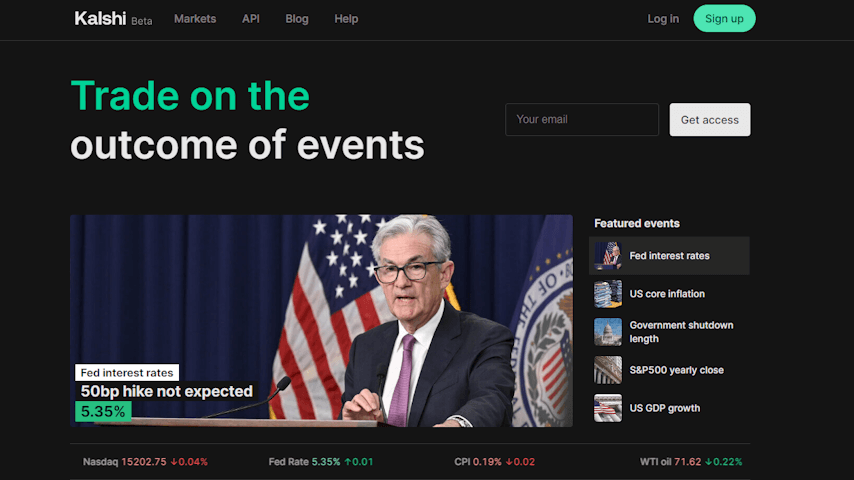

A brand new trading platform founded by MIT graduates allows investors to bid on the outcomes of live economic and political events. With Kalshi, traders can take out ‘Yes’ or ‘No’ contracts on events related to politics, economic issues, or even on the temperatures of different cities.

The first-ever federally regulated exchange for trading event contracts, Kalshi charges no minimum deposits and gives investors access to more than 80 trading markets.

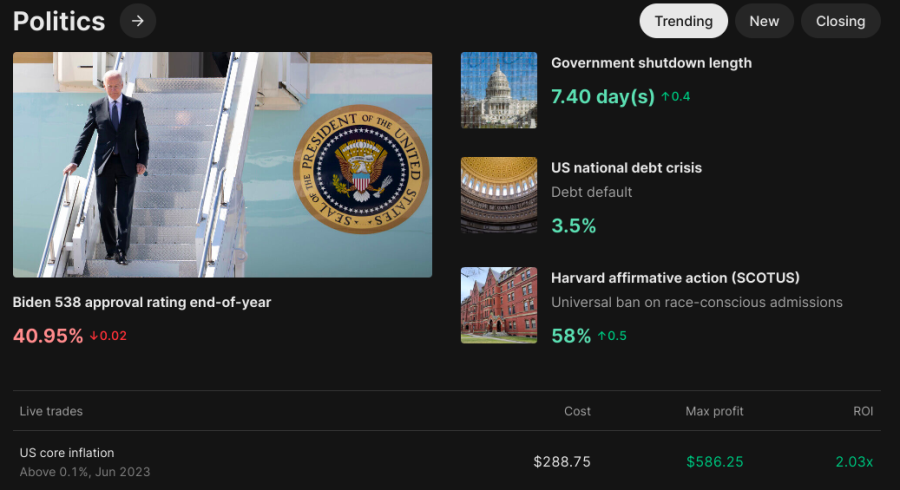

Bet on Different Events with Kalshi

For example, with Kalshi, you can trade on several economic events, such as the U.S. GDP growth to increase or predict the annual inflation numbers in the country to fall. Since this trading platform is based out of the United States of America, the events correlate to the country’s political and economic issues.

One can take out event contracts on Biden’s approval ratings, predict the next U.S. Secretary of Labor, or even on the possibility of a government shutdown. The closest Kalshi gets to trading real securities is through its financial events section.

Traders can take out event contracts on the future outlook of the S&P 500 and even the yearly close of the Nasdaq-100. You can also predict the movement of popular forex pairs such as EUR/USD and USD/JPY.

With Kalshi, investors can predict unique outcomes such as global average temperature deviation. Traders can also take out contracts on the potential temperature increase in some U.S.-based cities, including New York City, Chicago, and Miami.

Other events include predicting the number of vaccinated coronavirus individuals by the end of the year or betting on the weekly average of TSA airport check-ins.

How Do I Make Money with Kalshi?

With Kalshi, investors do not have a minimum deposit requirement. A new contract costs as little as $0.01 and can cost as much as $0.99. Thus, this trading platform is ideal for investors on a tight budget.

After purchasing a ‘Yes’ or ‘No’ event contract on Kalshi, traders can profit in two ways. Firstly, investors can decide their entry level for a particular contract. Since the odds can vary depending on your prediction, you will take home a higher amount for a more unlikely event.

For example, you can take out a contract on the U.S. inflation rate to increase anywhere from 0% to 0.8% in June 2023. While a ‘Yes’ contract on the inflation to rise by 0.2% leads to a 2% profit, a Yes contract on the inflation to rise by 0.5% results in a maximum profit of nearly 50%.

As the market moves in the right direction, you can sell the contract to make a profit. Alternatively, investors can hold their contracts until the end of the trading period. Each correct contract turns into a $1 settlement at the end of the session.

So, if you took out 10 successful ‘Yes’ contracts of 50 cents each, you will profit 50 cents per contract, equating to a $5 profit.

This Federally Regulated Exchange Vows Safety

While there are many event contract trading platforms, Kalshi is the first federally regulated event contract exchange. In 2020, the Commodity Futures Trading Commission (CFTC) approved Kalshi as an Authorized Designated Contract Market (DCM).

As such, Kalshi follows certain rules and regulations to protect investors’ funds. The platform leverages robust surveillance systems to identify any fraudulent trading transactions. Kalshi also uses regulated clearing houses that help mitigate default risk.

LedgerX LLC, the regulated clearing house used by Kalshi, stores investors’ funds in separate accounts until a withdrawal is initiated. Thus, Kalshi offers a unique asset class and is a safe platform to use.

Follow the link below to explore this innovative trading platform and learn more about Kalshi today.