If you are a business owner or if you ever want to become one, you absolutely need to know the difference between a lessor and lessee and how these terms compare with related terms like renters and lienholders.

In this article, we will share our knowledge on the topic to explain the difference between the terms and help you understand all you need to know about lessors and lessees. We will also cover the various types of leases and accounting standards that business owners and entrepreneurs should be aware of. Let’s get started.

Lessor vs Lessee: What Is a Lessor?

Simply put, a lessor is a party – which can be an individual or a business – who rents an asset to another entity. The asset here could be an immovable asset like a property or a movable asset like an equipment or a vehicle.

The terms of this agreement are set out in a lease contract. This contract usually stipulates the length of time the item will be leased, the price of renting the object (either per month or the total), and any other pre-set conditions that the lessor and lessee agree to.

Lessor vs Lessee: What Is a Lessee?

The term lessee is just as simple as lessor. The lessee is simply the entity (individual or organization) that is renting the asset. The lessee is generally required to keep the asset in operational condition (or better). Note that someone financing a purchase, which simply means that they took out a loan, they are not a lessee.

Renting or leasing is not the same thing as financing. When you finance an asset and pay off the principal and interest owed, you own the asset. A lessee, on the other hand, doesn’t (usually) own the asset after its lease agreement is over.

However, for some assets like cars, the lessee is sometimes given the option to purchase the asset at a discounted price once the lease is over.

A lessee can be an individual renting a car or a massive multinational conglomerate renting 10s of offices and hundreds of vehicles. Much of the time in business it simply doesn’t make sense to buy all of the equipment you need. Instead, many businesses rent equipment that they only need in the short term or that they simply don’t have enough cash to buy outright.

Take a look at the graphic below to help you remember the pros and cons of short term rentals, longer term leases, and full purchases.

Types of Lease Agreements

It’s just as important for business owners and entrepreneurs to know the different kinds of leases as it is to understand the terms lessor and lessee. This is most important for accounting as it can differ by the type of lease you use. Let’s dive into all of the types of lease agreements you need to know about.

Capital Lease (or Finance Lease)

A capital lease, also known as a finance lease, is an interesting type of rental agreement where the business renting the asset accounts for it as if it owns it. This kind of agreement is technically considered a purchase, even though the asset is returned at the end of the lease period. Assets under capital lease agreements are included in balance sheets as owned assets.

Lease agreements must satisfy at least one of these criteria to be classified as a capital lease:

- the lease period is 75% or more of the asset’s useful life

- the lease includes an option to purchase the asset at a significant discount

- the lessee gains ownership of the asset once the lease period ends

- the current value of lease payments exceeds 90% of the asset’s market value

Operating Lease

An operating lease agreement is closer to what most people think of as a rental or lease agreement. During the lease period, the lessor still records the asset on their balance sheet, and after the lease period is over they take back the possession of the asset.

Until recent changes to the most popular lease accounting standards, operating leases were not included on the lessees’ balance sheets for the most part. Now, most leases of both types are included on balance sheets.

This kind of lease is often preferred when the business needs the asset for a short period.

Real Estate Lease Agreements

Most businesses just need to know the difference between a capital lease and an operating lease but it gets a bit more confusing in the real estate world. Here are a few of the most important types of leases that anyone in real estate should know.

Gross Lease

In a gross lease, the lessee pays a single amount to the landlord who is then responsible for paying all the related taxes and maintenance expenses related to the property. It can be further divided into modified and full-service leases. In a full-service lease, the lessor pays all of the expenses related to the property while in a modified lease, the two parties decide which expenses would be paid by either party.

Net Lease

In a net lease agreement, the lessee also pays incidental expenses in addition to the periodic rent. The net lease is further classified into the following

- Single net lease: In this agreement, the tenant pays the rent along with property taxes while the maintenance and utility costs are borne by the property owner.

- Double net lease: In this agreement, the property owner pays for maintenance and repairs while the lessee pays utility and property taxes in addition to the rent.

- Triple net lease: In this agreement, the lessee is responsible for paying all the expenses related to the property.

Percentage Lease

In a percentage lease, the tenant pays a fixed rent along with a percentage of sales or profits. Such agreements are quite popular among malls and other commercial properties. It helps the tenant lower their fixed expenses and gives the property owner a chance to profit from the success of the tenant.

This table from TXRE Properties should help you learn and remember the most important things you need to know about the main kinds of real estate leases.

Lessor vs Lessee Examples

Let’s look at some examples of the terms lessor vs lessee in the real world.

1. Office Leasing

A business (the lessee) might take an office on rent from another entity (the lessor). In this case, the property owner becomes the lessor while the business taking the property on lease becomes the lessee. The two sign a rental agreement that specifies the legal terms and the rights and obligations of both parties.

Usually, the lessor is responsible for paying all the property taxes as well as doing any major maintenance work. The lessee is generally responsible for the day-to-day maintenance and their legal obligations include paying the rent within the timeline mentioned in the lease contract.

2. Equipment Leasing

Another common example of a lease in business is for expensive equipment. The business (lessee) makes payments to the equipment leasing company (the lessor) for the contract period. Large machines like bulldozers and large diggers in particular are often leased because the initial cost of purchasing the equipment is so high and it may only be needed for a short period of time.

Equipment leasing can be either a capital lease or an operating lease. Typically, businesses opt for a capital lease when they intend to buy the equipment at the end of the lease agreement or need the equipment for a long time.

3. Vehicle Leasing

Businesses (lessees) often lease vehicles for a specific period from either a car dealership or a specialized leasing company (lessors). In a vehicle lease, the lessee is entitled to use the vehicle within the mileage limits defined in the agreement. They are usually also responsible for all the repairs and maintenance related to the vehicle.

Generally, vehicle lease agreements include an early termination clause but the lessee might need to pay an extra fee to the lessor in case they terminate the agreement before the contract ends.

Leasing vehicles was extraordinarily popular for a long time until the pandemic. Soon after the pandemic it became even less popular because of high interest rates and economic instability.

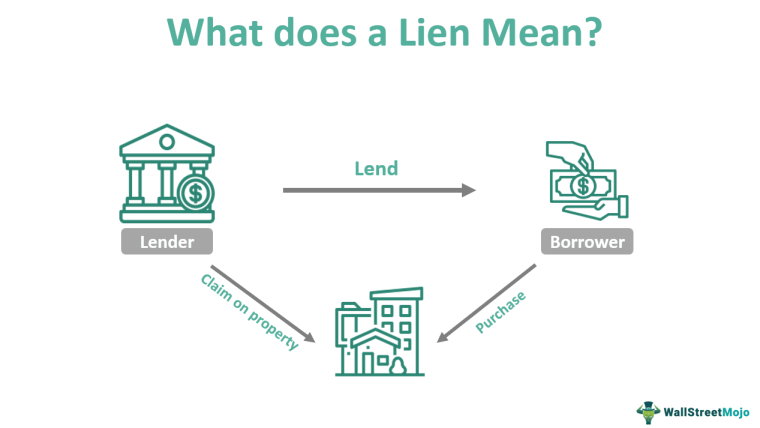

Lessor vs Lienholder

Many people get the words lessor and lienholder confused but they are quite different. A lienholder is typically a financial company that has a legal claim (called a “lien”) over someone else’s property until a debt is paid off. In terms of asset ownership, a lessor is the owner of the asset while a lienholder does not own the asset but only has a legal claim on it when the lessee defaults.

One example of a lienholder would be a bank that loans the buyer the money to purchase a house or car. While the buyer is the legal owner of the asset, the bank holds a lien and can repossess the asset in case the borrower defaults on the loan. Sometimes government agencies (namely the IRS) put liens on assets if the owner has not settled their dues.

Also, while the lessor receives periodic payments from the lessee, the lienholder is not entitled to any rent but instead receives the principal and interest payments. Also, if the business goes bankrupt, the lienholder’s charge on the assets is superior to other creditors.

Lessor vs Lessee: Accounting Standards Explained

Business owners and accountants need to stay updated on the most recent accounting standards for leases. Let’s dive into the a few important updates to 2 most relevant modern standards you need to know: ASC 842 and IFRS 16.

ASC 842

The Financial Accounting Standards Board (FASB), a private standard-setting body in accounting, recently introduced the ASC 842 standard, replacing ASC 840. This standard says that all leases of over 12 months should be recorded as assets and liabilities on the balance sheet. The accounting treatment is irrespective of whether the lease is classified as a financial lease or an operating lease.

IFRS 16

The International Financial Reporting Standards (IFRS) is another standards body that recently updated its standards with IRFS 16. The changes implemented by this new standard are similar to the additions made by ASC 842. It requires companies to include nearly all lease obligations on their balance sheets, whether they are capital or operating leases.

The Bottom Line

Leasing is a vital tool for almost every successful business which is why it is so important to understand for anyone trying to make it in the business world. Equipment leasing and financing alone is a $1 trillion market and nearly 80% of US companies use it in one or the other form. Commercial real estate leasing is another popular market and was estimated at $257.6 billion in 2022.

When considering entering into a lease agreement, the business should understand the various types of leases as well as the relevant accounting standards.