This is a sponsored post provided by Synder.

After being in business for a while, you understand that having your clients pay without delays is one of your most important everyday tasks. Why is it so critical that your customers pay on time? Because it influences the financial health of your business. So, when customers are late with payments, it can cause your business to fail to pay bills, which can later backfire with additional expenses, lost reputation, not to mention the inability to keep up with the budget, growth plans, and more. To avoid such situations, you need to think over some ways to help your customers pay on time and in an easier way with the least number of steps.

In this article, you’ll find actionable steps that businesses can take to ensure they get paid on time, improve their workflow of receiving and managing payments with less effort, and put the process almost on autopilot. Keep reading to learn more about invoicing, recurring payments, payment links, and how to set them up to work best for you, with the help of business software.

Here’s what we’ll take a closer look at:

- How to improve your invoicing process

- How simple payment links help you get paid faster and easier

- How to thank your customers automatically

How to improve your invoicing process

As a business owner, you know that the process of receiving payments for your services or products can take much time and effort, as it comprises creating and sending invoices to customers, and keeping a constant track of due dates. When you issue all the invoices manually the main reason why your clients don’t pay on time could be that you simply forgot to send those invoices. Or sometimes, a client can’t find a convenient way to pay right away. If this ever happened to you or bothers you now, you’ll find options for solving these problems below.

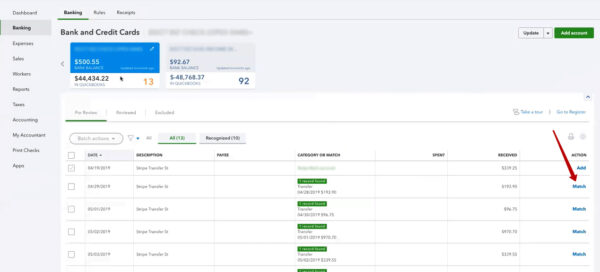

To keep better track of expected payments it’s convenient to keep them in your accounting company and check which invoices were paid and which are still pending. It is very easy to create and send an invoice within one software, then have it appear in your accounting company, and when the invoice is paid it will be closed automatically.

You’ll see how it could work for you using the example of Synder.

Whenever you need to create an invoice you just need to fill in the information and press Create invoice. As soon as you send the invoice to your customer, it will appear in your QuickBooks account right away. Once your client paid the invoice, you will have a payment created automatically that will be associated with this invoice.

In addition to the one-time invoices, you can create recurring ones within one app. Recurring invoices will be sent to your customers at certain intervals of time and you are free to choose when you would like your clients to receive them: weekly, monthly, or yearly, or set certain dates.

The biggest advantage of recurring invoicing is convenience. Business owners don’t have to send repeating requests to pay, and customers don’t have to worry about forgetting to pay on time.

In general, recurring invoicing can be used in cases where it is necessary to issue an invoice to the client on a regular basis and is a good fit for a subscription-based business like Netflix, iTunes, or any other app or service people have to regularly pay for.

After all, to receive payments from clients in a timely manner it is important not to forget to issue invoices yourself. The recurring option helps you to set this flow up once and then will keep track of it automatically. You no longer need to worry about forgetting to send something to your customers.

How simple payment links help you get paid faster and easier

Another thing that helps ensure you are paid promptly is the speed and convenience of the payment process. Shortening the period and the number of steps between a purchasing decision and payment can increase your sales rate. And giving your customers the freedom of choice in the payment method combined with security plays in favor of your customer experience.

For you, as a business owner, this can mean dealing with the process of implementing a payment gateway to your website, which can be complicated, especially if you are not a tech-savvy person.

And here is where payment links come to help. Payments via links is one of the easiest ways of paying for customers and businesses. It’s a payment method when you create and share a payment request, and a customer can make an online payment instantly.

Payment links can be shared on social media and for companies that are based on Instagram, Facebook, or any other social network it’s an option to pin a payment link to their profiles.

See how easy you can generate a payment link for your business within Synder. You just need to set up payment details:

- Select currency – set the currency you want to receive payments in.

- Fixed amount – determine how much your clients will pay. If you want your customers to input the number then you leave this field blank.

- Customer notes – if you want your customers to be able to add notes to the payments, you can enable this setting.

- Billing address – whenever you need or want your customers to indicate their billing address, you can enable this option. If this information is not important, you can disable it.

The link is ready to be sent to your client via email, shared in direct messages, uploaded to your website or social media profile.

How to thank your customers automatically

Continuing the idea of sending invoices automatically, with the Smart Rules functionality that Synder has, you can send past due invoices automatically, with no need for you to go and check whether you did so for all the unpaid invoices, and also payment reminders to ensure your customers won’t forget to pay.

For example, you can set the invoice to be sent X days before the payment due date and your customer will receive the invoice in advance.

With the help of the rules, you can improve your customer experience, and make them feel cared for. As a rule of thumb, companies send thank you emails to their newly registered users which creates a welcoming atmosphere for a person and starts the customer journey off right.

Such emails and friendly reminders will work well to increase customer loyalty. You can create software scenarios that will start for your customers whenever they take certain actions.

For example, when a customer places an order and there is an invoice created automatically, a thank you email will be sent to that customer. Or whenever an invoice is paid and closed, you can thank the buyer for purchasing from your company, offer some kind of discount for the future, or invite people to visit your website or social media page again.

The emails you want to send can be fully customized and you are free to create the content that your creativity allows. You can even send voice messages instead of emails if you want.

Watch this video to see how easy it is to create these flows and make them work in the Synder example.

Why you should choose Synder

As you can see, using software helps you ensure your customers pay on time, and moreover, manage these payments in a better, more convenient way. There are many solutions available on the market, so you can choose the option or options that would perfectly fit the bill for you. But having many options doesn’t always mean quality. It happens quite often that business owners use a range of separate options to cover all the things mentioned above meanwhile there is one app that can manage all the tasks simultaneously. Synder is a universal solution. It suits owners of e-commerce businesses who need to receive, process, and manage online payments using a minimal software set. But also it is a solution for bookkeepers and accountants that need to eliminate a great deal of manual data entry.

With Synder you can:

- Reconcile your books in one click;

- Upload historical payment data and automatically record ongoing transactions;

- Manage multi-currency transactions;

- Connect all sales channels and payment gateways within one interface;

- Create invoices and payment links;

- Get detailed data synchronization, including product inventory, locations, shipping, discounts, refunds, customer names, and more.

Synder allows you to connect within one account up to 14 payment processors and accounting platforms such as Shopify, Amazon, Stripe, Etsy, PayPal, eBay, Square, Ecwid, Authorize.net, Gusto, LawPay, Pin Payments, QuickBooks, and Xero.

To summarize

Making sure your clients pay on time doesn’t have to be difficult. All you need to do is add more automation and customize your invoicing processes so your clients feel welcomed and supported at all payment stages. Just be sure you don’t overdo it with all the reminders and keep a friendly tone so that your clients don’t feel pushed or forced to pay. And if you feel like you need a reliable companion to help you issue invoices and take control over payments, Synder can be by your side.

To see how Synder works and ask questions you can request a free live demo. Sign up right now and you will get 50 FREE syncs by promo code “Business2Community”.