tool is available worldwide and enables you to access your finances from anywhere.

Best Features

Here is what we love about FreeAgent:

- Tax Filing: Filing your taxes is a breeze with FreeAgent. It takes care of all your tax calculations, returns, and end-of-year filing, meaning all you have to worry about is meeting your revenue goals

- Expense Tracking: Track your everyday expenses and money spent on traveling on the go with FreeAgent’s intuitive expense tracker.

- Data Security: Data security is a top priority for FreeAgent. Multiple layers of protection, high-end encryption, and reduced vulnerabilities ensure that your data remains secure.

- Mobile App: FreeAgent is also available in a responsive mobile application, meaning you will have access to your finances even outside working hours.

Pricing

Here are the plans offered by FreeAgent:

- Monthly: £14.50 month + VAT (for the first 6 months); £29.00 month + VAT after that

- Annual: £145 year + VAT (for the first year); £290 year + VAT after that

Pros

Cons

8. Bonsai: Best Self-Employed Accounting Software For Expense Tracking

Bonsai is one of the few accounting software that are exclusively designed for freelancers and self-employed individuals. It is an all-in-one product suite for accounting that allows you to streamline expense management and automate recurring processes so that you can focus more on your work and less on paperwork.

Bonsai is currently trusted by over 500k+ freelancers. Want to know the best part? Features offered by Bonsai can cater to the financing needs of all industries all over the world.

Best Features

Here is what we love about Bonsai:

- Tax Reminders: Bonsai not only reminds you of your tax dues every quarter and year but also calculates your taxes with every transaction you make.

- Profit & Loss Tracking: By tracking the profit or loss your business is making at any moment, you can analyze your business’s health and make informed decisions accordingly.

- Expense Management: Manage your expenses by keeping all your bills, invoices, payments, and payables in one place.

- Automated Tracking: Bonsai automatically tracks all your transactions. Note that it will also take it upon itself to categorize all the payments and maximize your write-offs.

Pricing

Here are the plans offered by Bonsai:

- Starter: $24/month

- Professional: $39/month

- Business: $79/month

Pros

Cons

9. OneUp: Best Accounting Software For Self Employed For Automated Payment Processing

If fast processing and profitability are your top priority, try OneUp. The tool has a whopping 95% automation rate. This means that out of every 100 entries made, 95 are automatically processed, saving you a lot of time.

OneUp will also reduce your client management cost, further adding to your savings. For instance, reports suggest that OneUp users can successfully reduce their client management costs from $30 to approximately $6.90.

Best Features

Here is what we love about OneUp:

- Invoicing: OneUp has a flexible invoicing feature under which you can instantly convert a quote into an invoice. You can also create personalized invoices or connect your account with SquareRegister to instantly transform your transactions into invoices.

- Automated Payment Notifications: Send automated notifications to your clients when their payments are due. You also get a glimpse into all the payments that are due soon from OneUp’s dedicated customer payment portal.

- Bank Connection: Once you connect your bank with OneUp, it will automatically track and record all your transactions.

- Automated Categorization: Once OneUp is thorough with your business, it will automatically categorize your business expenses. That said, you will always have the final authority to either accept or reject the suggestions.

Pricing

Here are the plans offered by OneUp:

- Self: $9/month

- Pro: $19/month

- Plus: $29/month

- Team: $69/month

- Unlimited: $169/month

Pros

Cons

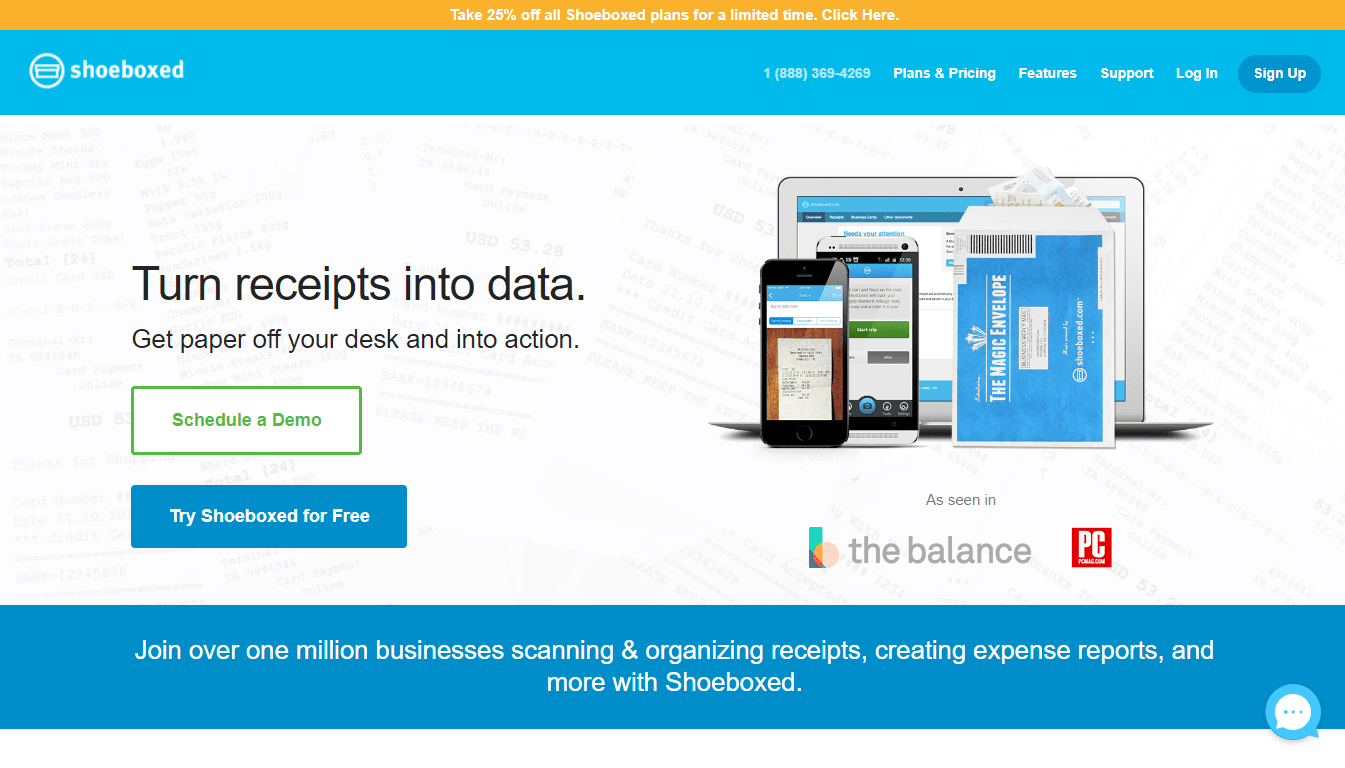

10. Shoeboxed: Best Self-Employed Accounting Software For Receipt Management

No matter how digitized your business is, you might still have some physical receipts that need to be taken care of. And when you are the sole mind behind a business, organizing your receipts is no less than a headache. We recommend Shoeboxed for all your offline expenses.

Currently, with a massive user base of over a million, Shoeboxed not only has a stellar customer support team but also schedules product demos for new users to get acquainted with the service.

Best Features

Here is what we love about Shoeboxed:

- Receipt Organization: Shoeboxed scans all your receipts into readable digital format and keeps them organized in one place. Note that scanned receipts by Shoeboxed are at par with IRS standards.

- Human Verification: Afraid of machine error creeping into your digital receipts? No worries. All your receipts are manually evaluated by a human executive at Shoeboxed before they get stored in your account.

- Magic Envelope: Shoeboxed’s unique feature called Magic Envelope allows you to drop all your receipts and paperwork in one place where it is instantly digitized.

- Expense Report: Expense reporting has never been easier. With all your receipts in one place, Shoeboxed allows you to create expense reports in seconds, and that too, remotely from anywhere in the world.

Pricing

Here are the plans offered by Shoeboxed:

- Startup: $18/month

- Professional: $36/month

- Business: $54/month

Pros

Cons

What Is Accounting Software For The Self-Employed And How Does It Work?

While pursuing your dream career as a freelancer, it’s natural to remain obsessed with designing, coding, writing, or whatever appeals to your intellect. As you scale your services and grow your clientele, you will run into loads of accounting tasks like invoicing, logging expenses, filing taxes, and scanning the receipts.

Engaging yourself with such tasks, you would end up losing your valuable productive hours. However, at the same time, you cannot afford to operate without accounting, invoicing, or billing. This is exactly why successful freelancers and self-employed people use dedicated accounting software.

With these easy-to-use and feature-packed tools, you won’t be wasting your time on non-core priorities. For freelancers, these tools would seamlessly help track the expenses, keep an account of the work done, send invoices, and even calculate the taxes you need to pay. When you deploy the right software for accounting, you need just a few hours each month to carry out the accounting tasks.

Although there are different types of accounting software available, the ones designed for self-employed individuals will help you track your expenses and revenue the way they need to be tracked for a one-person business. With the right tool at your disposal, you can manage all your accounting tasks with dexterity.

What Are The Advantages Of Using Accounting Software For Self Employed?

Are you still skeptical regarding signing up for an accounting software for your solopreneurship? Here are 8 solid reasons to quit being skeptical and understand the importance of an accounting software for self-employed individuals:

1. Immediacy And Ease Of Use

Data entry and accounting tasks turn out to be a tedious ordeal. It’s easy to postpone your invoicing task to the end of the month. However, when the month-end approaches, you would find huge volumes of invoicing stacked up. Managing these bills will rob you of your valuable hours.

Moreover, you cannot rule out the chances of losing track of your work or invoices. This way, you would receive your payments late or even miss out on a bill. An accounting software can help you sort these issues out.

Rather than wasting your time with paperwork, you can digitally record the data each day. Whether it’s a one-time work or an ongoing project, you need to organize the data sequentially online. Besides, these tools record bank withdrawals and payments automatically.

An updated interface for accounting would also give you a holistic idea of where you stand financially at any point during the month. This would help you make informed decisions regarding increasing or relaxing your workload.

2. Collecting Online Payments

After you send your invoices, the next important task is to track your incoming payments. In case you are scaling your business, it would be challenging to remember the payment status of every new client.

You can integrate the best accounting tools with your bank accounts. This way, all your incoming payments would reflect on the mobile app you are using. The payment gateways would keep a record of every transaction in your account. Accordingly, they would update the invoicing software with all these details.

When you expand your client base outside your country, accepting payments in different currencies becomes necessary. Advanced accounting tools seamlessly integrate with payment gateways capable of receiving payments in different currencies. This way, you need not waste time converting one currency to another. The automated system would smartly carry out all the calculations and present your income in the desired currency.

3. Managing Timesheets And Projects

Robust accounting tools go a long way in helping freelancers manage their projects and timesheets. You would be able to track the time you spent on a particular project. This way, you can know whether you have been utilizing your time productively enough on the particular project.

With timesheets integrated into these tools, you can manage different aspects of your ongoing projects. This includes the invoices, logging time, and budgeting. Thus, you can detect possible financial blunders like underbilling or overbilling your clients.

To ensure that your clients remain on the same page, you also have to get the bills approved by your clients before you enter them into your system. At the end of the project, the software will help you determine whether your actual manhours have been the same as the estimated ones or have been unproductive.

4. Access To Multiple Locations And Vendors

In case you have been operating remotely as a self-employed professional, it would be convenient if you had digital access to different vendors and locations. Advanced accounting software for self-employed people operates on cloud systems. The data remains stored in a centralized catchment, which you can access from any location. This has enhanced productivity for freelancers.

This flexibility primarily benefits professionals who work remotely. Even if you are working on a project while traveling, you can update the accounting software on the go.

5. Obtain Insightful Reports

When it comes to evaluating your success as a professional, you need to capitalize on data. The numbers and other details you feed to these software prove to be vital sources based on which the analytics systems work.

You can obtain insightful reports and analytics from the system to measure your performance. In the process, you would easily be able to identify your deficiencies. Besides, these reports will also help you evaluate your financial growth. You can get a quick overview of how fast you are expanding by comparing the trends and graphs.

Traditionally, you would have to manually create these reports on spreadsheets if you wanted a comprehensive insight into your operations. However, you need not consolidate the data or enter figures for formulas when using an accounting software. Advanced tools come with automatic report generation features, which will fetch you the necessary insights, without you having to do much.

6. Accuracy In Calculating

In case you have been managing your accounts manually all these years, you know how susceptible these systems are to human errors. A single faulty entry might mess up your entire calculation and even lead to faulty invoices. However, when you shift to advanced accounting software, you can maintain a higher degree of accuracy in your financial data.

In the first place, you won’t be missing out on any task, regardless of its size. Also, the system would flag possible issues in case it detects figures that are too large or small. You would also receive notifications with these updates and authorize the entries before generating the final invoices. This ensures that your accounting system remains flawless, with all the entries being accurate.

7. Better Tax Compliance

The last thing freelancers would want is to run into legal trouble. When you operate your business as a self-employed professional, it pays to prioritize your tax compliance. With advanced accounting tools, you will know the amount of tax you need to pay for each invoice. Therefore, you need not waste your time calculating the tax entries separately at the end of each quarter. The accounting tool will generate the tax reports for you.

Besides, you can also analyze trends using these tools. For instance, freelancers can check the tax amount they have paid over a specific period. It would be much easier for you to compile data. The process simplifies the task of filing taxes with the government. Also, you would be able to view the historical tax returns from previous years.

8. Organize Your Operations

Surely, you wouldn’t want to be in a situation where you are fretting over lost invoices. An accounting software will store all your data, most likely on the cloud. This will make searching for particular invoices a breeze. You would also be free to enter the date, invoice number, or client’s name to organize your operations better.

Most importantly, accounting software for self-employed professionals will centralize your operations, meaning you will be able to manage your customer relationship, inventory, and payroll using a single software. The process would be cost-effective since you would be saving time and channeling the same for your productive pursuits.

Conclusion: What is the Best Self-Employed Accounting Software?

It might not be hard to guess that Quickbooks Self-employed is the best accounting software for self-employed individuals on the market right now. That said, the other tools on this list are equally adept and can serve your individual needs quite well. But what makes Quickbooks Self-employed stand out is its comprehensive range of features, including a mileage tracker, expense categorizer, tax calculator, and receipt tracker. Last but not least, it’s also incredibly affordable, allowing freelancers and self-employed individuals of all income levels to benefit from it.